Buyer’s Guide: Appointment and Queue Software for Financial Institutions

Explore the top appointment solution features and learn how to pick the best vendor for your bank or credit union in this thorough guide.

What’s Inside

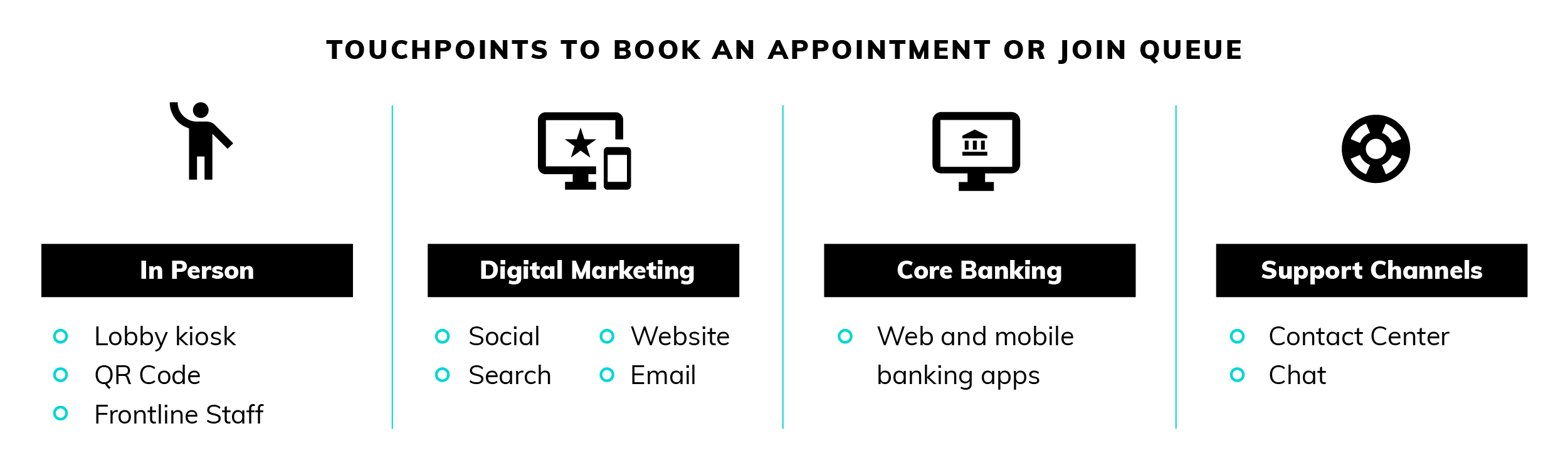

Today, customers and members want to choose their own path. And they expect a great experience—whether online, in-app, or in-person.

That’s where self-serve appointments and digital queue management software can help. They direct clients to the right person faster. They also make frontline staff more efficient, so whenever and wherever customers or members show up, they’re ready to make it a great interaction from the get-go.

But there are lots of software options out there. Which one should you choose?

This guide is here to assist. Keep reading to learn what a bank by appointment platform can do for your financial institution, smart questions to ask, and how to build a business case for the one you want.

![]()

1. Improve your customer and member experience.

When customers and members can quickly understand their options and take control of their experience, they tend to be delighted and appreciate the choice and visibility. Streamlining the customer journey—whether it’s online or in-branch—will drive higher Net Promoter Scores, better Customer Satisfaction Scores, increased loyalty, and higher retention.

Whatcom Educational Credit Union increases NPS

Whatcom deployed appointment and queue management software to create a more frictionless member experience. And once they did, they saw their Net Promoter Score rise from 65 to an impressive 86.

![]()

2. Increase your operational efficiency.

With customer appointment solutions, staff save time booking and preparing for meetings. They can also plan ahead for busy times and reallocate team members as needed. Plus, advisors spend less time traveling between branches thanks to remote options—all of which all helps reduce appointment length, wait times and admin burden.

Coastal Community Credit Union lets software do the work

CCCU used to call members to confirm appointments and managed bookings in a confusing spreadsheet that led to mixups. Now, they’re providing a better, streamlined service to customers and staff.

![]()

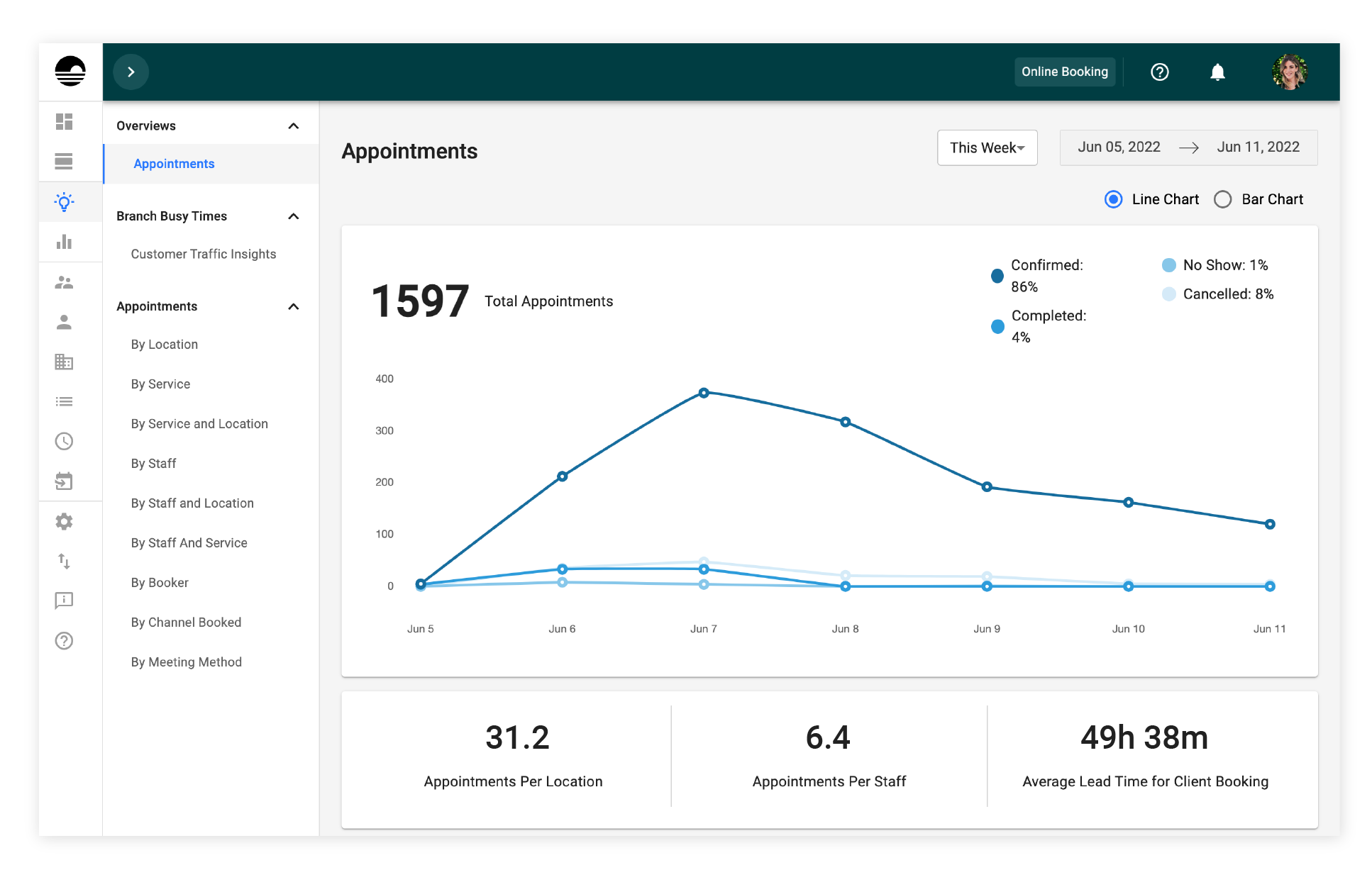

3. Collect better data—and make better decisions.

Appointment and queue software brings untrackable events “online” where you can analyze them. Traffic trends and conversion rate tracking help make smarter staffing and marketing, decisions. Institutions can also see where and when clients have interacted with staff, including how many appointments occurred and average meeting length.

Arvest Bank builds a data set to better serve customers

Arvest Bank realized it lacked appointment data. When they launched appointment and lobby management software, they could scan 47,500 online appointments and 137,600 walk-ins per year for insights.

![]()

4. Drive more growth and retention.

When it’s easy to meet with your team, clients will do it more often—especially when it’s simple to book a meeting from your website, a search engine, or a marketing campaign. Plus, when advisors know the reasons for a meeting, have data on past interactions, and are given more time to prepare, upselling and cross-selling becomes more natural.

Interior Savings pivots overnight to retain customers

When it had to close its branches during the pandemic, Interior Savings used appointment management software to offer online services. Now, they’re using it to keep pace with customer preferences.

Top Appointment + Queue Software

Features Checklist

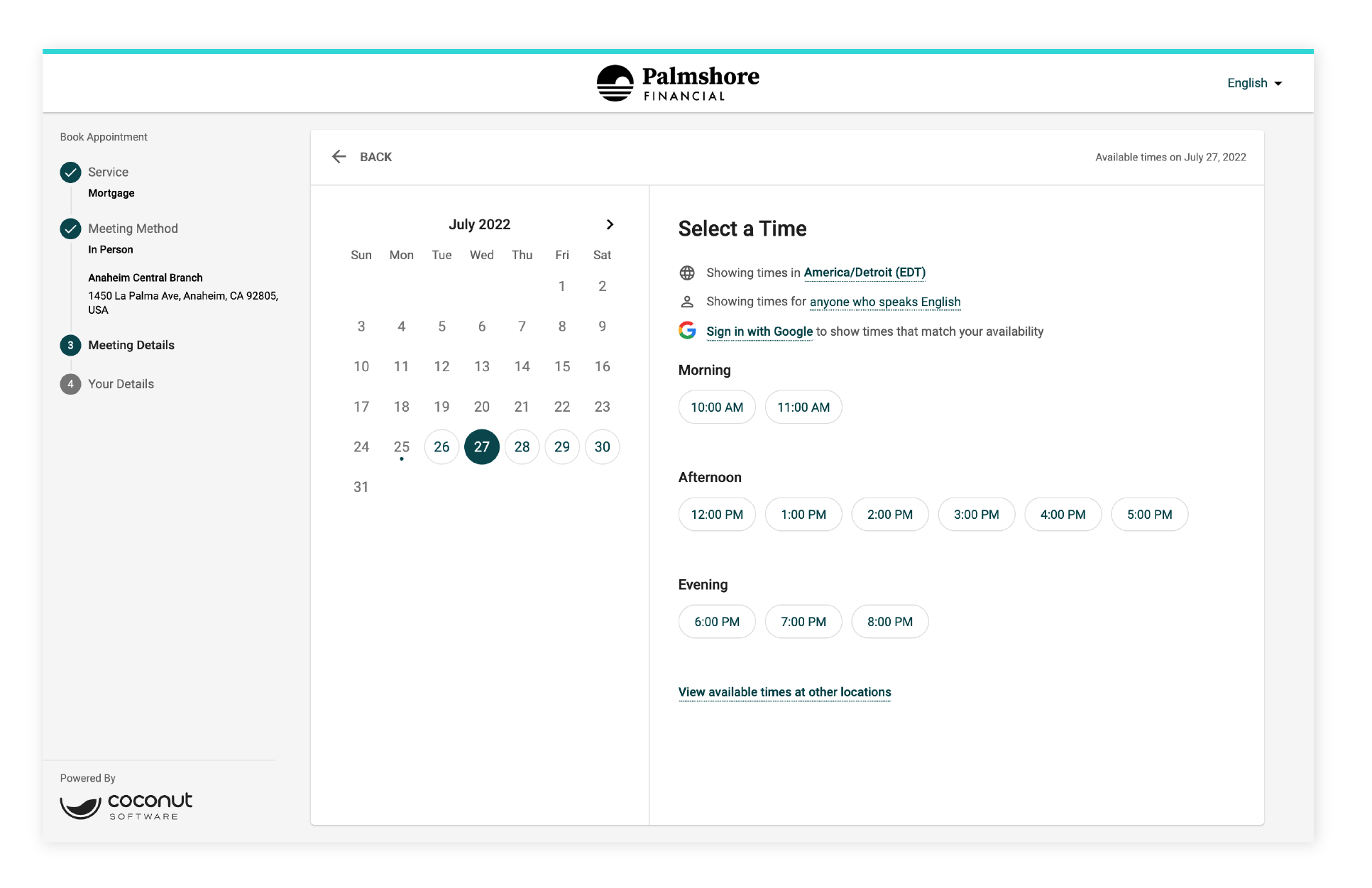

1. Appointment Scheduling

☑️ Easy book-a-meeting flow (front end for customers and staff)

☑️ Works from any internet-connected device (with responsive layouts)

☑️ Reliable, real-time Outlook and Google calendar integrations

☑️ Custom in-take questions

☑️ In-person, phone, and video options

☑️ Book meetings based on location

☑️ Book meeting with a specific staff member

☑️ Show staff availability based on location or channel (remote vs. in-branch)

☑️ Book meetings direct from Google search, website, or mobile app

☑️ Booking shortcut links

☑️ Automatically assign available staff to an appointment

☑️ Automatic meeting reminders and confirmations

☑️ Self-serve customer check-in

☑️ Redirect customers to self-serve options for transactional services

☑️ Supports multiple attendees or staff

☑️ Set buffer times before and after appointments

☑️ Multi-language support

☑️ Custom branding options across the experience

☑️ Staff can book appointments on behalf of a client

☑️ Appointment rescheduling or editing (including converting to another channel)

☑️ Ability to collect documents ahead of or during a meeting

☑️ Outcome collection after every appointment

2. Data, Analytics, and Admin Features

☑️ Appointment data—volume, length, no-show, popular appointment types

☑️ Branch traffic insights, like walk-in and appointment volume

☑️ Conversion rates by product, service, or staff member

☑️ Conversion rates across marketing campaigns

☑️ Utilization reporting

☑️ Staff performance and productivity at a glance

☑️ Capture customer or member NPS after interactions

☑️ Custom reporting and dashboards

☑️ Pre-built reporting templates

☑️ Quick-start guides

☑️ Data export and import capabilities

☑️ Ability to schedule and send reports through SFTP, email

☑️ Ability to track marketing campaign performance

☑️ Integration with Google Tag Manager

☑️ API and webhook access

☑️ Easy-to-use backend interfaces for admin and staff

☑️ Ability to support multiple instances, brands, or lines of business

☑️ Ability to create personalized booking flows

☑️ SSO for staff and clients

☑️ User permissions and roles

☑️ Staff can set availability by channel or location, based on schedule

☑️ Automatically assign services to individual staff or roles

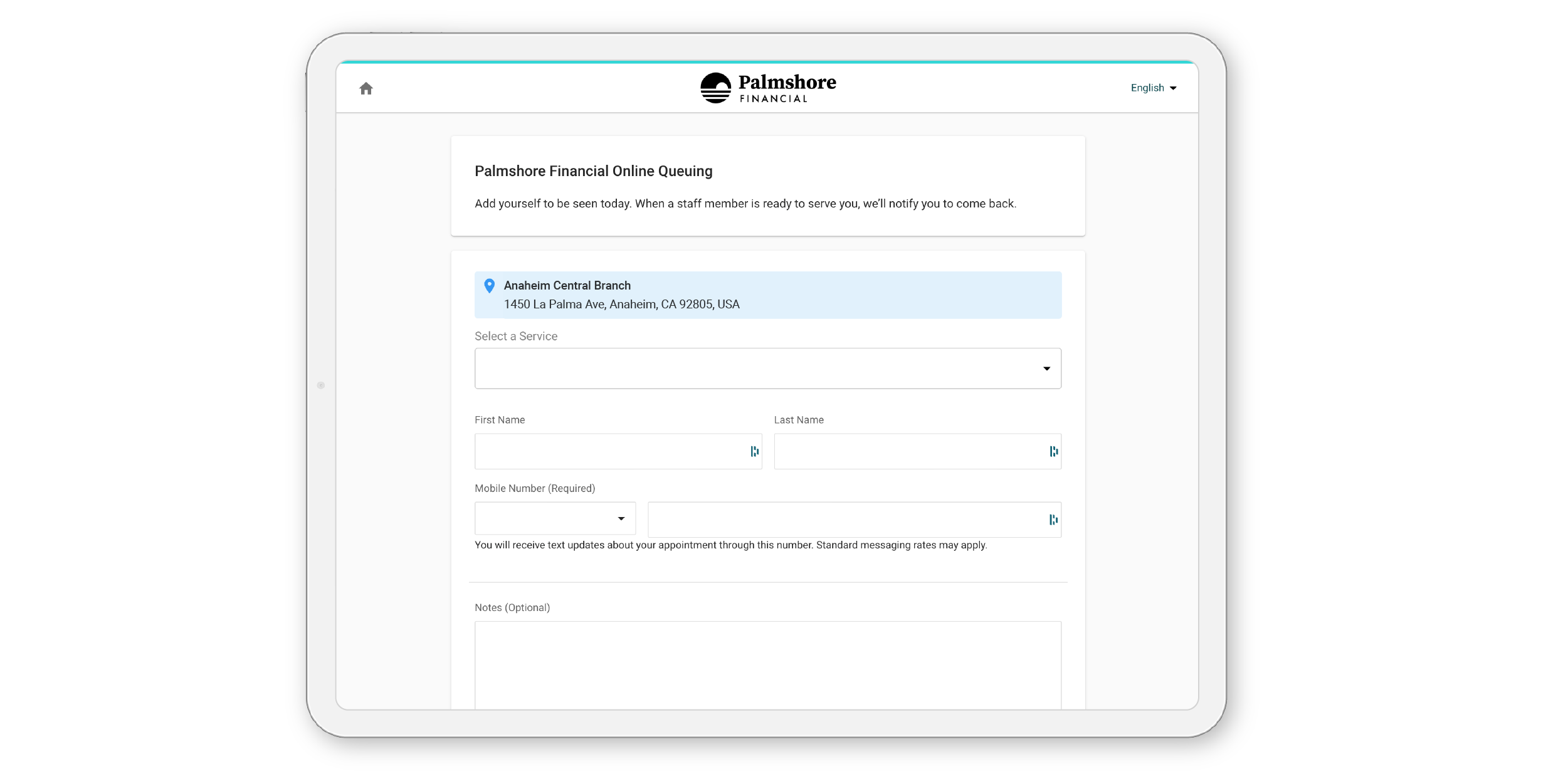

3. Queue Management

☑️ Ability to join the queue from a kiosk or mobile device

☑️ Ability to see wait times and current queue on lobby TVs

☑️ Automatic next-in-line notifications

☑️ Notifies advisors of client arrival

☑️ Virtual and in-person queue management capabilities

☑️ Displays wait-time prediction to clients in your branch or online

☑️ Allows clients to join the line online, before they enter a branch

☑️ Staff dashboard to show who’s in the line, how long they’ve waited

☑️ Instant join-the-queue options (online and off)

☑️ QR code scanning to allow clients to join the line or book an appointment

☑️ Ability to convert their spot in the line to an appointment

☑️ Curbside service option

☑️ Custom in-take questions to qualify referrals for advisors

☑️ Ability for frontline staff to add clients to the queue

☑️ Escalation notifications if clients wait too long in line

4. Video Appointments

☑️ Video and audio call options

☑️ Secure, unique link generation for each appointment

☑️ Browser-based experience (no third-party app downloads)

☑️ Virtual branch creation for remote advisors

☑️ Screen sharing and markup tools

☑️ Custom backgrounds

☑️ Identity verification integration

☑️ Co-browsing options

☑️ Audio recordings and transcripts

☑️ Integration with e-signature provider

☑️ Integrated with appointment and queue solution

☑️ View client history and appointment details during video call

☑️ Live, in-call chat

☑️ Privacy and security settings

☑️ Note-taking

☑️ Closed captioning

Questions to Ask Your Institution

![]()

Are clients frustrated by the wait to speak with someone?

Today, most branch locations can’t adequately forecast foot traffic—and can’t staff up or down accordingly. That makes customer and member wait times unpredictable. And if visiting is a chore, people will avoid it.

In this case, you’ll want to look for solutions that offer:

- Pre-booking appointment options to help cut back on unexpected foot traffic

- Share wait times online before clients come into the branch

- Queue wait-time displays and predictions upon lobby entry

- Self-serve check-in upon arrival

- Next-in-line notifications and schedule an appointment for later options

- Appointment volume tracking to help predict busy times and adjust staffing

![]()

Can finding the right person be easier or faster?

Customers and members like to use different channels for different tasks. For example, someone might be perfectly happy moving money between accounts in the app, but want to meet in-person to discuss their mortgage. Someone might be happy to use chat support one day, but want a video call the next. They expect flexibility and lots of options.

In this case, you’ll want to look for solutions that offer:

- Appointment booking that only takes a few clicks, from any device

- Integrated, end-to-end appointment platform to streamline the entire process

- Smart routing to specialists based on customer needs

- Integrations with contact center, chat tools, and other digital customer service channels

- Ability to meet with an advisor remotely

- Customer/Member NPS tracking to understand satisfaction

![]()

Is our staff over- or under-booked?

If you can’t predict when customers or members will visit, it’s difficult to prepare staff for their day. That affects the both the customer or member experience, as well as your staff’s: If you overstaff, you can degrade morale and waste budget. But if you understaff, it causes lines to snake out the door and you risk customers or members leaving.

In this case, you’ll want to look for solutions that offer:

- A calendar system that makes it easy for staff to see upcoming appointments and who’s booked

- The ability to divert simple inquiries to the contact center or self-serve tools

- Walk-in traffic and appointment volume data to predict staffing needs

- Virtual and in-branch queue visibility for staff to better handle lineups

- Staff appointment volume tracking and performance reporting

![]()

Do we need (or want) more wallet share?

Customers and members are purchasing more financial products than ever before—but not always with you. More than half of Americans have a relationship with more than one institution and rarely allocate more than 10% of their “wallet” to any one. Without the right tools, it’s tough to know what they want or the opportunities your team is missing.

In this case, you’ll want to look for solutions that offer:

- Easy embedding of appointment booking into your website and apps

- Intake forms that help advisors prep for meetings

- Reserve with Google options to drive new bookings from searches

- Custom links for advisors to make booking a call effortless for clients

- Marketing campaign tracking

- Tracking on conversion rates and products closed per booking

- Integrations with CRMs to track preferences and follow-up tasks

![]()

Experience Helping Financial Institutions

Does this vendor know the specific challenges financial institutions face? Seventy percent of digital transformations fail. A top reason is your partner didn’t have enough specialized expertise for the deployment. Verify that the vendor you’re considering has many clients in your industry, and ideally, focuses primarily on banks and credit unions.

Questions to ask:

- How many similar clients do they serve in your industry?

- How many other industries do they serve?

- What percentage of their product roadmap is focused on financial services?

- Do they have team members who have worked in financial services?

- What strategic advice, insights, or guidance can they offer?

- How familiar are they with the security and compliance regulations that apply to your institution?

- Do they interview customers in your industry frequently to help plan their feature roadmap?

- Will they provide best practices from other institutions with you post-implementation?

- What kind of integrations can they offer? Will it fit seamlessly into your tech stack?

![]()

Modern, Intuitive User Experience

Does the interface get high marks for usability, for both customers and staff? The less work it takes to achieve their goal, the better. Systems also require some backend maintenance, so the easier it is for you to manage on your own, the lower that cost. (Whereas if you’re entirely dependent on IT, you’ll have difficulty adapting, staying current, and launching new programs.)

Questions to ask:

- How easy is the interface to learn for new users?

- Can the front end be customized with our bank’s branding?

- How much control are you given to configure the booking experience?

- How many steps are required to book an appointment?

- Can customers select services or specific staff? Time zones and languages?

- Is it possible to create templates for different services?

- Can a customer cancel, reschedule, and manage appointments?

- What notifications and reminders does the system send?

- How complex or simple is the backend?

- How long does it take to make changes to your instance?

- Can you sandbox their solution to test the staff and admin experience?

- Is the interface usable for those with accessibility needs? Is it WCAG compliant?

![]()

Technical Support, Onboarding and Strategic Services Offered

How invested in your success is a vendor? You’ll want to understand their implementation process and support. (If possible, ask for a plan that includes timelines, steps, and insights into their process.) Top-tier vendors include a customer success manager to help guide your team, and they also offer professional services for setup or maintenance if time or resources are limited.

Questions to ask:

- What tier of technical support will we get during and after launch?

- Do they have a dedicated implementation manager, customer success manager?

- What are average support response times? How many support tickets do customers usually submit?

- Is onboarding support included in the cost of our contract?

- What is the onboarding process like? How long does it take?

- Do they do long-term success planning for customers? How often can you meet with your CSM? If so, is it at an additional cost?

- What types of white-glove services do they offer to help build or improve your instance of your solution?

- What is their retention rate and CSAT score?

![]()

Security Standards and Data Privacy

Is this vendor up-to-date on important security certifications and data privacy practices? In much of the technology industry, security tends to be an afterthought.

Enlist your IT team early in evaluating how your vendor will encrypt your data, where that data will be stored, how they monitor it, how they back it up, what their incident response plan is, and whether they have important credentials, like SOC II compliance.

Questions to ask:

- Is the vendor SOC II compliant?

- What does their employee clearance process look like?

- How do they track and manage cookies?

- How does encryption work?

- What kind of hosting do they offer, where are servers hosted and are they secure?

- How often are backups performed and where are backups stored?

- What’s their incident response plan?

- What does their audit process look like?

Integrations with Existing Tools and Systems

Does this vendor offer integrations to our must-have systems? What about our ‘nice-to-have’ systems? Be sure to inquire about how they can help you connect the dots between systems to glean insights, improve the customer or member experience, and arm staff with helpful data.

Questions to ask:

- How does this get embedded into your mobile and online banking systems?

- Can it be integrated with your Customer Relationship Management (CRM) system?

- How easy is it to connect and manage appointments from your Outlook/Google calendars?

- Does it support Single Sign-On (SSO) SAML 2.0?

- Can its data be synced with Business Intelligence tools?

- Does it have an open API for custom solutions?

Flexible, Fair Pricing

What kind of pricing and payment options does the vendor offer? Figuring out pricing is important for getting the most value from your solution. Vendors often have different pricing models, but you can often expect to pay based on users (or user type), volume of appointments, feature types, or a combination of these factors. Which you select depends on the size of your team, the amount of appointments you hope to handle, and must-have features.

Questions to ask:

- What are your regular payment terms and timelines?

- How flexible are your pricing packages? (If they offer tiers or packages.)

- What is the payback period after a full implementation?

- How do you recommend justifying the cost and tracking ROI for departments across your institution?

Organizational Benefits of Scheduling Platforms (By Team/Function)

![]()

Customer/Member Experience

- Route appointments to the right staff on the first try

- Smoother, consistent experience across channels (online and in-branch)

- Increased satisfaction and NPS

- Improved loyalty and retention

- Reduce wait times

![]()

Lending / Wealth Management Advisors

- More lending/mortgage appointments

- Improve conversions

- Reduce meeting times

- Create more cross-sell/upsell opportunities

- Measure revenue per branch and staff

- Deliver more personalized services

![]()

Marketing

- Book more meetings from search and marketing campaigns

- Identify top-performing channels, pages and products

- Drive more high-value conversations with sales

- Measure campaign ROI

- Better understand the user journey

*Numbers and results often support emotional appeals for better solutions.

![]()

Operations

- Forecast appointments and walk-in traffic

- Reduce call volume and speed up resolution time

- Improve queue speed and wait times

- Better plan for staffing needs and coverage

- Improve share of wallet

- Reduce no-shows or cancellations

Average Results of Appointment and Queue Management Software*

![]()

1. Improve client experience

When you can route people faster, reduce wait times, and give them more choice and convenience, you’ll increase satisfaction and loyalty as a result.

- 41% increase in booked appointments

- 21-point increase in member/customer NPS

- 97% average CSAT

![]()

2. Increase operational efficiency

Saving staff time on admin tasks, reducing appointment length and no-shows, and avoiding understaffing helps things flow more smoothly and efficiently.

- 75% reduction in appointment length

- 23% reduction in no-show rates

- 300% higher conversion rates

![]()

3. Increase growth and retention

Better meetings mean better outcomes, including product sales, new sign-ups, and more. Plus, more data means better results tracking—so you can effectively improve.

- 68% of appointments are for lending

- 45% of appointments are for new members

- Close 2-3 products per engagement

* Specifically, Coconut Software