Why Invest in Banking CX Software? 5 Benefits to Budgeting for CX Now

Budgeting season is upon us, and investments in customer experience are a high priority for financial institutions. Customer experience (CX) tools—like self-serve appointment software, virtual queuing, video banking, and member journey analytics—are finally topping the list of tech investments. Why, you may ask?

The truth is customers are demanding more choice and convenience. Twenty-five percent already identify as “phygital,” preferring a combination of online and offline channels to communicate with their bank. And 54% of consumers will switch their primary institution for a better digital banking experience. Forward-thinking financial institutions (FIs) recognize that by investing in customer experience and digital banking, they’ll see significant returns in the coming years.

In this article, we’ll explain the three major CX trends influencing financial institutions and five benefits of investing in digital experience tools. By the end, you’ll be able to confidently justify how CX investments increase staff efficiency, unify the tech stack, and serve revenue goals across the organization.

3 Trends Making CX Your Next Top Investment

In spite of recession woes, a survey by Bank Director found that 81% of banks and credit unions boosted their 2022 tech budget—and they’re spending more on digital tools that will improve customer experience and competitiveness. Increasingly, banks and credit unions want to get the most out of their tech investments and that’s where the trend towards investing in CX tools comes in.

- CX Tools Help You Shift the Recession Conversation

A 5,000-person survey by Personetics found that 66% of banking consumers want more proactive financial insights for their financial stresses from their institutions. But 63% haven’t received any communication or advice from their bank.

In the coming months of uncertainty, CX and digital experience tools can help your staff meet clients where they are—through channels like video banking, virtual calls, chat, and more. They can also make learning about services or products easier through self-serve appointment booking tools. Your advisors can offer the financial education that your customers and members crave—as long as you give them and their clients tools that make connecting fast, easy, and simple.

- They Help You Get the Full Client Data Picture

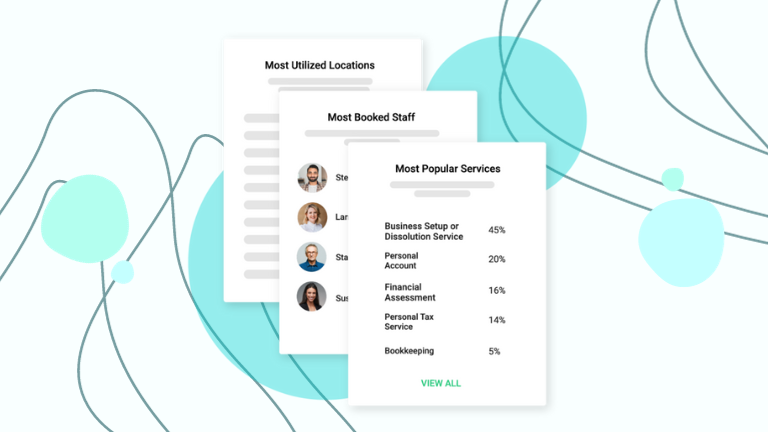

Nearly half of banking executives say their most significant concern is that their internal teams aren’t making effective use of existing data and relying too much on outdated technology. CX software helps FIs track in-person and digital data they couldn’t before—like lobby traffic, reasons for appointments, wait times, no-show rates, and staff capacity. This way, they can apply those insights to improve the customer or member experience.

Does your operations team understand your in-branch traffic and how to forecast your staff’s availability? Does your marketing team understand what service types are the most requested? With CX tools like appointment and queuing software, you’ll have real-time, actionable data to improve operations and the client experience (both online and off).

- Digital Experience Tools Unify Your Tech Stack

Each new digital channel you implement will require management and training. Many CX tools allow you to consolidate the tech burden of appointment booking, video banking, co-browsing, chat, and SMS software into one accessible platform.

Through software integrations with Google Reserve, Outlook, and legacy banking software, your staff will have fewer platforms to wade through to do their admin tasks. This leads to an improved digital experience for clients, too. They can expect the same seamless experience whether they’re visiting a branch or exploring your digital channels.

5 Benefits To Investing in CX This Budget Season

Customer experience tools are no longer just for the customer. Tools like queuing management, video banking, or in-branch analytics impact the entire organization. Not to mention, CX software is an easy choice for banking executives who are thinking about tech projects with direct and measurable ROI.

Here’s 5 reasons to invest in CX tools this budget season:

- CX tools have cross-departmental impacts. In the budgeting season where it’s “use it or lose it,” CX tools are a perfect sell. They can support a number of goals across the organization like revenue, member retention, and new customer engagement. As you build a business case, share how more efficient meetings would lead to more upsell opportunities for the lending and wealth management advisors, or how understanding your top-performing channels would support marketing’s targeted campaigns. They’re not just a tool for operations or user experience teams.

- CX software helps you drive revenue gains and savings. Financial institutions that use appointment and queuing software typically see an average increase of 13% more appointments booked and many see up to 150% more revenue thanks to better hand-offs between departments, appointment speed, and staff preparation. It also has proven ROI, like recovered revenue from lapsed member connections and increased staff efficiency. If your bank or credit union doesn’t already track the ROI of your CX software, there’s no time like the present to start.

- They don’t have to take long to implement. Every organization is strapped for staff and resources. Appointments, video banking, and queuing software will likely be the easiest implementation you’ll do. It can take less than eight weeks and you’ll see immediate value, like increased quality appointments, reduced admin time, and improved member experience. Managing tech changes among your staff doesn’t have to be tedious—and the impact for customers and members is well worth it.

- Digital CX tools save staff time and effort. With appointment booking, queuing, video banking, and analytics rolled into one system, you can simplify outdated booking processes and bring your meetings to the 21st century. All appointments—including bookings, reminders, and follow-ups—are automated so staff know exactly what their day entails and how best to support clients. Staff are better prepared to lead efficient meetings and be in-branch when they’re needed. And when they can connect with clients easily virtually, they can work from anywhere, saving on travel time, costs, and productivity.

- Multi-channel CX solutions support digital transformation. If you’re thinking about your overall digital transformation strategy, CX tools are an integral piece of the puzzle (from both the client and staff perspective). Offering more digital self-serve tools or virtual channels to attend appointments will help you remain competitive from an experience perspective. You can also use them to meet customers or members via the physical, remote, or digital channels they prefer. As an example, according to Accenture, 36% of banking consumers would prefer video calls post-COVID. And with the right tools, you automatically book new meetings with clients, confirm their identification, get signatures, and close an application using one tool in a single interaction.

Trending Towards Tech Transformation

When you’re building your tech budget this year, don’t fall behind other financial institutions. Offer your customers and members choice and convenience on how they engage with you. By investing in CX and digital experience tools, you’re investing in goals like increased revenue, staff efficiency, and client retention. Your customers and members expect a seamless experience—and you won’t regret giving it to them.