4 Fintech Innovations for Creating Deeper Connections

With technology innovations in fintech causing global investments to soar to a record $111.8 billion in 2018, and further gains expected this year, it’s clear that the future of finance is going digital. But what do they offer that major banks and credit unions don’t? Considering that 4 in 5 presenters at NACUSO’s Next Big Idea Competition were from the fintech industry, their innovative financial technology offerings are the obvious answer, but a closer inspection of these technologies paints a clear picture of what customers are really after — a stronger connection.

With a strong support network backed by AI, video and personalized services, fintech companies have the ability to create a relationship with customers that goes beyond the standard levels of service that most banks and credit unions provide, but at the same time, the majority lack one thing that has historically served as the backbone for financial services. Real people. With that in mind, it should be simple for established financial institutions to bridge the gap between the digital and physical world with ‘phigital’ services that leverage new methods for customers or members to interact with their company that supplement, rather than replace, their knowledgeable and helpful staff. Below, we’ll go over 4 of the ways that emerging technologies in the financial services industry can help established financial institutions develop long lasting, reciprocal relationships with their customers.

To discover how Coconut Software helps banks and credit unions compete with the current innovations in fintech and create lasting connections through personalized self-service solutions, check out our Digital Transformation Guide.

Innovations in Fintech #1: AI Chatbots

The average person spends 43 days of their life sitting on hold. When most calls are for nothing more than routine questions or advice, how can a company establish a connection when staff are tied up with low-value, repetitive tasks, leaving customers with complex needs or difficult scenarios waiting in line. In order to build a strong relationship, staff needs to be free to serve them, which is why so many fintech companies have jumped on the AI chatbot bandwagon. By automating the more mundane tasks, staff are able to spend their time on high value customer problems, making their jobs more stimulating and allowing them to deliver superior relationship oriented service. What’s perhaps most attractive about AI chatbots is that they don’t necessarily require complex integrations with a company’s own app or website. For example, Vancouver-based fintech Finn AI rolled out the first full-featured personal banking assistant available through Facebook Messenger back in 2017, providing a way for customers to get advice in an app they’re already comfortable using. And for companies worried that customers are not ready to turn to a chatbot for advice, consider that Gartner has predicted that “by 2020, the average person will have more conversations with bots than with their spouse.” Whether looking at young millennials or existing baby-boomer customers, studies have shown that AI chatbots are capable of providing benefits to all demographics.

Top AI Chatbot Implementations:

- In March of 2018, Bank of America launched Erica, a natural language/AI based chatbot. Within six months, approximately 45% of their customers were using it — an adoption rate that took ATMs 25 years to attain, and Amazon Alexa 2 years.

- Following user growth of over 433% in just one year, the money managing AI chatbot app Plum has received an additional $4.5 million in funding, bringing the total backing for the London and Athens-based fintech to $6.3 million.

- London-based fintech startup Cleo offers an AI-powered chatbot as a replacement for their customers’ banking apps. Just 21 days after bringing their service to the USA, they were gaining over 1,000 users per day.

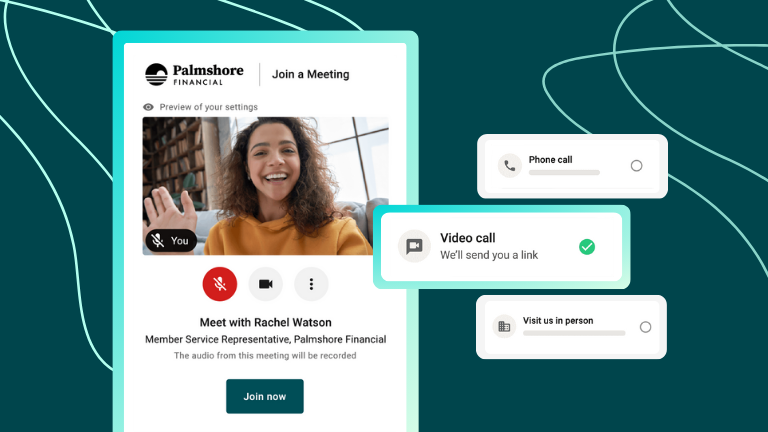

Innovations in Fintech #2: Remote Video Banking

Most customers under the age of 45 cringe at the thought of having to physically drive to their financial institution. They get their paycheck remotely deposited, transfer money through the app, set up automatic bill payments online. Why would they ever need to go to a bank or credit union? Of course, there are some financial services that either require a higher level of assistance, or that customers simply don’t feel comfortable trusting to themselves. With AI chatbots capable of taking care of routine customer interactions, there is technology available to remotely handle those more complex customer interactions that require face-to-face meetings — video chat.

Video solutions have already been implemented in a number of banks and credit unions, however for the most part they remain dependant on a visit to the branch for customers to utilize. Options like video conference rooms and smart ATMs are an excellent temporary solution to the issue of getting customers in front of experts while ensuring a secure connection, but far from the future of remote delivery in the financial space. Customers are looking for a way to speak with advisors when they want, where they want. And in these days of hyper-convenience, that means outside of business hours, from the comfort of their home. While IT teams are concerned about security requirements that come with customers conducting video calls outside of the branch network, it’s far from impossible to achieve, and the reward can easily far outweigh the cost. And with an existing team of highly trained financial advisors to pull from, banks and credit unions can leverage video banking to put a face to their services and create a connection with their customers that goes beyond the branch.

Top Video Banking Implementations:

- Pioneer Federal Credit Union has used video teller machines to serve its 52,000 members since 2015. They have now begun testing a remote video banking feature in a standalone app, with plans to integrate it into the banking app in the future.

- Barclays allows account users to connect 24/7 through remote video on their own devices, recording Net Promoter Scores 44% higher than for users calling in by phone, and lowering average handling times by 25%.

- Induslnd supported the launch of its new Video Branch desktop and mobile app with an extensive nationwide advertising campaign, helping position the bank as innovative, convenient and tech-savvy. One year later, the system was supporting over 1,000 daily video calls with more than 65% repeat usage.

Innovations in Fintech #3: AI Powered Advisors

Artificial Intelligence is advancing rapidly these days, with possibilities that go far beyond AI chatbots. While many banks and credit unions struggle to figure out what to do with these capabilities, a few are emerging as leaders in deploying AI in the sensitive areas of budgeting and investment management. With 56% of consumers stating that they would like creating a financial plan to be as simple as booking a hotel, it’s no surprise that fintech companies like budgeting app Cleo or investment manager Wealthsimple have taken off, but there is still space for established financial institutions to bring these offerings to their customers directly. As these fintech companies have shown, the millennial and Gen Z audience is hungry for financial advice and more than ready to put their trust in technology to accomplish their goals. In fact, 45% of consumers believe that of all the disruptive fintech options, robo-advisors are likely to have the biggest impact. Far above even cryptocurrency, which comes in second on the list at just 29%. For the most part, what they are looking for is something that banks and credit unions are already well equipped to offer — tracking their expenses and planning for their future. By taking advantage of AI, you can avoid disintermediation and create a connection with customers who otherwise may not feel confident in seeking advice on managing their finances, or who simply can’t afford to do so, by providing them with a low cost way to invest and plan with your organization. In this way, customers can build a connection with your organization. And when they’re ready, they know they have a team of experts ready to serve them.

Top AI Advisor Implementations:

- BBVA in Spain looks at different aspects of your finances and they actually turn around and make personalized recommendations based on your goals. In three weeks they had 500,000 customers.

- With over 2 million users and set to double its valuation over $2.5 billion in 2019, fintech company and digital bank Monzo has smart tracking features and personalized financial planning, telling customers where they spent their money via Google Maps, categorizing spending by type and providing budget recommendations to increase savings.

- Providing automated investment management to users in Canada, the USA and the UK, robo-advisor Wealthsimple is now managing $1.9-billion in assets and has over 65,000 customers.

Innovations in Fintech #4: Self-Service Solutions

In the last couple years, we’ve seen an increase in self-serve solutions. From gas stations to food delivery, customers want what they want, when they want. Leaving them waiting for customer service even for a short time is a sure way to create a poor customer experience that could easily send them in search of better, faster options. And often the fastest option available is for the customer to simply serve themselves. In fact, a study by Forrester found that 72% of customers prefer to use self-service rather than phone or email support. And it’s not just about speed either. Customers want to feel as though they are a valued customer with unique needs, and that your organization has taken the time to ensure they receive the best customer experience. To meet these desires and create a lasting connection with your customers, self-serve solutions can be tailored to capture customer data and track buyer behaviour, so that companies can deliver that personalized service and elevate their customer experience. When these solutions are easy to navigate and implemented appropriately, service becomes faster, convenient and personalized. Organizations see increased customer adoption and satisfaction, as well as improved productivity.

Top Self-service Implementations:

- After implementing Coconut Software’s self-service booking solution, tax preparation service provider Jackson Hewitt increased booked appointments by 41%.

- By allowing customers to apply for and receive small loans for up to $40k online and in app, fintech company Lending Club has served over 3 million customers, lending out over $45 billion since 2007.

- After introducing self-service mortgage applications through their Rocket Mortgage service, Quicken Loans grew from less than 1% of retail mortgage originations in the US in 2008 to almost 6% at the end of 2017.

What’s Next?

Powerful forces are rapidly changing the banking industry. Shifting customer expectations, rapidly advancing technological capabilities, and ever evolving regulatory requirements and demographics make fluctuations in the financial space inevitable. If banks and credit unions want to continue to compete during the rise of financial technology, getting ahead of these challenges and discovering ways to reach out and connect with consumers by taking advantage of the latest innovations in fintech is imperative in the years ahead.

Technology and automation, far from being the alienating force and the death of personal customer service they were viewed as in the past, today have been proven time and again to be a cost effective and efficient way to build lasting relationships. Whether it’s through a complex AI implementation that manages an investment portfolio, or a simple method to book appointments online, customers are keen to embrace technology. And the companies that take advantage early, win.

To discover how Coconut Software helps banks and credit unions create lasting connections through personalized self-service solutions, check out our Digital Transformation Guide.

Ready to get started? Schedule a consultation today.