The Appointment Scheduling Growth Guidebook

31 ways to create a five-star appointment experience that drives retention, revenue, and growth at your financial institution.

10 Crucial Tips to Improve Appointment Efficiency

1. Implement a digital, self-serve appointment booking solution.

Set things up so clients can book an appointment online to save time. Staff can use the same system to book on each other’s calendars, too. This makes things more efficient in a number of ways:

- Clients can instantly book when and where its convenient for them, 24/7

- It offers multiple meeting formats (in-person vs. virtual)

- Team members can see other’s calendars, saving time on back and forth

- Advisors can proactively share a booking link with customers

- Clients automatically get reminders before their appointment

- Some tools save transcripts and record activities in your CRM

2. Add a self-serve appointment booking button to your website, app, and more.

Let everyone know you’re now accepting (and prioritizing) appointments. Consider adding an appointment booking button to your:

- Website top navigation bar, next to the “login” button

- “Find a location” page

- Support page

- In-app help center

- Staff email signatures

- In-branch self-sign-in kiosks

- Branch front door, via a QR code

- More ideas

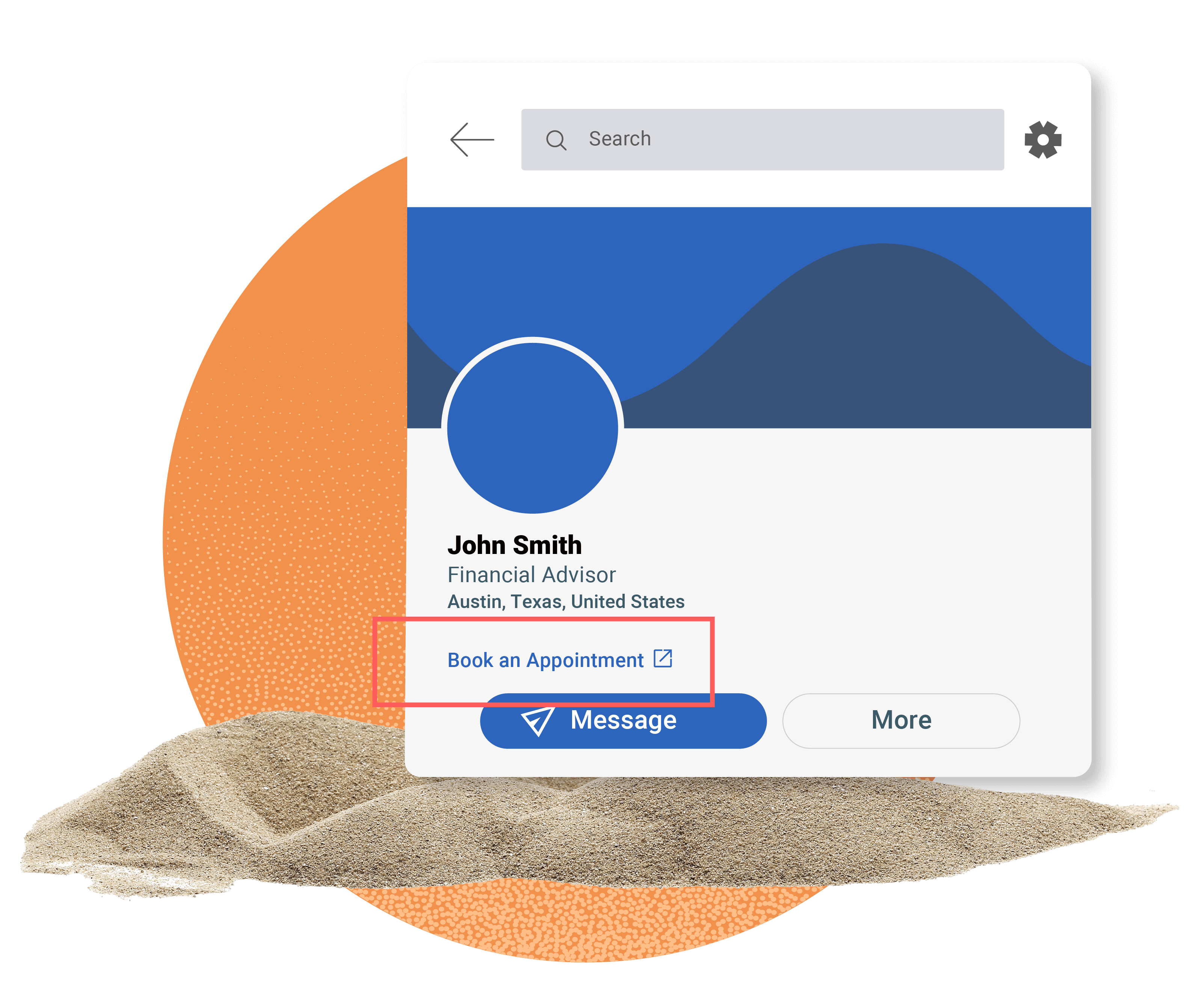

3. Use custom booking links and shortcuts.

Save clients even more time with custom booking links. They allow you to create specific appointment scheduling links for a campaign, a team, or an individual, to save clients those extra clicks.

For example, if running a new campaign about your low loan rates, you can include a link that allows people to book directly with a loan specialist.

![]()

📚 Learn how appointment scheduling software works in our Buyer’s Guide.

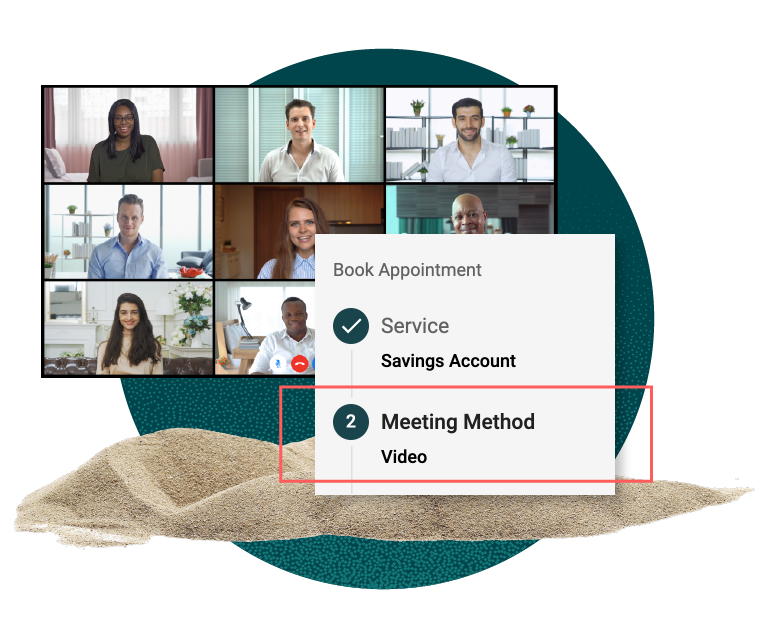

4. Offer multiple ways to meet—in-person, by phone, and by video.

To clients, there’s no longer a clear distinction between online and offline. A meeting is a meeting, whether via video or at a branch. Different people have different preferences and those preferences can shift. The easiest approach is to let them choose:

- Meet in-person

- Schedule a phone call

- Schedule a video call

(An all-in-one appointment scheduling tool can offer all these options. Alternatively, you could use several tools, and hook them up so they speak to one another.)

5. Add a few extra required questions so you can route them better.

Set things up so when someone books an appointment, they tell you why they’re hoping to meet. This helps you properly route them, and steer them away from booking an appointment for something they can handle today within the app.

Ideally, your appointment tool will allow you to use a mixture of menus and drop-downs so someone seeking an appointment can indicate their:

- Desired location

- Desired service

- Reason

- Level of urgency

6. Use appointment data to show when branches are busy.

When your branches accept appointments via an appointment and queuing tool, it generates data that you don’t necessarily have with walk-ins. For example, when Arvest Bank launched an appointments feature during the pandemic, they suddenly had insight into 47,500 meetings. For the first time, they could estimate how busy branches would be.

You can use this data on your website, in your app, and on Google, if you’re using the quick-booking feature known as Reserve with Google. It’ll help clients know in advance when to book a meeting, and thus help your staff manage walk-in traffic and serve each client better. You can also use it to alert your staff that you’re fully booked up, and they should be encouraging people to schedule appointments.

8.Send automatic pre-appointment email and SMS confirmations.

Ensure customers and members show up for the appointment with automatic email and SMS text reminders. The best practice is to send these at least one day before, and at least one hour before. This helps clients, and also helps your team trust the whole appointment program. (They’ll want to feel certain that if they set aside time for an appointment, people will show up.)

9. Instruct clients on how to prepare for the appointment.

Use that appointment calendar invite and confirmation email to instruct clients on exactly what they need to prepare, and what will happen. For example, “Bring a pay stub” or “This service will require a credit check.”

Put that information on the confirmation or “success” page after they book, as well as in the calendar invite and reminder texts and emails.

10. Use calendar links to book new member meetings.

In your automatic new customer or member welcome emails, offer the option to speak to an associate and provide that associate’s calendar booking link. This tends to generate many more meetings than having staff direct dial those people. (These days, over half of people keep their phone on silent because Americans get tens of billions of robocalls annually.)

“Sometimes salespeople fall into playing phone tag with new members. But if they book an appointment, it makes everything much more efficient,” says John Ryczek, Director of Branch Operations at Addition Financial.

![]()

“We always follow up with a new member within 7-10 days and now, using an appointments tool, our first meeting no-show rate dropped from 15% to 9%.”

Candy Shearer, Senior Member Care Manager, Kemba FCU

10 Ways to Improve Appointment Quality

1. Test your appointment solution before a full roll-out.

Before launching the program to members, give your staff a few weeks between being trained and actually having to use it. This’ll allow them to practice with each other and troubleshoot, so the first experience clients have is positive.

“When we first launched, we left a two-week incubation period for associates to practice setting up appointments and understand the system,” says Candy Shearer, Senior Member Care Manager at Kemba FCU. “On a scale of 1-10 in importance, I’d say this was a 20. It generated a lot of knowledge among the associates that encouraged members to understand it and find it super easy.”

2. In-branch, offer self-sign-in.

Use kiosks at the entrances to allow every walk-in to sign in. This will expose new clients to the ability to book an appointment (the tablet will present several options beyond just checking in), but also ensure that people who are there for their in-person appointment don’t wait in line. Clients can opt in to text notifications for when the associate is ready, and it’ll also display how long their wait is on branch TVs.

3. Offer fast lanes so people with simple requests need not wait.

For some services, you might consider offering a “fast lane.” For example, if all someone wants to do is ask a relatively routine question of an associate, you can direct them to immediately talk to someone in the branch who’s available, or talk to a specialist at another branch via an instant video call.

This’ll weed out some requests that don’t really need to be full appointments so you can offer an even quicker resolution.

For you to do this, you’ll need an appointment tool that allows staff to flip up a virtual “open to walk-ins” sign, so clients who self-sign-in can be routed directly to their desk. And if you have it set up for this, possibly route them via an instant video call to someone who’s open, but at another branch.

4. Set clear expectations of how long each appointment will take and what’s needed.

Give people all the information they’ll need to make that appointment a success. For example, if an appointment will take an entire hour, say so. That way, people planning to visit on their 30-minute lunch break will know to reschedule. Or, if a service will require a credit check, they won’t be surprised by that when they arrive and sit down.

Also, don’t assume clients only want one thing they booked the appointment for. Allow them to also write in the reason for their appointment so staff can come fully prepared.

“A good meeting is a prepared meeting. Do they need to bring documents? Should they have maybe filled out something ahead of time, and signed it? Whatever needs to happen, we’re trying to just be succinct, but also really clear in the instructions what will be expected.”

Kristina Smith, AVP of Retail Operations, UMassFive FCU

5. Train agents to help clients get more from appointments.

Don’t assume all agents are going to know what makes a good appointment right away. Or that you’ll know who’s struggling and needs help. Take a “train the trainer” approach and craft materials for training people managers to coach on good appointments, as well as volunteer “champions” who want to become experts and explain appointment management to their team. A few more ideas here include:

- Creating a playbook and FAQ, and designate someone to maintain it

- Designating champions and trainers

- Developing a certification program

- Incorporating appointment management into performance reviews

6. Encourage staff excellence with prizes and spiffs.

You can generate a lot of excitement around appointments using rewards. Consider launching a reward program for booking the first meeting of the month, scheduling the most meetings, and meetings in new modalities, such as a video meeting that involves co-browsing. You could also consider rewards—like a team party or activity—for the branch with the best appointment outcomes.

The more excited your staff is to pre-book appointments, the more likely they are to adopt the process and tell clients about it.

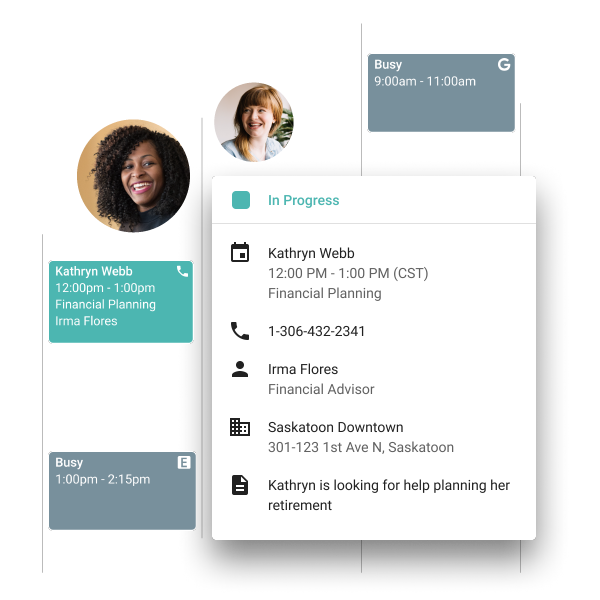

7. Have agents send a follow-up appointment right away.

Instruct your staff to treat the post-appointment touches just as carefully as the pre-appointment ones. Have them record all their notes during the meeting (if your appointment booking and hosting software allows) or right after the meeting, before they forget, and assign any follow-ups. Have them send a short summary to the client, and then schedule the next appointment right then and there, and put information in that invite to remind them what it’s about.

“Schedule the follow-up appointment right away and put the reason for it right in the calendar invite so both you and the member can be clear on what it is for,” says Aaron at the Credit Union of Southern California. “That way, there’s no way they’ll forget.”

8. Automatically log interactions in the CRM, along with a transcript.

The more integrated your appointment tool is with your tech stack, the more valuable it becomes. If you can save staff the time of having to log their notes by automatically logging meetings that occurred in the CRM along with a transcript, you not only save time, but increase compliance, because staff no longer have to take any action. (And you can save yourself the hassle of reminding them!)

Better data also opens up things in the future like marketing or web personalization. For example, if you know who booked particular types of meetings, you can send a personalized email just to that group offering a similar meeting.

9. Review transcripts and adjust the appointment prompts and length.

Make a practice of reviewing appointments for quality. Listen to sample recordings or review transcripts and look for which ones ran short, which ones ran long, and what happened after. Based on what you learn, make adjustments. Always be tweaking and improving those appointments so people come prepared, meetings end on time, and everything goes according to plan.

“We just launched a new service and one week later, adjusted the time frame to make this appointment longer. It’s hard to ask for more time, but that ensures you’re meeting everyone’s expectations, because if a member is there longer than they anticipated, and there’s a line, that’s not a good meeting.”

Kristina Smith, AVP of Retail Administration at UMassFive FCU

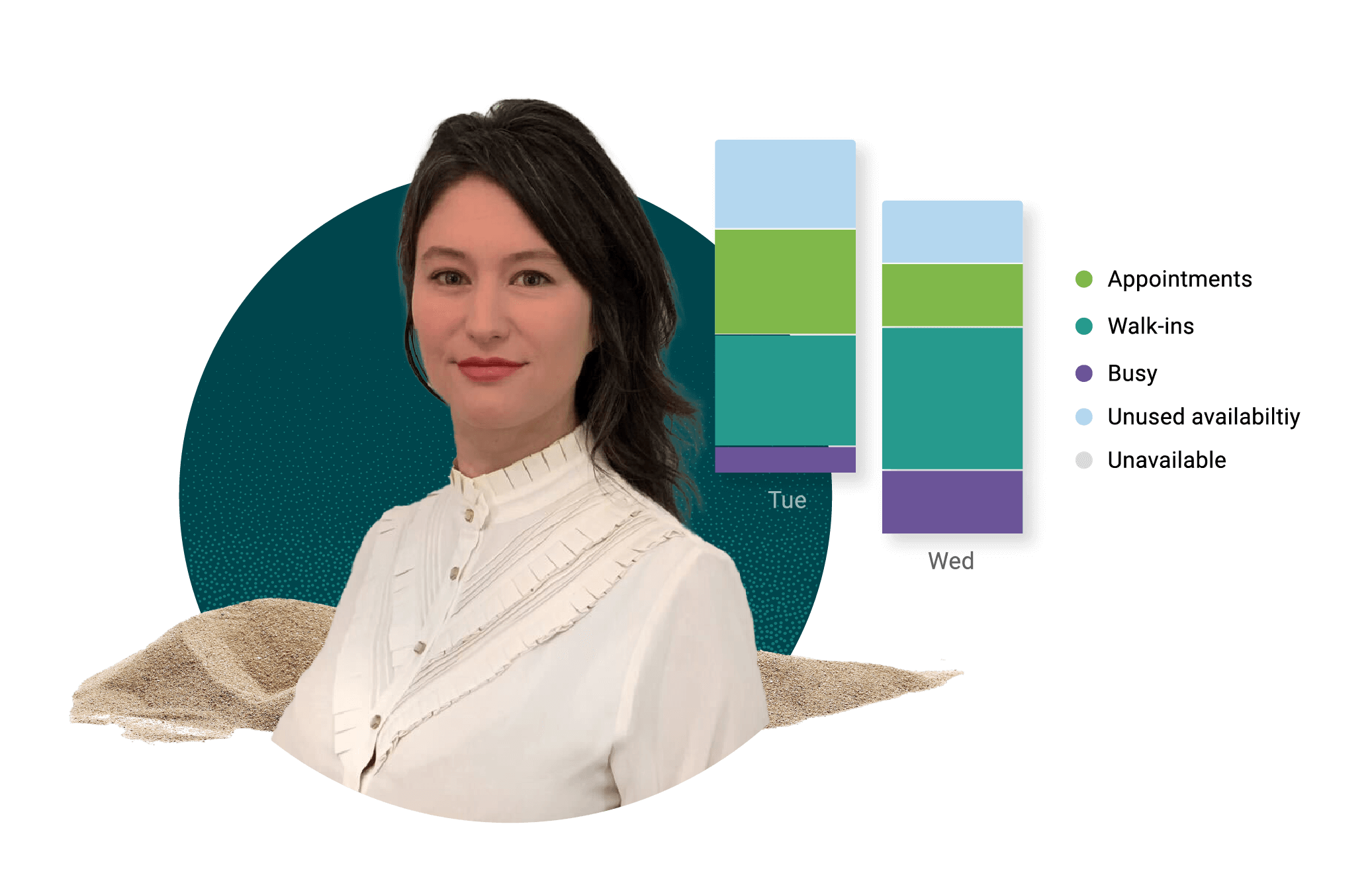

10. Consistently review your analytics to understand data around product interest, foot traffic, and more.

Meeting data offers lots of insights into how to make meetings of higher quality. (And the booking process easier.) In particular, look into your appointment analytics to ask:

- What products were people interested in?

- Where did people book those meetings for?

- Where did people book those meetings from? (Location, device, etc.)

- How many were remote versus in-person?

- How often do meetings convert?

- How do meetings convert versus walk-ins?

Use that information to run tests, like offering different meeting types to different groups.

11 Ways to Increase Bank Appointment Scheduling Volume.

1. Integrate meetings into your website and run campaigns there.

Beyond putting appointment links in all the usual places, you can use pop-ups and banners to run “book a meeting” campaigns. If someone clicks, it directs them to book a meeting. You can run multiple at one time, which allows you to test offers, or give appointments a seasonal spin. For example, “Do your New Year’s resolutions include financial goals? Come in for a free financial check-up.”

During the pandemic, Kemba FCU tested a website banner offering phone rather than in-person appointments and found it “seriously increased appointment volume.”

2. Tell walk-ins that next time, they can schedule an appointment.

Institutions that rely on appointments tend to view walk-in traffic as the engine that powers appointments, and they measure how many of those walk-ins convert to appointments. “Whenever we open new memberships, if they didn’t find us through the website and schedule an appointment, we let them know that if they need any services in the future, they can schedule an appointment from our website,” says Candy at Kemba FCU.

Instruct staff to always let walk-ins know that next time, they can book an appointment and skip the wait.

“To prospective members, your website really is the key to everything. That’s where they determine what you offer and who to talk to. Your appointment success is all in how you position it there, and how you connect it to your other communication channels.”

Aaron Young, SVP of Branch Operations and Retail Banking, Credit Union of Southern California

3. Advertise meetings in-app.

Use mobile pop-ups and banners within your app to promote meetings, same as you would on the website. The integration can be fairly simple—the app can simply direct members to the same appointment link, provided that landing page is mobile-friendly. For Kemba FCU, this was the big unlock that increased their appointment volume.

“We added a UTM code source to our digital banking that allows people to schedule the appointment straight through their mobile application. And as soon as we did that, then it exploded,” says Candy. “Most of our users were on their phones all day anyway, and this increased the ratio of the number of appointments members set for themselves without our assistance from 48% to 71%.”

4. Include product-specific appointment links in marketing collateral.

Tailor those links to meetings with particular groups (custom links) to save clients a click (or three). For example, in collateral about a wealth management offering, include a custom link to book time directly with a wealth manager.

Beyond email signatures, have your staff include appointment links to their own calendar on their business cards, or social media profiles.

5. Use in-branch displays to alert people of wait times, and suggest appointments.

Use in-branch displays like TVs and welcome tablet kiosks to guide people to the right options . If the wait is short, maybe a walk-in appointment is best, and the TV can show that. But if the wait is long and growing longer, show everyone waiting that there’s an easier way to book ahead—starting with a message on the iPad they sign in on.

6. Use meeting booking links in Google Ads.

Google Ads has a feature called “Reserve with Google” that allows people searching for financial products to book time with a local bank or credit union. You can connect it to your staff’s appointment links so someone can book a meeting directly from Google. They don’t even have to go to your website.

If you want to get fancy with it, you can even use custom links based on the search intent. For example, you can direct someone who entered the term “refinance” to your loan department, or “business checking” to your small business department.

7. Launch email, social media, and outdoor campaigns around a product.

When running product-specific campaigns, such as lower loan rates, you can include custom links or QR codes in your social media posts or signage. Anyone who follows the link will be able to book directly with a loan officer from their mobile phone.

Yolo FCU launched one such refinancing campaign and saw a 12% increase in auto loan appointments and a 120% increase in refinancing appointments.

Read Yolo FCU’s story.

8. Encourage customers and members with prizes.

You can encourage clients to book appointments just the same as you can encourage staff—with prizes. Offer branded clothing, mugs, gifts, or rewards to clients who book their first appointment, book the first meeting of the month, and more. Also consider running raffles and drawings where only clients who book appointments ahead of time are entered.

Ideas for prizes:

- Coffee mug or swag for booking their first appointment

- Holiday-themed prizes for booking the first appointment in a month

- Gift cards for referring people who then book an appointment

- Handwritten thank you notes from the specialist they met

9. Send a targeted email marketing campaign to repeat clients.

It may seem counterintuitive, but you may want to promote appointments to people who already book a lot of appointments. Look for individuals with lots of recent activity, and offer an additional time for them to check in.

As Aaron at the Credit Union of Southern California explains it, “I’m looking for real frequency. Folks who’ve come in multiple times over the past six months. We’ll say, ‘Hey, next time you need to talk, book it as an appointment—it’ll help us improve your experience and you’ll be entered into a drawing.’”

10.Survey members to understand the appointment experience.

Add appointment-related questions to your ongoing customer experience surveys. Use that information to understand whether appointments are a better experience than walk-ins, and if so, why. Also ask what you might improve about those appointments, and share the results with your staff.

Questions to ask:

- Have you booked an appointment recently?

- How would you rate that experience?

- What can we do to improve it even further?

11. Instruct your team to use appointments links in their outreach.

Appointment links work great in cold outbound emails, provided staff phrase things correctly. If they just say, “Book time with me,” it might come across as demanding. Whereas if they say, “Let me know what time works best for you. Or, if it’s easier, you can book time here,” it feels inviting. The booking link becomes a convenience and improves the experience.

That slick, friendly initial impression can open the door to retention, and create opportunities for more cross-selling and upselling. “When someone comes in for fraud, we want that to be a meeting. Every time a member walks in, it’s an opportunity to deepen our relationship,” says Kristina at UMassFive FCU.