Coconut vs. Digital Customer Service Platforms

Watch a demoOver 150 financial institutions use Coconut Software to make appointment scheduling, lobby management, and video banking a breeze.

Our suite of solutions makes conversations about complex financial products and services more enjoyable—for clients and staff alike.

Explore how we’re different from Digital Customer Service solutions.

Why Financial Institutions Choose Coconut

Focus on High-Value Products and Services

Coconut makes it easy for clients to connect with the right advisor when they need help with mortgages, loans, and other complex services or products—the lifeblood of any financial institution.

Long-Term View of the Client Journey

Whether you want to understand how many interactions it takes to complete a new loan or how many products a household has purchased over time, Coconut gives you a central location to see how each touchpoint connects to long-term revenue.

Seamless Experience From Online to in Person

We’re digital-first, not digital-only. That means clients have the flexibility to begin their journey online and finish in person at a physical location. Plus, Coconut’s walk-in management tools give you a clearer view of branch traffic over time.

Strategic Support For Every Department

Coconut helps more than just your contact center. Our platform supports marketing, lending, client experience, retail, and operations departments with tailored solutions that can help them reach their goals (which helps you get even more out of your investment).

What Coconut Users Love About Us

“We’ve worked with other vendors who don’t understand our culture. Coconut Software is the ideal fit for us, as they share our values and understand the importance of putting customers first.”

MICHELLE FITTRO,

Director of Retail Product Development, Arvest Bank

“I can confidently say that Coconut is one of our favorite vendors to partner with.”

KELLEY JACOBSEN,

VP Marketing & Operations, YOLO Credit Union

“My favorite thing about Coconut is their flexibility. Their team has been a great partner to us. They listen when we have feedback, and they actually take action on it.”

RYAN MCDONALD,

Business System Manager, University Federal Credit Union

Why Choose Coconut Over Digital Customer Service Platforms

Digital Customer Service solutions help make contact centers more efficient by reducing the time agents spend on transactional interactions, like answering online banking questions.

Coconut’s platform is best for financial institutions that want to drive more profitable, high-quality conversations for complex services like loans, mortgages, or financial advice, while reducing administrative work for frontline staff and contact centers.

Coconut quickly connects clients and staff to discuss complex services like loans, financial advice, and more—making interactions more enjoyable and efficient.

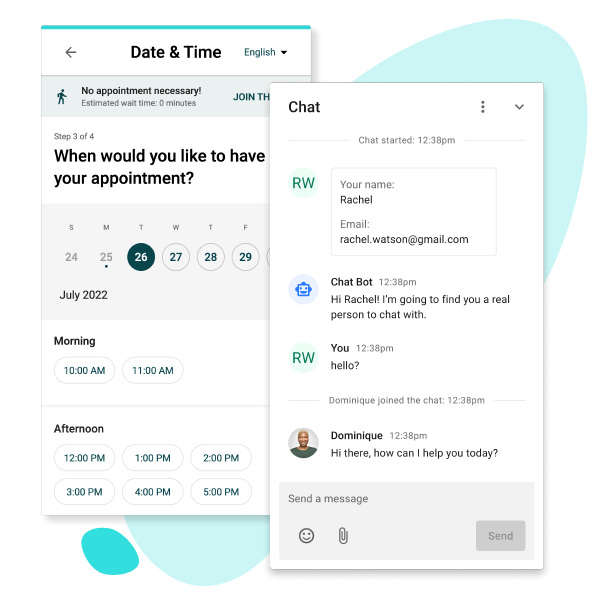

Coconut gives clients the ability to start their journey online and finish in person, ensuring a smooth transition between every channel.

Get the clearest view of your client’s journey. Capture interactions across physical and digital channels to see which channels lead to the highest-value outcomes.

See where your team spends their time and who’s overbooked. Then, adjust schedules or staffing to get the most out of your team.

Instantly route clients to the right staff member based on their needs, share advisor availability, and allow them to book a meeting in just a few clicks.

Instantly engage walk-in traffic with self-serve tools that allow them to join the line, see wait times, or schedule an appointment without waiting in line.

We work closely with our customers to determine where we head next. And we build it all in-house, meaning every update delivers a smooth experience for end users.

Coconut’s solutions impact more than just your contact center. Tailored solutions for marketing, lending, retail, and experience help stretch your budget further without adding multiple tools to your tech stack.