RETAIL AND BRANCH OPERATIONS PLATFORM

Optimize Staff Performance

Long lines and wait times. Over and under-staffing. Team burnout and missed customer connections. Sound familiar? Enable your team to deliver better service in less time, with Coconut Software.

Join 150+ Financial Institutions Who Trust Coconut To Deliver Smoother Experiences

Customers Who Use Coconut Have Seen

21 point

Higher NPS

75%

Reduction in appointment length

23%

Reduction in in no-shows

Why Retail and Operations Leaders Love Coconut

Empower Your Team To Deliver Great Advice, Faster

- Direct customers to self-serve channels for transactional requests to keep your team focused on high-value product conversations

- Easily surface information and documents collected during the booking process to help advisors deliver personalized service

- Measure performance across staff, services, and locations to uncover coaching opportunities

“We’re increasingly moving walk-ins to high-value appointments and building that behavior because we know appointments convert”

Aaron Young

SVP of Branch Operations and Retail Banking

Credit Union of Southern California

Put The Right Advisor In Branch At The Right Time

- Get a clear view of in-branch activity, so you know when customers are visiting, and why

- Forecast how many staff you’ll need to meet customer needs today, tomorrow, and beyond

- See where staff spend their time, who’s overbooked, and who’s available to help reduce wait times

“Before Coconut, we were unorganized, which caused scheduling stress! Now, we have organization to our day that allows us to better serve our customers.”

Kacie Harmon

Branch Manager

Rogue Credit Union

Improve Coverage For In-Demand Advisors

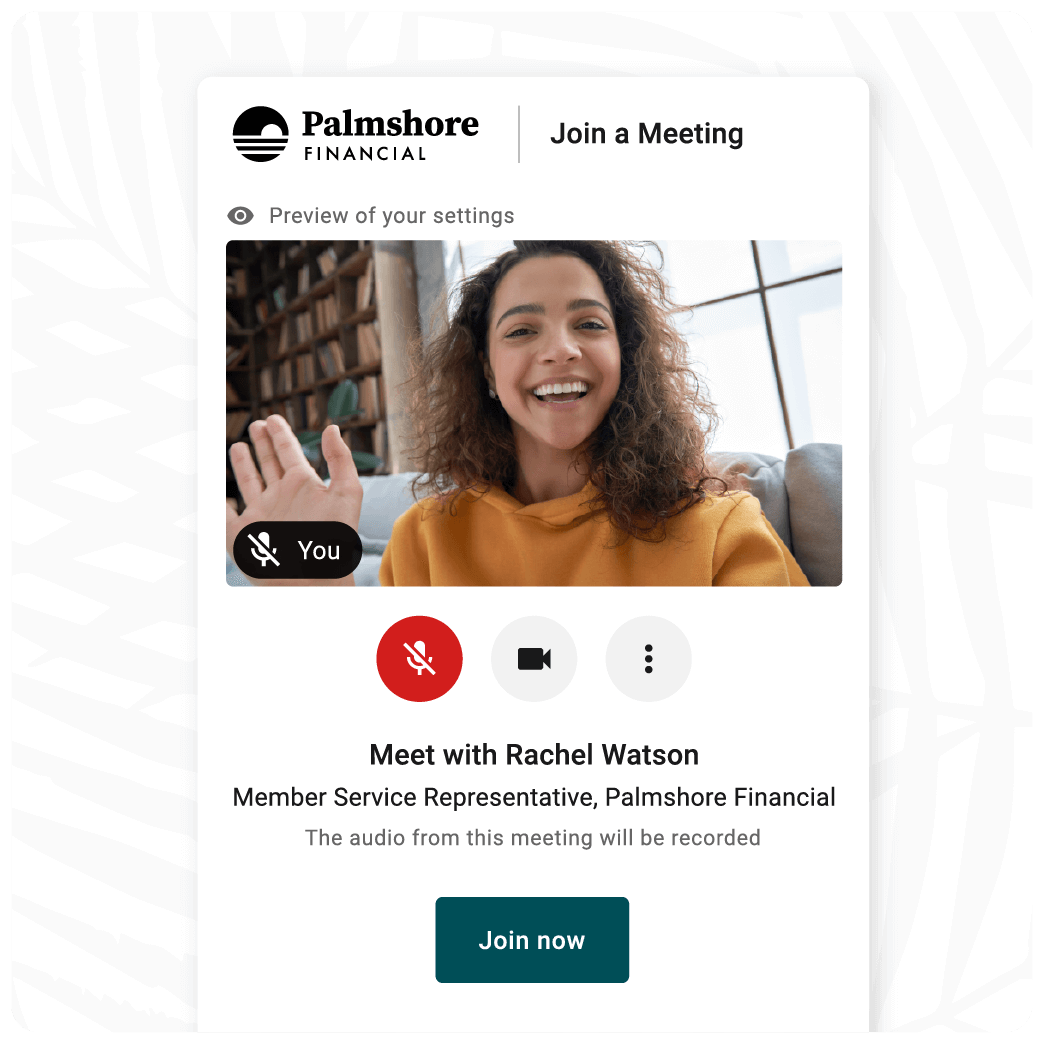

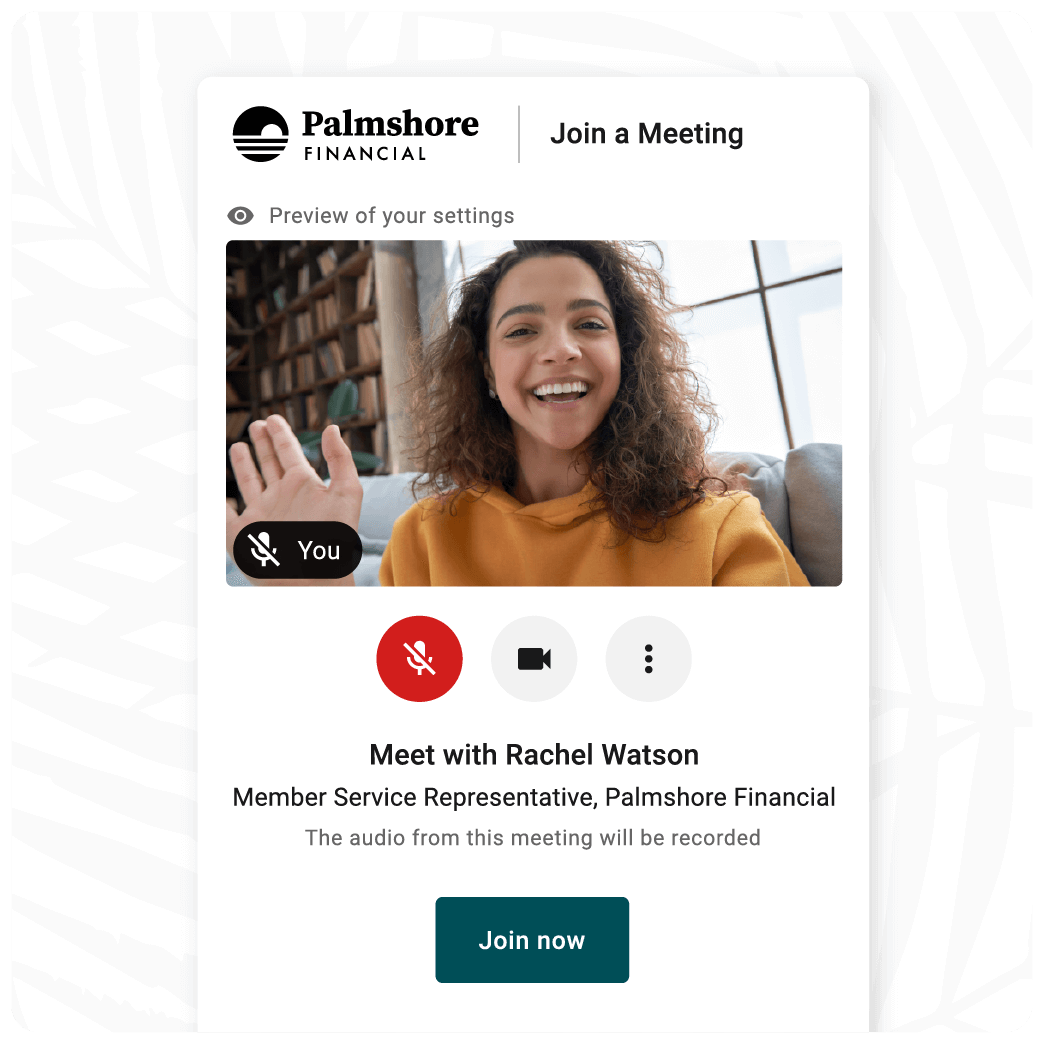

- Let advisors serve customers remotely through video banking—no travel required

- Give advisors digital booking, meeting, and follow-up tools in one easy-to-use platform

- Set hybrid schedules that quickly show which meeting modes advisors are available for

“At Libro, we were surprised by the initial and immediate uptake of video. Libro members like that they can meet without needing to travel and they find using video easier than expected.”

Tasha Newman

Digital Specialist

Libro Credit Union

Support from Experienced Pros

- Launch quickly with playbooks proven to help financial institutions like yours grow

- Connect with peers through quarterly networking sessions to share best practices

- Get ongoing strategic advice and guidance through success planning with our team

“I can confidently say that Coconut is one of our favorite vendors to partner with.”

Kelley Jacobsen

VP Marketing & Operations

YOLO Credit Union

Ready To Learn More?

Speak With One of Our Experts.

Take A Peek Inside Our Platform

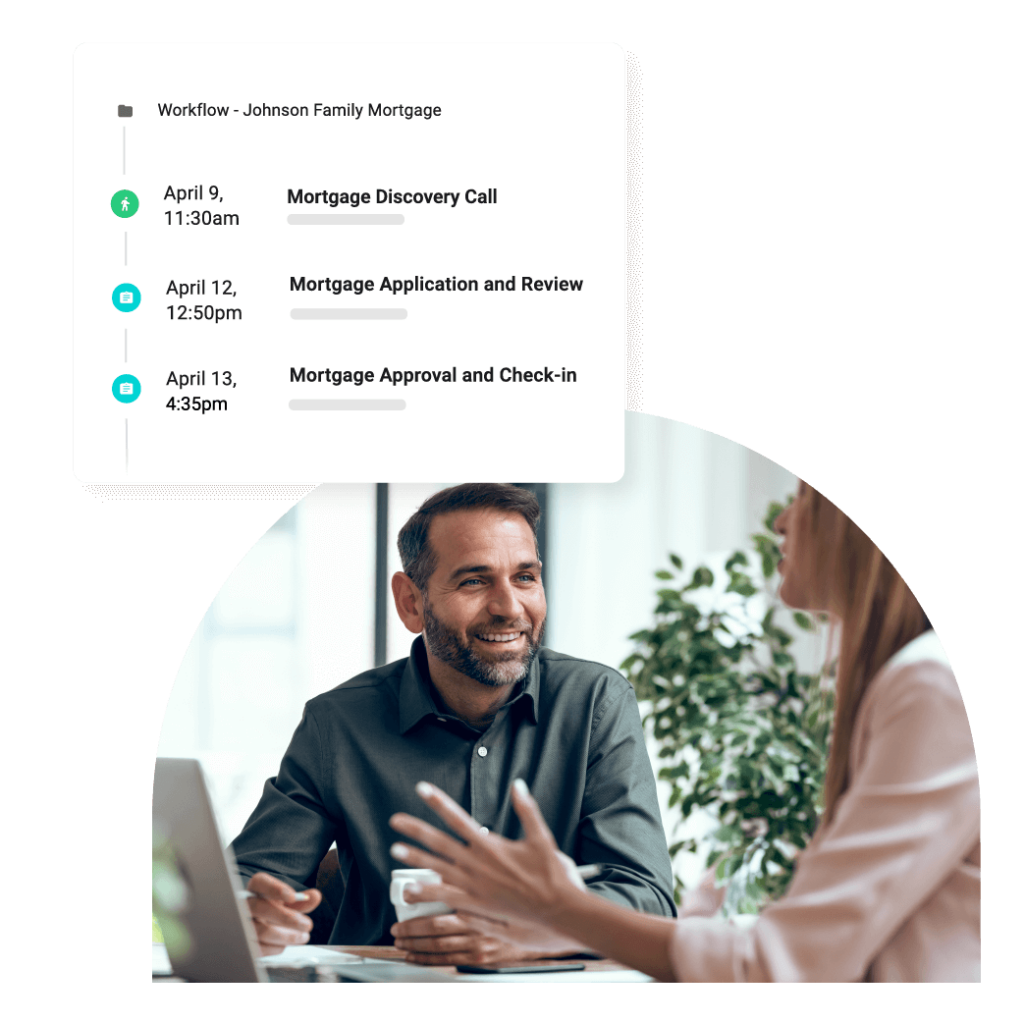

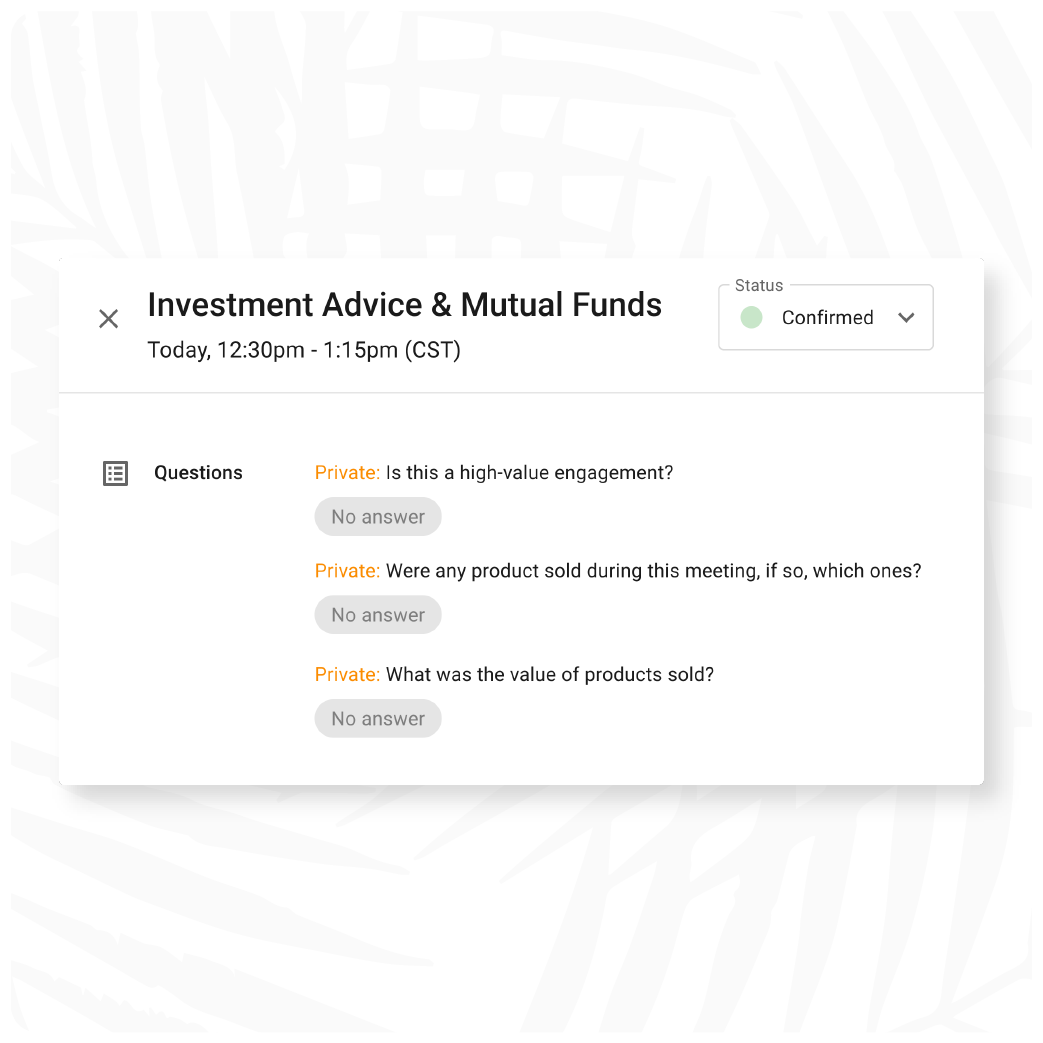

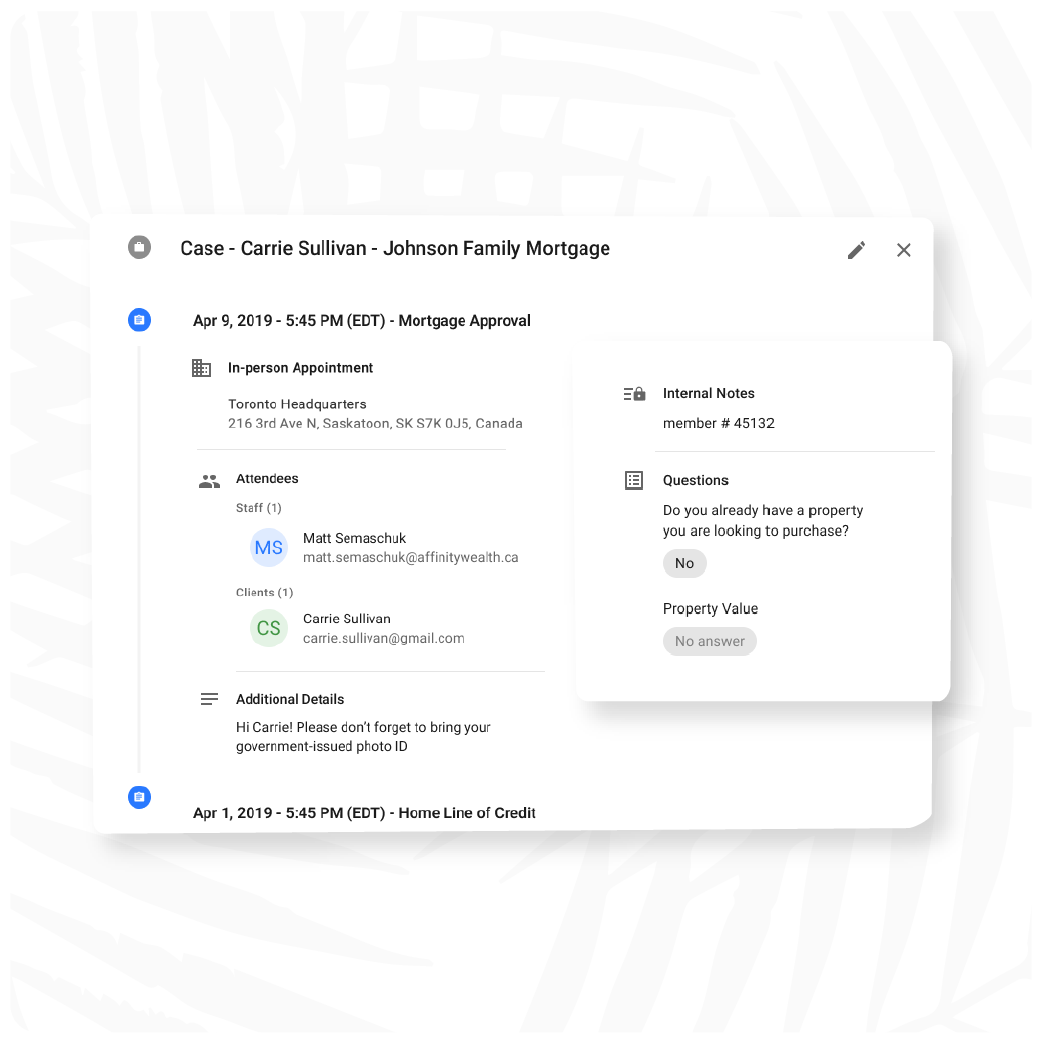

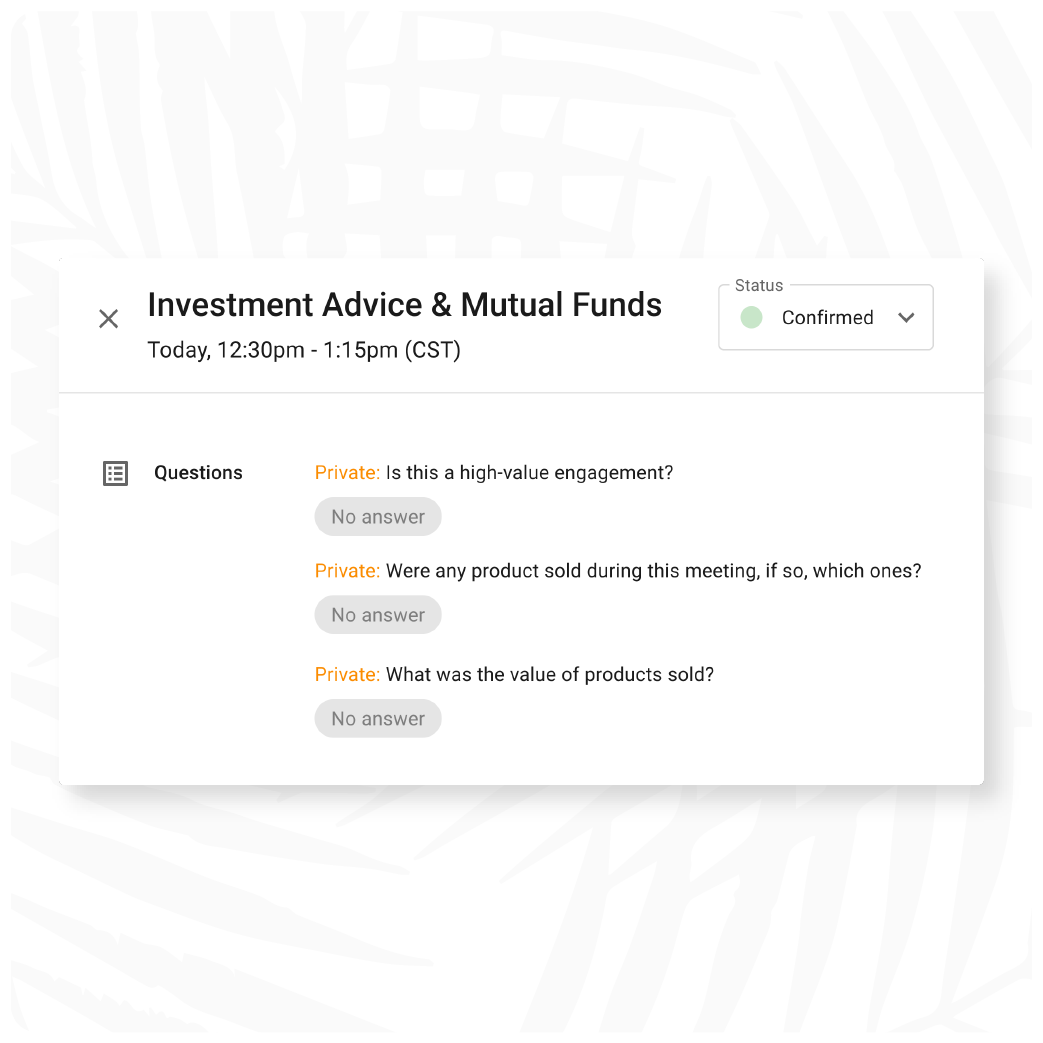

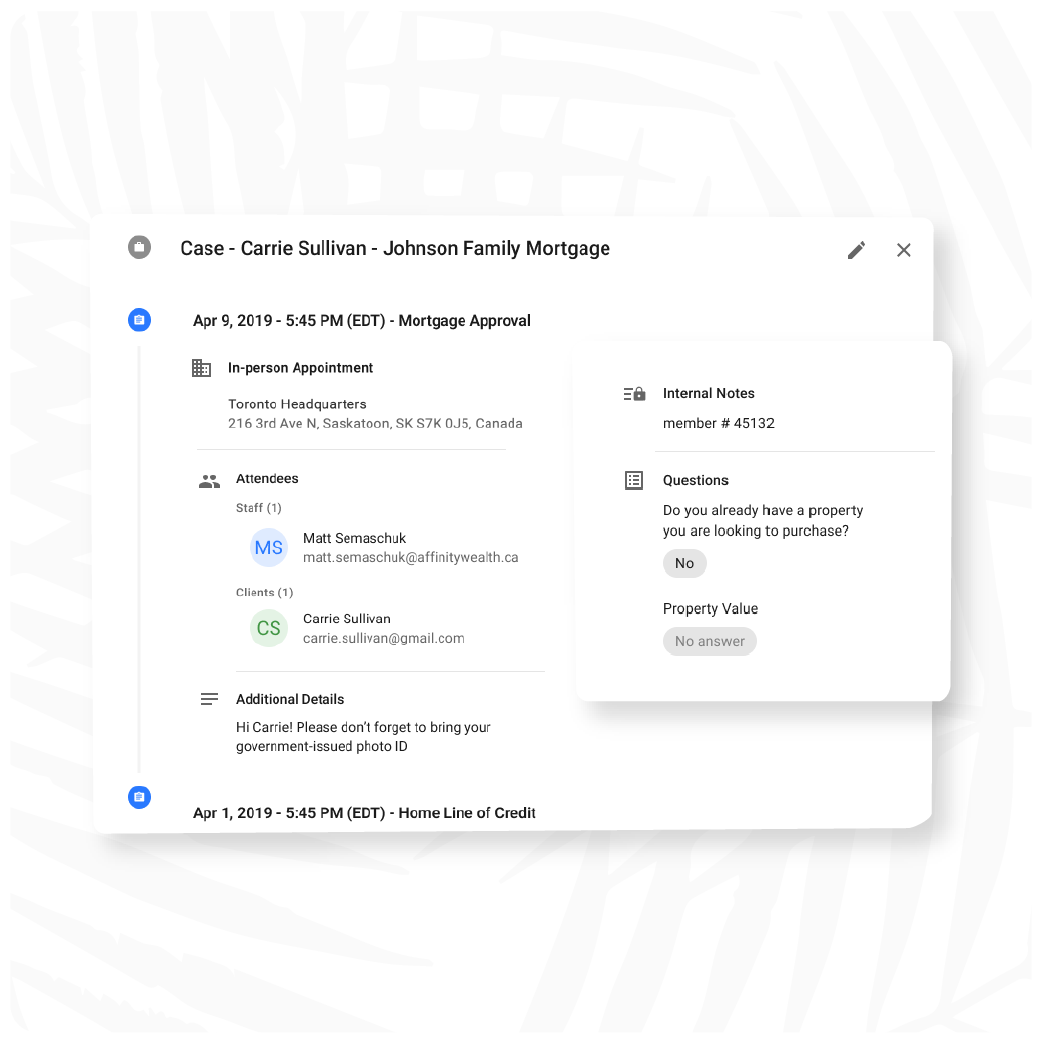

Capture outcomes from every interaction in Coconut so you can see which staff, products, and locations are getting you closer to hitting your growth goals.

See where your team members are spending their time with customers so you can allocate resources to better serve your most in-demand locations or products.

Keep everything your staff needs to deliver a standout experience in one spot (including customer history, important documents, and information gathered through the booking flow.)

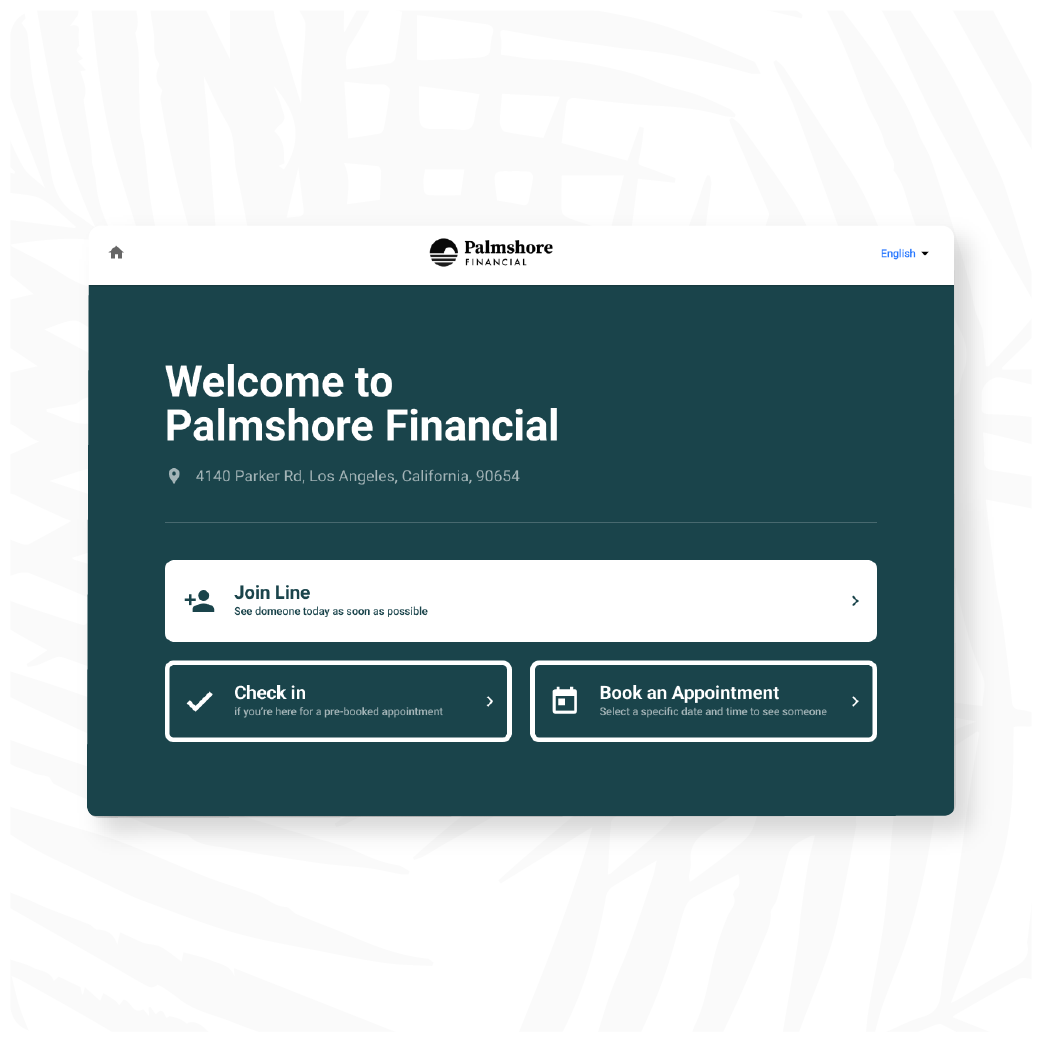

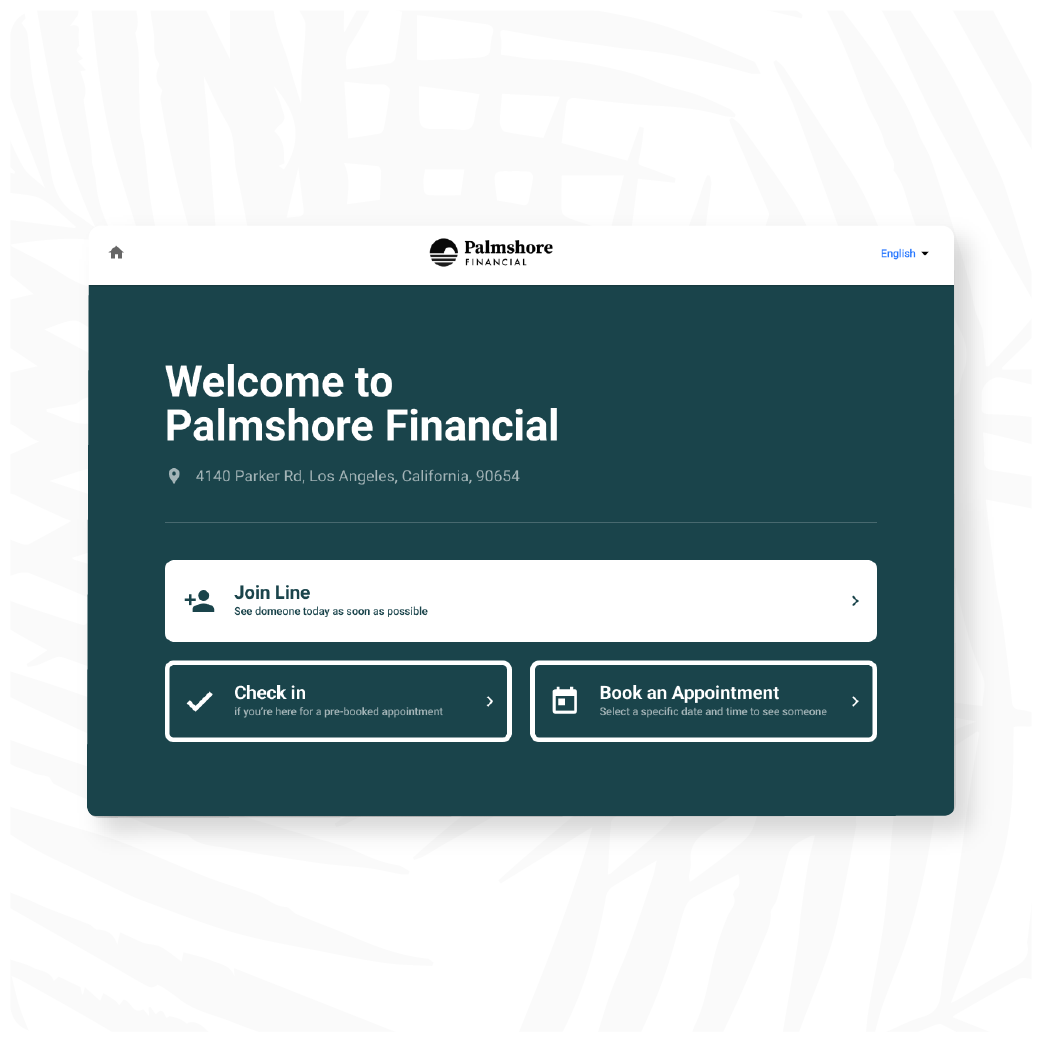

Keep branch traffic flowing smoothly with self check-in tools that enable customers to see wait times, join the line, or pre-schedule an appointment without having to wait in line.

Let floating staff serve multiple locations with a robust virtual appointment tool that has everything they need—including e-signature, ID verification, and more.

Learn How Coconut Can Help Other Teams

Marketing

Customer or Member Experience

Lending

Check out the 2023 Benchmark Report

Unlock appointment experience benchmarks all financial institutions need to know about and see how your financial institution stacks up