The Video Banking Playbook

A step-by-step recipe for video appointment success for financial institutions.

Types of Video Meetings You Can Offer

✅ Member onboarding and account setup

Present a friendly face that’s more memorable than a phone call but more convenient than commuting.

✅ Discuss a specific product, like a loan

Allow customers or members to connect with a specialist for something they already know they need.

✅ Customer support and account questions

Use it for customer support and walkthroughs. Bonus points if you can set up chat-to-video options online.

✅ Walk through a contract before signature

Explain complex topics simply by going over it together on video. (Screen sharing and co-browsing features will be useful.)

✅ Run a virtual workshop or seminar

Offer financial advice and education to build trust with customers and members at scale. (Be sure to check call capacity first.)

✅ 1-1 financial health checkups

Help clients discover new products and services. Give advisors personal booking links and promote through email, campaigns, etc.

Video appointments can help different areas of the business achieve their goals:

![]()

1. Member/Customer Experience

- Create more convenient, flexible experiences online and in-branch

- Maintain or improve one-on-one personal connections virtually

- Increase satisfaction, NPS, and loyalty—especially among tech-savvy customers and members

- Better track and understand the customer journey and key touch points

![]()

2. Retail Operations

- Route clients to the right staff faster

- Better anticipate branch traffic and staff calendars

- Expand reach beyond physical boundaries

- Create a hybrid work environment for certain roles

- Have clearer data on staff or product performance by location

![]()

3. Marketing

- Embed meeting booking as a specific, trackable call-to-action in campaigns.

- Easily identify channels, pages, and products that drive conversations

- Brand virtual engagements so they match in-person experience

- Better measure campaign ROI

![]()

4. Contact Center Operations

- Offer real-time support virtually

- Resolve issues faster with on-screen co-browsing

- Reduce average call time and increase first-call resolution rates, CSAT, and NPS

- Quickly book appointments with specialists on behalf of clients

Share the ways video appointments can impact your institution with internal stakeholders.

1. Meet demands for more convenience and flexibility

Video appointments save customers and members from traveling to a branch and waiting.

They can proactively book a call on their own time and adjust the time if needed—without having to call someone or go back and forth on dates. Plus, they can also meet from anywhere, which is great, not only for those who are busy, but also for those with accessibility or mobility limitations.

“Many of the members that I have worked with expressed appreciation for the option for a video call. It saves them time and allows multiple people to connect from different locations. It allows the personal connection to be made without leaving their office or home.”

Annie King, Mortgage Loan Advisor, Park View Federal Credit Union

2. Enhance the customer or member experience and build stronger relationships.

It’s easier to build stronger relationships with people we can see. Body language and eye contact also play a large role making video more effective than phone calls.

Video appointments create more opportunities for (virtual) face-to-face time with clients, where it’s easier to review documents or next steps because you can share screens.

“We’ve found that some members don’t want to turn their cameras on, but they choose video because they do want to see who they are talking to. It adds a sense of connection and comfort while discussing their finances.”

Kelley Jacobsen, Vice President, Marketing & Operations, Yolo FCU

3. Increase workforce efficiency.

Video allows in-demand, floating specialists to take appointments from anywhere, so they’re more accessible to clients, no matter which locations they normally serve. This way, clients and staff don’t have to wait for specialists to be at a nearby branch to work with them.

With video, specialists will spend less time on the road—meaning they may gain bandwidth to take on more appointments each day. This can help with productivity as well as retention.

Video banking can also help in-branch or call center staff be more productive. Depending on the software you use, it can be easier for them to find meeting times with specialists (versus going back and forth), and you can record those video calls (or just the audio) for everyone’s training.

“Video banking allows banks and credit unions to serve their entire customer base and have their most in-demand subject matter experts in every single branch—without hiring more people.”

Jared Jones, Head of Sales, DBSI

4. Create more opportunities for revenue and growth

By making it easier to book appointments, you can expect more appointments, and thus more opportunities to recommend products and services. It also makes it easier to expand your reach into regions where you may not have physical locations yet, since clients can meet face to face with local advisors where there is no branch.

Video also offers casual insight into a member’s life that can lead to growth opportunities. If your agents notice someone thumbing their wedding ring, kids chasing each other, or construction going on in their house, they can infer topics for deeper discussion, like refinancing loans or saving for college.

“When a potential member joined a video call and said, ‘I thought I scheduled this with another company,’ the call nevertheless lasted 30 minutes, and she ended up taking out an auto loan. I don’t believe that would have happened had they not been able to see each other face to face.”

Austin Hopkins, AVP of Premier and Relationship Sales, Teachers Federal Credit Union

5. Improve data tracking and forecasting

Video data can shed more light on client engagement levels and preferences. Because you can see which meetings are being booked from which website pages, and at which branches they’re being booked, you gain a view into your meeting “traffic.” That can help you push meetings from overloaded branches to less busy ones, understand which products people find interesting, and more.

Institutions with an all-in-one video appointment software often find they’re able to more accurately forecast staffing needs, promote products, and gauge meeting close rates.

“At Libro, we were surprised by the initial and immediate uptake of video. Libro users have expressed their enjoyment when using video to meet with coaches. They like that they can do it without needing to travel and that using video was easier than expected.”

Tasha Newman, Digital Specialist, Libro Credit Union

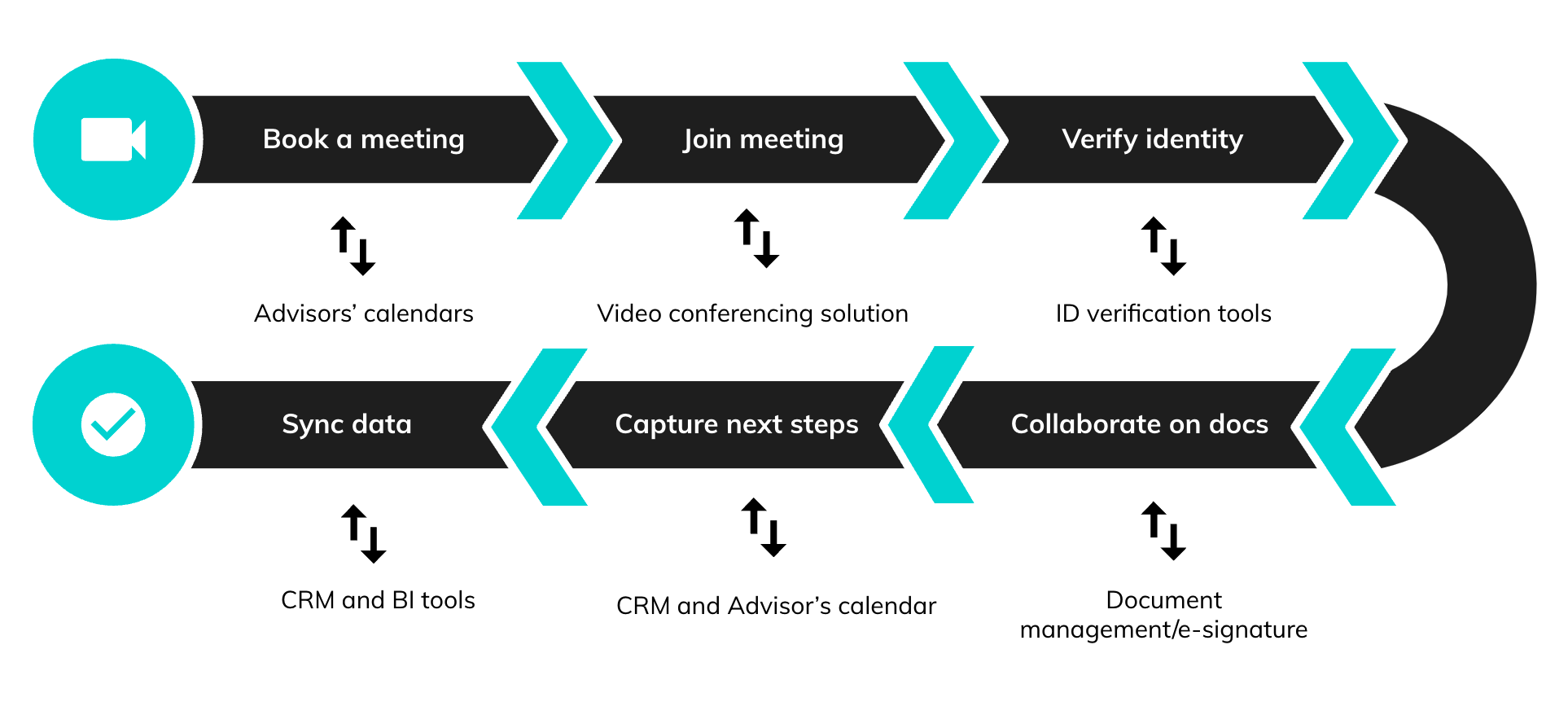

Top Video Appointment Software Features

🧠 Intuitive design

Flexibility to proactively book a video appointment or reach someone on-demand; Ability to join from a browser (no downloads needed); Screen sharing; Chat.

⚒️ Flexible admin tools

Easy appointment scheduling and join link workflow; Co-browsing; E-signature collection; Branded backgrounds and interface; Note taking.

📊 Analytics and reporting

Tracks data like appointment type, duration, NPS, meeting outcomes; Stores notes and call audio recordings; Filterable reporting dashboard.

🔒 Top-tier security

Unique, secure, auto-generated video call join links; Identity verification integrations; Encrypted recordings and transcripts; SOC II compliance.

🤓 Integrations and API

Can connect to existing solutions, like e-signature software, appointment system, single sign-on, or customer relationship management tools.

Tips and Tools For High-Quality Video Calls

1. Invest in quality cordless headsets 🎧

1. Invest in quality cordless headsets 🎧

Any video production expert will tell you that it’s bad audio—not bad video—that really ruins an experience. If you’re on a video call and the image drops out, it simply becomes a phone call. But if someone’s audio drops out, that’s generally the end of the conversation.

2. Upgrade your internet connection 💻

2. Upgrade your internet connection 💻

Glitchy first impressions are difficult to undo. Explore higher bandwidth internet in the office, or reimbursements for faster internet for remote workers. Ensure each agent has at least 1.5 mbps internet speed for video calls.

3. Place the camera at eye level 👀

3. Place the camera at eye level 👀

If the camera looks up at your agents from table height, it’ll be an unflattering angle. If your team uses laptop cameras, provide stands so they can adjust to a better height. Adjustable phone tripods are also available.

4. Minimize unnecessary sound 🔕

4. Minimize unnecessary sound 🔕

As much as possible, soundproof the space. Soft objects, like sound foam, rugs, wall art, and plants, can help with echos or “tinny” audio. Have agents to turn off notifications and run an audio test before calls.

5. Provide agents with branded visuals 🎨

5. Provide agents with branded visuals 🎨

No matter what mode of video appointment your agents choose, it should feel consistent—just like when visiting a branch. Consider providing a digital background graphic so things look consistent.

Encourage agents take the video facing into natural light. If that’s not possible, face a diffuse, flattering light that minimizes shadows, such as a ring light. (Consider buying ring lights for your team.)

6. Teach agents how to lead video conversations 📚

6. Teach agents how to lead video conversations 📚

Coach your agents on video best practices that will help them have better calls, including:

- Sit up, don’t slouch

- Try to eliminate the filler words “like” and “umm”

- Set an agenda for what you both hope to achieve

- Gather cues and questions from their environment, and take notes

- Maintain eye contact and don’t browse other screens

- If you can, avoid using slides or too many visuals, and simply talk

- Try not to move things on your shared screen while the customer is talking

- Ask follow up questions when something sounds important

- If you talk over them, stop, apologize, and insist they finish

- Play around and don’t be afraid to have fun

The Internal Employee Rollout

1. Announce it internally and find employee champions

Just as you’ll have early customer adopters, you’ll have early employee adopters. Identify the managers and team leaders most likely to champion the technology, and involve them in the selection, planning, and rollout. Nobody is better suited to communicate the value to their team than they are.

Beyond enlisting their help, you’ll need to run an internal marketing awareness campaign so everyone understands why your organization has video banking. Some employees will be indifferent, so it’s up to you to help them understand how it can help them in their role.

“Introducing yet another tool could be frustrating for staff—communicate the benefits of video meetings and build their comfort. The pandemic definitely helped expedite our transition. And because staff were using it in internal meetings, that accelerated the overall adoption.”

Tasha Newman, Digital Specialist, Libro Credit Union

2. Build an easy-to-reference playbook for staff

The most successful video appointment system rollouts involve a playbook—one place where everyone can go to access the software, get trained, and have their questions answered. It could be a PDF, or it could be a page on the company intranet—or both.

Your playbook should include:

- What the technology is

- Why your institution is investing in it

- Who will use it, and when

- How it works

- Scripts for specific situations

- The main point of contact for technical issues or questions

- Answers to frequently asked questions (theirs and your clients’)

“We rolled ours out with a playbook. We have an appointment banking page on our internal website just for employees. There, we created an FAQ specifically for video banking. And my advice is this: if you don’t market it, don’t expect immediate engagement. Put it in your materials, put it in your emails, and get the news out there.”

Austin Hopkins, AVP of Premier and Relationship Sales, Teachers Federal Credit Union

3. Execute formal, mandatory training

Launch a certification process for member-facing individuals, marketing team members, and anyone else who’ll be using the technology to book meetings. This can be done formally through a learning management system or similar tools, or in person. You can also offer self-directed learning and assessment options.

Also, don’t forget to go beyond the technical ins and outs. Include pre-meeting best practices and post-meeting follow-up procedures as part of training.

Then, add this training to your employee onboarding materials so future hires go through it too.

“Many executives hope that if they build video appointment infrastructure, the appointments will follow. But it really has to be a push mentality. You have to get in front of your employees and harness their buy-in. Explain what it does, and how it’ll make each person’s life—and the life of the client—easier. Hold deliberate training. Then market it to your customers.”

Jared Jones, Head of Sales at DBSI

Your Clients’ Biggest Questions—Answered

Everyone on your team should know how to explain the benefits of video banking to clients. They should also be able address questions or concerns about how video appointments will work.

Here are the top client questions your rollout playbook should answer for your staff:

- Where do I book the appointment?

- What happens if I need to change the appointment?

- Am I supposed to come into the branch, or can I take this from home?

- What kinds of transactions or conversations can be done over video?

- What hardware/devices do I need? Can I use FaceTime?

- How will I join the call?

- Where can I find the call information and details?

- How do I enable my microphone or my camera?

- Do I have to turn on my camera?

- How do I adjust the sound or use headphones?

- If I get disconnected, how do I get back on?

- Is this a secure and safe way to share information?

- How will you verify my identity, documents, or signature?

The External Client Rollout

Marketing your video appointment service to customers and members is important. Most will never know it exists unless shown, and many won’t try it until prompted. (Though once they try, many may love it.) Market your new video appointment service across channels for a full year. As the adage goes, you have to tell people seven times in seven ways to get them to remember.

Video Appointment Marketing Checklist

✅ Consider branding the service and giving it a memorable name

✅ Add a demonstration video to your website

✅ Add a meeting booking button to the website and mobile app

✅ Add individual meeting booking links to people’s email signatures

✅ Add a meeting booking link in your print marketing materials

✅ Add a link to your automated messages (IVR)

✅ Run an email campaign

✅ Run a social campaign with a sweepstake for those who try

✅ Run a calling campaign

✅ Print flyers and hand them out locally

✅ Add it as an option within your website and mobile app help center

✅ Craft in-branch signage to promote video services

✅ Have floor staff mention it in-branch

✅ Run a staff contest to see who can book the most video meetings

✅ Ask early adopters for written or video testimonials

Metrics To Consider Tracking

Bookings Data

- Number of meetings booked (as a trend)

- Bookings by client vs. staff

- Percentage of total meetings

- No-show and cancellation rates (vs. in-person)

- Conversion rates (by call to action or channel)

Demographic Data

- Who tends to book video appointments

- Which segments have the highest satisfaction rate

- Which segments have the lowest satisfaction rate

- Impact of video appointments on overall satisfaction rate

Branch + Staff Data

- Branch traffic where members book video calls

- Staff needed at each branch to meet video call demand

- Staff with most video calls

- Virtual video queue wait times

- Video call back requests from lobby kiosk

Sales Data

- Conversion rate per advisor/rep

- Which services are most commonly booked by video

- Which products have the highest upsell or cross-sell on video

- Number of video calls to close a new product or service