Partnering With Fintech for Your Digital Transformation

Last year over 70% of financial institutions globally placed “improving the customer experience” as one of their top 3 strategic priorities. With the financial services industry evolving at a rapid rate, many banks and credit unions are feeling the pressure to evolve, partnering with fintech might just be the answer.

Partnering with FinTech to Keep up with Digital Transformation

Banks and credit unions are presented with a few options for innovating the customer experience. If your financial organization opts to develop its own homegrown technology, you risk losing time-to-market and end up being left in the dust. On the other hand, if your organization chooses to collaborate with third-party vendors, you have the advantage of enhancing the customer experience with existing, proven technology before your competitors catch up.

According to Capgemini, 41% of financial institutions are implementing digital enhancements to improve their organization’s customer experience. As customers are migrating to online channels, this is becoming critical to the success of financial institutions. Digital behaviour such as mobile banking and online appointment scheduling has grown from 27% to 46%, as human interaction channels such as contact centers and in-person appointment scheduling have shrunk from 15% to 10%.

Which part of the customer journey should we digitize first?

As technology improves and enables customers to interact with companies more easily, service expectations will only continue to rise. And evidence of these expectations is already apparent: Consider that 91% of banks already want to collaborate with FinTechs to provide their customers with an enhanced experience. In particular, appointment-driven businesses rely on customer retention to stay afloat, so keeping up with digital trends related to customer experience is imperative.

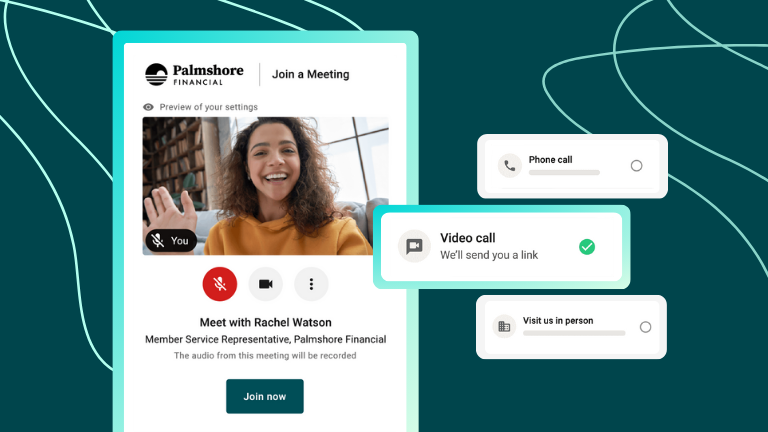

Customers like innovation, however, they do not like change. The technology that you choose to implement has to ease the transition into the future of banking customer experience. Enterprise appointment scheduling allows your appointment-driven businesses to meet customers’ expectations when it comes to interacting with your financial organization through its appointment scheduling channels.

For new customers, scheduling an appointment is one of the first touch points they have with your brand and it is in your best interest to make a good first impression. And for existing customers, implementing enhanced and efficient scheduling channels will be a welcomed improvement to their service experience.

Partnering with FinTech to Implement Appointment Scheduling Solutions

On average, in-house IT projects run 45% over budget and 7% over their initial time-frame, while offering 56% less value than predicted. Additionally, 19% of IT projects are scrapped completely after a significant amount of time, resources, and money have already been invested. Why not opt out of the sleepless nights you anticipate and instead consider the benefits of implementing an enterprise appointment scheduling solution.

Quick Implementation

Transitioning the customer journey to digital channels can be a valuable differentiator, but only if you get the integration to market on a reasonable timeline and before your competitors. Working with a third-party FinTech provider means that you are working with a product that has already been developed, and available to begin implementation as soon you are.

When working with a third-party provider you have access to a support team who is experienced with the product and will be available to help you every step of the way to ensure that your implementation runs smoothly and quickly, allowing you to keep up with your competitors.

Established Solution

When implementing a customer-facing solution, you want something that will provide your customers with an enhanced experience. Working with an established solution allows you to rest easy knowing that the solution you are implementing is able to provide your customer with the service that they desire.

Your appointment driven enterprise business requires a solution that can accommodate enterprise complexities. Working with a FinTech provides you with an established solution that you can depend on to help centralize appointment scheduling within your organization.

Experienced Team

Enterprise software implementations can be complex. However, partnering with a pre-developed solution provides your organization with a support team who knows the product, and is committed to ensuring that the implementation is a success.

Working with a FinTech provider comes with the benefits of devoted Project Managers and a Customer Success team that will support you every step of the way. Rely on the experts to guide you through the implementation process, as well as provide follow-ups to ensure that your new integration is delivering the premium customer experience that your organization and its customers will benefit from.

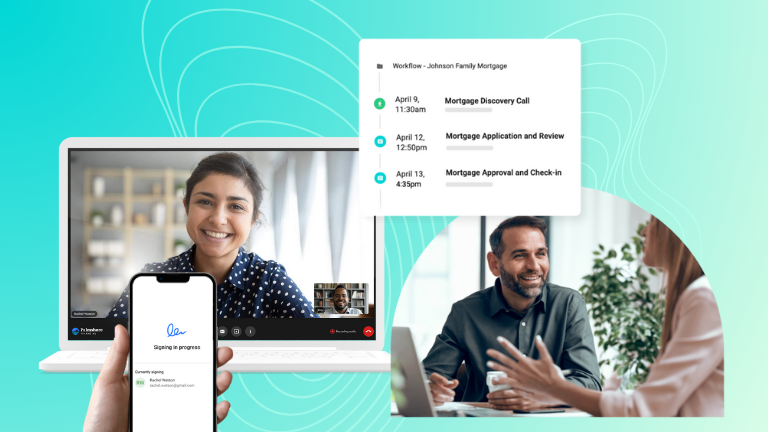

How Coconut Software Solutions Enhances Financial Services Digital Transformation

Coconut Software integrates into your business’ contact center to help streamline the existing scheduling process and improve the back-end operations behind the customer-facing appointment scheduling experience. When customers call in to book an appointment, their experience will be more efficient, as your contact center reps will have access in one view to staff schedules, specialties and other variables that they’re currently checking via a number of applications and systems, including printed-out paper schedules. The solution can also be integrated with your website to allow you to provide customers with a self-serve experience that offers 24/7 access to book appointments.

Implementing a solution that will streamline the current channels you offer to your clients, while also introducing new self-serve channels will enhance the customer experience and position your business as an innovator. As your business transitions into the future of banking, this will help you target new customer segments while reducing current customer churn.

86% of financial institutions believe that digital will fundamentally change the economics and competitive landscape of corporate banking. To build or to buy is the million dollar question, however, when it comes to customer-facing channels, partnering with an experienced third-party FinTech is the most strategic move for your organization as they bring efficiency, peace of mind and experience in the race to keep up with competitors as we move into the future of the banking industry.

Schedule a consultation for more information about how implementing an enterprise scheduling solution can allow you to keep up with the future of banking technology.

What’s Next?

Close the gap on creating a frictionless customer experience. Schedule a Customer Effort Assessment.

Interested in learning how appointment scheduling can help your entire organization engage more efficiently and effectively with customers? Download our Customer Experience Whitepaper.

Ready to get started? Schedule a consultation today.