What is Stalling the Digital Transformation for Your Bank?

There is a major digital transformation occurring in the financial services industry and some organizations are moving faster than others. Has your organization found itself falling behind in the banking technology rush?

In this post, we’ll explore some of the reasons why some banks, credit unions, and other financial services institutions have found it challenging to keep up with digital trends, and what to do to overcome these roadblocks.

3 Major Obstacles Blocking the Digital Transformation for Your Bank

1. Older back-end processes hinder IT innovation

We’re moving towards the future of digital banking at a rapid rate. And given this pace, you’ve probably observed that your organization’s core technologies are struggling to support integrations with newer technologies that are available. To help overcome these challenge, you should seek out new systems that both enhance the operational processes in your organization and are compatible with your current core technologies.

2. Key talent gaps in the team

The next common obstacle you may be experiencing has to do with your people. Again, given the pace of innovation and change due to new technologies in the workplace, your organization’s IT team may be struggling to support new technology implementations that are available. If you don’t want your tech team to be taken away from the important day-to-day work that keeps your organization running in order to manage new implementations, you should seek out new technology that requires minimal in-house resources to implement. If this is not possible, you may want to consider bringing in senior IT talent who has experience with large-scale technology implementations and can help you navigate the pitfalls and obstacles.

3. Organizational resistance to changes that threaten the status quo

Customers and staff can have a difficult time adjusting to rapid change. This is understandable, however, change is inevitable and is absolutely the way forward if your organization is going to keep up with digital transformation in the bank sector to stay competitive.

That said, finding a tool that is intuitive and user-friendly is key to the success of your business and will allow ease of staff and customer adoption while improving the customer experience.

Overcome Your Banks Stalled Digital Transformation with Appointment Management Solutions

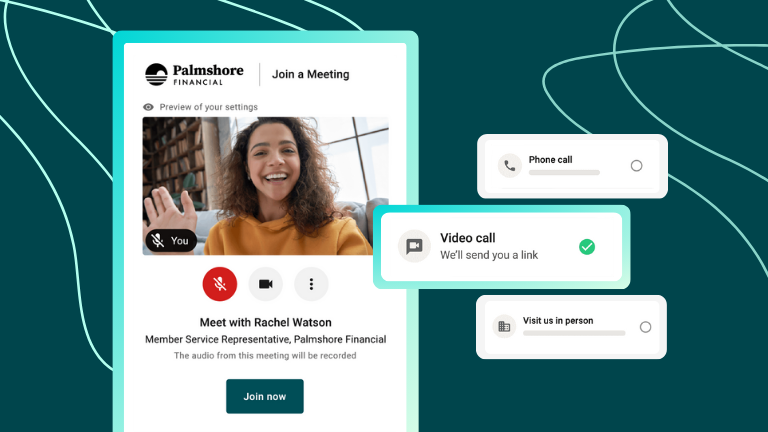

When looking at tech solutions that will enable your organization to offer a premium, digitized customer journey, online scheduling is just the implementation for the job.

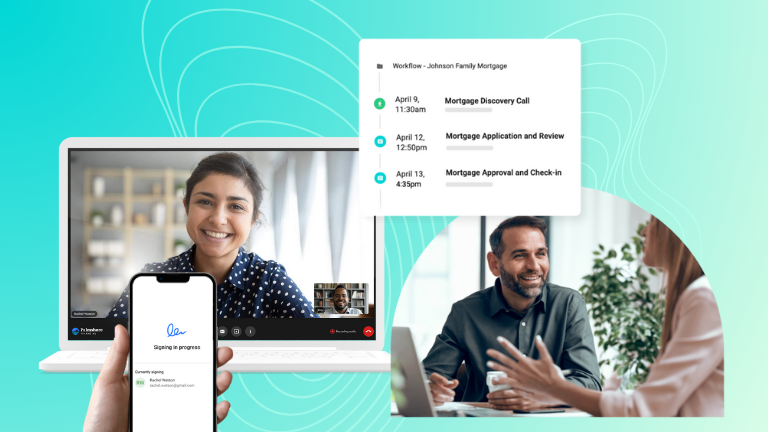

Enterprise appointment scheduling can help you overcome a number of obstacles traditionally associated with tech implementations and can be integrated into your current customer communication channels as well help you open up new, online channels. The benefit of a scheduling solution that integrates into different channels is that is can be rolled out in phases to ease both your staff and customers into your digital transformation.

Call Center Integration

By starting tech implementations through existing channels, such as your organization’s call center, your in-house IT resources will not be swamped by your new solution. Additionally, organizational resistance will be low due to your new implementation enhancing a channel that both staff and customers are already familiar with.

Online Integration

The benefit of implementing an enterprise scheduling solution is that you can also offer new channels, that allow your customers the ability to book appointments in real time, 24/7. This caters to one of the many ever-increasing customer expectations that your organization be accessible to them at all times.

How Coconut Software Can Help

Once you have decided that enterprise appointment scheduling is what your organization needs, where do you go from there?

Simple implementation

Choosing a tool that can be implemented in a matter of weeks with a dedicated support team is key, especially if your organization is at the beginning of its digital transformation, lacking up-to-date, back-end support.

Coconut can be implemented within a matter of weeks and allows your organization to have a smooth implementation that is ready whenever you are.

“Amazing support structure, quick turn around times, and always willing to work with us to provide out of the box solutions.” – Carly Lock, Rogers

Full support team

It can be a struggle to use a significant amount of in-house resources to implement a new solution in your organization. Looking for a tool that comes with an exceptional support team that will allow you to use a minimal amount of your own resources is beneficial.

Coconut provides you with a dedicated customer success coach as well as a project manager to support your financial organization to kick-start the digital transformation for your bank.

“Our experience with Coconut has been excellent. Their team of dedicated professionals worked hard to accommodate our needs and we are very pleased with the end results.” – Nathan Heemskerk, Tandia Financial Credit Union

Easy transition through channels

Customers and employees can be adverse to change. Implementation adoption is very valuable but hard to attain. Coconut can be integrated into existing channels, such as your organization’s call center, as well as new channels, such as your online platform, easing both your customers and staff into the digitization of the banking industry.

Any transformation can be daunting, especially one that is shaking up an entire industry, however, change is inevitable and choosing an implementation that best supports your organization in this time of change is key. Enterprise appointment scheduling is that tool that your financial organization has been looking for. Schedule a consultation today to experience the benefits of enterprise scheduling solution.