About Whatcom Educational Credit Union (WECU)

Headquarters: Bellingham, Washington

Size: 415 employees across 13 locations, over 130k members, $2 billion in assets

Coconut Solutions: Appointment Scheduling, Lobby and visitor management, Reserve with Google, Phone and Video meeting add on.

WECU is one of Washington State’s largest credit unions. For more than 80 years the credit union has earned a strong reputation for providing personal service, straight forward banking products, and through its extensive community giving and volunteerism.

Although WECU had already engaged with Coconut to begin the process of providing onboarding a new Appointment Scheduling and Lobby Management solution, when the COVID-19 pandemic hit the credit union realized it needed to quickly reprioritize strategic initiatives.

“As the news about the Coronavirus and the Governor’s stay-at-home directive rolled in, we had to step back and figure out how to best serve our members,” said Jerimy Saldivar, Director of Member Experience at WECU.

Both organizations worked together to speed up the project rollout in an effort to support social distancing and safety precautions.

Download the Case Study PDF

WECU’s Challenge

Investing in digital innovations that enhance the member experience and deepen relationships through personalized interactions is a key priority for WECU, especially as member and prospective member expectations about banking change. “WECU is committed to providing a frictionless digital experience for our members,” states Chief Information Officer, Jack Ingram.

However, one must track and measure in order to manage – prior to working with Coconut WECU had not been tracking any of their member engagements.

Lobby management was a ‘first come, first served’ home-made check in system with no appointment booking process. Wait times were long, not only for tellers but also loan officers, a strategic service for WECU. Without the ability to prebook appointments, walk-ins were at the mercy of chance – branch managers didn’t have the insights to schedule staff to address busy times, and lobby abandonments were a real risk.

Challenge #1 – Building upon existing member engagement to retain market share

Members expect to bank the way they want to bank – at times and ways that are convenient to them. Ingram, Saldivar, and the rest of WECU’s leadership team realized that their existing process of supporting member engagement could be improved upon, especially when competing with digital only banks and other local credit unions.

“You need to go into the trenches with user groups, focus groups, and by utilizing secret shoppers in order to allow your customers to give you feedback,” Saldivar said. “From doing these things, we understood that our members wanted to bank differently.”

Challenge #2 – Managing location traffic through a pandemic

Originally, WECU planned to implement appointment scheduling, followed by Coconut’s Lobby and Visitor Management after a “easing in” period. However, with the quickly changing world due to COVID-19, WECU realized that managing location traffic was the most urgent challenge to tackle. With a revised timeline of 4.5 weeks to get the project live, both organizations would need to work together closely to support WECU’s staff.

Challenge #3 – Deeper insights to inform strategy

While WECU had always been interested in data, the credit union wanted to garner more significant insights to validate whether its strategy was on track. It also wanted to use data to adjust day-to-day execution. To start capturing this data, WECU staff would have to “open up their calendars” and adapt to a new way of working. Saldivar and team had some reservations about how willing the WECU staff would be to the changes.

“There was some culture shifting that had to occur in order to support this strategy,” Saldivar said. “We knew we were going to have to communicate transparently to internal teams to facilitate the change.”

The Solution

WECU’s leadership firmly believed Coconut’s solution could help address their challenges and decided to implement several keystone modules.

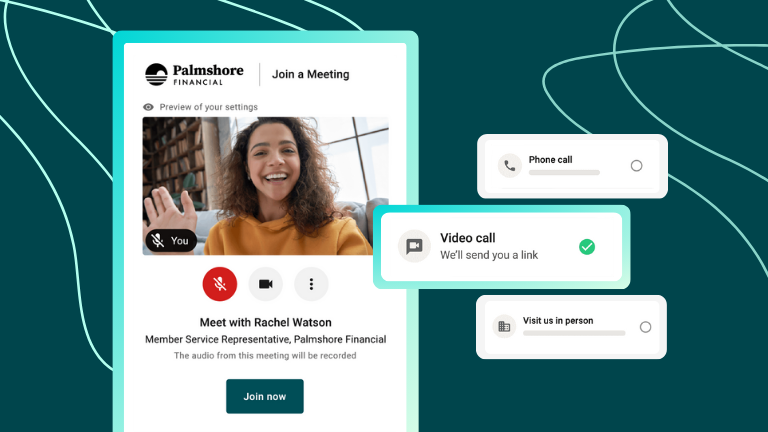

Solution #1 – Appointment Scheduling

Leveraging a platform by which to engage members and prospective members effortlessly was the key directive in the initial project proposal. WECU is now able to capture member attention throughout the engagement process – from visiting their website, using the app, clicking on an appointment booking link in an email signature, or scanning a QR code on a poster in-branch. Saldivar says that WECU’s staff appreciate how simple it is to review their upcoming schedule as well as the automated notifications and reminders for meetings, whether they are in branch, over the phone or leveraging video conferencing.

Check out WECU’s solution live.

Solution #2 – Lobby and Visitor Management

Managing traffic through WECU’s locations became a top priority for WECU to ensure proper social distancing while balancing member and staff expectations and state regulations. WECU has been successful in using Coconut’s Lobby and Visitor Management solution to track appointments and walk-ins. This data is then fed back to the team to provide insights into location busy times, staff adoption, and member engagement. WECU branch visitors can check-in using their mobile devices and can wait in their car until their appointment is ready to begin. Visitors can also see up-to-the-minute wait times in the lobby.

Solution #3 – Reserve with Google

When a visitor searches for a WECU branch, they can now immediately schedule an appointment right from the results page (as well as when they use Google Assistant or Google Maps). Faster engagement had lead to more booked appointments.

Download the Case Study PDFThe Results

WECU’s emphasis on tracking and data means they’ve already seen significant improvements in engagement, better insights, and an evolved member experience, all within weeks of launching.

Results #1 – Improved efficiency of member engagement

“The implementation of the appointment system has given us one more tool as we look to grow our membership, but also expand our footprint,” Saldivar said. “In our marketing, we’re no longer limited to pointing members to visit a branch or a site, we can point them directly to the ‘make an appointment’ page. We’ve seen a huge lift from those marketing messages.”

By leveraging these booking links, the team at WECU can track where drop offs occur, any bottlenecks and experiment with how formatting and content in marketing can affect the number of appointments booked. From May 27, 2020 to mid August WECU had completed 10,600 appointments. “That number is mind boggling to us,” Saldivar said.

The research that WECU did to better understand how members and prospects wanted to bank is paying off. With the rollout of Reserve with Google, visitors are searching for “WECU or banking, and you can see immediately within those search results to ‘Book an Appointment’”. Saldivar says that of the 374 appointments booked from July 1 to September 18, nearly 10% were booked through ‘Reserve with Google’.

Results #2 – Improved reporting and insights

Tracking the results of the new ways to engage is key to WECU, not only to evaluate the success of the engagement project with Coconut, but also to make sure that their strategy is sound and they are meeting member expectations.

Using the insights and reporting capabilities of Coconut, the WECU leadership team has decided to emphasize a move to more advisory and consultative type services, also leveraging the digital engagement tracking that Coconut’s solutions provide. Recently, the team created a first-time homebuyer webinar. Immediately following the webinar, attendees were redirected to schedule an appointment with a loan officer. In the past, the team would typically see 8 or 9 appointments. Using Coconut, more than 29 had been scheduled in the first week.

“That’s sticky engagement,” Saldivar said. “When you are able to take someone, who is highly interested and engaged in a topic and serve them up a low friction next step, that’s sticky.”

Results #3 – Better member experience

Net promoter score (NPS) is a key metric WECU uses to measure their member experience and prior to launching Coconut, it hovered between 65-67 – a very respectable score. WECU wanted to see how much of an impact active engagement through appointment scheduling would have on NPS – for members who pre booked an appointment through Coconut, the NPS score leapt up to 86 “which is just incredible. It’s a reassurance that we’re doing something right” Saldivar states, even referencing recent quotes from members. ‘The online appointment system is wonderful’ and another who shared they were ‘Amazed that I could set a same day appointment and I was contacted immediately… you guys rocked it!’

A key function in member experience is how engaged and prepared the staff member is – something that cannot be overlooked when considering both software implementation and change management. One of the reasons why WECU’s engagement has been so high is because staff are using Coconut’s tool to prepare for their meetings before the member arrives. As the Director of Member Experience, Saldivar expected that this prep time would help and it was an important part of the original business case. “It just becomes the best member experience you could have – members are thinking ‘you purposely thought about my situation, you took the time to prepare for me, and you’re respecting my time of having to come down, mask up, and enter the branch.’” Saldivar always grounds himself and the team in his favourite saying “‘How do we enable members to become the heroes of that financial journey?’ If we can answer that, we can constantly evolve to improve member experience.”

Conclusion

While the future remains unclear, WECU is confident that the utilization of Coconut will continue to become ingrained in their business practices.

“Pivoting quickly to meet the sudden pandemic was key to solidifying this relationship,” Saldivar said. “Coconut met our level of intensity and speed to roll out. Having a project plan isn’t the only thing you need to make a project successful. You also need to have two willing parties that are equally focused on completing it.”

“This initiative is another move toward a banking experience that allows members the ability to interact with our team when and how they choose.” Ingram said. “At the end of the day, how we take care of and support our members is the key to our long term success.”