LENDING

Sell More Products Per Household

Customers getting stuck with loan applications online? No easy way for them to connect with help? Coconut removes friction for customers and staff alike by guiding customers to experts who can help and serving up customer history so staff can personalize service.

Join 150+ Financial Institutions Who Trust Coconut To Deliver Smoother Experiences

Customers Who Use Coconut Have Seen

30%

of appointments booked through Reserve With Google are for new customers.

12%

increase in loan pull-through rates because advisors deliver better service.

75%

reduction in appointment length—since staff and customers are more prepared.

Why Lending Experts Love Coconut

Drive More Loan Conversations

- Empower customers to connect however they prefer—whether that’s pre-booking time or joining the line through your website, mobile app, or marketing campaigns

- Allow greeters, tellers, and contact center agents to easily connect customers with advisors so no interested customer falls through the cracks

- Capture interest outside of regular business hours with always-on scheduling CTAs

“People of all ages welcome the ability to book appointments, but younger clientele are especially keen.”

Alexis Miarecki

Marketing Manager

UMassFive FCU

Increase Loan Pull-Through Rates

- Collect information and documents during the booking process to help advisors and customers prepare for every conversation

- Surface historical activity so staff are prepared to deliver personalized service and product recommendations to each customer

- Empower advisors to walk through documents and collect signatures virtually to reduce the need for follow-up appointments

“We’re increasingly moving walk-ins to high-value appointments and building that behavior because we know appointments convert.”

Aaron Young

SVP of Branch Operations and Retail Banking

Credit Union of Southern California

Make The Most of Floating Staff

- See where staff spend their time, who’s overbooked, and who’s available to help reduce wait times across locations

- Forecast the staff you’ll need to meet customer needs today, tomorrow, and beyond—so you can adjust staffing accordingly

- Allow advisors to reach more customers since remote meetings cut down on travel time

“Before Coconut, we were unorganized, which caused scheduling stress! Now, we have organization to our day that allows us to better serve our customers.”

Kacie Harmon

Branch Manager

Rogue Credit Union

Support from Experienced Pros

- Launch quickly with playbooks proven to help financial institutions like yours grow

- Connect with peers through quarterly networking sessions to share best practices

- Get ongoing strategic advice and guidance through success planning with our team

“Working with the Coconut team has been a fantastic experience. Not only does Coconut offer best-in-the-industry appointment software, but they also have an incredibly passionate and dedicated team. Our implementation was a great success.”

Nathan Heemskerk

Director, Member Solutions & Integration

Tandia Credit Union

Ready To Learn More?

Speak With One of Our Experts.

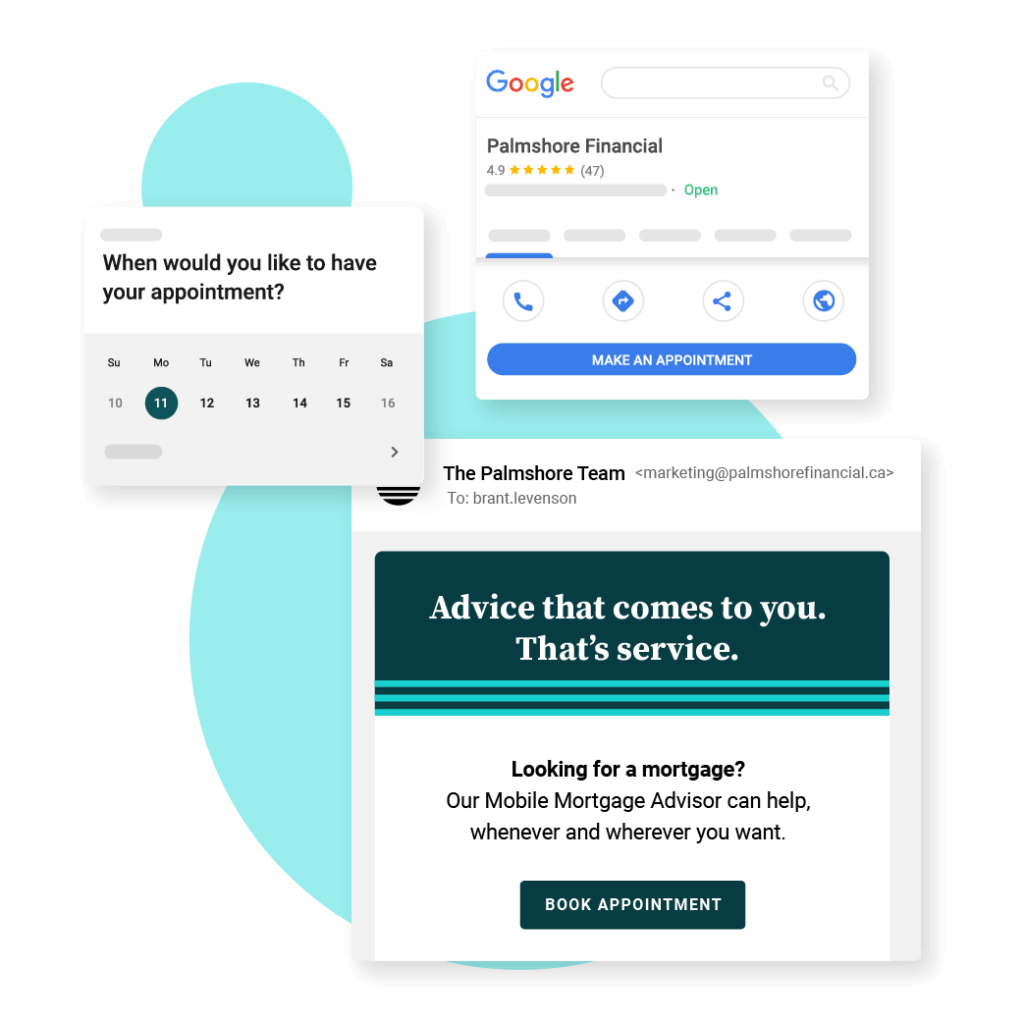

Take A Peek Inside Our Platform

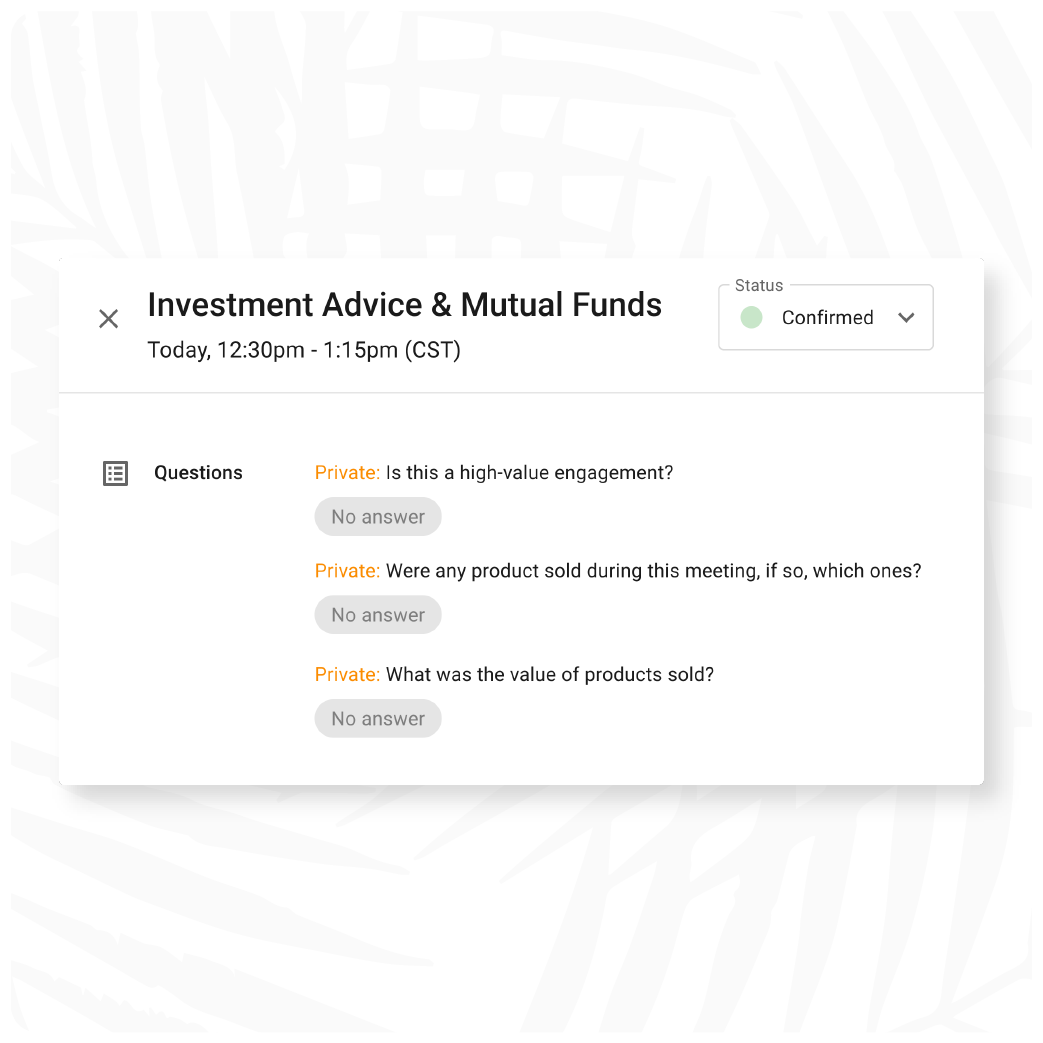

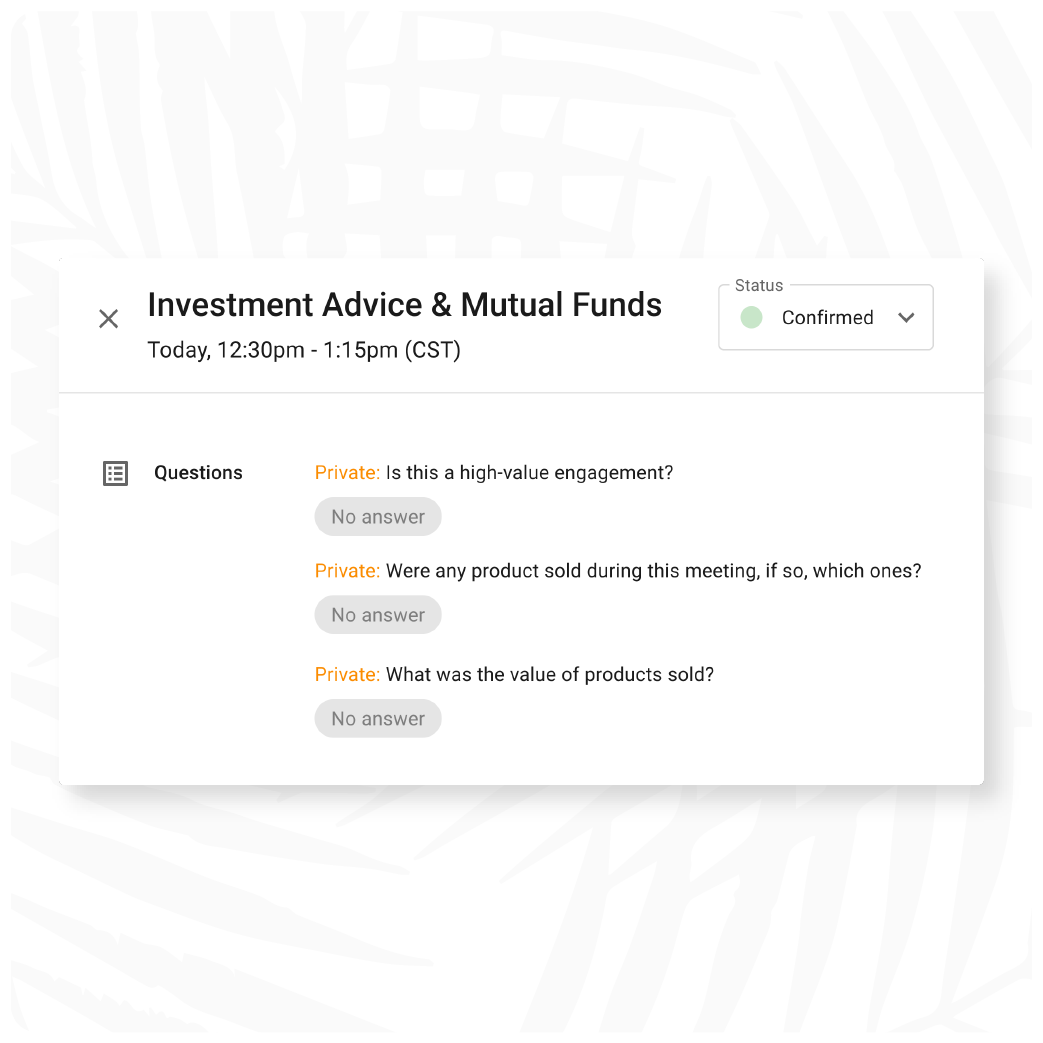

Capture outcomes from every interaction in Coconut so you can see which staff, products, and locations are contributing most to your lending goals.

See where your team members are spending their time with customers so you can allocate resources to better serve your most in-demand locations or products.

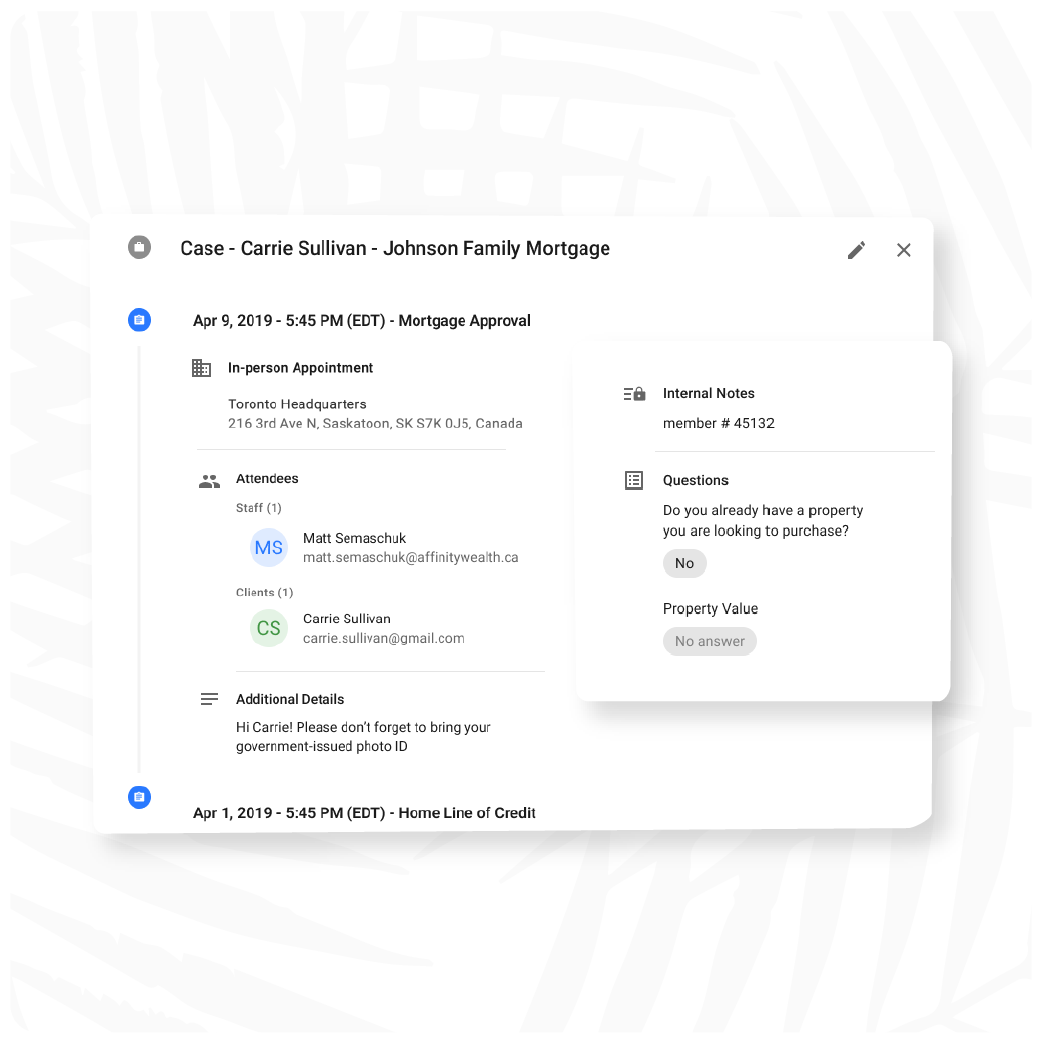

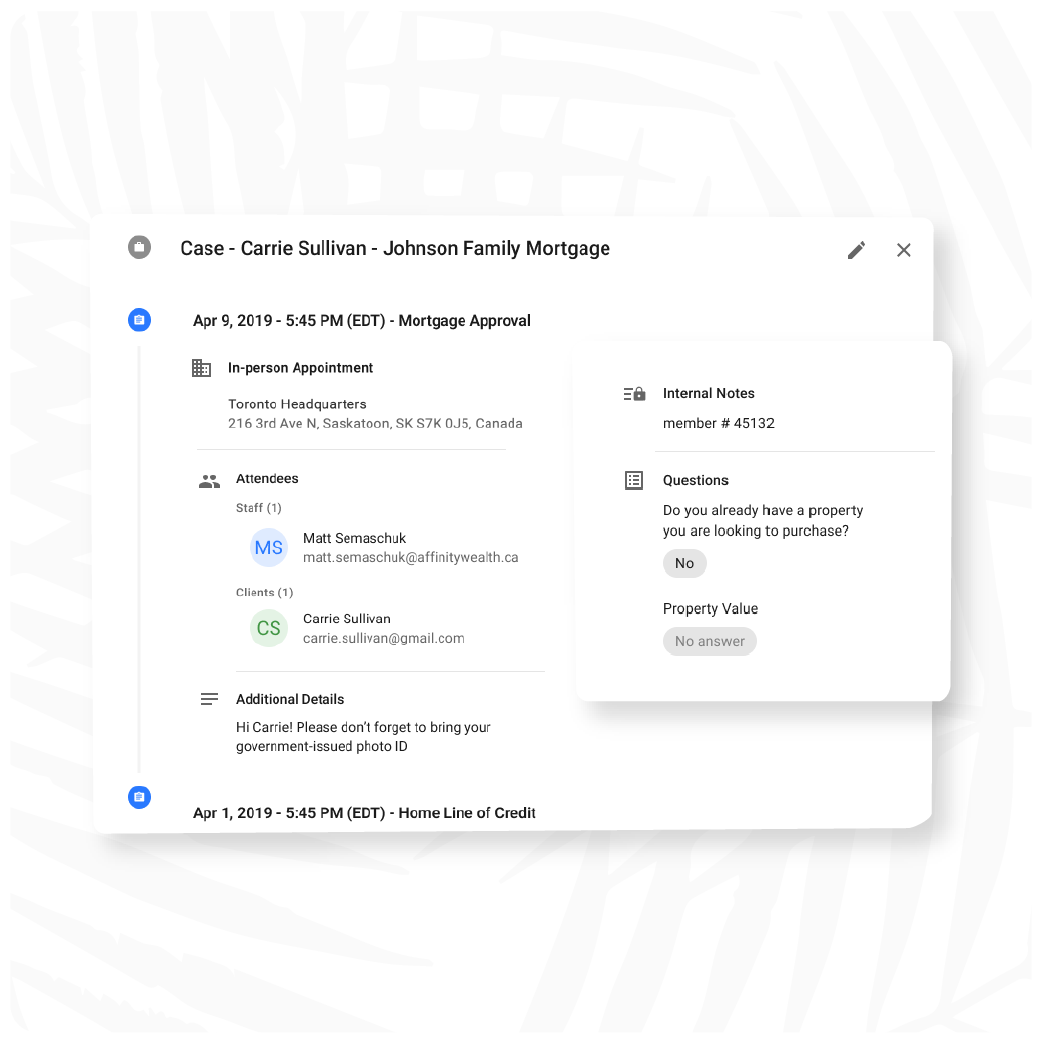

Keep everything your staff needs to deliver a standout experience in one spot (including customer history, important documents, and information gathered through the booking flow).

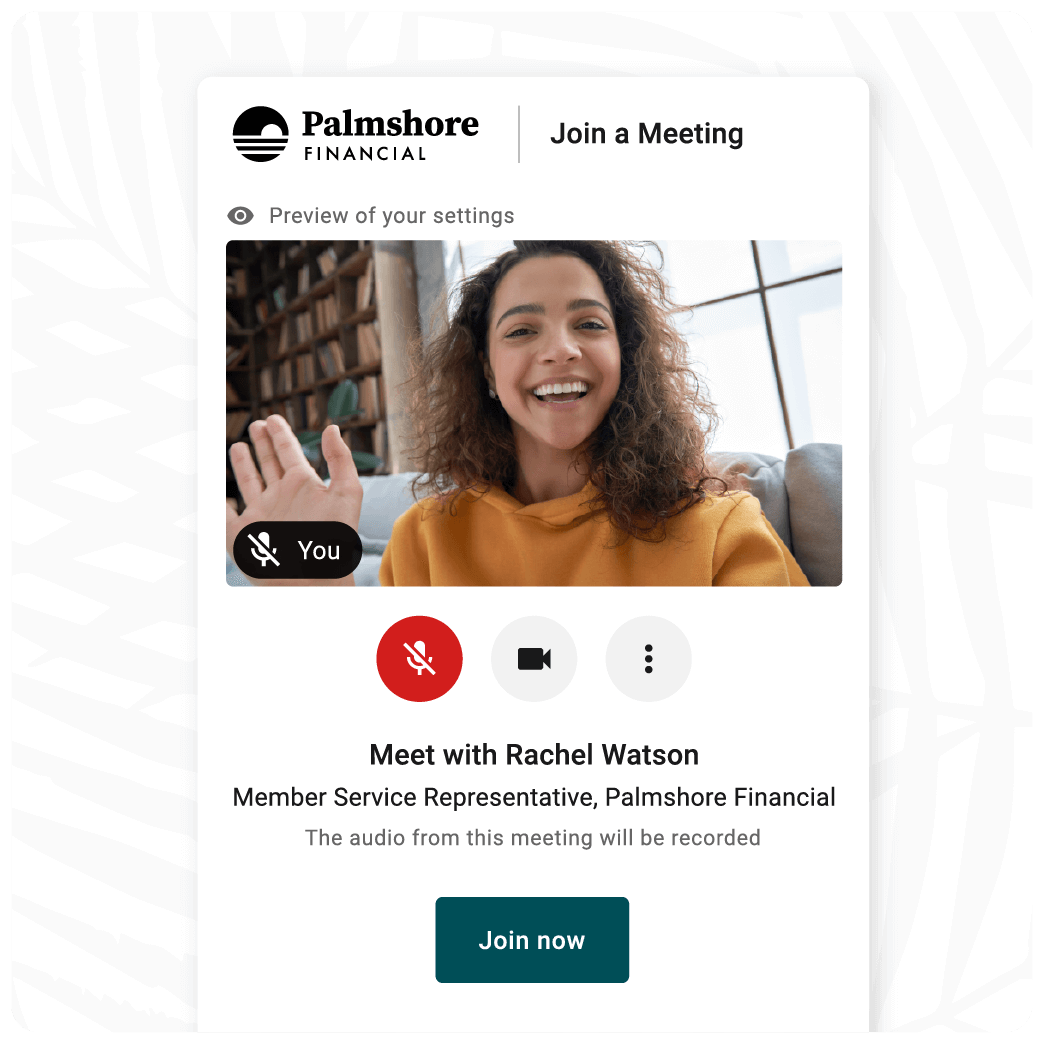

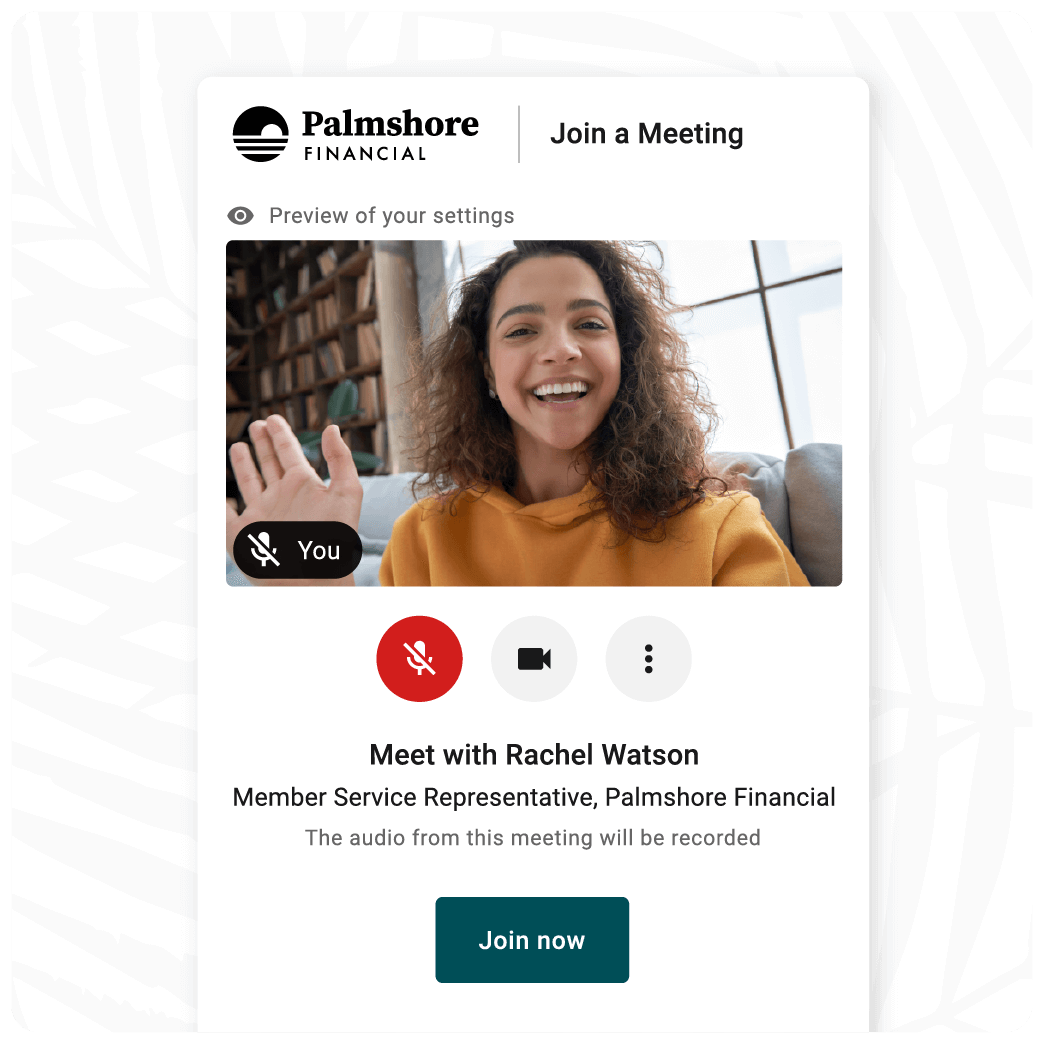

Let floating staff serve multiple locations with a robust virtual appointment tool that has everything they need—including e-signature, ID verification, and more.

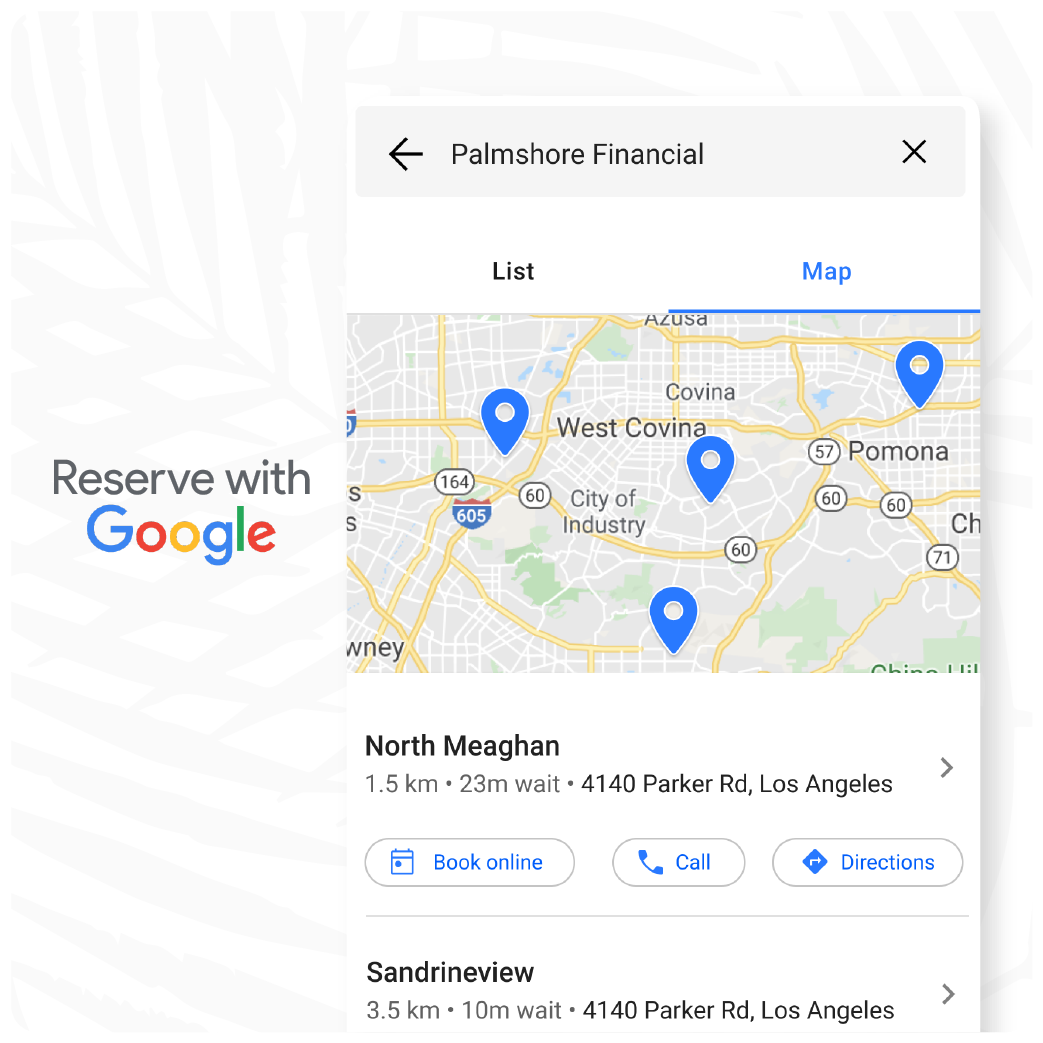

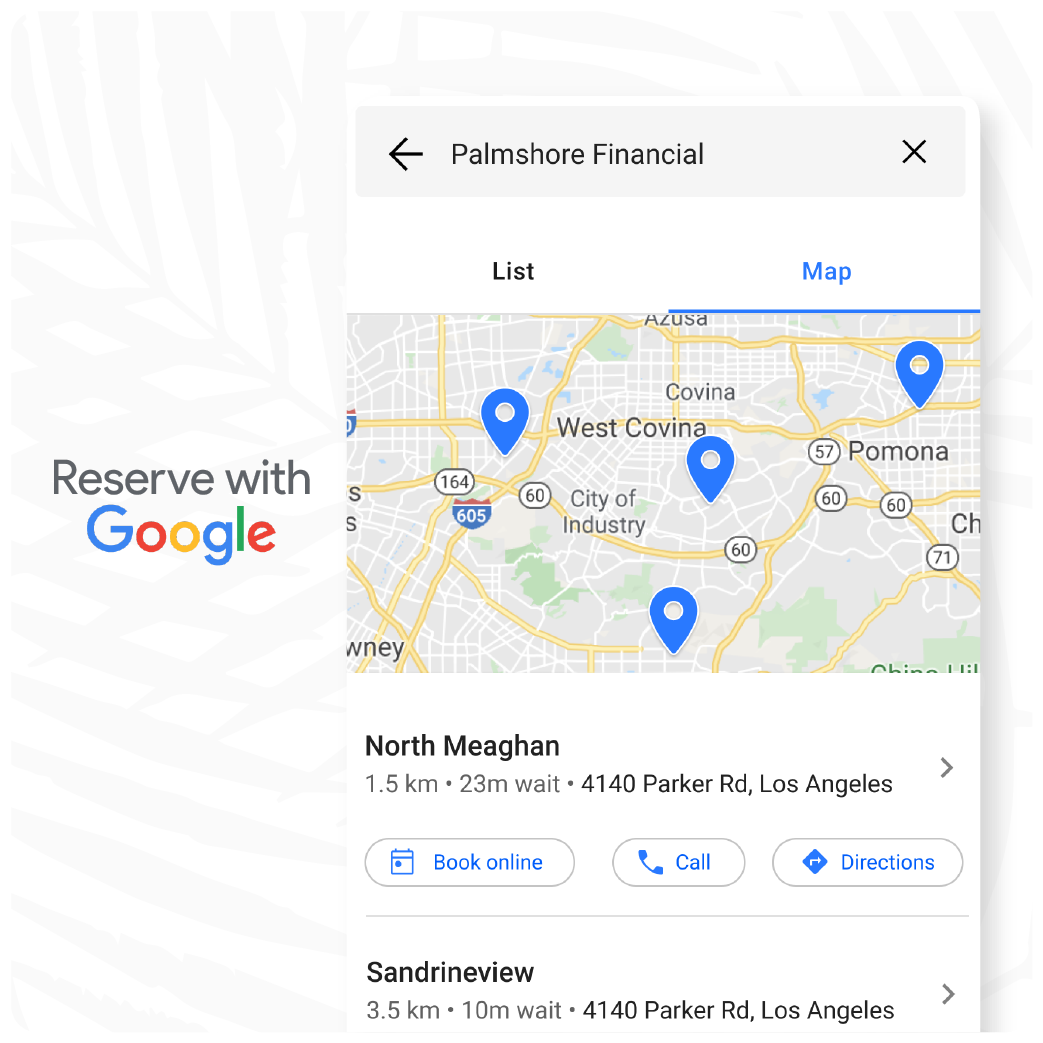

Set yourself apart from the competition by allowing customers to schedule time with your team directly from their Google search results.

Learn How Coconut Can Help Other Teams

Branch & Retail Operations

Marketing

Customer or Member Experience

Check out the 2023 Benchmark Report

Unlock appointment experience benchmarks all financial institutions need to know about and see how your financial institution stacks up