CUSTOMER AND MEMBER EXPERIENCE PLATFORM

Seamless Experiences,

Care of Coconut

Dealing with walk-ins who walk out because of long lines? Customers who need to repeat their story when they switch channels or staff? Customers left in the cold when your advisors are busy? You’re not alone. That’s why we built Coconut.

Join 150+ Financial Institutions Who Trust Coconut To Deliver Smoother Experiences

Customers Who Use Coconut Have Seen

21 point

Increase in NPS

97%

Customer Satisfaction Score

13%

Increase in Appointments

Why Customer Experience Leaders Love Coconut

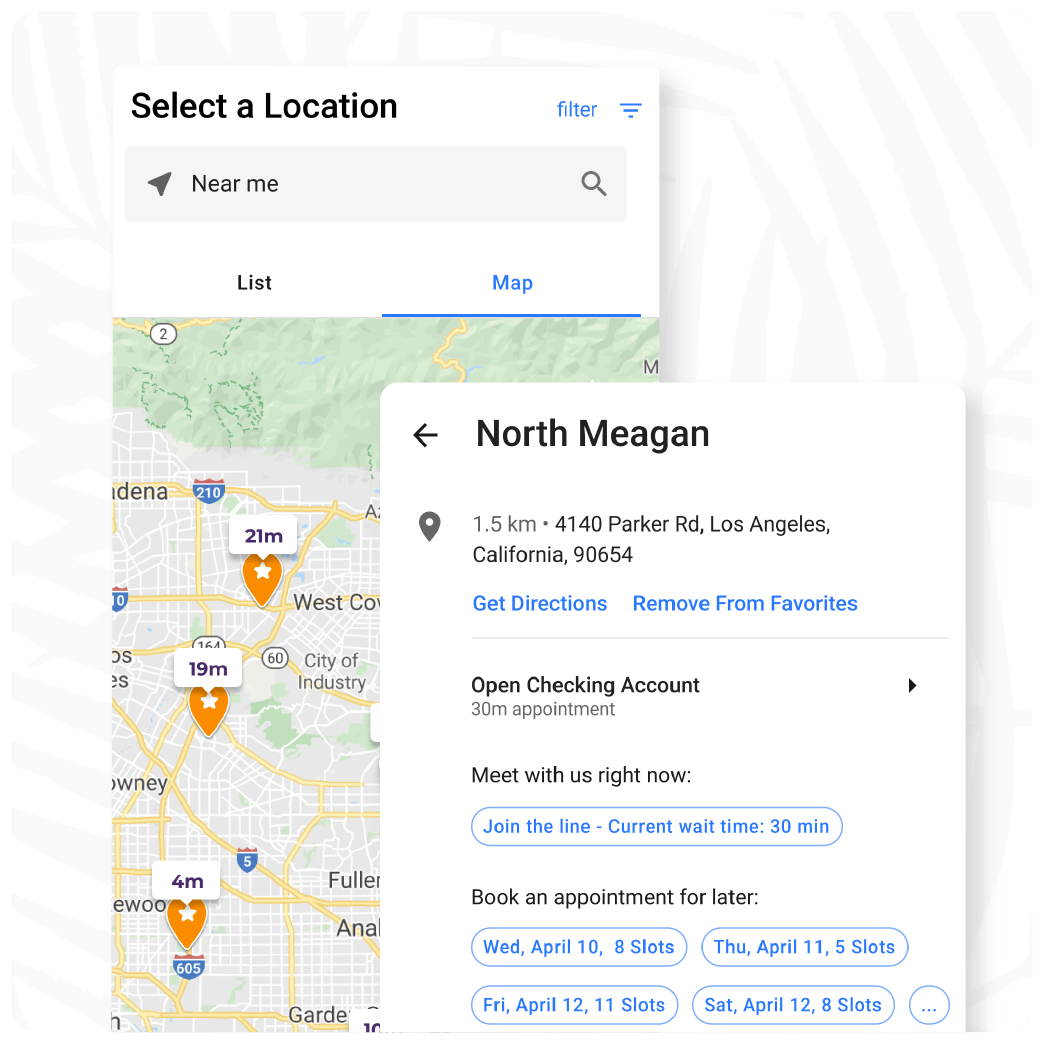

Guide Customers To The Help They Need, Fast

- Enable customers to enter through any channel and share more about their needs

- Show them the fastest way to get help whether it’s a self-serve tool, visiting a nearby branch, joining a virtual queue, or pre-scheduling time with your team

- Offer self-serve tools for customers to join the line, book an appointment, or check in on their own

“Our appointment scheduling process creates peace of mind for members. We’re able to offer more choice to our members, and that leads them to choose us.”

Aaron Young

SVP of Branch Operations and Retail Banking

Credit Union of Southern California

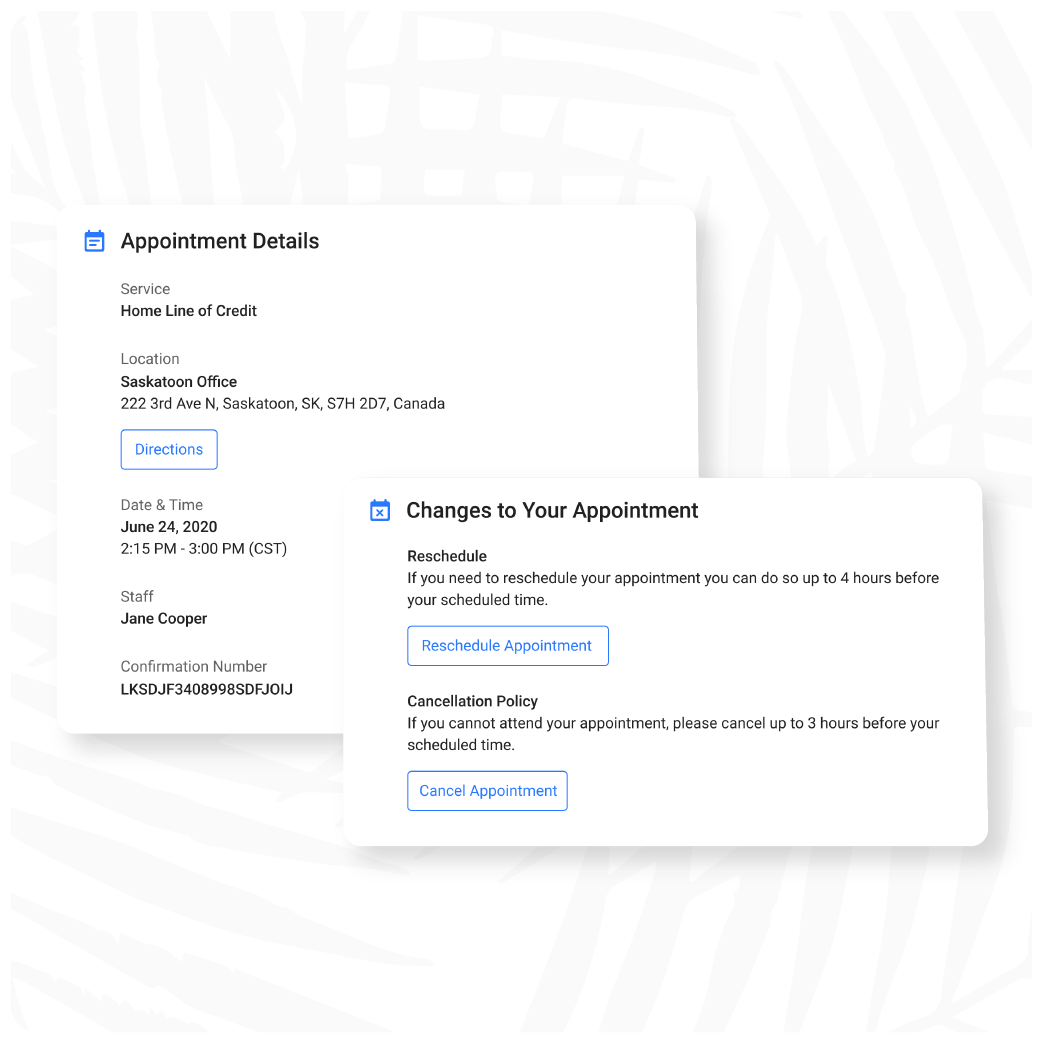

Deliver A Connected Experience Across Every Channel

- Give customers more choice around how and when they interact with your staff—both online and in-person

- Allow customers to seamlessly switch between physical and digital channels without missing a beat

- Reduce the need for customers to repeat their story with a central view of their needs, their recent interactions, and more

“Since implementing Coconut, our customers report that their experience is smoother and more pleasant. Coconut Software has allowed us to build connections between our associates and community.”

Michelle Fittro

Director of Retail Product Development

Arvest Bank

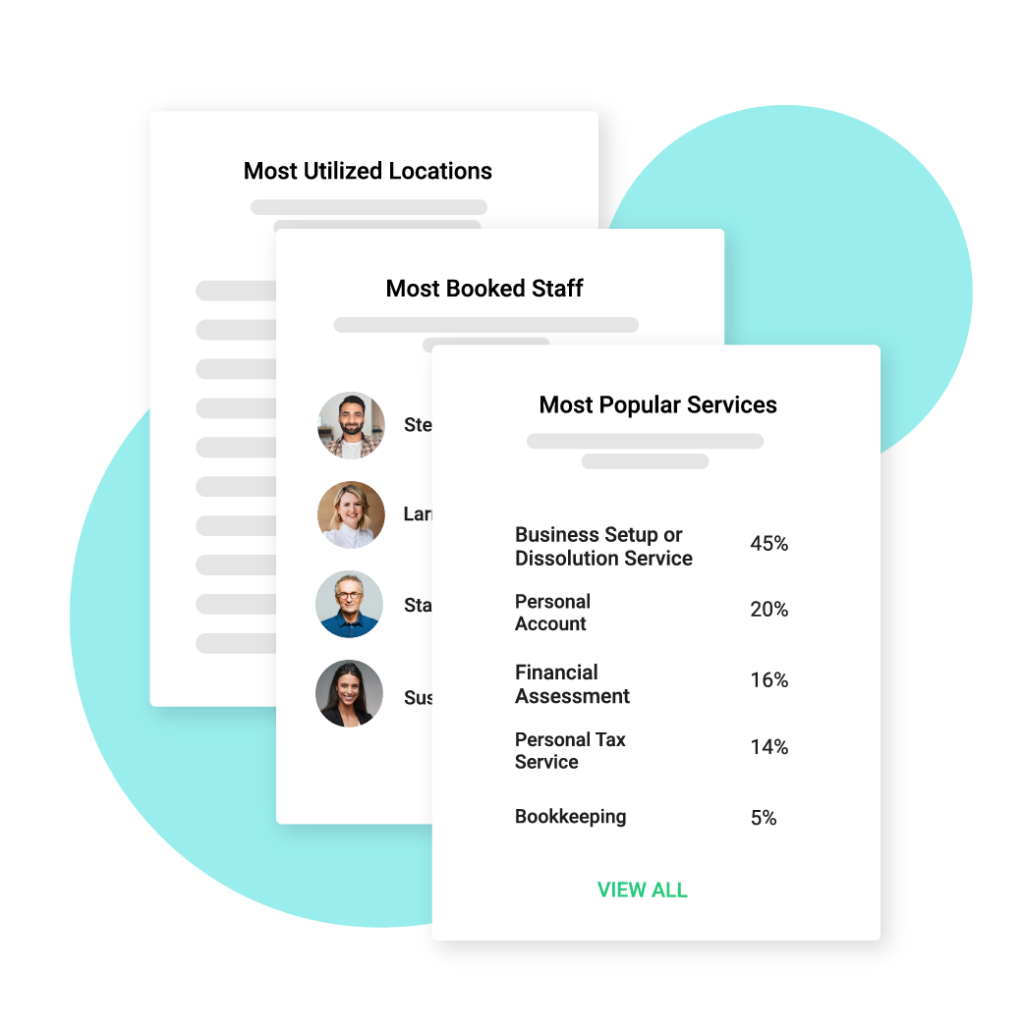

Discover The Lost Pieces of Your Customer Journey

- Understand which services your customers prefer to handle with your team in-branch vs. on their own through self-serve channels

- Get ahead of experience issues like wait times so you can proactively fix them

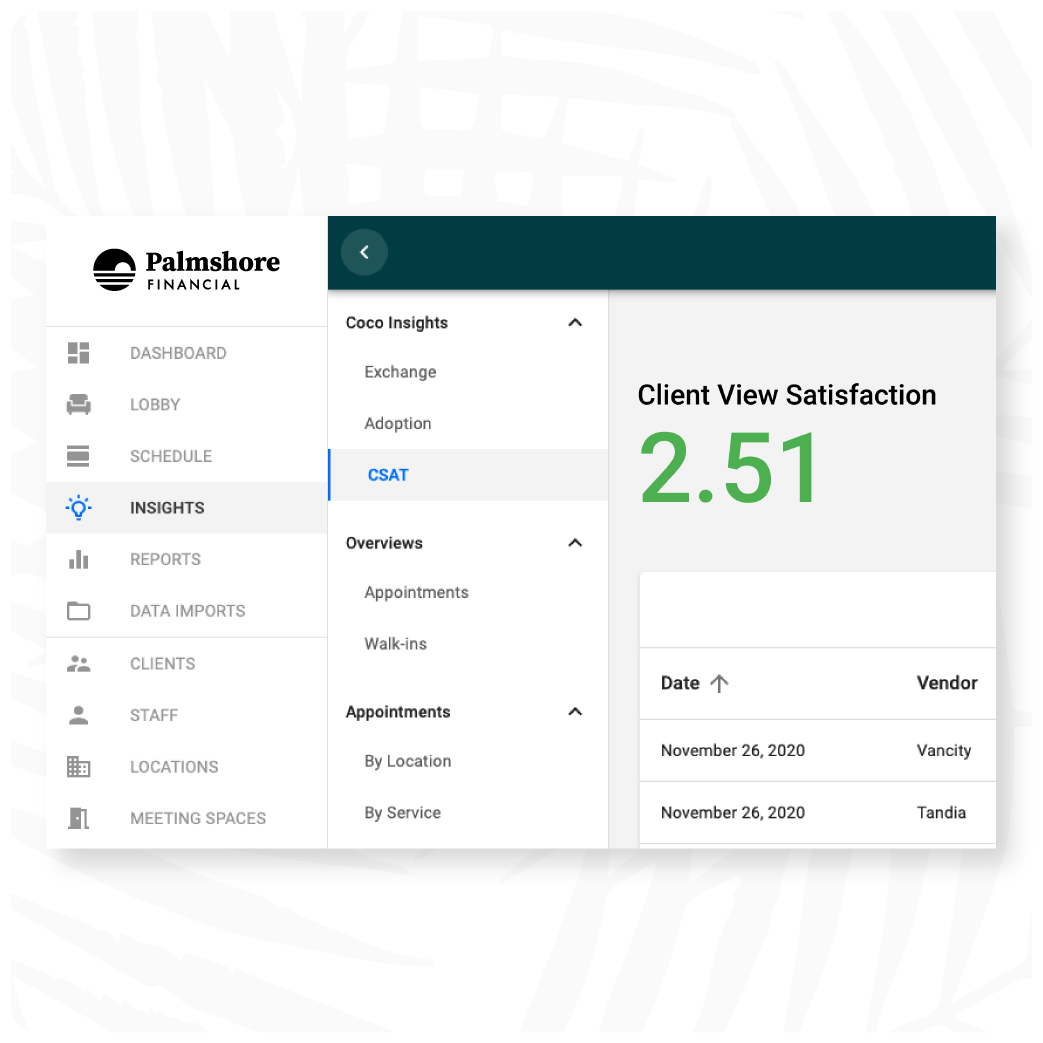

- Collect CSAT after every interaction for instant feedback that helps you enhance the experience

“Over the course of one year, Coconut Software increased our membership 6% and loans 13%. And that’s not just increased production—that’s all directly attributable to the appointment experience.”

Candy Shearer

Senior Manager of Member Experience

Kemba Credit Union

Support from Experienced Pros

- Launch quickly with playbooks proven to help financial institutions like yours grow

- Connect with peers through quarterly networking sessions to share best practices

- Gain strategic advice through ongoing success planning with our team

“Working with the Coconut team has been a fantastic experience. Not only does Coconut offer best-in-the-industry appointment software, but they also have an incredibly passionate and dedicated team. Our implementation was a great success.”

Nathan Heemskerk

Director, Member Solutions & Integration

Tandia Credit Union

Ready To Learn More?

Speak With One of Our Experts.

Take A Peek Inside Our Platform

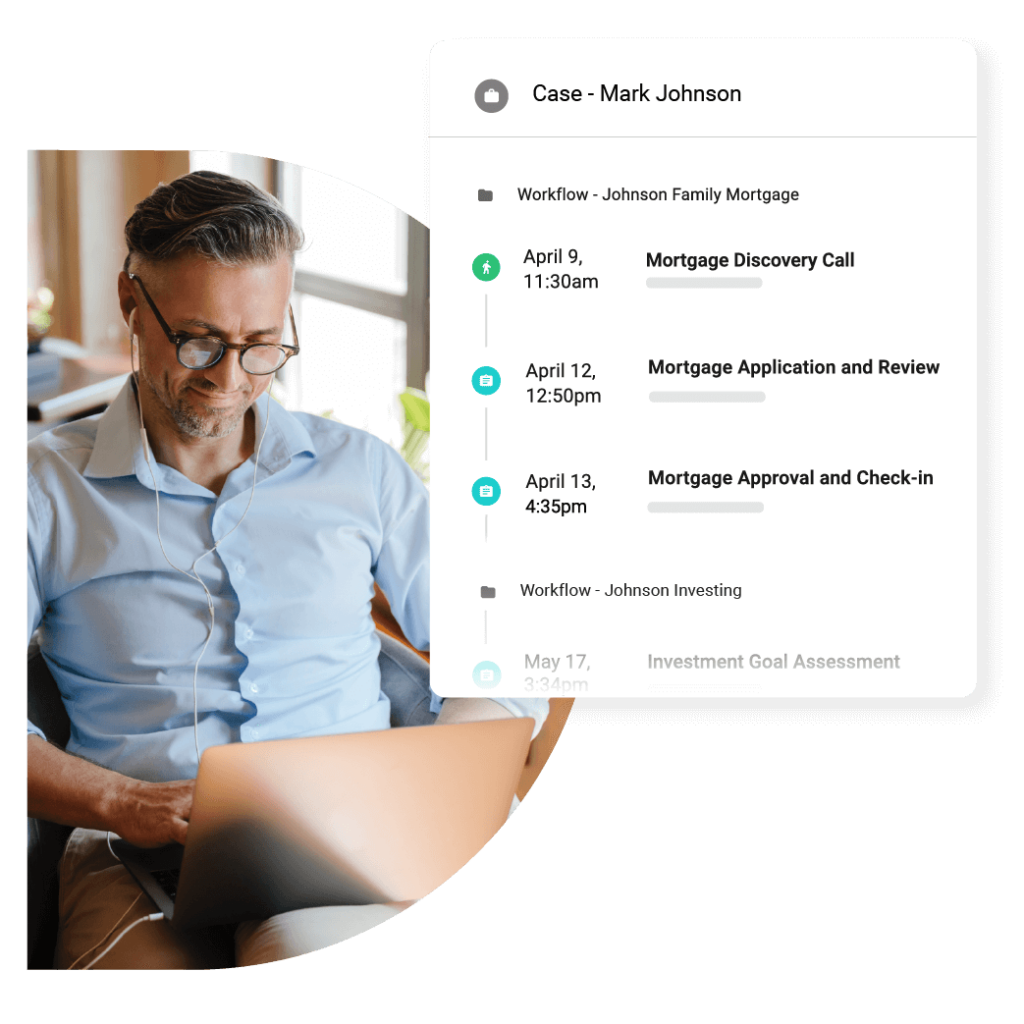

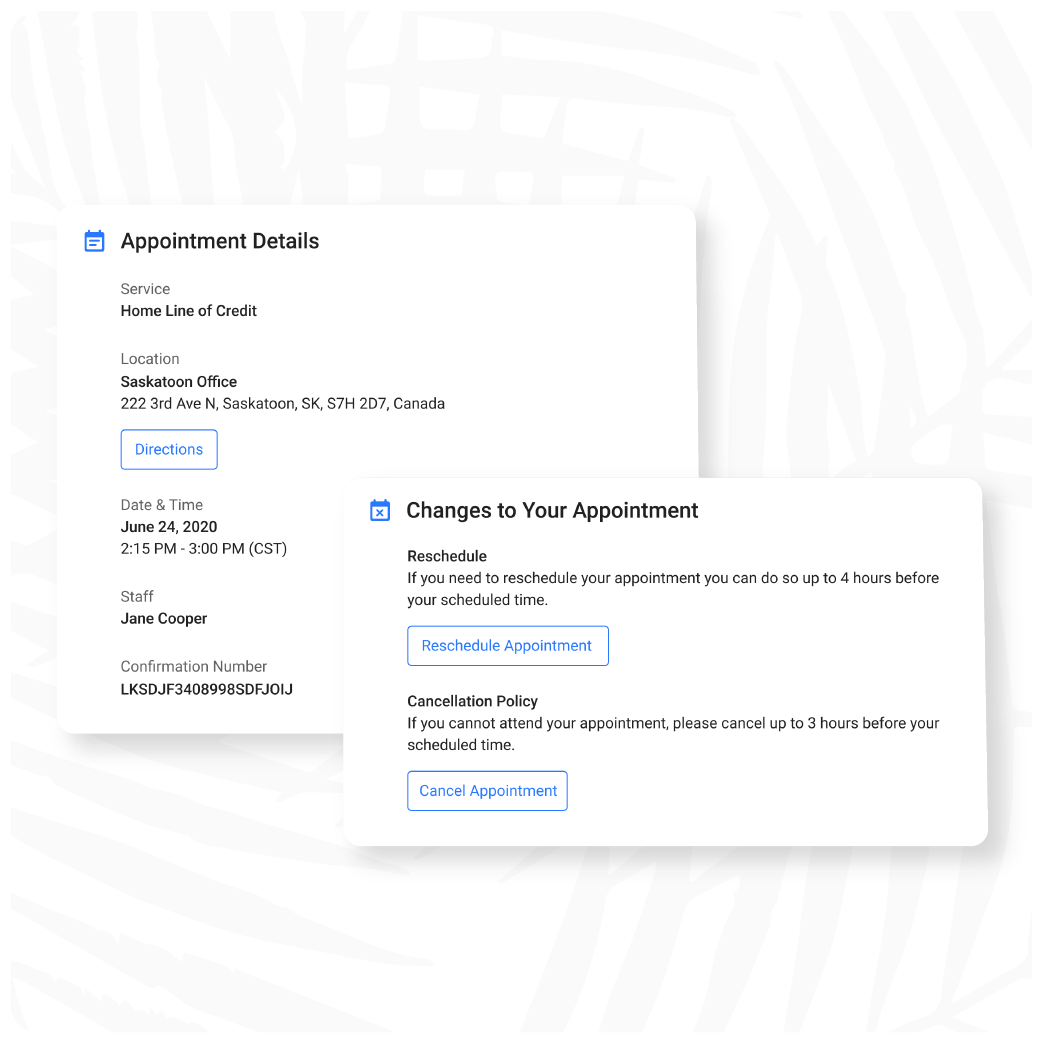

Learn more about your customer’s needs (like products they’re interested in and preferred ways to connect with your team), so staff can deliver personalized service.

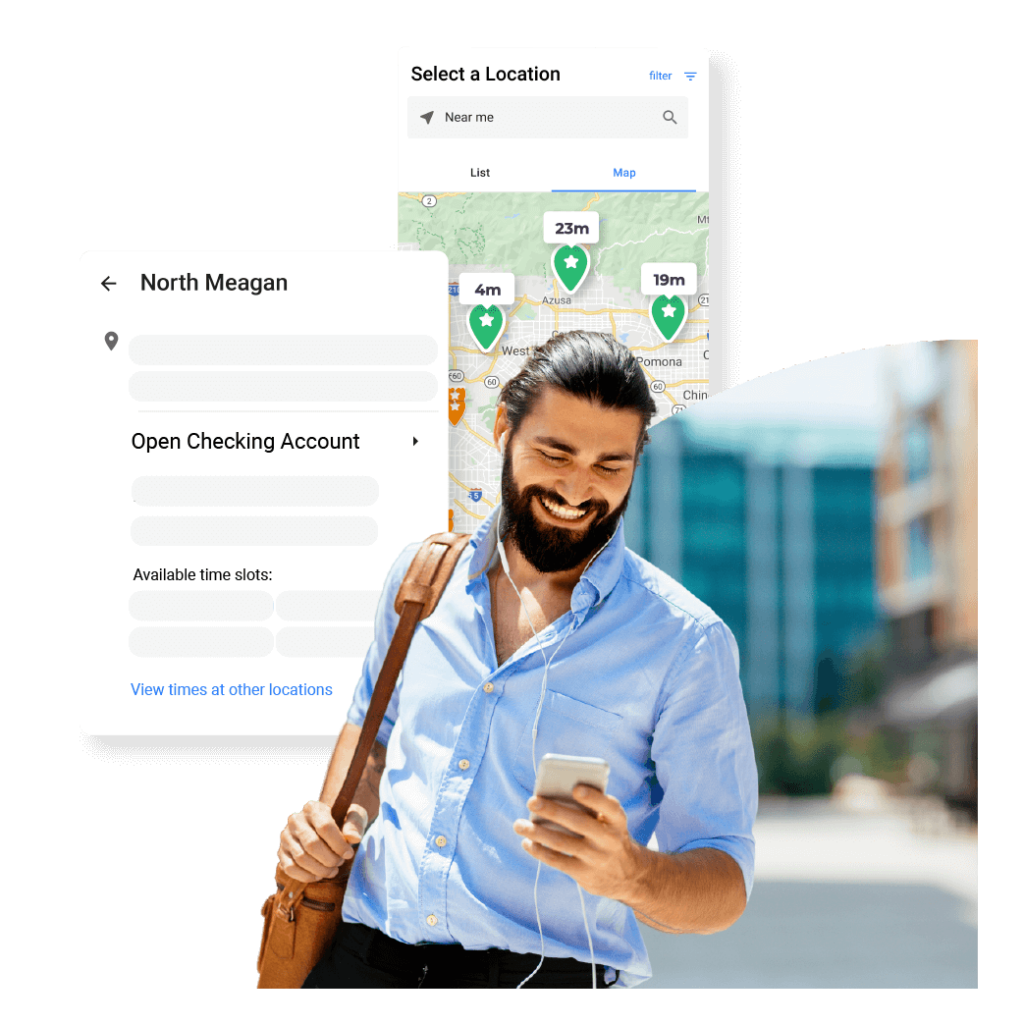

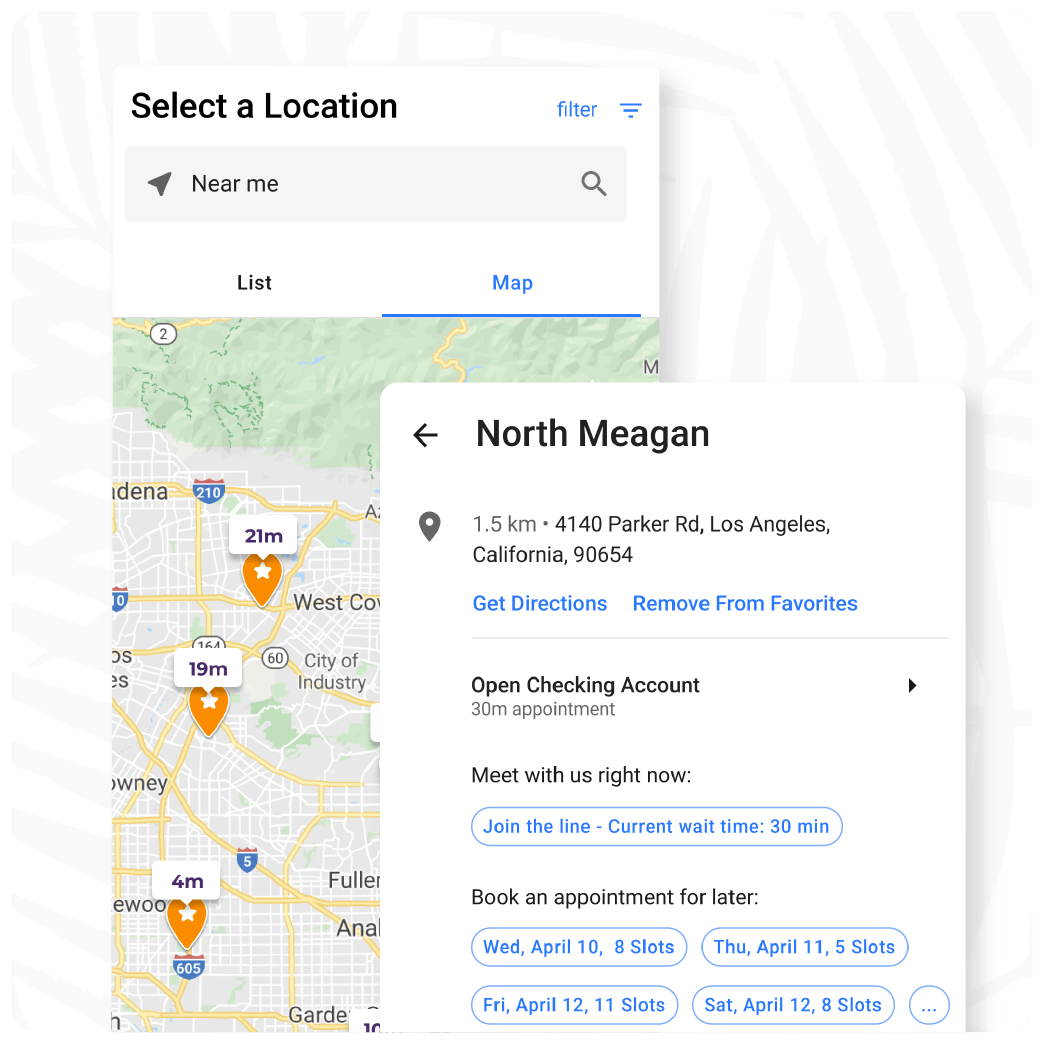

Show customers the fastest way to get help, whether it’s through a self-serve tool, joining the line at a nearby branch, or scheduling time with your staff.

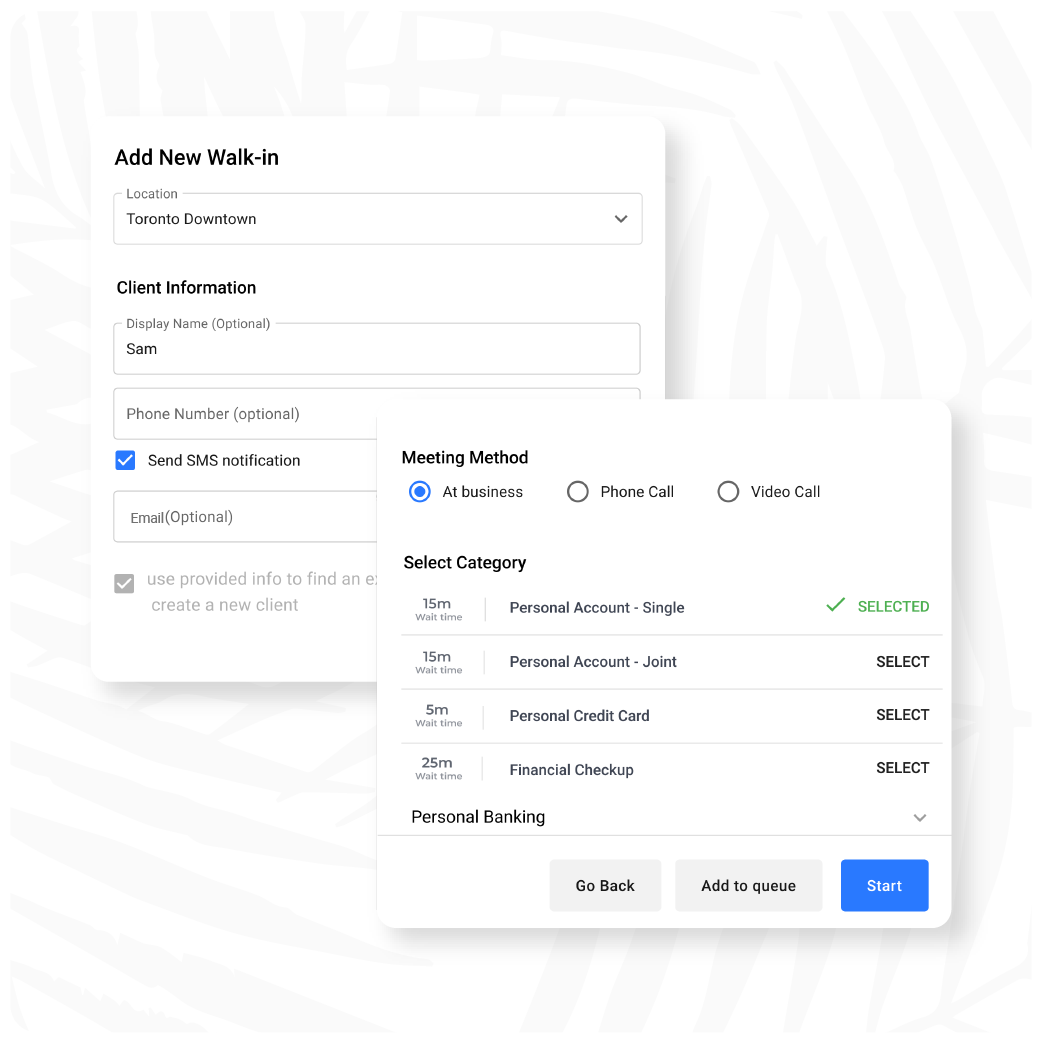

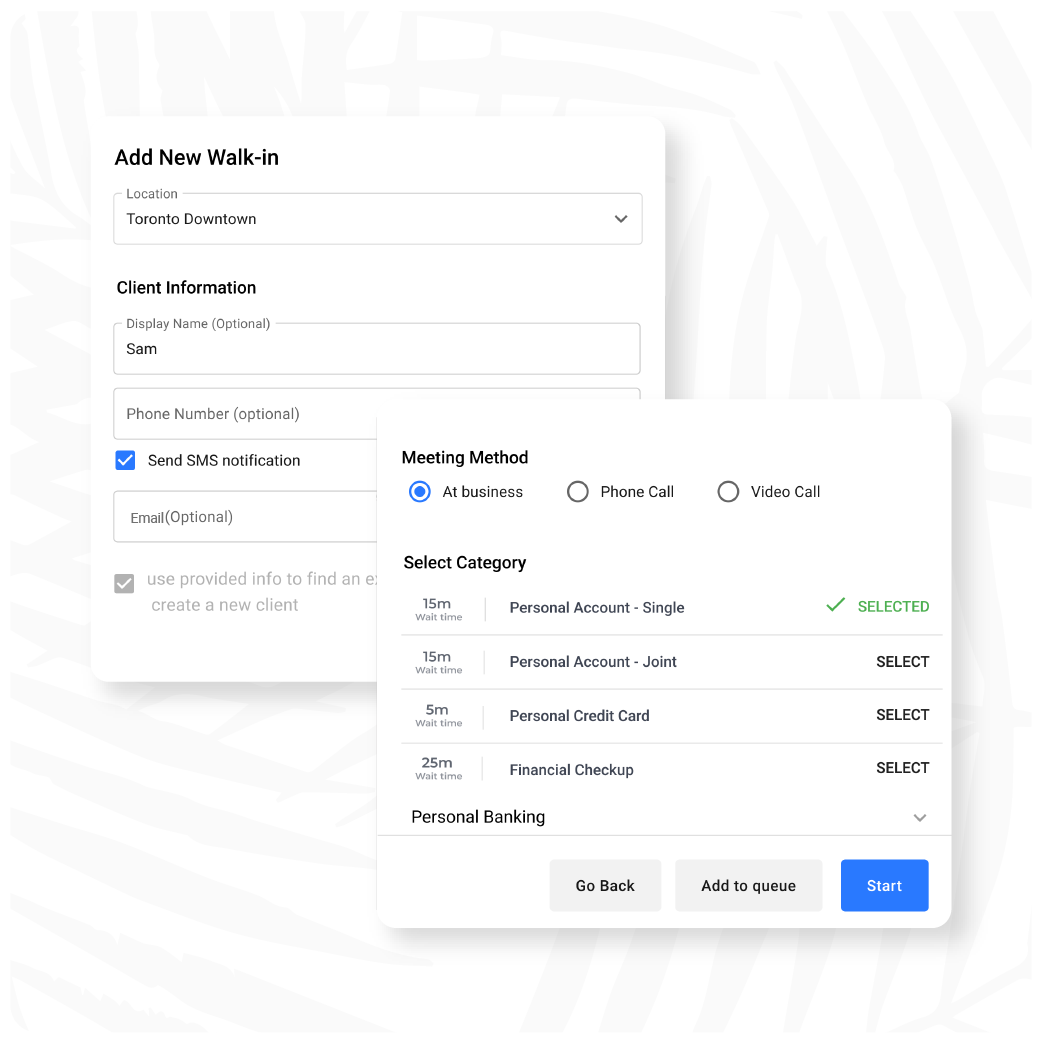

Make it easy for your greeters, tellers, and contact center agents to connect customers with advisors for financial advice.

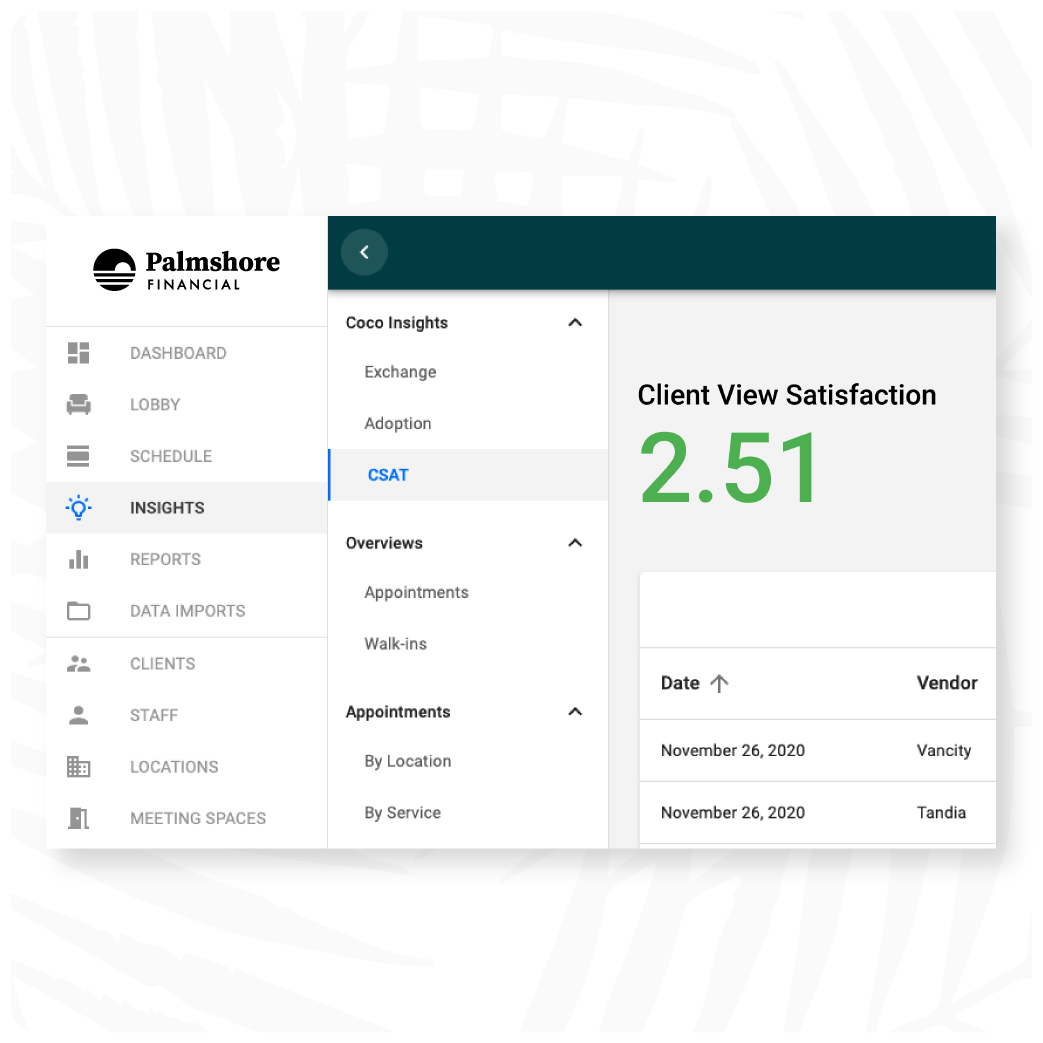

Gather data after every interaction so you can spot and fix trouble areas.

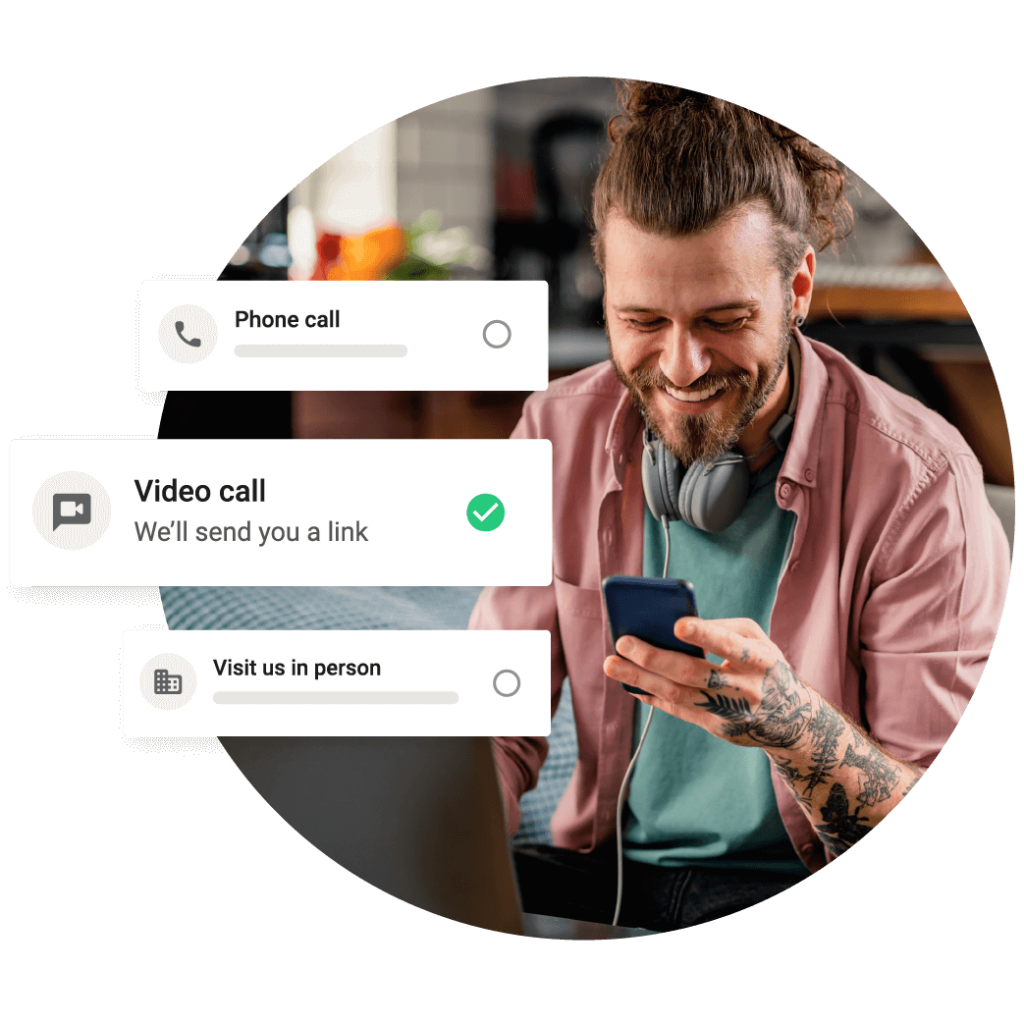

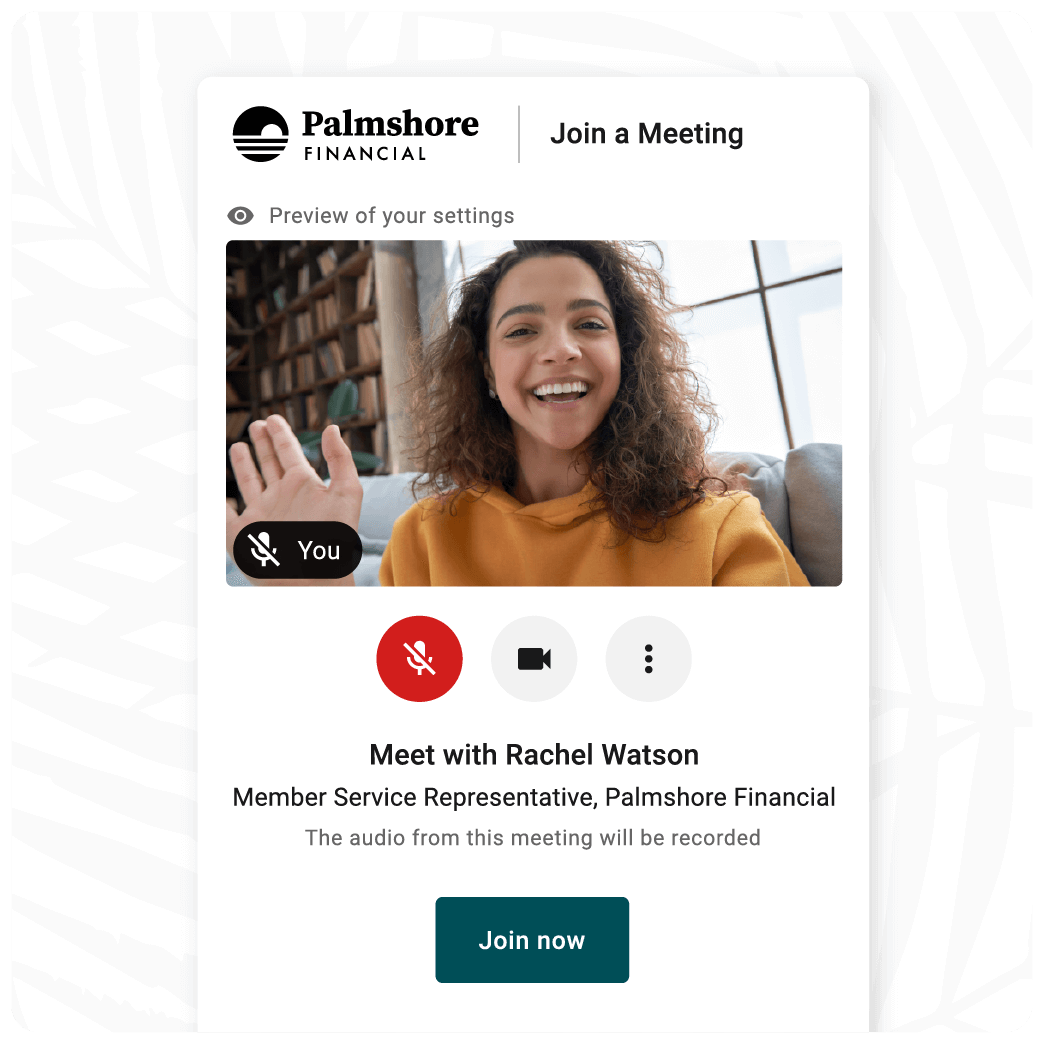

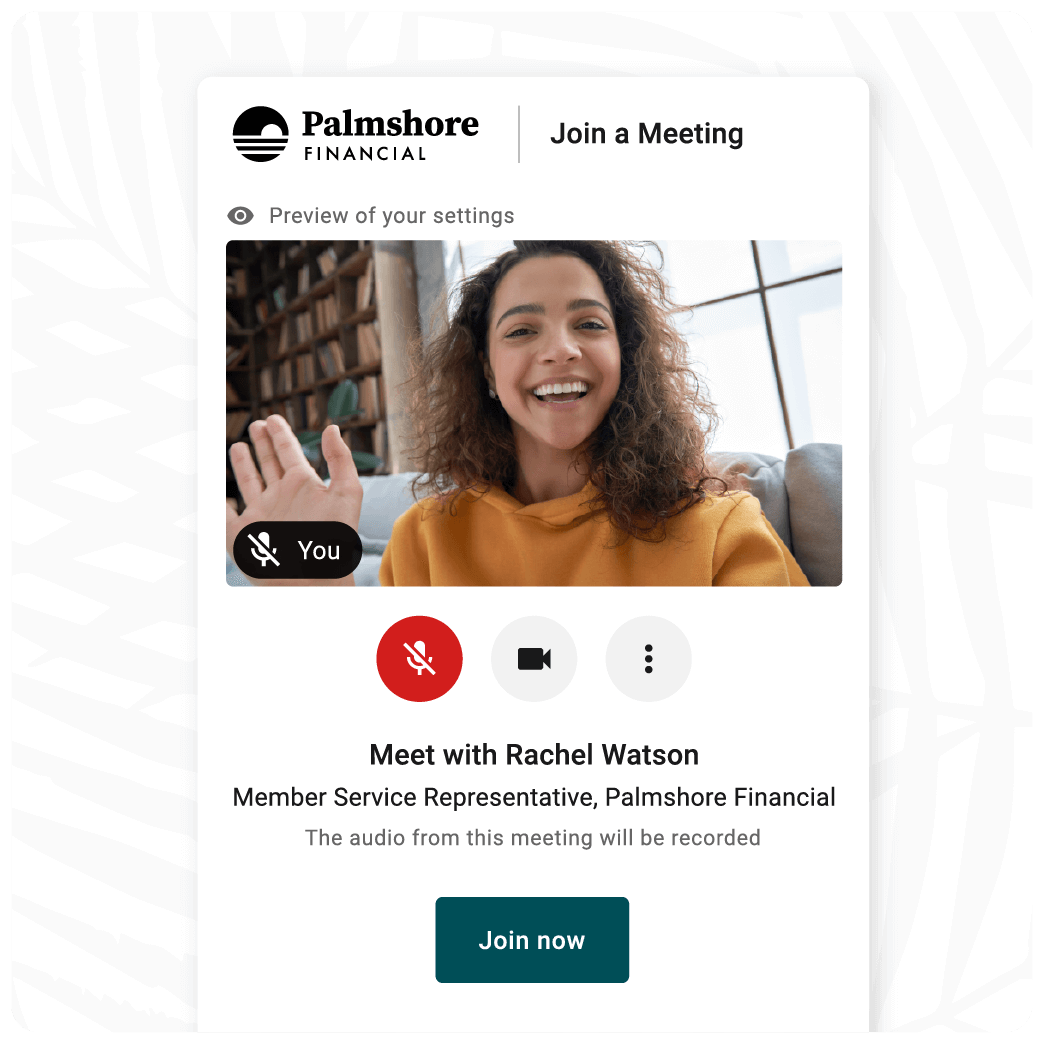

Allow customers to connect with your staff anywhere with an end-to-end virtual experience that rivals their experience in-branch.

Learn How Coconut Can Help Other Teams

Branch & Retail Operations

Marketing

Lending

Check out the 2023 Benchmark Report

Unlock appointment experience benchmarks all financial institutions need to know about and see how your financial institution stacks up