Banking Analytics Guide: 32 Metrics for CX Leaders

A three-step process for building a data foundation, maturing your analytics strategy, and making predictions at your financial institution.

Interaction Data: The Key to Unlocking Customer and Member Delight

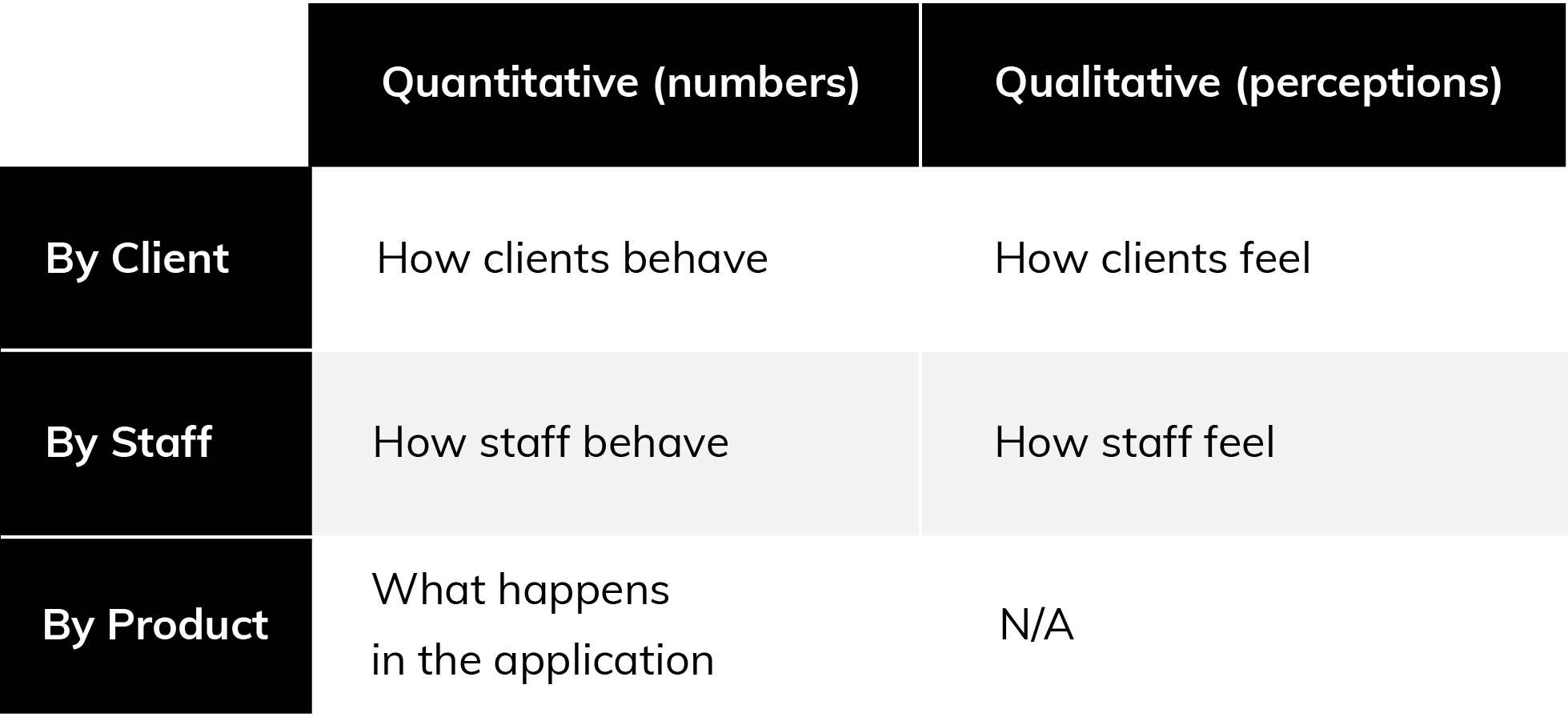

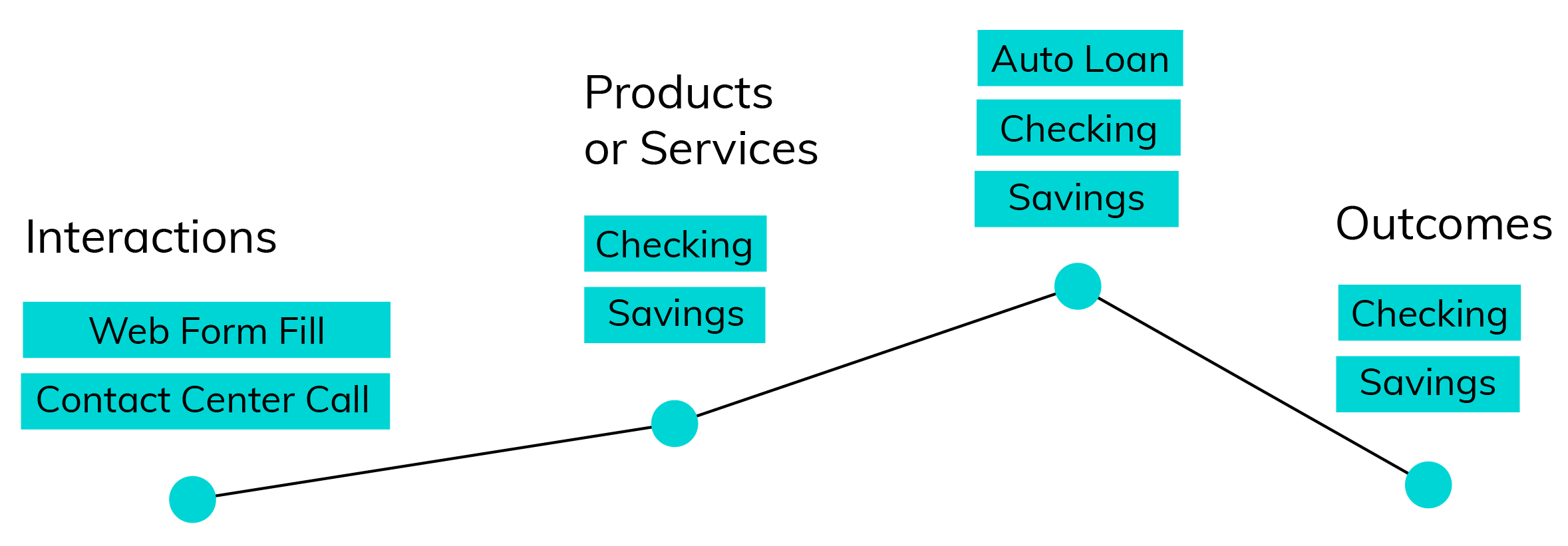

Today it feels like every financial publication is saying some version of “data analytics in banking matters.” But rarely do they explain precisely how institutions are supposed to track it, measure it, and use it to improve the customer or member experience. Nor do they pay attention to the interaction points that are still the lifeblood of most institutions: appointments and walk-ins.

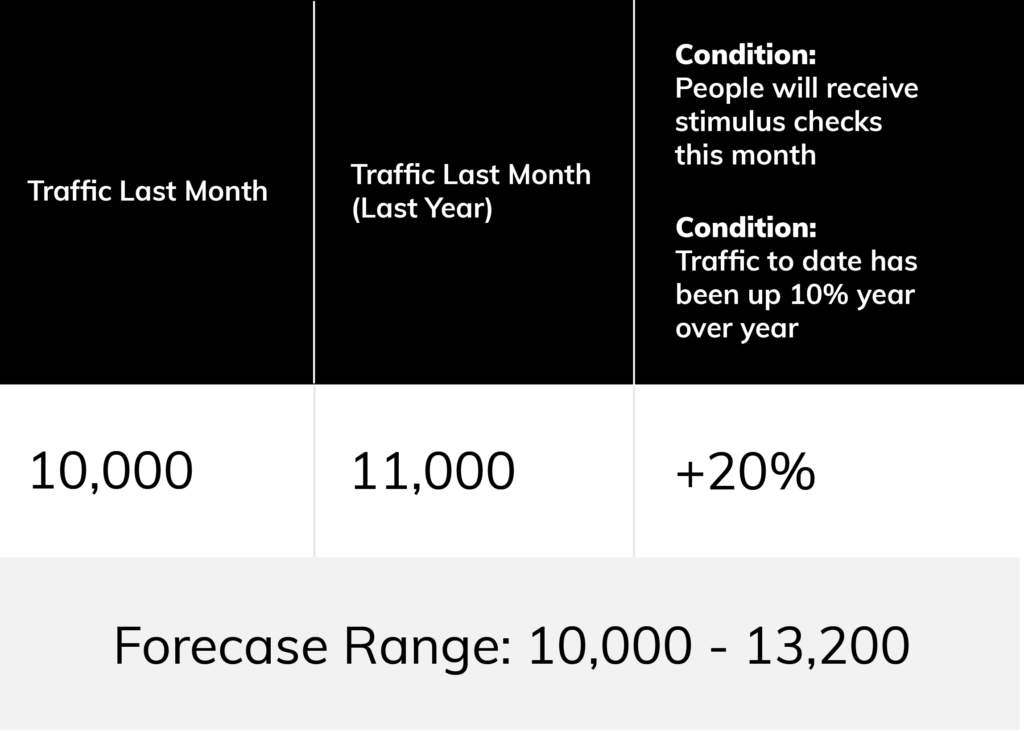

We set out to change that in this practical, step-by-step guide. We share how to get a clearer picture of how customers and members interact with staff across online and offline channels in three stages. First, we cover how to gather your data. Second, we share how to set up banking analytics tracking and what metrics to measure. Third and finally, we’ll talk about using all that historical data to forecast things like traffic, staffing needs, and whether to make big decisions to redesign a branch.

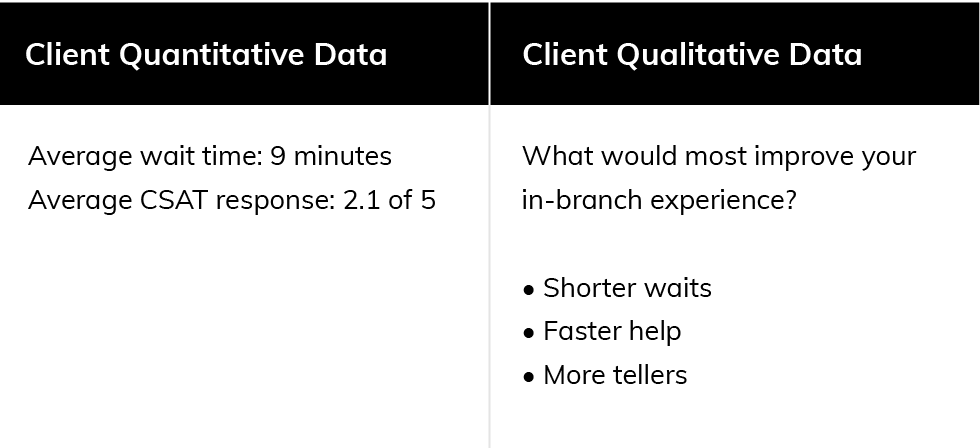

By the end, you’ll be making decisions with data and combining multiple data types to craft a better customer and member experience. For example, before, you may have known people waited an average of nine minutes in-branch. But did you know how they were feeling about the wait? What if to them, it feels short, and doesn’t need fixing?

When you have a data foundation as outlined in this guide, you’ll know the answer. And you’ll know answers to lots of other questions that tell your institution where your time is best spent improving customer and member engagement.

7 Common (and Useful) Banking Analytics Data Sources

![]()

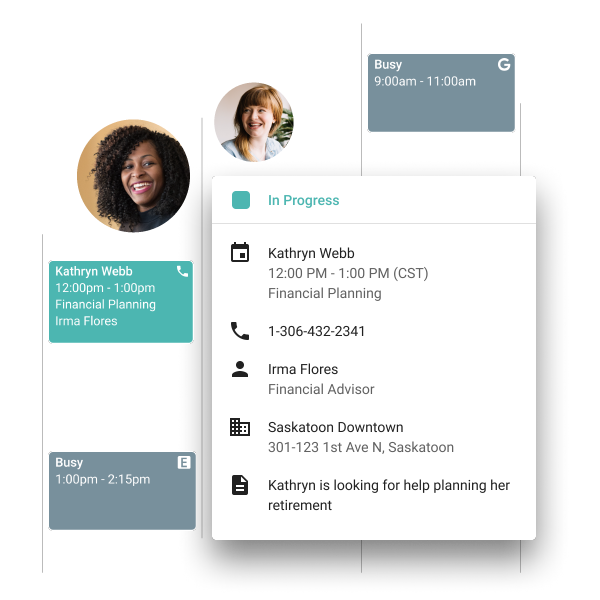

1. Appointment and Queuing Platform

An appointment and queue platform can tell you what services people requested, what location they booked at, whether they showed up, who they met, how long they waited, how often they rebooked, what the next steps were, and more.

- Shows desired services, handle time, wait and lead times, no-show rate, source, completion, outcomes

![]()

2. Survey Results

Satisfaction surveys are one of the truest barometers you can get on clients’ thoughts and feelings. Consider the question we posed earlier: Did people think the nine-minute wait was long or short? Unless you ask, you never know.

- Shows satisfaction, sentiment, needs, requests

![]()

3. Customer Relationship Management (CRM) Tool

If your staff logs their client interactions and opportunities in the CRM, it can tell you how conversations progressed, how long it took to close a product, whether the rep included additional products, and more.

- Shows staff activities, opportunities, interactions, products

![]()

4. Marketing Tools (Email, Ads, etc.)

If you send lots of emails, it can be valuable to know which get clicked, how often, and what sorts of things people tend to click. Similarly, ads can give you insight into what products or messages work.

- Shows interactions, product interest, campaign performance

![]()

5. Contact Center

Where do your staff log customer service interactions? Those interactions are meaningful to understanding the full view of your customer or member and their experience, and what happened when they needed help.

- Reveals service issues and resolutions

![]()

6. Website, Online Banking, and Mobile Apps

How do customers and members engage you digitally? Interaction data from your website, online banking portal, and mobile app can shed light on what services people are interested in, how useful they find these channels, and what offerings are underrated.

- Shows interactions, desired services

![]()

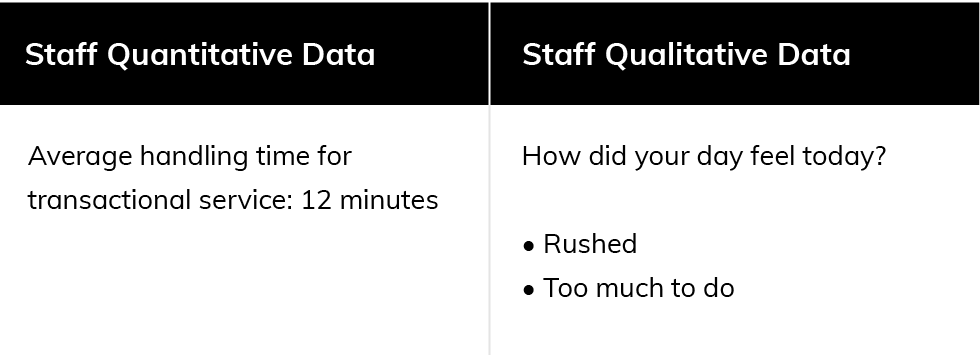

7. Associates and Staff

Your staff hold a trove of insights on customers and members, as well as their own experience. Their observations, comments, engagement scores, and feedback can help paint a fuller picture of roadblocks and opportunities.

- Shows staff sentiment, qualitative feedback

1. Select (or Build) Your Analytics Dashboard

Where will you get your own analytics dashboard? Well, that’s the tricky thing. A spreadsheet can tide you over in the meantime. You can write formulas to do the calculating for you.

But long term, you’ll find it much easier to use software tools like your appointment and queuing platform, which provide ready-made analytics. Unlike a spreadsheet, that data will be constantly updated. And, if you sync the platform with your CRM, marketing, or business intelligence (BI) tools, you can get a more complete picture of the customer or member journey from one central system—all of which makes it easier to focus on asking great questions. Plus, you can always download the data and organize it yourself in a spreadsheet if needed.

2. Make a List of Your CX Interaction Goals

Now that you’re getting more organized, it’s time to pause and ask, what do you hope to achieve by tracking things? And what actions will you take if the number is positive or negative? Ultimately, every metric you select should exist because it helps answer a question you already have. (Otherwise, it may just be a vanity metric.) And every test aimed at answering that question should be tied to a clear goal. Select 1-2 of the goals below that you want to focus on.

Some potential goals to focus on are:

- Increase membership

- Increase client satisfaction

- Increase loans

- Increase appointment volume

- Better plan staffing

- Better plan product launches and rollbacks

- Better plan branch openings

- Improve retention

- Improve customer lifetime value

3. Make an Updated List of Questions You’d Like to Answer

If you’ve already been writing down questions you’re curious about, now’s the time to formalize that list. Good CX insights start with asking good questions.

Here are a few to get you started:

- Do our interactions tend to be single product or multi-product?

- How many appointments does it take to obtain a loan?

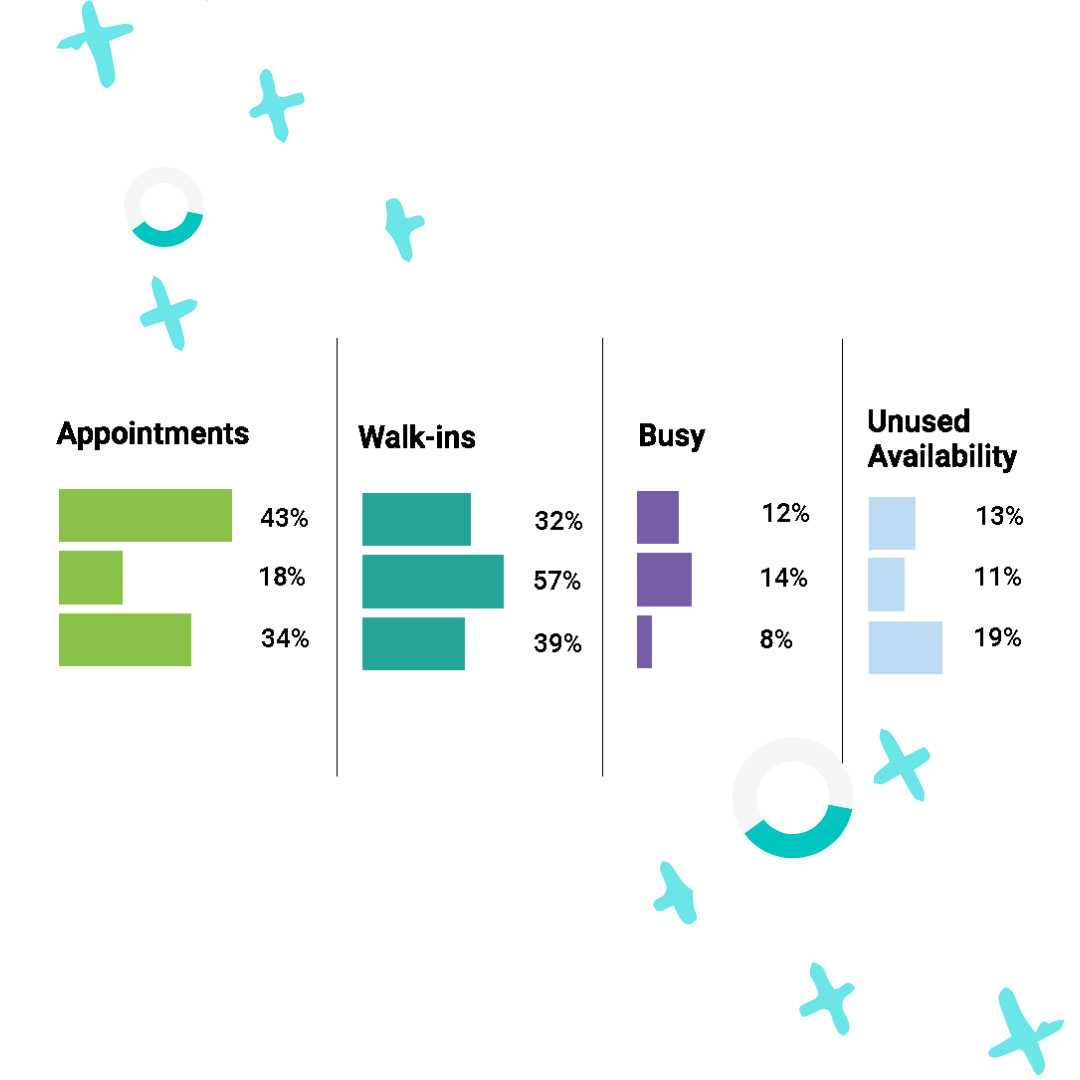

- How fully are staff being utilized? What capacity do branches have to handle walk-in traffic or rebooked appointments?

- Are staff spending time on the right things?

- What interactions tend to lead to sales?

- What interactions leave clients feeling satisfied?

- What experiences cause members to churn?

- Can we assign a dollar value to appointments?

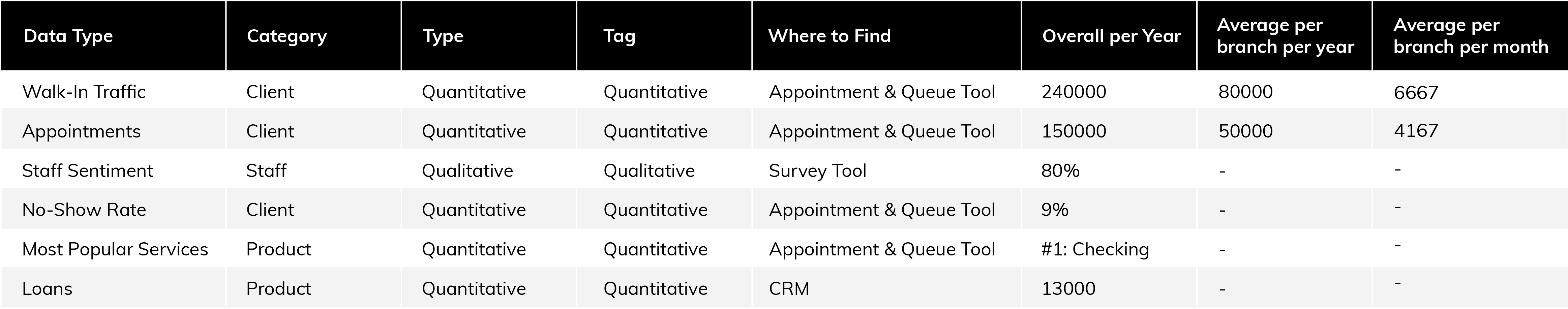

4. Select the CX Metrics You Plan to Track in Analytics

Now it’s time to select your metrics. Take your top 4-5 questions and work backwards to find metrics where, if you had those numbers, you’d have a pretty good answer to your question. For example, if you want to know whether your interactions tend to be single product or multi-product, you’d need to know:

- The total number of interactions (in-person or online)

- The total number of products attached to interactions

- And ideally, which products are tied to which interactions

Using your questions, select data types or metrics from the list below, add them to your data map spreadsheet, and add a star next to them.

List of CX Interaction Metrics Financial Institutions Can Track

![]()

Client Metrics

- Total interactions online

- Total interactions with staff

- Show-up rate—of people who booked appointments, how many showed up

- No-show rate—the opposite of show-up rate

- Missed appointments

- Customer satisfaction—by average, by client, or by location

- Most engaged—clients with the most completed appointments

- Summary by client or household—all products by client or household

- Client activity overview—see all of a client’s interactions with staff (calls, chats, or appointments), or digital campaigns or channels, or their in-progress or completed services

- Top acquisition channels—how did people find you / where did they book from

- Customer lifetime value—the average revenue an institution expects to make from a typical customer or member over their lifetime as a client

![]()

Product Metrics

- Total products

- Most popular services

- Average products per transaction

- Average products per interaction

- Average interactions per product/service type

- Top channels—how did people find you / where did they book from

Staff Metrics

- Total interactions with clients

- Appointments per location

- Appointments per staff

- Lead time for booking—how far in advance people book appointments

- Walk-in volume—total in-branch walk-in traffic

- Wait times

- Handle time—how long it takes an advisor to help a client

- Abandonment time—how long before clients abandon queue

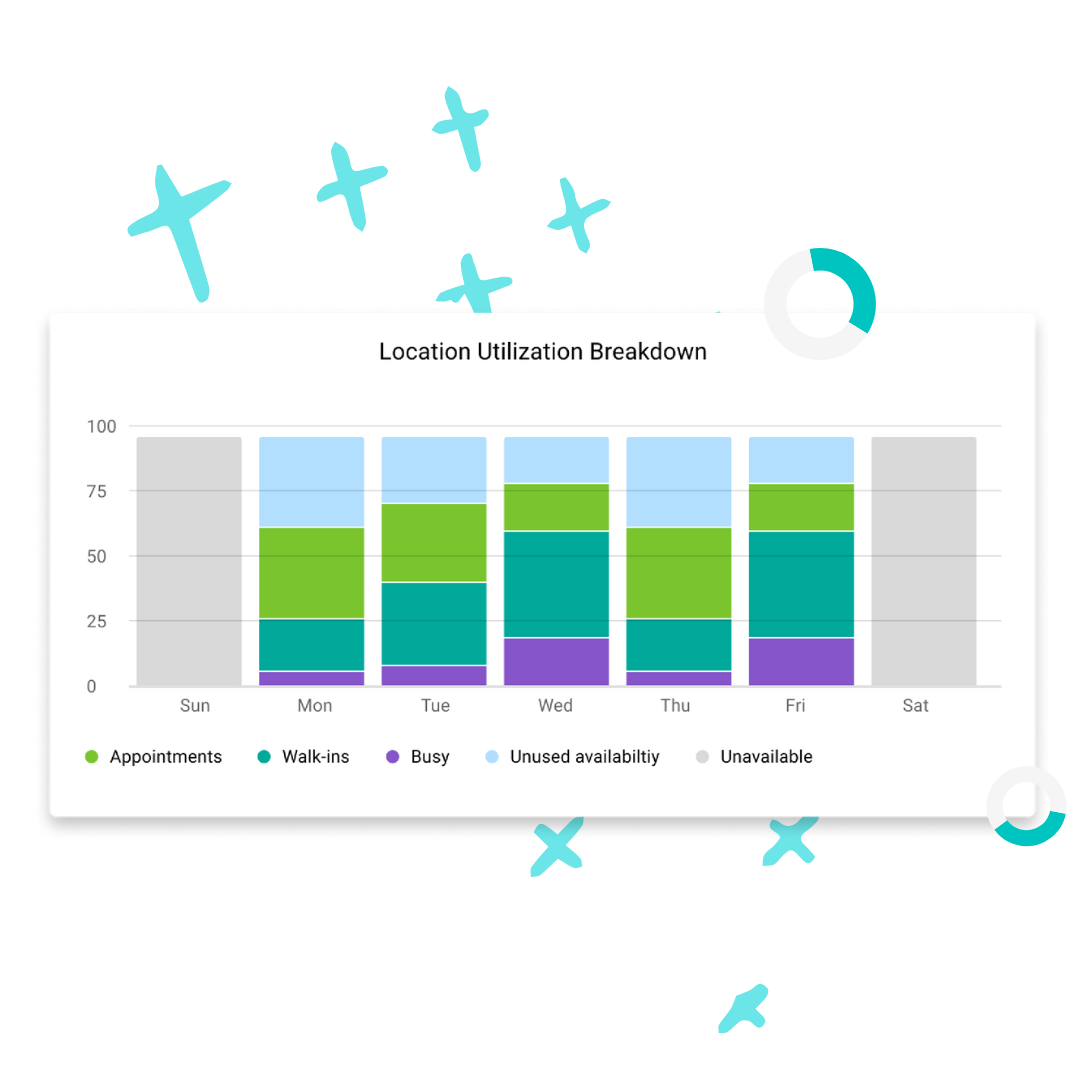

- Busiest and slowest branch times

- Waitlist trends—whether wait times are growing or shrinking

- Staff interactions—number of interactions for individual staff over time

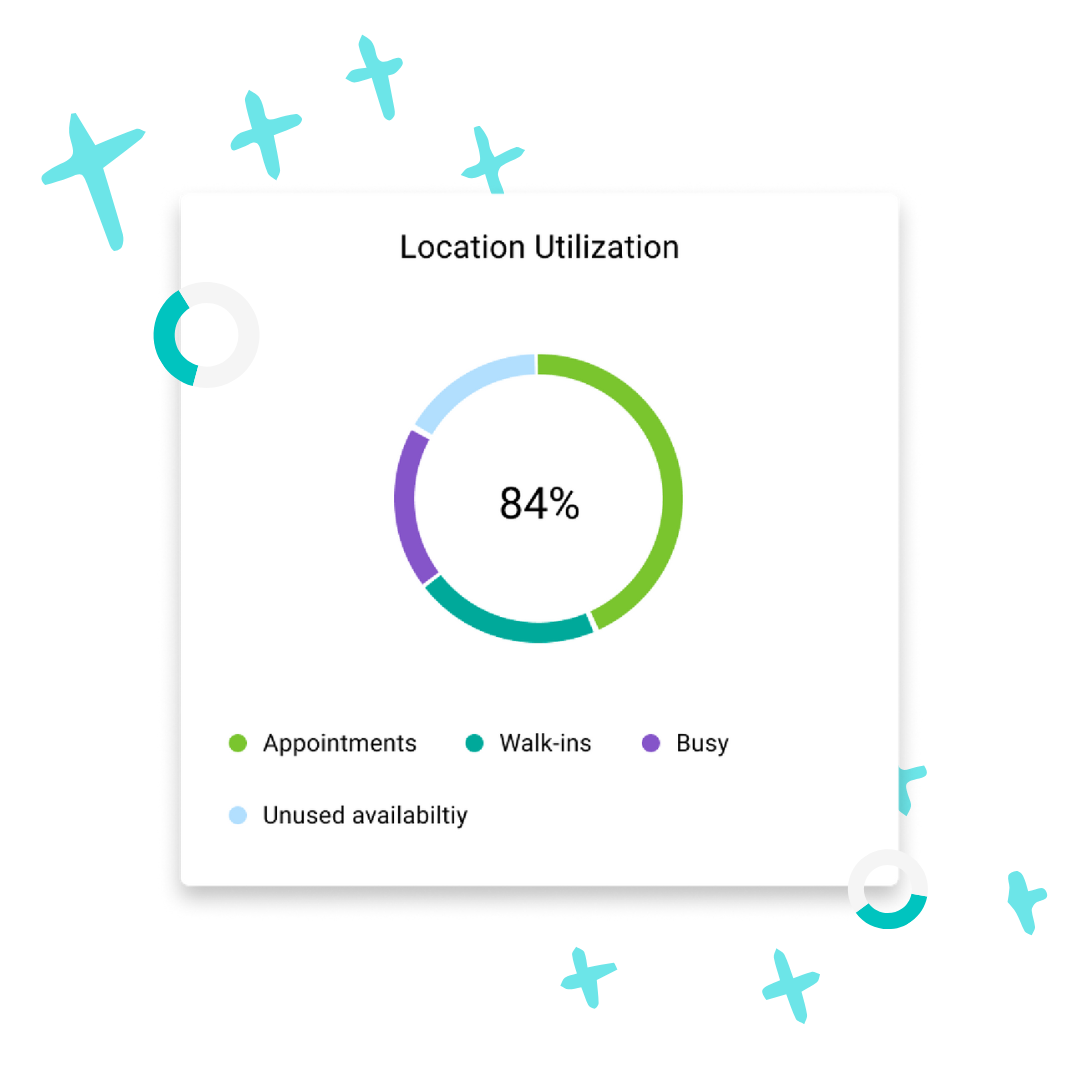

- Staff utilization—pool of available staff time

- Staff capacity—how much time staff have open for future appointments

- Location deep dive—traffic map by location, by hours/day

- Location traffic trends