How to Replace Your Appointment Scheduling Software in 8 Easy Steps

A thorough guide for banks and credit unions considering a switch to Coconut

There are two things to know about replacing your appointment scheduling software:

- You stand to gain more efficiency, more high-value appointments, and happier staff from switching out an appointment scheduler that’s not working for your financial institution.

- Implementing a new tool may seem daunting at first—but it’s manageable when you partner with the right team who can guide you every step of the way.

Coconut has more than a decade of experience working with financial institutions (including helping them migrate from previous systems), and we’ll hold your hand every step of the way.

Before you jump into the process, this guide will describe it for you in detail. By the time you finish reading, you’ll understand how to seamlessly and easily make the switch.

What’s Inside

Starting from scratch with appointment scheduling software? 💻 👀

Need more information on why these red flags may be holding your FI back? 💻 👀

Read: 8 Signs It’s Time To Replace Your Appointment Scheduling Software

Data Collection

Data Needed

- Location Name

- Address

- City

- State/Province

- Country

- Timezone

- Public/Private Location

- Service Title/Name

- Service Description

- Length of Service

- Public/Private Service

- First Name

- Last Name

- Email Address

- User Name

- Public/Private

- User Role & Permissions

Optional Data Points

- Phone

- Extension

- Opening Hours

- Service Instructions

- Service Category

- Buffer Time

- Group Service

- Time zone

- Language(s)

- Job Title

Data Sources

Operations Team, Company Website

Member Experience, Operations, Marketing

Member Experience, Branch/Retail Leads, HR

Want to see a complete list of client view settings? 💻 👀

Read: Client View: Setup from the Coconut Help Desk

Want advice on how to communicate well with your team during implementation? 💻 👀

Read: 8 Change Management Strategies for Smoothly Navigating FinTech Rollouts

Soft cutover

✅ No appointment downtime

✅ Customers don’t feel the transition

✅ Staff have more time to learn final details of new software

❌ Staff work in two systems for a period of time

Hard cutover

✅ Staff don’t need to work in two systems

✅ It’s an option if your previous contract can’t be terminated at the right time

❌ Customers need to be re-booked in new software

❌ Customers can no longer manage appointments in old software

❌ Old links won’t work if they’re missed during the audit

❌ FI is dependent on old vendor to provide all data for a smooth transition

❌ All appointments from old software must be recreated in new software

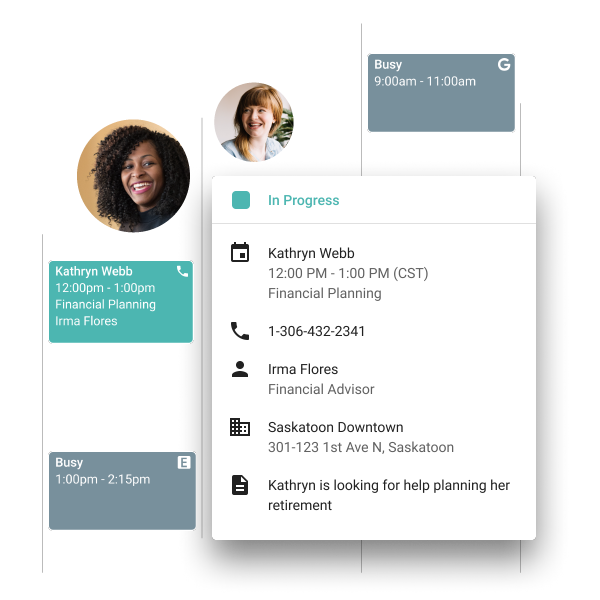

1:1 Customer Support Menu

Tech support

- Feature requests

- Sync assistance with Microsoft Exchange or Google Workspace

- Audit requests

- Configuration help

Business review

- Usage improvement advice

- Service review

- Scorecard goal guidance

- Next steps for better efficiency

Analytics review

- Total appointments and walk-in traffic

- Staff vs. customer bookings

- Popular appointment types

- Staff engagement and usage

- Average wait times and no-show rates

- Customer experience survey results

- Impact on financial metrics and goals

Want instant advice on your analytics strategy? 💻 👀

![]()

Change Management Tips

Without staff buy-in and usage, you won’t get customers or members using the system. To help ease the transition to using new software, try to get as many of the items on this checklist done as possible before, during, and after the launch process:

☑️ Create an ‘FAQ’ for the initial introduction (See sample questions to the right)

☑️ Create a table showing roles and responsibilities for frontline staff, managers, advisors, etc.

☑️ Clearly outline policies for appointment reminders, wait times, notifications, rescheduling, etc.

☑️ Host live in-person and/or virtual training sessions for questions and demonstrations

☑️ Create your own “how to” videos for folks to watch outside of formal training sessions

☑️ Add instructions or training tools to your learning system or training documents

☑️ Create formal training with a quiz to show certification with the system

☑️ Have super user/manager feedback sessions planned to learn about challenges or get feedback

☑️ Provide prizes or other incentives to staff who use the system, get the most appointments booked

☑️ Nominate a platform expert at each branch to help train others and handle questions

☑️ Regularly promote customer or member success stories internally

![]()

Internal Staff FAQ Sample Questions to Answer

- What is the purpose of this platform?

- How does it work, at the highest level?

- What are the benefits it will bring to our organization? Our customers/members?

- How will this impact my day-to-day tasks and responsibilities? (Based on role.)

- How flexible is the system? What settings can we change ourselves?

- What kinds of services will be available through this new system?

- What do I do if I experience an issue or need help?

- How and/or when will we receive training? What resources are available?

- What is the launch day? What is required of me by this date?

- Are there any goals or metrics I will be responsible for?

- How does this change our in-person experience? Our virtual experience?

- Are there other options if customers or members decline to use it?

![]()

IT Team Task Checklist

☑️ Active Directory sync instructions

☑️ SSO sync instructions

☑️ Video software sync instructions

☑️ Allowed IP addresses list