The Importance of Humanizing Banking for Enterprise Financial Institutions

Download the PDFDownload the PDF here, or read it below.

Summary

How can financial institutions balance between low value but necessary transactions and high value advisory solutions, while delivering those activities in the ‘channel of comfort’ for the individual customers?

Customers want to spend their limited time on the people and experiences they find valuable. Inefficient processes often leave consumers feeling as though they are not being prioritized but are rather a digit in line waiting for their turn. As a financial institution, it is important to demonstrate your value for them by personalizing your engagements to humanize your interactions.

“As digital becomes the channel of choice for many more customers during the pandemic, banks should focus on making customers feel valued, appreciated, and respected in these digital moments too. How? Start by streamlining task flows and minimizing steps, a signal that you value and respect customers’ time.”

The US Banking Customer Experience Index, 2020, Sept. 1, 2020, Forrester

Why Humanize Banking?

Much of our world treats individuals like numbers, with minimal concern for the person behind the digits. Consumers want to spend their limited time on the people, experiences and things we find to be valuable – financial institutions need to demonstrate their value for their customers by personalizing engagements and interactions and building deeper connections. No matter how quickly organizations delve into much needed digital transformation by using apps, CRMs, IVRs and chat bots, financial institutions cannot replace human to human connection for the pivotal moments your customers are expecting it – the consultative advice for those very important life moments.

In this white paper, we’ll cover the following key considerations when evaluating your enterprise financial institution, and how you can humanize your engagements:

- Customers who feel valued stay, spend and advocate

- You can’t manage what you can’t measure

- Engage in individuals’ ‘channels of comfort’

- Different activities require different levels of support

Improving your customer engagement is necessary to gain and retain market and share of wallet. Engaged customers are key to growth in 2021 and beyond, especially considering the complete digital transformation currently underway in the financial services space. Ideally, banks, credit unions, wealth management firms and tax preparation companies will be able to bridge the digital and physical channels to create a seamless banking experience, with little friction for customers when they move from online to bricks and mortar, then back again. If your financial institution gets a good handle on these considerations, you’ll be well positioned to balance between digital and physical, providing consistent value to your customers. And treating them like humans.

Customers Who Feel Valued Stay, Spend and Advocate

The September 2020 US Banking Customer Experience Index from Forrester looked at the three dimensions of customer experience to determine the drivers behind high quality journeys. They found that effectiveness, ease and emotion were the most important considerations, however they were not equally important. Emotion, how customers felt about the experience, was the key differentiator between various financial experiences. This differentiation is necessary to stand out from the increasingly homogeneous crowd of financial institutions. 30% of US online adults agreed that “All banks are basically the same” with a further 32% stating they were neutral. It’s even worse in Canada where 47% of Canadians felt that all banks were the same, according to another Forrester study.

With the increasing pressure from new entrants into the world of finance, banks, credit unions, wealth management firms and tax preparation companies all need to return to the crux of effective customer engagements: the emotion behind the experience through deeper relationships with prospective and existing customers.

A Gallup research study also found that the emotional connection is what keeps customers coming back, with fully engaged customers netting an incremental 23% revenue. However that same research showed that only one in five customers are actually emotionally connected to their primary banks.

Meaningful differentiation doesn’t just come from products and interfaces; it comes from having a holistic view of customer need. For example, while most consumers in … North America prefer online interactions, physical locations continue to serve as important touchpoints (even for Millennials) when opening accounts and buying banking and lending products.

Retention Is Not Enough: Banks Must Build Emotion-Rich Relationships To Grow May 14, 2020

You Can’t Manage What You Can’t Measure

Coconut Software regularly discusses industry trends, upcoming challenges and internal processes with banking executives. It is surprising how often financial institutions are not tracking basic metrics to measure prospect and customer engagements. Understanding what your meeting no-show rate is, how many walk-ins you have at each location per hour per day, what channel is most popular for which question, and what services are in highest demand, means your team understands how, when and where your most valuable engagements are happening and which areas require more attention.

28% of banking executive respondents to a recent study of ours say that improving in-branch personnel’s access to insights about individual customers is important. But what are those other 72% of banks doing – are they not providing their staff with this data?

Measuring engagement goes beyond a simple tally of how often a customer logs into a mobile app, calls into the call center, or visits a branch. Financial institutions need to be able to connect each of these touchpoints across all channels to records in a CRM tool to begin painting a picture of how an individual behaves, as well as track how they want to be engaged with in the future.

Collecting these data points will allow you to segment prospective and current customer bases to understand what is driving valuable, revenue driving behaviors, what can be used to predict future actions, as well as help with operational execution like workforce capacity planning in branch and upskilling your talent for popular services.

Using technology is the only way enterprise level financial institutions can begin to measure the engagements between staff and customers. Using analytical tools like Hubspot, Pardot and Google to track the customer behavior through digital channels, then pairing that up with vendors like Coconut Software for the in branch and appointment based analytics, means the entire customer engagement journey is mapped. From the initial search query in Google, all the way through submitted paperwork via your central banking platform and customer records management like Salesforce.

According to Financial Brand’s Digital Banking Report, 32% of financial institutions stated that they did not use any customer engagement tracking, with 67% of surveyed organizations not using an omnichannel customer experience platform. This means that the vast majority of financial institutions are operating blind, not knowing how their customers are currently engaging with them. It also means there is no historical data upon which to create predictive models for future behavior to get to the strategically desired state.

In the U.S., even when people love a company or product, 59% will walk away after several bad experiences, 17% after just one bad experience.

PWC report “Experience is everything: here’s how to get it right”

“The ability to pull reports or quickly view numbers at a glance helps us determine the volume of appointments (completed or canceled) and determine what our most popular service is. As a manager, I have found it to be a great tool to project staffing needs as well!”

Branch Manager, Members CCCU

“The ability to pull reports or quickly view numbers at a glance helps us determine the volume of appointments (completed or canceled) and determine what our most popular service is. As a manager, I have found it to be a great tool to project staffing needs as well!”

Branch Manager, Members CCCU

Engage in Individuals’ ‘Channels of Comfort’

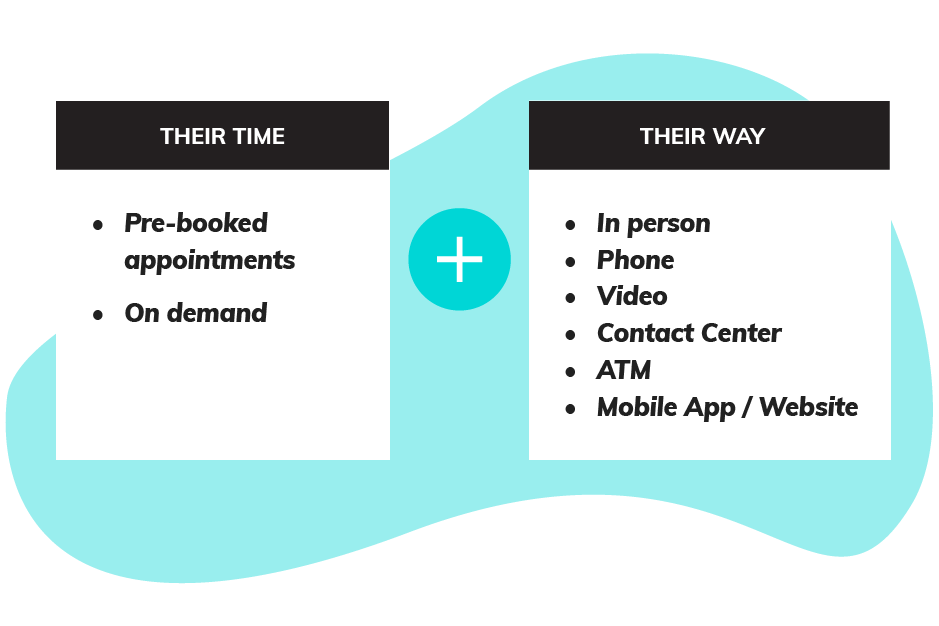

Your banking customers want to complete their transactions and get advice in a way that is convenient for them. Gone are the days where everyone visited their local branch before 5pm on a weekday, and instead the pendulum is now swinging towards a “digital only” experience with online banks.

Your customers have preferred channels, what we call ‘channels of comfort’, that vary individual to individual, and can change based on the query they are trying to resolve. These channels include mobile apps, call center support, social media, ATMs, phone appointments, video conferences and face to face meetings in branch, with most individuals using between three and four channels.

When customers are able to select and use their ‘channel of comfort,’ their engagement improves significantly. Engaged customers spend more money and are more likely to stay with their bank. Research has shown that there is a serious mismatch on how banks service their customers and how customers want to be served. 38% of respondents to a recent survey wanted a personal relationship with their bank but only had a digital one, or vice versa, which resulted in them being less likely to fully engage with their bank by 47% compared to those whose preferences were being met.

More importantly, customers’ satisfaction with a channel matters most. Financial institutions need to match the experience they deliver to the customer’s preference for how they want to bank with you. Creating experiences that leave customers “very satisfied” will boost engagement significantly. Even if you can’t provide service in their preferred channel, at least make sure the experience they have is as good as possible. Of the customers that are “very satisfied” with their online banking experiences, 50% are fully engaged even when they prefer a different channel, meaning the ‘warm fuzzy’ feeling that comes with an excellent experience seeps across channels and is reflected in their overall engagement, according to Gallup. On the flip side, engagement drops when customers don’t interact with their bank in the way they want to, and drops a further 40% when they give a “less than perfect satisfaction score to even one of the channels they use.”

In one of our studies, we found that 25% of banking executives are focusing on personalization in their engagements, meaning they’re asking their customers how they want to be helped. What about those other 75% of executives? Are those financial institutions assuming they know what those customers want? Or even worse, perhaps they don’t care enough to diversify their offerings into a variety of channels in the first place.

“Whether the business is ready or not, your customers are ready to start booking appointments online. Don’t wait to implement appointment scheduling-do it immediately! You can miss out on valuable appointments if your customers have to wait until working hours to call and book in.”

Shara Abrams, SVP Operations, Jackson Hewitt

“Conventional wisdom states that customers prefer digital experiences, and digital interactions have certainly risen in importance as a result of the pandemic shutdowns. As a result, companies race to create entirely digital experiences to entice customers away from physical channels like call centers and brick-and-mortar locations. That’s a mistake.”

The US Banking Customer Experience Index, 2020, Sept. 1, 2020, Forrester

“We wanted to offer our members the ability to interact with the credit union using their preferred channel at the time that is most convenient for them. We also wanted to gain a better understanding of why members were visiting our branch and requiring a longer sit-down appointment that couldn’t be resolved with their first point of contact.”

Tara McQuillen, Chief Experience Officer, Discovery Federal Credit Union

Different Activities Require Different Levels of Support

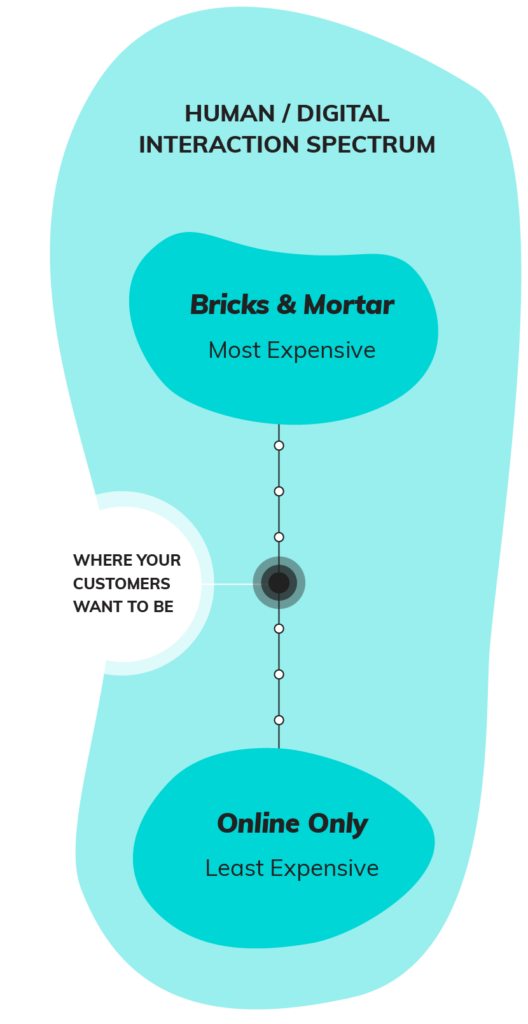

Coconut Software commissioned several studies in 2020 to better understand how your customers want to engage with your institution. Our research has found that your customers and prospects want to be met somewhere in the middle of the digital/bricks & mortar continuum – encouraged to use digital options when low value transactions can be completed, but welcomed into their local branches when advisory and life milestone discussions need to happen. After all, money represents their dreams, their kids’ future, and is a reflection of their hard work.

Physical branches and the personal interactions they facilitate are still important for large and complex banking transactions, such as renegotiating a mortgage or taking out a business loan. On the other hand, many consumers are now doing smaller transactions like checking their balance and making deposits by using ATMs and banking apps. It is imperative for financial institution leaders to know when to automate and when to humanize interactions.

Banks should focus on delivering more empathetic personal interactions. When asked why they went to a bank branch, surveyed customers stated that:

- They had to complete a bank’s manual process in person

- The branch is the simplest way to perform transactions like cash-in

- They need the support of a human being

Only one of these boost branch engagement, and aligns to high value, advisory type services.

Refocus The Bank Branch On Delivering Empathetic, Personal Interactions, Aug. 10, 2020, Forrester

Match the level of support you provide to the level of complexity for that request. Don’t make opening a chequing account more difficult than it needs to be, and see if you can support that activity through a less expensive channel, like a chatbot on your website. That way, you can focus your highly trained and highly paid in-person staff for truly advisory type support.

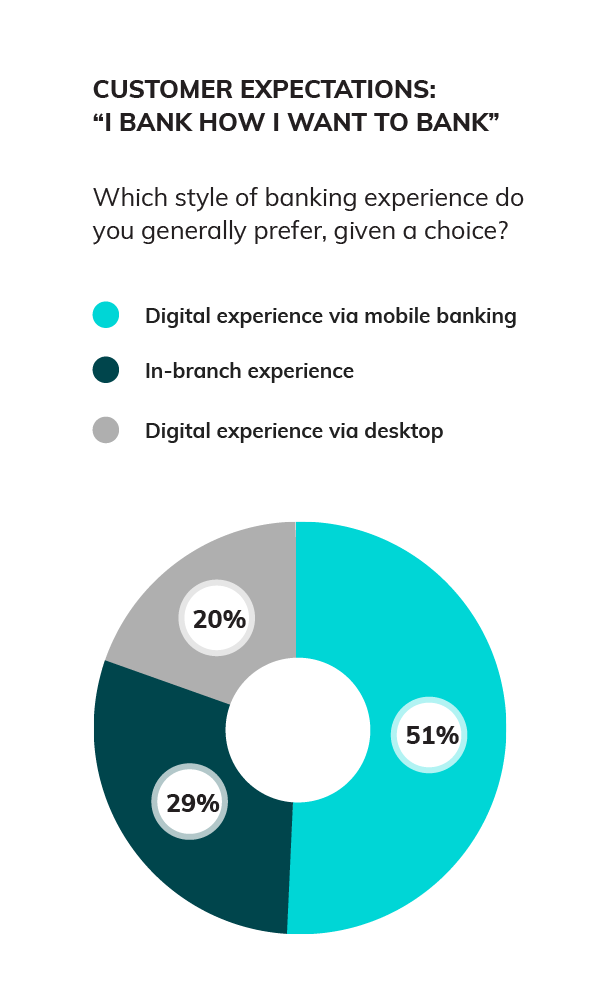

This pie chart was created from a report we commissioned with Future Branches that asked banking customers their thoughts on how they prefer to bank with their financial Institution. It showcases that the majority (51%) of individuals prefer a digital experience through a mobile app, followed by in branch at 29%, and finally a desktop digital experience at 20%. But the most interesting part is that 71% of those same respondents believe it’s important to build a relationship with bank personnel. What does this truly mean – for those transactional, day to day activities, your customers like the digital option. But when it comes to larger and more complex transactions, like buying a house or investing lottery winnings, your customers want to leverage the expertise and advisory services of your staff in branch.

“Our response to COVID was certainly seamlessly supported by the Coconut solution. We made changes and additions to our offering very quickly, facilitating the execution of important initiatives like offering loan and mortgage payment deferrals, or to close our branches to walk-in traffic at the height of the lockdown.”

Paul Cockshutt, Senior Manager, Integrated Alternate Channels, Interior Savings

Naturally, customer preferences must be weighed against the cost of supporting the various ‘channels of comfort’ with significant differences in the expenses between them. Having someone book an appointment to deposit a single check into their checking account is a high cost for a low value transaction that easily could be automated through taking a picture on a mobile device via an app. For example, an average call to a call center in the US costs $7.50 or $2.35 for an overseas agent. If an AVR/IVR (automated or interactive voice response system) is used, the cost can fall to $0.32.

However for high value, consultative type of services like wealth management, insurance policies or mortgage renegotiations that signify a significant transfer of funds or key life milestone, an in person or virtual face to face prebooked appointment makes sense.

Another study looked specifically at the different channels individuals preferred for common queries and found:

- 75% of customers prefer in person interaction to open/close an account, apply for a loan or seek financial advice

- Nearly equal proportion of individuals prefer in person or online to learn about products and services (37% versus 38%, respectively)

- 43% prefer digital for account information, such as balance inquiries or check images

- 50% wanted an in person discussion to report an issue, followed by 39% preferring to use a call center

- Equal proportion (47%) of respondents preferred to withdraw money from an ATM or in person at a branch.

It’s absolutely imperative that you ask your prospective and current customers how they want to be helped, instead of assuming.

After all, moving customers from channels they prefer to use, to ones they do not, lowers their engagement and satisfaction: key reasons why customers leave their financial institution. Once you’ve established how those individuals want to be supported in their ‘channel of comfort’, determine what technology and processes are required in order to service them in said channels. The “thought that matters” concept only will take your customer experience so far – backing it up with operational execution to solve their queries is the only way to create true engagement.

“Our members are gravitating towards being in charge of their experience – not having us tell them how they’ll have an experience. The more we offer them flexibility and engagements when it’s convenient for them, the more we’ll be able to grow and provide an exceptional member experience.”

Gina Jorgensen, AVP of Member Services, Rogue Credit Union

Conclusion

According to a PWC study, 59% of all consumers feel companies have lost touch with the human element of customer experience. That same study also found a mismatch between how the companies’ employees execute on that experience and the customers’ expectations: only 38% of U.S. consumers say the employees they interact with understand their needs.

Numerous studies have proven that when brands deliver a high-quality experience by communicating clearly, their customers are nine times more likely to spend more with them, according to the 2019 Forrester Analytics Customer Experience Index Online Survey of US Consumers. The revenue impact of a 1 point improvement in CX index score (a way that Forrester measures high quality customer experience) results in $8.19 of annual incremental revenue per customer for multi channel banks, and $9.82 per customer for direct banks.

Humanizing banking needs to become a transformative shift in how financial institutions engage with their customers in order to improve the experience and by extension, market share. It isn’t enough to endlessly create new channels for new products – customers are expecting that their experience between and across channels will be consistent, simple and valuable.

Why does humanizing banking work? Because it makes your customers feel appreciated, respected and valued, necessary ingredients for loyalty and an increase in share of wallet. Personalizing the experience through asking then servicing individuals in their ‘channel of comfort’ means they feel valued, and that their time is being respected.

With direct and measurable results on the feeling of engagement leading to loyalty and share of wallet, any financial institution looking to gain and retain customers in a swiftly changing environment must evaluate whether they have the technology stack, and internal resources, to support the humanizing of their customer engagement experience.

“It just becomes the best member experience you could have – members are thinking ‘you purposely thought about my situation, you took the time to prepare for me, and you’re respecting my time of having to come down, mask up, and enter the branch.’

Jerimy Saldivar, Director of Member Experience, WECU