Becoming Future Proof: Four Strategies to Create the Branches of the Future

Access the PDFDownload the PDF or read it below.

Overview

Financial institutions like banks and credit unions exist in a rapidly changing environment fueled by evolving customer and member preferences and new technologies. The growth and opportunity these changes ignite are exciting, but financial institutions need to understand how their operations and customer experience will be affected. In the wake of the pandemic, FI leadership is asking, is the physical branch going to remain relevant in the coming years? The simple answer is, yes but branch strategy (and the execution of said strategy) will need to change substantially.

Branches will always be important to your customers and members. Major financial decisions like new mortgages, education loans and financial advisory will always benefit from having a human on the other side of the virtual or physical table. After all, this money your customers and members are trusting you to assist with represents their future, their childrens’ dreams and the hard work they put into their careers. They want to have a strong human connection when making these important investing decisions.

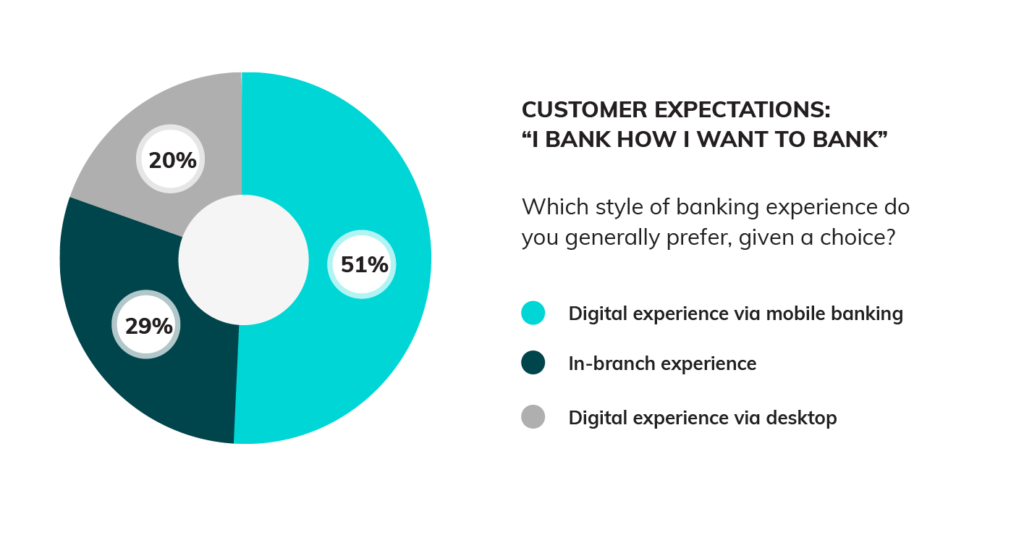

This chart (below) was created from a report we commissioned with Future Branches that asked banking customers their thoughts on how they prefer to bank with their financial institution.

It showcases that the majority (51%) of individuals prefer a digital experience through a mobile app, followed by in-branch at 29%, and finally a desktop digital experience at 20%. But the most interesting part is that 71% of those same respondents believe it’s important to build a relationship with bank personnel.

We saw this clearly during the COVID 19 pandemic. Branches were forced to close and drastically reduce their traffic, yet customers and members still needed ongoing support to pay loans, receive government assistance and access safety deposit boxes. While many

transactional, and even some advisory, services can be rerouted to digital or self-service channels, there will always be a need for branches, and thus a branch network strategy.

The role of branches is changing. Customers and members are increasingly comfortable taking advantage of online and mobile channels, leading to lower branch traffic and fewer teller transactions. As more of them use digital channels to deposit checks, transfer funds and manage their accounts, banks and credit unions must continue to move away from their transactional focus and adapt to meet the expectations of the evolving relationship that customers and members have with their branch. In this report, we’ll explore some of the options to become future proof.

#1 Provide Self-Serve Kiosks

As the first engagement for any customer or members entering your branch, upgrades to the lobby should be a top priority when seeking to future-proof the physical banking experience. While some companies have gone for a complete technological overhaul as seen with the robot-run branches of China Construction Bank or Bank of America, the majority of these upgrades involve bringing in technology to supplement the human experience, rather than replace it. It appears that this relationship-centric approach to technology is more likely to lead to long-term success.

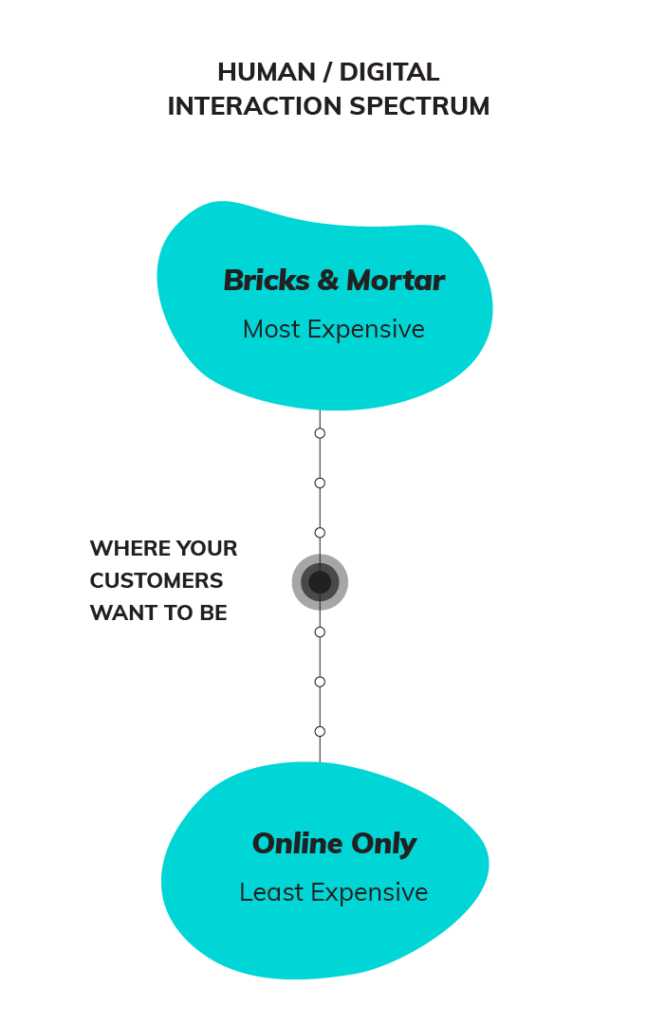

We commissioned several studies in 2020 to better understand how your customers and members want to engage with your financial institution. Our research found that your customers and members want to be met somewhere in the middle of the digital/bricks & mortar continuum – encouraged to use digital options when low value transactions can be completed, but welcomed into their local branches when advisory and life milestone discussions need to happen. 71% say access to self-service tools in the branch are important in their physical banking experience.

By far, the most efficient method is through replacing or augmenting the standard greeting desk with self-service kiosks. Through this relatively simple investment, visitors can conveniently complete their task, creating a streamlined lobby that’s more engaging to your customers and members and more efficient for your staff. They also provide the added benefit of tracking and measuring operations metrics across branches, providing leadership with the information they need to make more informed decisions and improve the experience even further.

It is important to consider all the ways that a visitor, whether they are already banking with your financial institution or it’s their first time walking into a branch, might engage in-branch. Expectations are at an all time high and the technology your financial institution uses will either make or break those key touchpoints.

“Digital technology and new forms of automated service offer many exciting opportunities for financial services to become more tailored and convenient. But there will always be a role for face-to-face service when it comes to banking. Money issues are complex and emotive. Customers like to talk through what it all means with a real human being.”

Paul Riseborough, CCO, Metro BANK

Self-serve must include options for visitors to:

- Add themselves to a walk-in queue and immediately see how long the wait will be

- Check into a pre-booked appointment and receive notifications when staff are ready to meet them

- Book a future appointment if the visitor doesn’t have time to wait at that moment

These three key functions will cover off the majority of the use cases for self-service kiosks and if designed and implemented well, will be a valuable way to quickly engage a visitor as soon as they enter the branch.

Most importantly, this forward-looking strategy shifts the focus for branch employees from answering routine questions and manually booking appointments to growing revenue. By empowering visitors to self-serve where appropriate, your staff are given more time to engage in higher quality conversations with your customers and members about their financial goals.

#2 Lobby-as-a-Hub

To push lobby improvements further, it’s also important to make the atmosphere more conducive to human interaction. Some contemporary banking providers like Capital One made the radical decision to entirely revamp their branches, turning them into cafés. Such concepts were far and few between, and those that tried them were often ridiculed.

Bank and credit union leaders are reimagining the purpose of the in-branch experience, treating it less like a retail outlet and more like a hub for financial activity. A great example would be having financial advisors and mortgage specialists, readily available whether over the phone or video for conferencing or in-branch – that way if a customer or member comes in looking to buy a house in the next few months, their advisor is there to help with budgeting and the mortgage specialist can quickly assist them to see what kind of loan terms they’d be offered. And, being able to preplan and book these appointment ahead of time, means that the customer or member can meet these specialists when it’s most convenient for them.

From a recent McKinsey article, physical distancing has necessitated a sharp change in branch usage. In March 2020, 25% of branches globally were closed, and 15% remained shuttered by May. However, even before the crisis, branch contribution to core banking unit sales had fallen from 75% in 2015 to 55% in 2019 (although average sales value remains higher in the branch than other channels).

More and more customers and members are embracing the idea that banking doesn’t need to be purely transactional nor purely in-person, and many financial institutions are converting customer spaces in their branches into ‘third places’ — comfortable locations between work and home where people can meet and hang out. The idea behind this movement is to encourage the most important aspect of the branch that sets it apart from increasingly popular digital options — human interaction. And it does this by removing the barriers that have traditionally been in place. This change doesn’t necessarily need to mean converting customer areas into a full blown cafe either. Through a self-service kiosk as mentioned in the previous recommendation, space that would otherwise be taken up with queueing customers or members, greeter stations and tellers standing behind a counter can be utilized to create a more open and inviting area.

Think of an interior design featuring fewer walls or straight edges, round tables and comfortable seating, and you have a space that’s less of a ‘lobby’ and more of a comfortable lounge that encourages conversation and interaction. At the same time, mobile technology can be implemented in order to allow staff to roam about ready to answer questions, provide transactional services through tablets, educate customers and members on self-service options and direct them to private meeting areas to speak to advisors.

“Conventional wisdom states that customers prefer digital experiences, and digital interactions have certainly risen in importance as a result of the pandemic shutdowns. As a result, companies race to create entirely digital experiences to entice customers away from physical channels like call centers and brick-and-mortar locations. That’s a mistake.”

The US Banking Customer Experience

Index, 2020, Sept. 1, 2020, Forrester

#3 Introduce Remote Video Banking

Video banking has been popular for years now, with many banks and credit unions having installed ITMs — interactive teller machines — for their drive-up and in-branch kiosks. A number of financial institutions have been successful with this technology, but consumer habits continue to evolve. Today, millions of people are making video calls through Zoom, FaceTime and Skype every day thanks to the pandemic and ensuing lockdowns.

With remote video calling becoming mainstream, customers and members are beginning to question the need for branch visits. The expectation that their financial institution extends the same capabilities that they enjoy everyday when communicating with their friends and colleagues, to things like mortgage applications and investment consultations is increasing.

“We recognize that [SMB customers] work unconventional hours, are travelling or might not be able to visit a branch for a number of other reasons. Being able to access RBC Small Business specialists via video wherever and whenever they want helps them maintain that personal connection they expect with

our bank.”

Cathy Honor, SVP Contact Centres, Royal Bank of Canada (RBC)

Currently, most remote video offerings are created for specific use cases — with RBC it’s SMB clients, while others like Barclay’s provide limited retail banking services. In these early stages, these constraints to service levels work to streamline implementation as specialized representatives are able to serve customers and members from central video contact centers. However, if remote video banking is to be extended to more services in the future, it should also be extended to include the branch itself. Along with allowing branches to leverage the talented and experienced staff they already employ, it would allow customers and members to engage by video with a local representative that they know and trust. This not only plays to the strengths of the branch in providing expert face-to-face financial advice, but also fits with what customers and members are expecting from digital services. Banking customers and members want the convenience of access to multiple channels — and when they use their preferred channels, their engagement improves significantly. As a result, these engaged customers and members spend more money and are more likely to stay with their bank or credit union. Customers and members want digital, but they also want the trust, security and relationship that comes from physical services. 38% of respondents to a recent survey wanted a personal relationship with their bank but only had a digital one, or vice versa, which resulted in them being less likely to fully engage with their bank by 47% compared to those whose preferences were being met.

This means combining physical and digital services, rather than separating them into two divergent channels — the branch and the video contact center should be working to support each other.

#4 Simplify Appointment Scheduling

If branches are going to remain relevant in the years ahead, it’s vital for them to make it as easy as possible for customers and members to schedule a visit. According to our research, 72% of banking customers and members prefer the online appointment scheduling experience but only 23% say their bank or credit union provides this method of engagement. This means that customers and members are visiting branches less frequently, but when they do it’s for high-value face-to-face consultations. No amount of in-branch technology or improvements is going to eliminate the friction caused when they visit a location only to discover that nobody can see them at that time.

Thankfully, this is the easiest solution to implement, and many financial institutions have already taken steps to bring self-service online scheduling capabilities to their branches. With a unified, self-service scheduling platform for all channels, financial institutions can streamline the appointment booking process across every touchpoint. Whether an appointment comes through via your website, Google search or map results, your mobile app, contact center or social platform, customers and members can book that meeting as soon as the thought crosses their mind.

With this in place, financial institutions can effectively remove the friction and increase the number of valuable appointments driven to your branches, but also enable better optimization of employee schedules to improve their overall efficiency. By reducing the level of effort that both customers or members and staff have to go through in order to complete their interaction, you vastly improve the entire experience, and customers and members feel more valued by your FI. This is important – Forrester has found that among financial institution customers in the US that felt valued, 71% plan to stay with that financial institution, 82% plan to spend more, and 87% will advocate to others. This demonstrates that making it easy and convenient to do business with you leads to higher customer satisfaction. Even better, for those that felt satisfied across all channels, meaning when they engaged with their financial institution on a website, contact center, in person, or in app, they tended to have a 7% increase in deposit share.

“On average a ‘Highly Digitally Engaged’ consumer has 4.4 products with their main bank compared to only 2.7 for the ‘Digitally Unengaged’. Digital engagement correlates with more products per member or customer, improving retention rates.”

Conclusion

There’s no denying the fact that customer and member preferences are changing, and that branches are going to have to adapt if they want to remain relevant. Innovative technologies and new digital tools are bringing massive changes to the banking and credit union landscape, and nowhere is this more visible than in the brick and mortar channel.

But these changes don’t mean that the branch is becoming irrelevant. Even with the reduction in branch traffic and increase in mobile and self-service solutions, customers and members still want to be able to sit down with a financial professional when making big decisions.

There are far reaching implications on the efficiency of your staff as well, the topic of a future white paper. McKinsey found that in the United Kingdom, “some advisers spent only 27% of their time with customers, half of teller customer time was still spent on migratable demand, and branch managers spent almost a day per week on paperwork and equipment maintenance.” This showcases significant work can be done in-branch to help your staff reduce the manual, low value tasks they are currently burdened with, and instead leverage a revitalized branch to streamline operations and refocus on advisory support, the services that often drive the most revenue.

With millennials and Gen X ranking convenient branches as their primary consideration when selecting their financial institution, that’s not likely to change any time soon. What does need to change is the idea that they will continue sitting on hold, standing in a queue or waiting in an outdated lobby to meet with a staff member at a time that may not be convenient to them.

Financial institutions have already embraced the change in customer and member expectations and are rapidly adapting to meet them. And the good news is that improvements don’t necessarily require massive investment and a complete institution-wide overhaul of the branch experience.

Solutions already exist that can be implemented in stages, and each of the four suggestions outlined above can be combined to create the branch of the future. Even starting small and introducing just one of these suggestions into your strategy can bring serious improvements. Sitting on the sidelines is not a winning strategy and the time to begin future proofing your branch is now.