About Interior Savings Credit Union

Founded in 1939, Interior Savings is the largest credit union based in the interior of British Columbia, Canada and serves members from Osoyoos to Clearwater. Representing nearly 72,000 members who are served by 21 branches and two Commercial Services Centers, their assets currently exceed $2.6 billion.

Since their establishment, one thing has remained constant for Interior Savings – their commitment to their cooperative principles. Interior Savings is constantly on the lookout for new ways to make a positive impact on the lives of their members and the communities to which they belong, enriching their experiences while keeping the human touch in a digital world.

Interior Savings’ Challenges & Results

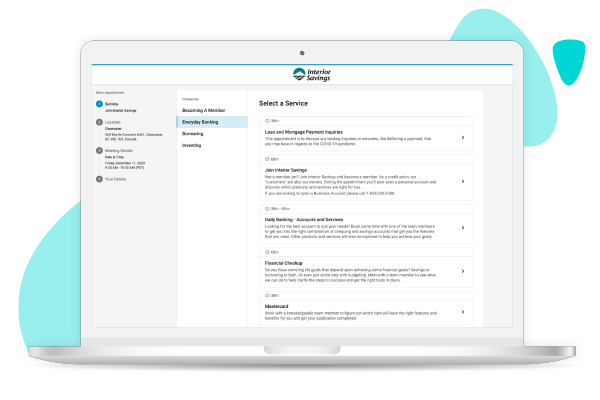

Interior Savings’ priority for partnering with Coconut Software was to consistently improve the member experience. This helped guide the project from the buying process, to implementation and go live. Interior Savings leveraged appointment scheduling and received immediate positive feedback from members. However, once the COVID 19 pandemic hit everything needed to be adjusted overnight.

Managing Branch Closures

Within days of deciding to defer loans and help members with mortgage payments, Interior Savings shifted focus to support their members through their various contact channels, including their website, and they created a special booking shortcut specific to each of these services.

As Interior Savings’ leadership team temporarily reduced branch hours and access, Paul Cockshutt, Senior Manager, Integrated Alternate Channels, and team were tasked with ensuring no member queries were left unanswered. “We created two phases to manage operations. Phase 1 was to quickly move in person appointments to the phone, to keep as many transactional meetings out of the branch, reducing traffic. We also adjusted to limited branch opening hours and changed when appointments could be booked. The shift from in branch to phone was almost immediate – it took the team only 2 hours to convert all of our in person appointments to over the phone. We never could’ve done this without Coconut to help.” Paul continues, “Phase 2 was the shift to appointment only with no walk-ins, but encouraging members to book a meeting with a staff member to ‘triage’ what service, and therefore method, that member should be using, instead of doing self-service. This allowed us to control the number of people showing up at locations for services that could be done over the phone or digitally.” Using a centralized system like Coconut, Paul and team were able to manage multiple locations at one time, adjust hours of operation quickly and switch notifications and reminders to reflect updated procedures in the wake of social distancing.

It also meant that as restrictions began to slowly lift, Interior Savings was able to roll out a phased reopening plan in a consistent manner, not burdening each individual branch manager with updating branch hours, services allowed over the phone, etc. It also allowed Paul to provide managers with the ability, on an exception basis to make decisions to help members. Those managers could position 1 on 1 appointments when they felt it necessary – this empowerment is key to staff engagement. Paul and team are pleased with how their reopening has gone so far. “It went very smoothly – we started by removing the requirement for appointments for in-branch service. After that, we expanded the service hours, and finally we opened up our regular appointments to in-branch.” With the flexibility that Coconut provides, the leadership team at Interior Savings knows that they can scale their digital support up or down, depending on the needs of members while also complying with local regulations on social distancing.

Supporting Staff Working from Home

In the early days of the pandemic, Interior Savings shifted some of their branch employees to flexible work arrangements to keep staff safe and also ensure business continuity, this included adjusting hours of service and managing the number of hours staff were working directly with the public. “When we had issues at a specific location, or had to suddenly reduce hours, we were able to leverage the Contact Center solution to quickly reach out and manage appointments, either to reschedule or to complete the conversation over the phone.” This flexibility meant that staff could support members in their preferred method of communication, while also maintaining public health social distancing requirements and shelter-in-place orders.

“Giving members the opportunity to book appointments for specific purposes, with their choice of staff, date and time is such a welcome upgrade to our previous methods. [Coconut] also makes the member more accountable, as the reminders prevent them from forgetting about the appointment. As a result, I find I get more email cancellations or rebookings, rather than “no-shows”, since the process to update their appointment is so simple,” states Jessica, another Account Manager at Interior Savings.

Another benefit for Paul is the centralized control of Coconut, which allows administrators such as himself more access than other user roles. “I don’t have to chase IT and other administrators to accomplish various processes, I simply log in with my credentials and can make the changes I need to in order to pivot to changing environmental factors. It allows us to respond to changes that much quicker than with a diverse set of solutions or systems. Everything is integrated and in one place.”

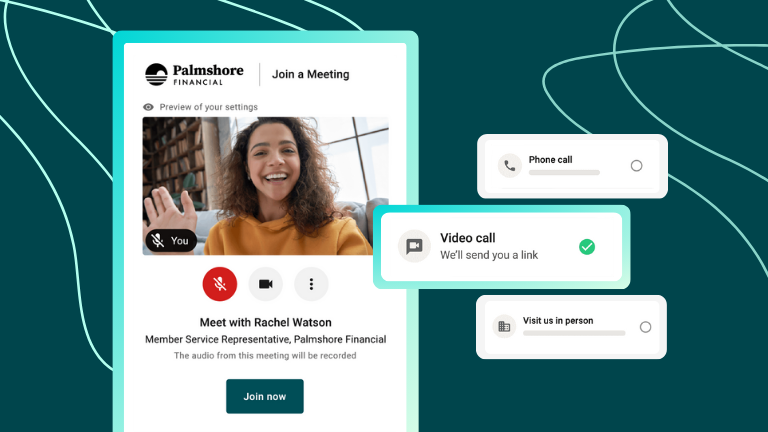

Shifting from In-Person Meetings to Virtual Engagements

Cockshutt explains, “We wanted to ensure staff and members stayed safe but we knew time was of the essence for many of our members, which is why the speed to convert was so important.”

“When we made the decision to go to appointment only for in-branch service, we knew that the switch had to be executed quickly. Thankfully we were comfortable with building new Service Types and making tweaks to get the desired results. It meant we could back up our member communications pretty much immediately.” Paul credits the user interface and ease of configurability within Coconut as a key reason for this quick turnaround, and for the successes Interior Savings has experienced with Coconut, even before the pandemic.

Angela, a Lending Account Manager shares, “I find using Coconut very user friendly. I send my shortcut link to my members so they can book an appointment that best suits their availability. It is very helpful that the members receive an email informing them of what to bring to our meetings. It saves a lot of time and helps with member experience.”

Next Steps

Expanding to Other Business Units

Even during the pandemic, Paul and team have been busy demonstrating to other areas of Interior Savings, like commercial services and wealth management, the power and value of using Coconut Software. Creating a separate instance for the Interior Savings Insurance Services in the future, will allow for specialized branding, notifications, services and workflows, while also ensuring the seamless integration of data across all teams. Paul and team have been showcasing their suggested set up and utilization of Coconut, in order for other business units to quickly gain value as they implement the solutions.

Paul is also excited about future developments from Coconut that’ll help them streamline their internal processes further. “When we heard that Coconut was going to be rolling out multi-staff appointments and online queuing, we were excited as it’s exactly how our business runs.” Interior Savings highest value appointments are advice driven and require strong relationships with members. Often, multiple staff from Interior Savings like to join the appointment call with the member, such as a Financial Advisor and a loan officer. This allows for quicker resolution of the member’s questions and breaks down data silos between lines of business and staff members. Multi-staff appointments will review selected staff’s availability and provide dates and times that are open for everyone, as well as update everyone’s calendar. “It’s always about the member and making it easier for them,” quotes Cockshutt.

Advice to Other Credit Unions

Paul suggests that other banks and credit unions “learn how to properly use and create reports through Coconut – they’re easy to use and help so much with productivity. If you want to improve adoption of technologies like Coconut you need to promote it more to your staff, and the best way to identify where you can help educate is through reporting. Nothing but good can come from that data and those insights.”