5 Digital Trends Shaping the Future of Banking and Credit Unions (2019 Update)

Innovations in technology have created an environment of constant change, and keeping up with this change as a financial institution can be a challenge, especially when considering the future of banking and credit unions. Why not look to implement tools that will create a smooth transition into the ever-evolving digital world that we live in? By doing so, organizations can keep things running smoothly at all stages in the consumer journey, boost experience for both customers and staff, and drive more revenue to your organization.

Below, we’ll discuss five digital initiatives for banks and credit unions to leverage in order to fine-tune operations and optimize scheduling.

Close the gap on creating a frictionless customer experience. Schedule a Customer Effort Assessment.

Trend #1: How Fintech is Shaping the Future of Banking and Credit Unions

Credit unions and banks that partner with Fintech vendors to deliver an enhanced customer experience have seen exponential growth. According to Capgemini, 91% of financial institutions want to collaborate with FinTechs to provide their customers with an enhanced experience. Financial organizations have a pressing need to implement and evolve quickly in order to keep up with their competitors, but don’t have the time to develop their own, competitive homegrown technology. This is where FinTechs come in, who can provide a specialized product that enhances the customer experience without the burden of developing in-house software.

Trend #2: Digitize Customer-Facing Channels to Enhance the Customer Experience

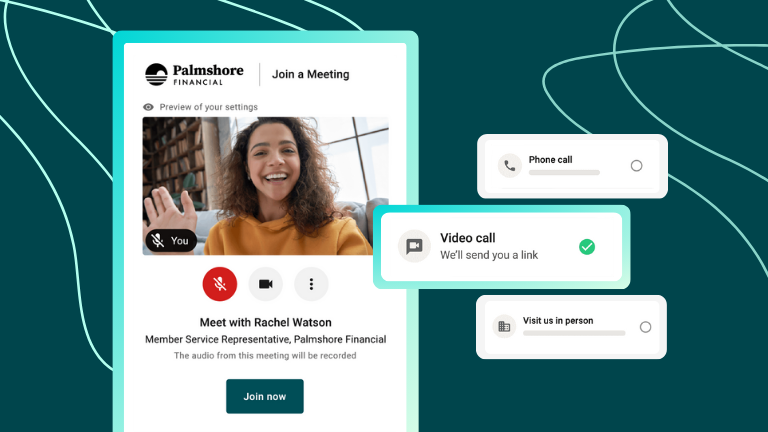

Consumers want to interact with their financial institution where, when, and how they want. Customer expectations have risen and clients expect to have 24/7 access to your organization. Providing self-service channels and digitizing customer-facing touchpoints makes your organization more accessible for your clients, while eliminating the need to hire more customer service staff to accommodate the demand for 24/7 access.

Not only does providing customers with real-time digital channels give them instant accessibility that makes it possible to squeeze you into their busy schedules, but it also increases the accuracy and efficiency of your business. One European study found that more than 70% of account applications were paper-based, and of those, 30 to 40% contained errors.

Digitizing customer channels increases efficiency, accuracy and the customer experience all in one fell swoop.

Interested in learning how appointment scheduling can help your entire organization engage more efficiently and effectively with customers? Download our Customer Experience Whitepaper.

Trend #3: Digitize Your Operational Processes

How are organizations accommodating all these new, customer-facing initiatives on the back-end? Many of them haven’t thought through this yet. 87% of organizations don’t believe their current core systems can keep pace with customer-facing initiatives. It is great if you provide a premium experience through your customer-facing channels, however, if you are not able to manage the customer traffic through your back office processes then you need to evaluate the current system you have in place.

Based on what we’ve observed, customer expectations are only going to continue to rise, and financial institutions will have to continue to enhance the customer experience to keep up. As such, it will become absolutely critical to modernize the back-end processes that power front-end experience.

Trend #4: Digitize Contact Centers to Enhance Traditional Channels

It is not a matter of if bank and credit unions will become fully digital, but when. With the digitization of financial organizations does not come the extinction of contact centers. To encourage your customers to embrace the future innovations in technology, you must continue to provide them with the channels they are comfortable with. That said, organizations cannot afford to turn a blind eye to operational efficiencies in their contact centers which are negatively impacting the customer experience. Implementing technology that will help streamline processes in your contact center, such as appointment scheduling, can enhance contact center efficiencies while still providing customers with a channel that they are familiar with.

Improving contact center performance is a must for financial institutions. Learn how to optimize your contact center with our Ultimate Guide to Contact Center Efficiencies.

Trend #5: Use Analytics to Understand the Customer Journey

Analyzing your own customer data can tell a lot about the experiences that your customers are having, and what steps can be taken to improve upon the services that you provide.

Your organization should be translating its customer data into actionable business insights to help understand your customer preferences and behaviors, and help you understand the changes they want to see.

How Integrated Appointment and Lobby Management Solutions Can Help

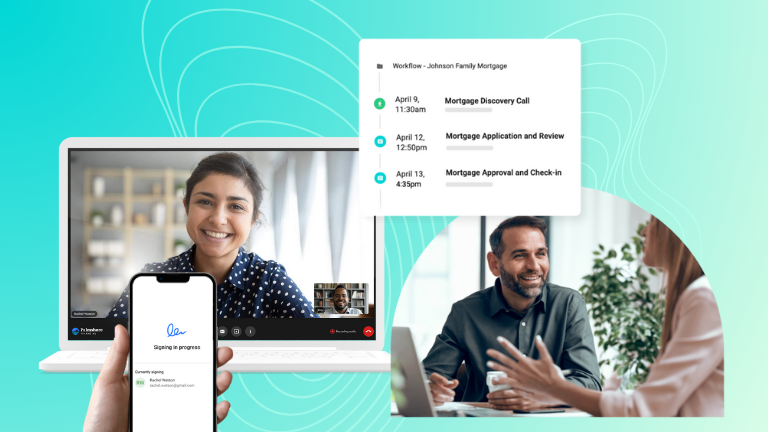

Integrated appointment scheduling and lobby management software is a tool that can help your organization meet all 5 digital trends listed above. I is a tool that can be implemented into your current systems and channels in your organization, and introduce new contact channels to your customers, such as an online, real-time, self-serve integration. Each integration can help to streamline your appointment scheduling process and provide them with the accessibility to your organization that they crave.

It’s no small undertaking to transition from pen and paper operations to full-on digitization. Integrating a software solution such as enterprise scheduling can help speed up the processes you already have in place, while also offering new and innovative channels, providing your customers and your organization with a smooth transition into the future of the credit union and banking industry.

What’s Next?

Close the gap on creating a frictionless customer experience. Schedule a Customer Effort Assessment.

Interested in learning how appointment scheduling can help your entire organization engage more efficiently and effectively with customers? Download our Customer Experience Whitepaper.

Ready to get started? Schedule a consultation today.