About Coastal Community

Coastal Community Credit Union, affectionately known as CCCU is the largest financial services organization based on Vancouver Island and the Gulf Islands and among the top 10% of credit unions in Canada based on asset size. Started by a group of Islanders looking to put people’s needs first and use local money to do local good, “Nanaimo & District Credit Union” opened their first office in 1946.

Through different mergers, acquisitions and years, those co-operative values live on today. CCCU is committed to improving the financial health of their members and building healthier communities. They want their members and clients to know exactly what they need financially and understand how to get there.

CCCU’s Challenge

CCCU was looking to provide members with more opportunities to access the products, services and consultative expertise of staff. To provide a better experience, leadership knew they would need to make some changes. It wasn’t a single moment that led to their decision to search for a solution but an accumulation of staff and member feedback: their current booking experience wasn’t very efficient, they had poor visibility into staff performance, and they were preparing to launch a new website and needed a solution that would offer a better online experience. They were looking for an omnichannel, self service solution that could tackle each of these main issues. “We can book haircuts online. We can book oil changes online. Why can’t we book financial services online? That was the impetus to get us going and then it just kind of grew,” explained Darryl King, Solutions Delivery Manager at CCCU.

Challenge #1 – Labour Intensive Appointment Booking Process

CCCU’s existing booking process was labor intensive, time consuming and did not provide a great experience, often resulting in misalignment among locations. King shared, “Pre-Coconut Software, our Relationship Centre managed appointment bookings for 24 retail banking locations. Each location had different protocols as to who was available, when appointments could be booked and for how long each appointment should be booked. Because of this, it would often require the member to be called back once all the appointment details were submitted to the branch.”

The process was inconsistent and strenuous to manage. Issues included double bookings and lots of back and forth for members and staff. The process didn’t match where CCCU needed to be as an organization. Empowering Relationship Centre staff to book appointments more efficiently would mean they could spend their time on value-added conversations with members, instead of appointment logistics.

Challenge #2 – Poor Visibility of Staff & Branch Performance

Originally, CCCU did not formally track appointment bookings and instead used shared calendars on an internal SharePoint site, making accurate tracking virtually impossible. The leadership team had anecdotal info from branches, but they were unable to verify accuracy.. “We all knew how busy our branches and our staff were, we just didn’t have any numbers to prove it,” states King. This gap in visibility made workforce planning difficult. Branch management needed more accurate foot traffic and service request data in order to staff appropriately. Collecting and then having quick access to this data was imperative to CCCU’s strategic vision for the future.

Challenge #3 – New Website Launch

Lastly, CCCU was preparing to launch a new website, necessitating clear calls to action. “We were also beginning to plan for a major website upgrade to advance our digital experience,” King noted. “We recognized the need for clear CTAs. The ability to embed booking links and ways to access our staff really help.” CCCU recognized the importance of having members complete a full and simple journey for a product or service request from their website in order to create a seamless digital experience. “If members could not take action to fulfill a product or service request on our website, the impact of the digital experience was diminished greatly. An effective self-service booking tool was critical to the overall success of our digital experience,” said King.

CCCU’s Solution

CCCU selected and implemented several Coconut Software solutions using a phased approach, instead of the initial plan to launch all Retail staff at the same time.

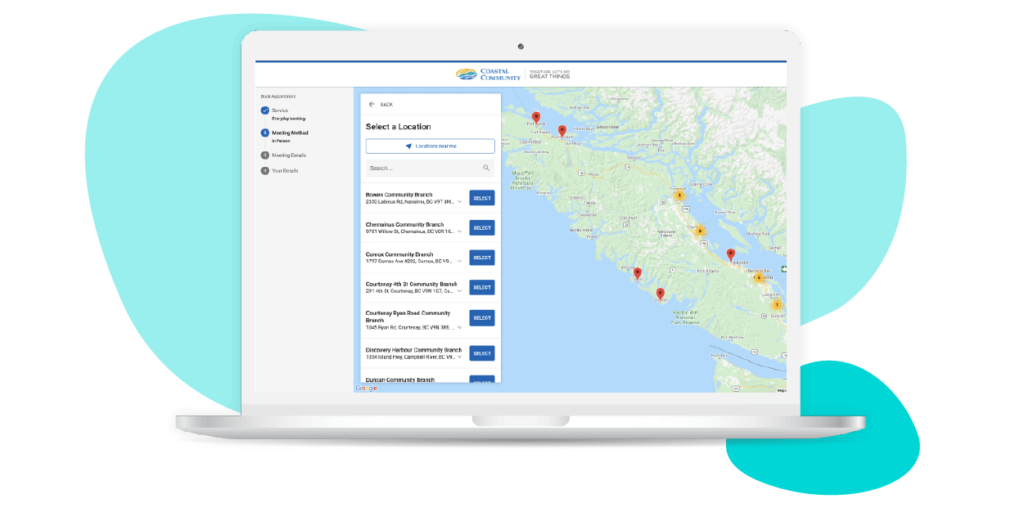

Solution #1 – Appointment Scheduling

Moving away from a labor-intensive process to one that creates seamless engagements between members and staff was a top priority for CCCU. They started by rolling out the Appointment Scheduling solution to Account Reps for lending appointments only. Members were able to schedule an appointment online from the website, digital marketing campaigns or directly from advisor emails when, where, and however it was convenient for them.

After eight months, Member Service Reps started taking appointments for higher touch transactions such as account openings and registered retirement savings plans. These staff members became champions for the product as CCCU went forward with the full rollout to all staff.

Solution #2 – Lobby and Visitor Management

From there, CCCU enabled the Lobby & Visitor Management solution for one of their high volume insurance locations to help eliminate friction in the lobby and optimize the branch experience for both staff and clients.

Insurance Agency staff were able see realistic wait times and easily add clients to a queue or schedule an appointment for a more convenient time. Agents also had the ability to monitor the number of clients waiting to be served and could easily help the next in line. After a short while, the queueing system became available for general transactions within the Credit Union line of business such as paying a bill, doing money orders, or wire transfers.

Solution #3 – Callback

The Relationship Centre, Credit Union and Insurance staff supported the new booking process through Coconut’s Callback functionality. Not only were members able to book an appointment online, they could request a phone callback from their mobile phone or desktop browser and would then be added to a queue eliminating the need to wait on hold. They would be given an estimated wait time, and staff who were calling members could see everyone waiting and take them off the queue. This feature proved particularly helpful when tackling high call volumes due to the pandemic.

CCCU’s Results

CCCU continues to put the financial wellbeing of members and clients first. “Ultimately, any solution that Coastal implements is focused on building member/client relations. Being able to implement solutions that provide a seamless, automated experience let us focus on improving the financial health of our members, clients, and communities,” states King.

Results #1 – Conquering In-House Operating Complexity

By implementing Coconut’s solutions, CCCU’s internal processes immediately improved. They were able to reduce inefficiencies to create seamless engagements between members and staff in their locations and online, as well as through the contact center. King said, “With Coconut Software, we were able to automate a number of our processes in the member journey to make things easier on our staff, and ultimately provide better service to our members.”

King credits their communication strategy with staff. By highlighting the current pain points that would be eliminated by using Coconut, change management went very smoothly. Staff were concerned that they would lose control over their schedule when opening up online booking. King and team assured them that would not be the case and the solution quickly received buy-in as soon as staff started using the system. Callback and phone appointments have been a game changer for CCCU’s insurance division. “We had to implement that callback queue and phone appointments relatively quickly,” King noted. “The new system allowed that team to manage large volumes of client contacts without plugging up the email inboxes.” From April 1st to June 30th 2020 the team handled over 13,000 telephone calls into the queuing system. King adds, “If one agency gets overrun with phone appointment bookings, another agency can pick up those call-ins off the queue and contact them back.” This has been especially helpful during COVID-19 restrictions and social distancing. “Insurance is typically a walk-in and sit-down at the other side of a desk transaction,” he said. “With COVID, it really turned into more of a digital experience. Through the use of call-ins and callbacks we’ve been able to really adapt and adjust to help our members and clients see us when they need to.”

Results #2 – ‘Always On’ Engagement

By allowing members to schedule appointments when and how they want, members are able to control their experience and choose how they want to be supported through ‘always on’ engagements. CCCU can now be reached virtually 24/7 and at a time that is most convenient for members.

King explains how important this has been during the pandemic. “Being able to provide an always on, always available appointment booking and virtual meeting solution was key to helping us navigate the pandemic. We were able to ensure that members and clients were still able to book whenever they were interested, through the meeting method they preferred.”

Features such as callback queue, virtual queue, and phone appointments allowed CCCU to continue providing exceptional member and client experiences. Being able to meet member needs, being respectful of their personal time, and providing safe meeting methods has been key to their success.

Results #3 – Tech that Builds Member Relationships

With the temporary closure of locations and limited business hours, having the right tools in place helped CCCU maintain the level of support members have come to expect, even during a pandemic. “Our members and clients still need financial advice, they still need to pay their bills, renew insurance policies, they still need to come in and talk about mortgages,” said King.

When providing consultative advice-based appointments, financial institutions need to continue building up that relationship for both staff and members. CCCU found that members and clients liked to select who they met with. King adds, “If they’ve had a really great experience with one staff member they wanted to continue seeing that individual.” Booking shortcuts and having the option to pick a staff member when scheduling the appointment has been helpful to personalize that experience for each member.

Results #4 – Better Insights & Reporting

Having access to advanced insights and analytics is more important than ever to gain valuable data into staff performance and engagement outcomes. CCCU is excited to use Coconut’s Insights to help manage staff and reduce costs. These analytics help not only track how many appointments are being booked but the outcomes of those appointments—how many were cancelled, how many no-showed? This data is key for workforce planning. Knowing peak times or days ensures there is enough staff at each location to manage the number of appointments or walk-in traffic.

CCCU’s insurance division in particular has found Insights extremely helpful to instantly see how many members are in the callback queue or waiting in-branch in order to better manage their day to day.

Conclusion

CCCU is excited about continuing to build their digital options and providing more ways for members to engage. “Continuing to expand our digital journey is very exciting,” King said. “The ability to provide members, clients and employees with further digital options is only going to make us better as an organization. Knowing that we can offer more digital options for our members and clients to do business with us in a way that works for them is definitely what I’m most excited about.”

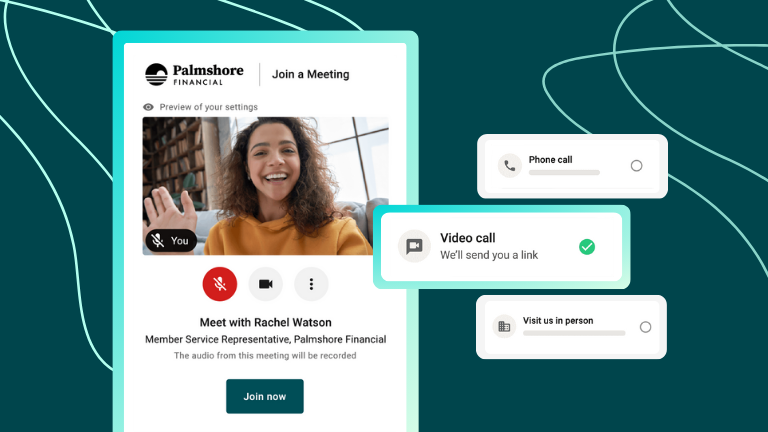

CCCU is looking to enable virtual appointments in the near future to connect with members or clients ‘face to face’ without having to be in person to help staff and members adjust to the new world of distance engagements.

“Coconut Software has been a great partner to work with. Everyone that we have been in contact with has been very receptive, patient and forthcoming. It’s really nice to know that you’re working with a partner that understands you, knows the need to progress and change and be relatively quick about it wherever possible,” said King.

Advice to Other Credit Unions

When asked what he would do differently, Darryl explains, “The biggest change we’d make is focusing on creating a strong business case with input and commitment from all internal parties. It’s key to focus on the specific pain points your organization is currently dealing with and discovering a solution that can help put these pain points to rest.

While we all agreed that we had a need for an appointment booking solution, we did not have a clear vision as to what that solution needed to do and how it would work with our business model, our organization goals, and its role in the member/client journey.”

When considering providers, consider asking vendors for best practices recommendations, business case templates or ROI calculators in order to ensure alignment and proper scoping of your customer engagement project. This will ensure all internal stakeholders are in alignment and you can ask the right questions to find the perfect partner.