8 Signs It’s Time To Replace Your Appointment Scheduling Software

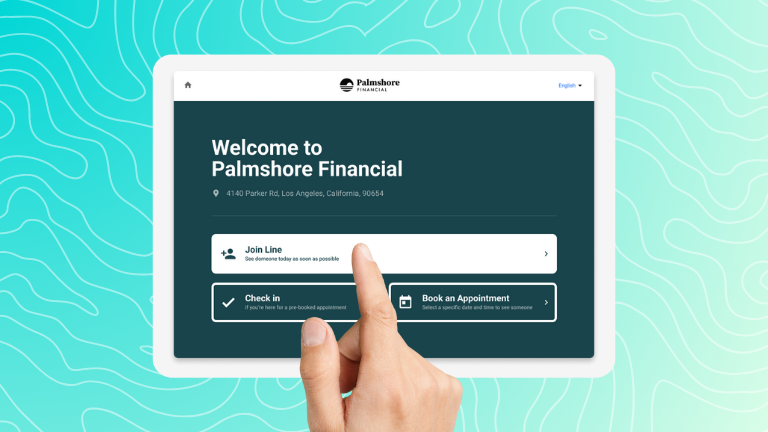

Today’s branches are transforming—while they were once places to handle every single banking activity, they’re rapidly becoming advice centers, where customers and members often only show up in person to receive personalized advice about matters like loans and investments. Banks and credit unions that make it easier for customers to receive advice are proven to attract more customers, sell more products, improve long-term loyalty, and boost experience scores.

Elevating your branches into well-run advice centers requires the right technology in place for everything to go smoothly, or else your customer experience could suffer. But not all appointment schedulers are created equal.

If your current appointment scheduling software is less-than-ideal, there are some common red flags you’ve probably experienced. Maybe your admins are consistently submitting support tickets to make simple changes … and those tickets take forever to get responses? Or your software is cumbersome for frontline staff, and it’s leading to less job satisfaction and higher staff turnover? Or perhaps you’re losing revenue because you don’t have the data you need to optimize your operations?

If you’re feeling doubtful that your current appointment scheduler is the right investment, here are eight signs you may need to start considering other appointment scheduling software options.

1. Your administrators can’t perform simple tasks without sending in support tickets that take weeks to resolve.

If you have to chase down an IT expert to make changes to your appointment scheduler’s backend, it’s a red flag. Here are some things your admins should be able to do instantly and on their own:

- Reassign an appointment to another advisor when someone is out of office

- Assign floating staff to different branch locations

- Easily change which services are assigned to which advisors

- Change which service an appointment is for

- Assign a language option to a staff member

- Add hybrid users who have multiple roles within your organization

- Add custom questions for customers to the scheduling process

- List required information so members come to appointments prepared

- Apply changes across all branches, not one at a time

Bottom line: You should be able to customize your appointment scheduling software to the needs of your organization without waiting on your vendor’s customer support team for help.

2. The vendor’s customer support ended after initial onboarding.

Often, financial institutions report feeling supported by their appointment scheduling vendors during the onboarding process. But as soon as that process is over, many of them feel like they’re on their own.

Here are some signs your customer support could improve:

- You don’t have access to a Help Center where you can troubleshoot on a self-serve basis

- You don’t have a dedicated customer support manager you can contact directly

- You’re seeing delayed response times on support tickets after onboarding is over

- Outreach from your vendor is more about new products than how to get the most out of your existing investment with them

- You’re not getting any guidance on how to interpret platform data and analytics

Bottom line: Your appointment scheduling software vendor should be a partner who’s just as invested in your organizational goals as you are.

3. You can’t track where your high-value appointments are coming from.

If your appointment scheduling software doesn’t come with easy-to-digest analytics that tell you where your high-value appointments are coming from, you’re not getting the most out of it.

When you understand how your customers prefer to engage (for example, via what channels, locations, times of day), you can tailor your operations to cater to those preferences. But you can’t improve what you don’t measure.

Here are the insights you should expect to get from your appointment scheduler:

- The percentage of walk-ins that convert to high-value appointments

- Your locations, times of day, and days of the week with the highest traffic (which will tell you how to staff your branches)

- Your most efficient and effective staff members

- Your most popular services

- The outcomes of your video appointments

- How many times customers meet with advisors before they convert

- Granular comparison metrics by branch

Bottom line: Appointment scheduling software shouldn’t only help you schedule appointments—it should help you identify how to get more value from advisor conversations.

4. You can’t create your own custom BI reports or alerts.

When branch managers want to dive deeper and communicate metrics with staff, they should be able to customize their reports based on what they need with business intelligence (BI) reports.

When your appointment scheduling software is connected to multiple channels across several branches, your reporting needs will likely become more complex than what basic analytics can demonstrate. Custom reports and alerts should allow you to:

- Create your own dashboards

- Schedule reports to go out to branch managers

- Take action if your wait time exceeds a certain time in any given branch

Bottom line: You shouldn’t need to sacrifice on report customization and readability to get the in-depth analytics you need to increase high-value conversations and appointment efficiency.

5. Your appointment scheduling software doesn’t integrate well with your other software.

Appointments happen because of the small interactions that happen around them. Your branch operations likely depend on calendar syncing, walk-ins, call centers, video conferencing, email, etc.—all necessary tools for selling high-value products.

Whether people are interacting with your website, call center, digital banking platform, or the branch itself, your appointment scheduling software should act as a hub to increase high-value conversations. That means integrations with crucial software like Reserve with Google, Outlook, MS Exchange, Office 365, Salesforce CRM aren’t a nice-to-have—they’re a must.

Bottom line: The best integrations are two-way. For example, if a staff member wants to make changes to an appointment, they should be able to do it directly within their own calendar instead of needing to login to your appointment scheduler to complete the change. And when members need to change an appointment, they should be able to do it with the click of a link, instead of logging into a scheduling platform.

6. You’re seeing too many appointment no-shows.

If you’re seeing a lot of appointment no-shows, it’s often a sign that your scheduling software isn’t intuitive enough for your customers to easily grasp. If they can easily cancel in a couple of clicks, most customers will. But if it’s a complex or confusing process, many won’t bother.

Here’s what your members should expect from your appointment scheduling software:

- Easy appointment rescheduling

- SMS and email reminders

- Appointment preparation details

- Virtual waitlists en route to your branches

- Wait time notifications by branch location

Bottom line: There’s no reason appointment scheduling software for financial institutions should be any more difficult to interact with than scheduling software for yoga classes or hair appointments.

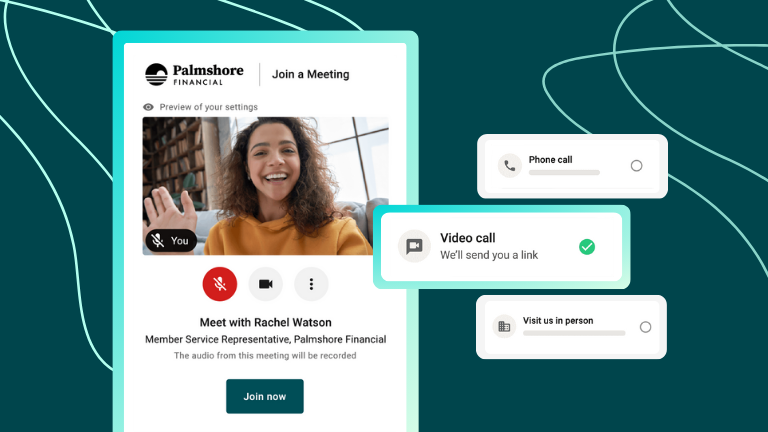

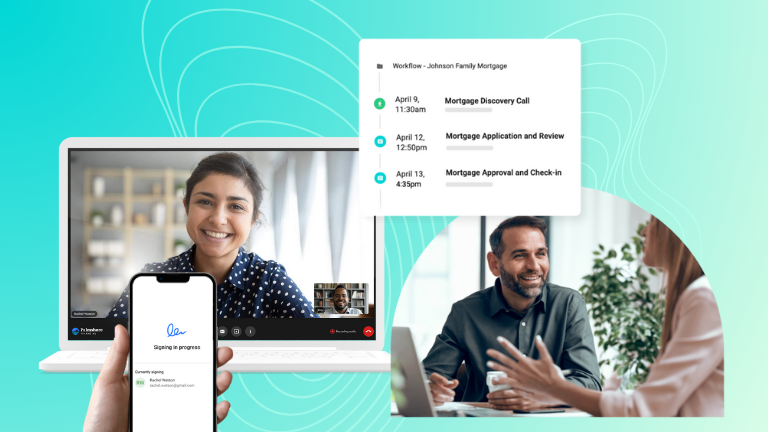

7. Your appointment scheduler doesn’t offer built-in video conferencing designed for financial advice.

Video conferencing apps are fine for generic conversations, but conversations about financial services are different. All meeting participants need to browse and sign documents together, which isn’t something easily done on generic video conferencing apps.

If your financial institution offers a video conferencing option for appointments, you’ll get the most out of those appointments by choosing a solution that:

- Integrates with software like DocuSign to collect e-signatures instantly

- Offers a co-browsing experience so all attendees can interact with web pages and online forms

- Connects back to your appointment analytics, so you can track the success of your video conferencing meetings and spot opportunities for improvement

- Offers closed captioning to improve accessibility for members who need it

Bottom line: Generic video conferencing software isn’t built to make banking easier. Capture the most value from these conversations by offering a video chat experience that was made for selling financial products.

8. Your appointment scheduling software isn’t built specifically for financial institutions.

Appointment schedulers exist for a wide variety of services from booking a haircut to an oil change. But when your appointment scheduling software is trying to serve too many industries at once, you’ll feel it.

The back end won’t be structured the way your admins need to smoothly support their workflows. Your customer support manager won’t have the expertise needed to solve your problems. And the data you extract won’t match the metrics you’re measured against when you’re trying to improve the outcomes of your advisor meetings.

Bottom line: Appointment scheduling for financial institutions is a specialized service that requires knowledge of the intricacies of providing high-level financial advice. Expect your vendors to specialize in serving financial institutions, not you and everyone else.

Want to find out what an appointment scheduler made for a financial institution looks like?

Speak With One of Our Experts.