MARKETING PLATFORM

Create Campaigns That Convert

Struggling to connect the dots between your marketing efforts and your revenue goals? Coconut lets you say goodbye to guesswork and hello to growth with reports that show which channels drive more high-value appointments—so you can be confident you’re investing your budget in the right places.

Join 150+ Financial Institutions Who Trust Coconut To Deliver Smoother Experiences

Marketers Who Use Coconut Have Seen

30%

Of appointments booked through Reserve With Google are for new customers

13%

Increase in total appointments booked for high-value products

3x

Increase in conversions when a customer schedules an appointment vs. walks in

Why Marketing Leaders Love Coconut

Capture Leads for New Products and Services

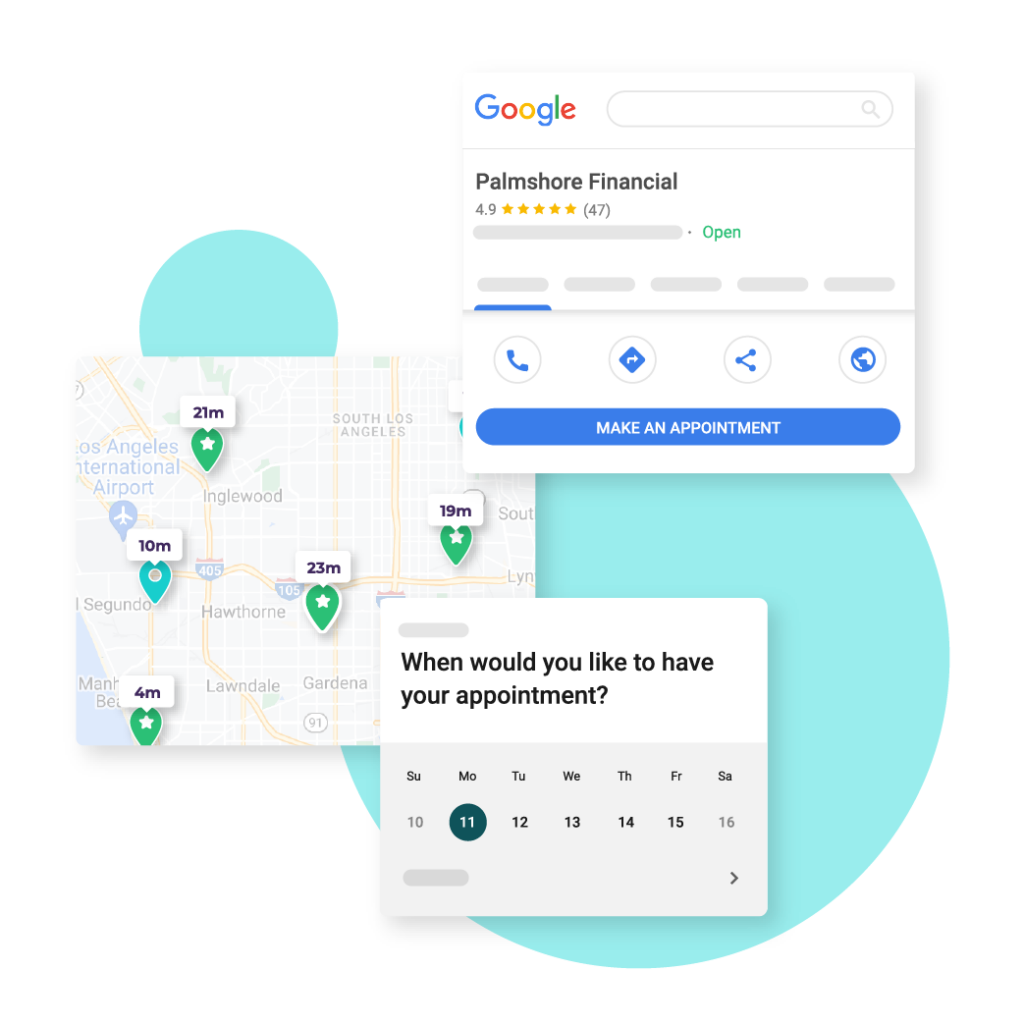

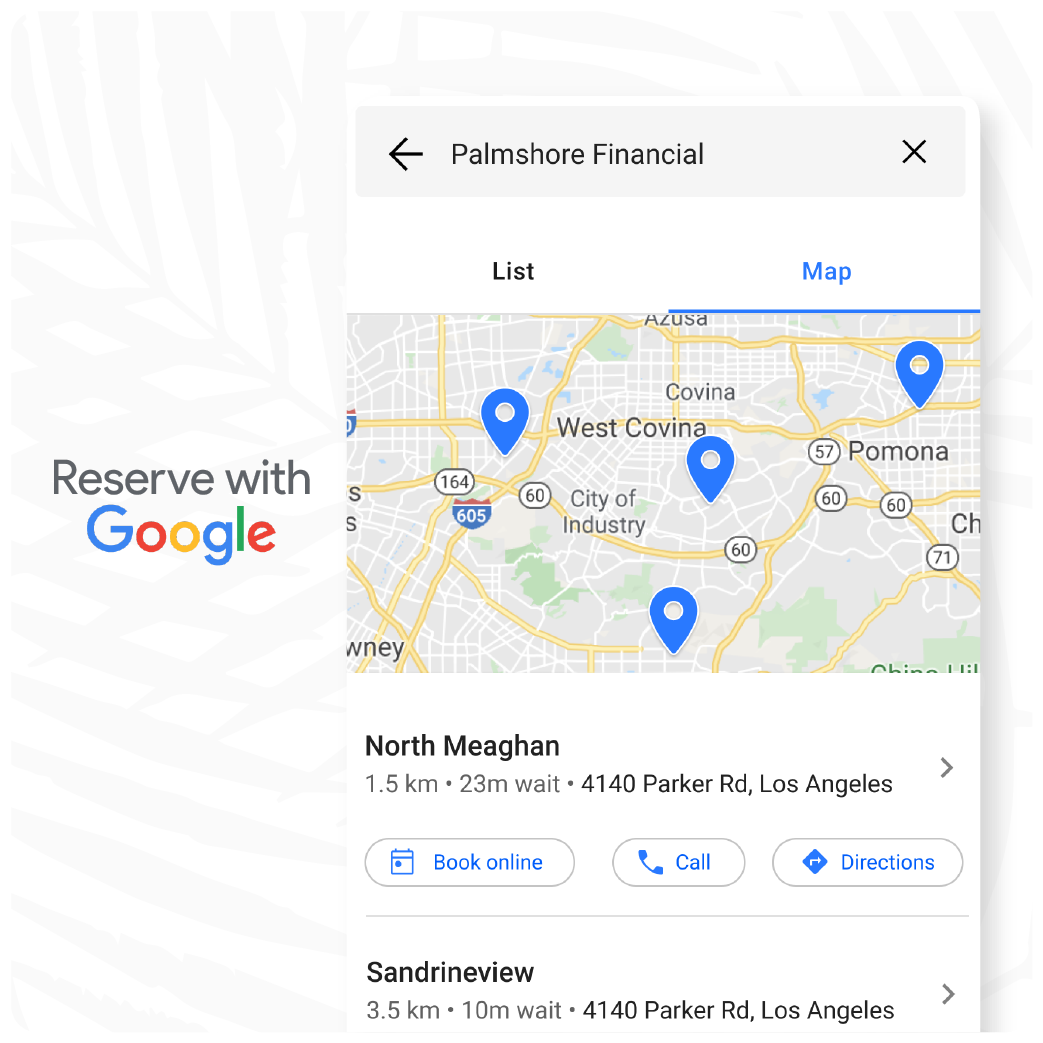

- Empower customers to schedule time with your advisors directly from their Google search results

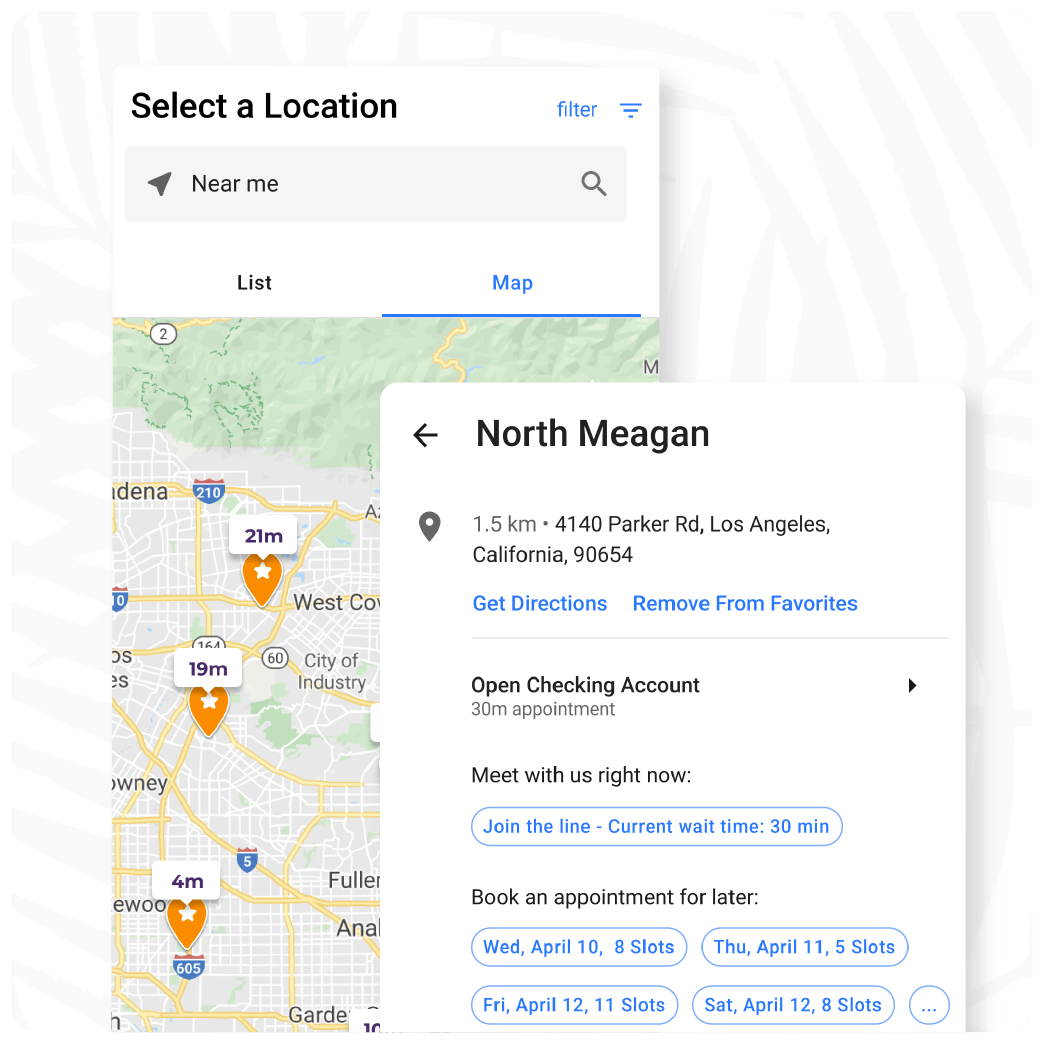

- Allow customers to see wait times at branches nearby, then join the line or schedule time with an advisor—right from your locations page

- Capture interest outside of regular branch or contact center business hours with always-on scheduling CTAs

“People of all ages welcome the ability to book appointments, but younger clientele are especially keen.”

Alexis Miarecki

Marketing Manager

UMassFive FCU

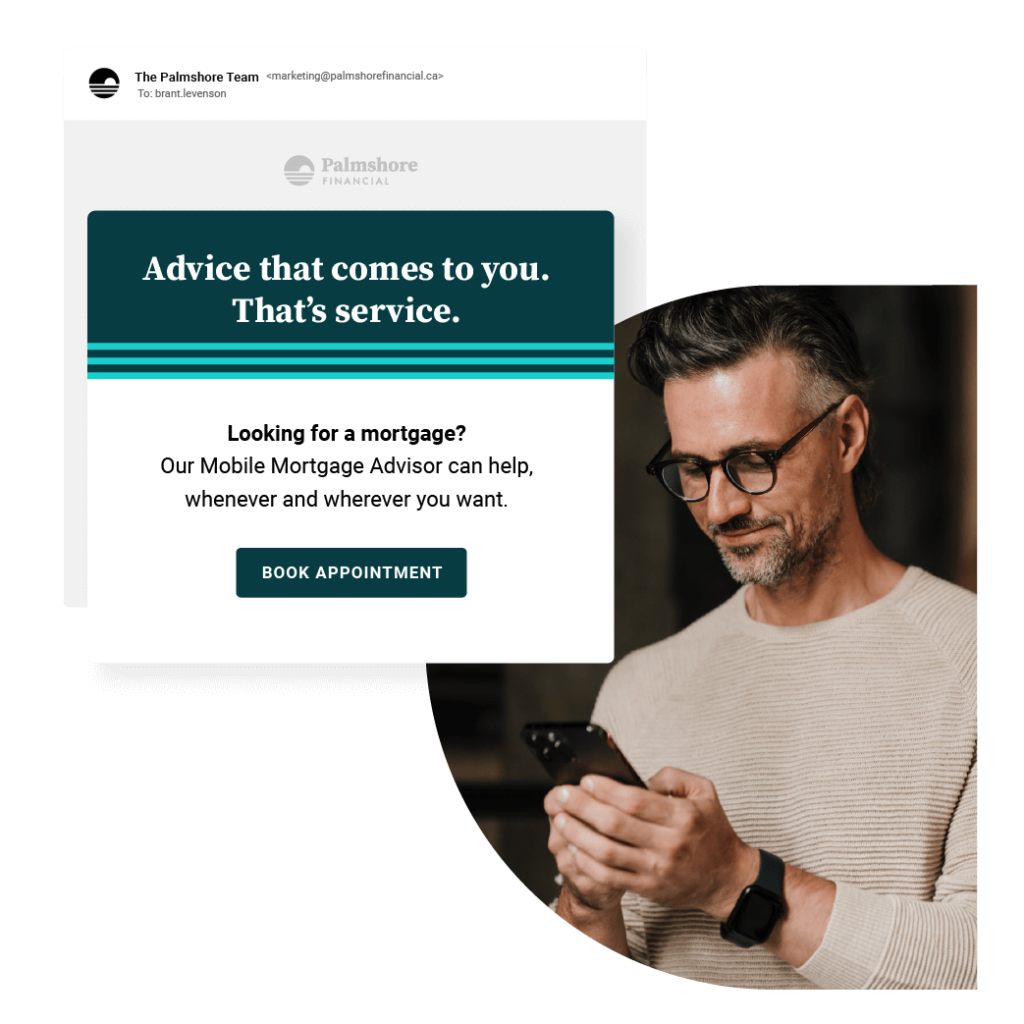

Boost Conversion With Tailored Campaigns

- Understand how customers have engaged with your team in the past so you can send relevant offers to targeted lists

- Improve conversion with custom booking shortcuts that you can embed across physical and digital marketing channels

- Encourage customers to leave a Google Review after a positive experience to drive word of mouth referrals

“We were struggling with a low connect rate through indirect channels, such as partnerships with auto dealerships—just 5%. Once we had our team send emails that included an appointment link and an explanation of next steps using Coconut, their connect rate rose to 25%.”

John Ryczek

Director of Branch Operations

Addition Financial

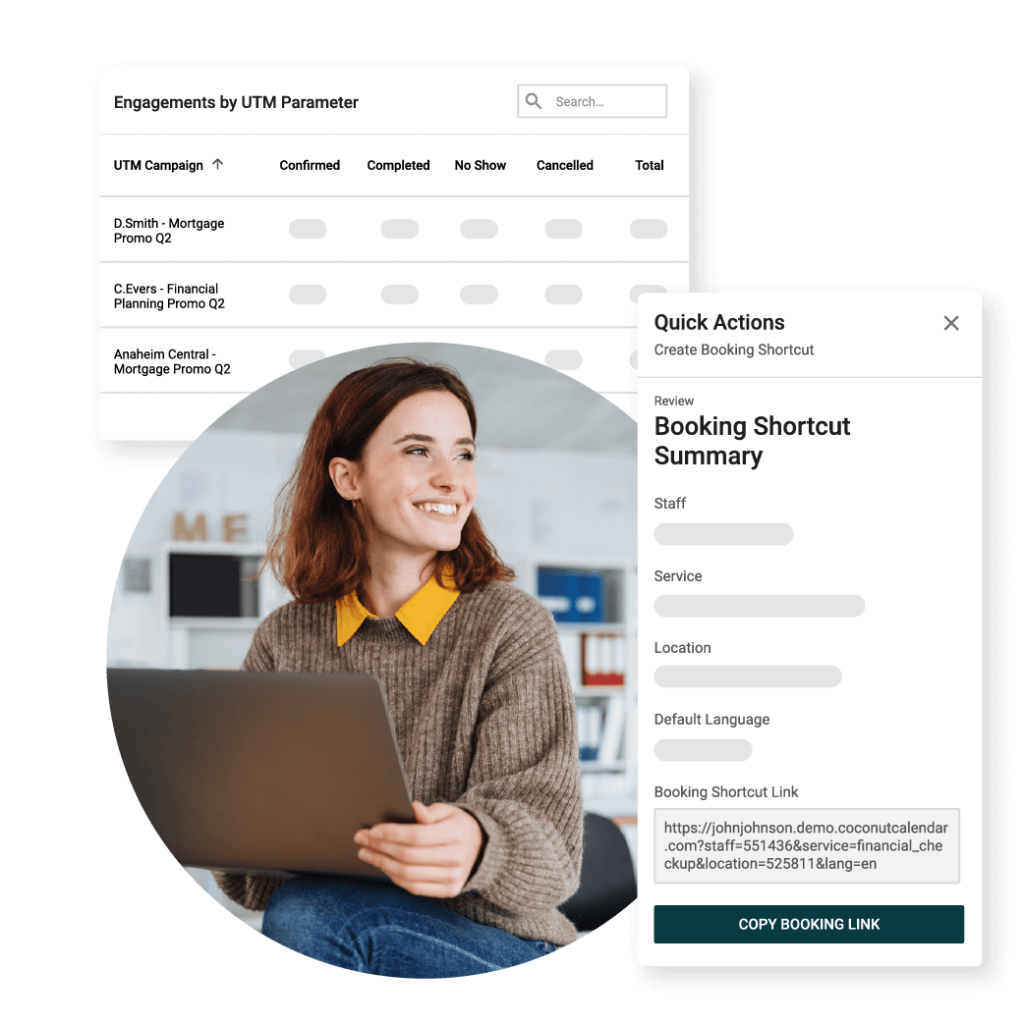

Understand What’s Working

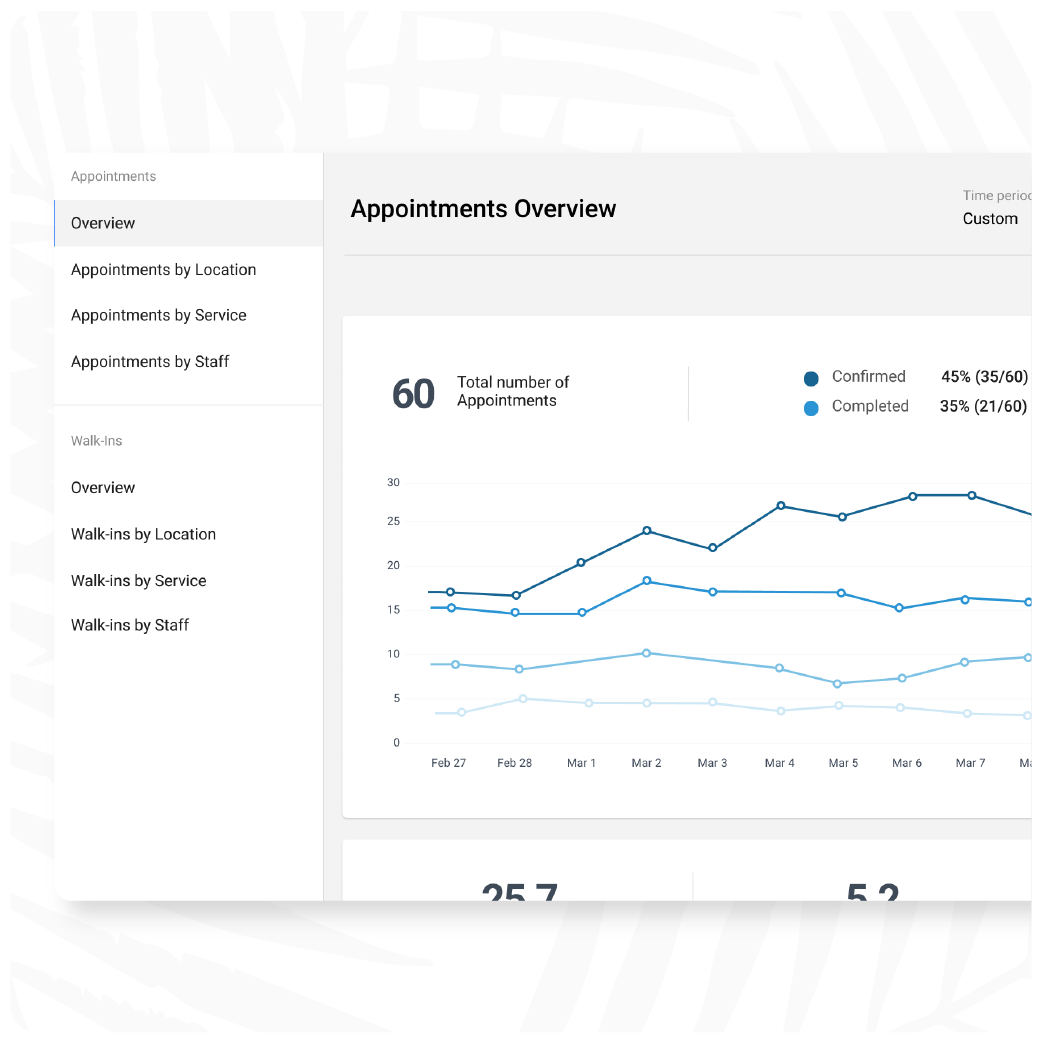

- Measure which campaigns and special offers lead to selling more products

- Understand which channels drive more high-value appointments so you know where to invest your budget

- Integrate with your preferred tag management or analytics solution to get a clearer picture of performance throughout the marketing funnel

“In our marketing, we’re no longer limited to pointing members to visit a branch or a site. Now we can point them directly to the ‘make an appointment’ page. We’ve seen a huge lift from those marketing messages.”

Jeremy Saldivar

Director of Member Experience

WECU

Yolo Federal Credit Union saw a 12% increase in auto loan appointments and a 120% increase in refinancing appointments in the first month of launching a targeted campaign.

Support from Experienced Pros

- Launch quickly with playbooks proven to help financial institutions like yours grow

- Connect with peers through quarterly networking sessions to share best practices

- Gain strategic advice through ongoing success planning with our team

“I can confidently say that Coconut is one of our favorite vendors to partner with.”

Kelley Jacobsen

VP Marketing & Operations

YOLO Credit Union

Ready To Learn More?

Speak With One of Our Experts.

Take A Peek Inside Our Platform

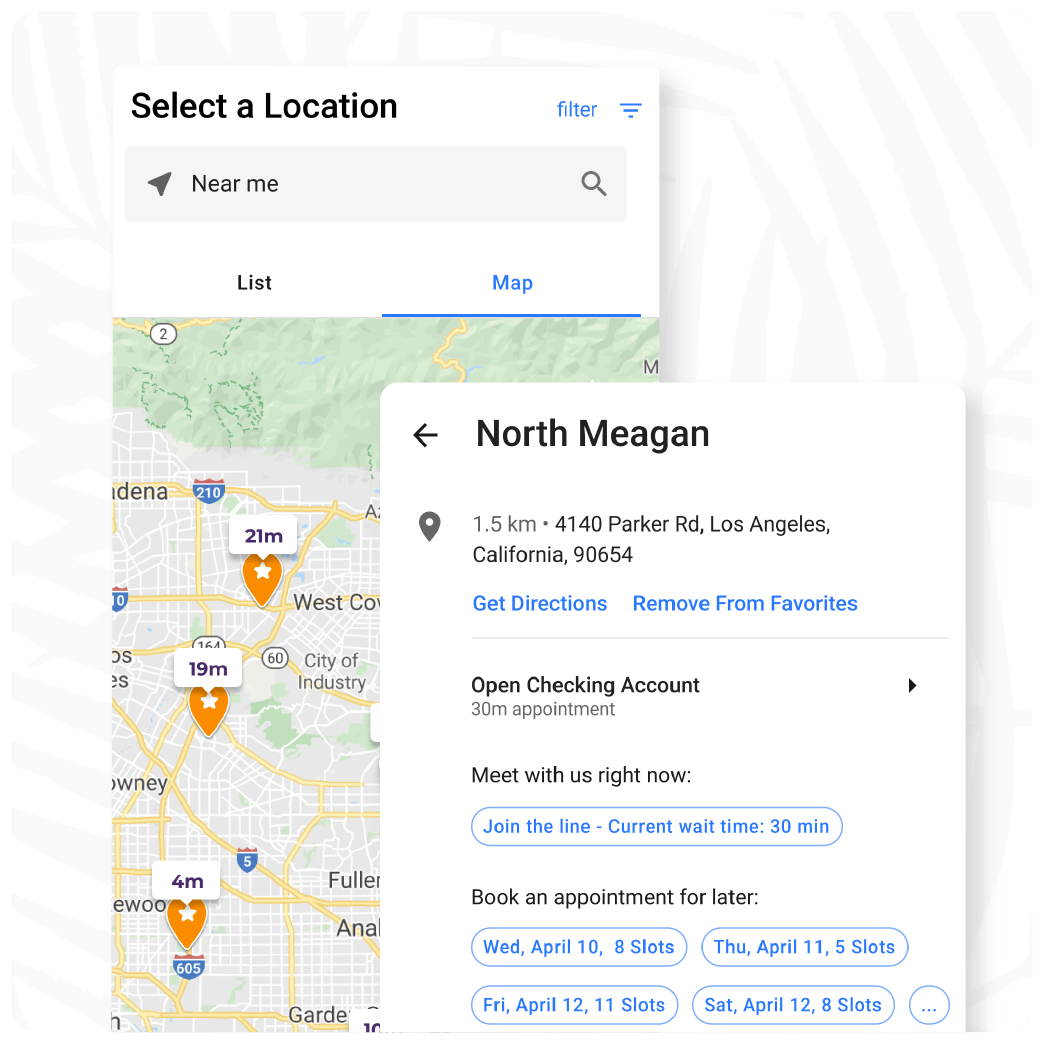

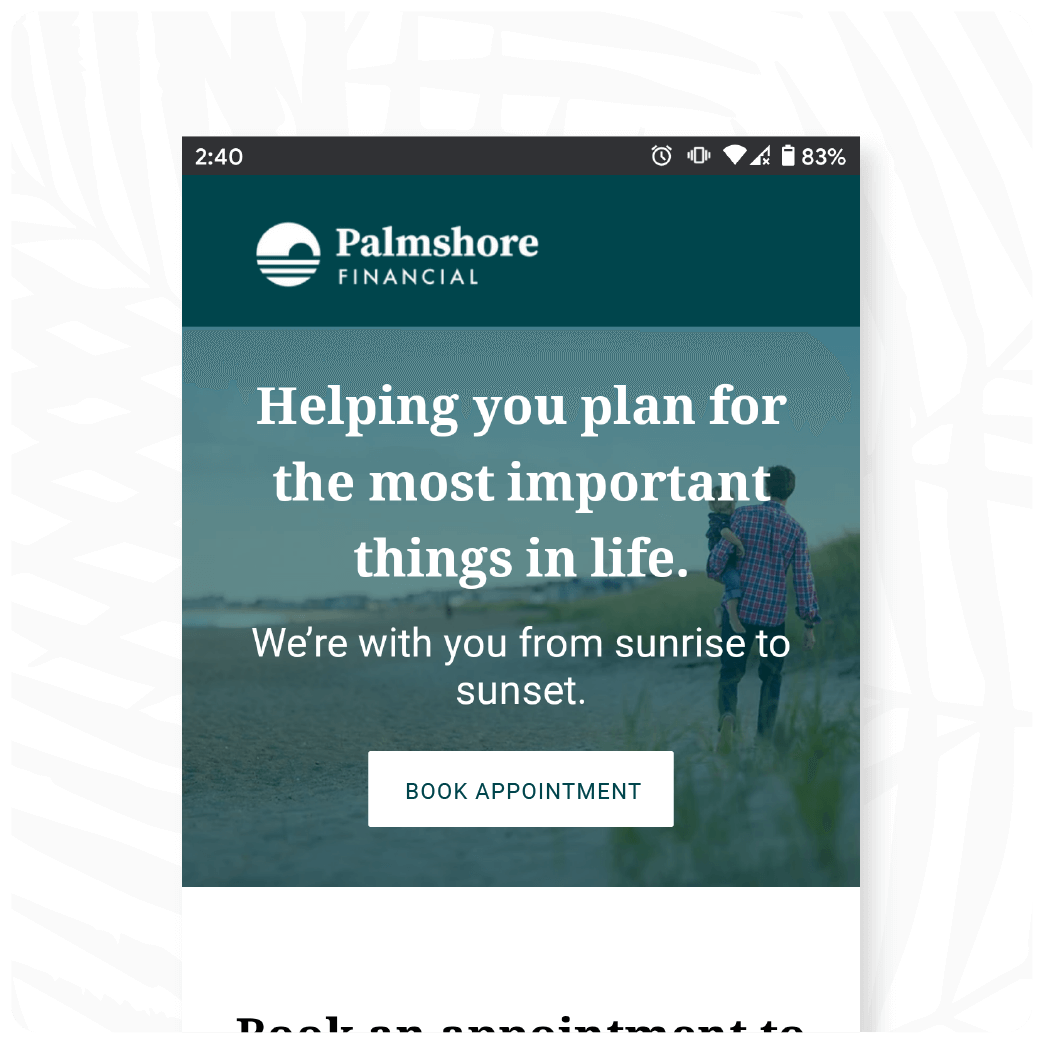

Transform your locations page into an online marketing channel by allowing customers to go from location search to booked appointment in just a few clicks.

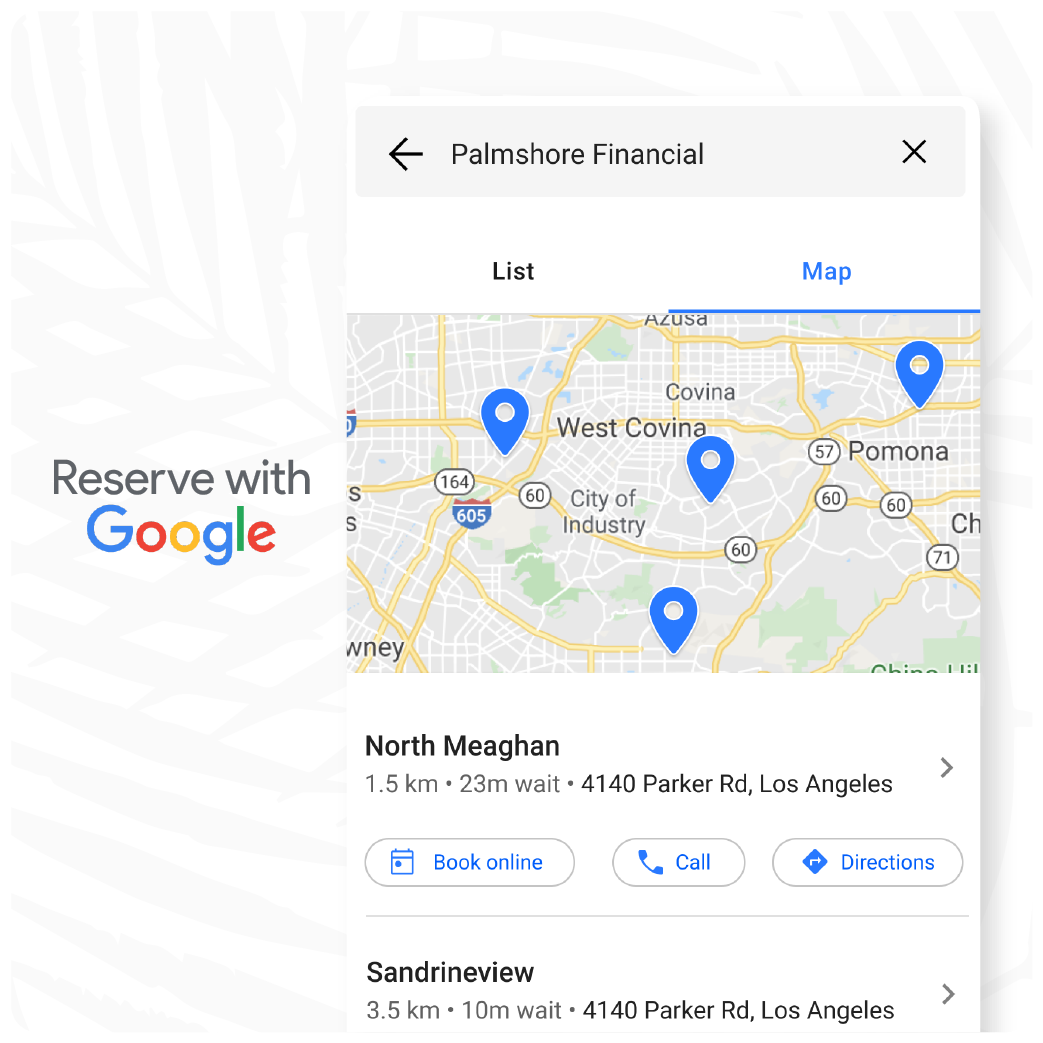

Beat the competition by allowing customers to schedule time with your team directly from their Google search results.

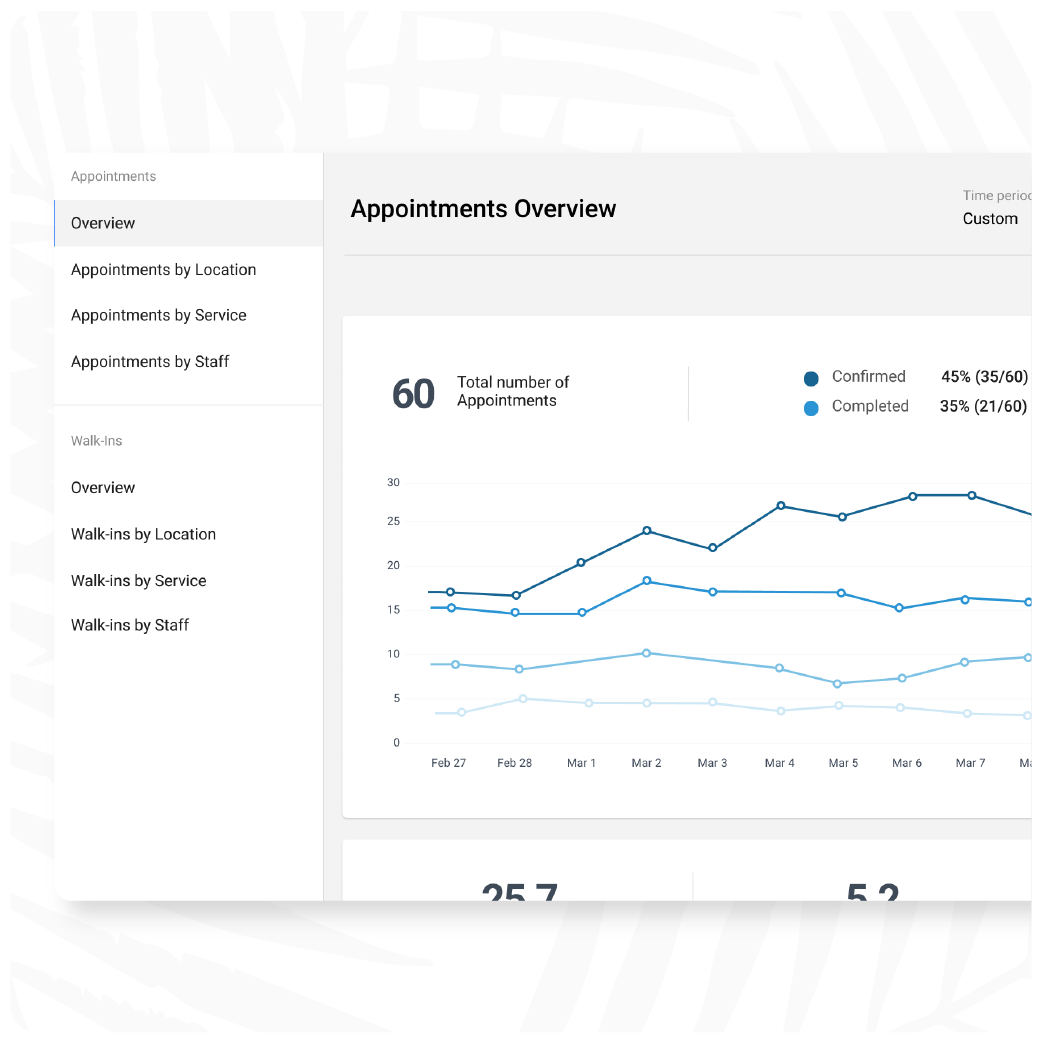

Discover which channels lead to more high-value appointments booked and products sold so you can optimize your marketing spend.

Integrate Coconut with Google Tag Manager and Google Analytics so you can understand how your campaigns are performing.

Boost campaign conversion with custom CTAs that make it easier for customers to connect with your team to discuss product offers.

Learn How Coconut Can Help Other Teams

Branch & Retail Operations

Customer or Member Experience

Lending

Check out the 2023 Benchmark Report

Unlock appointment experience benchmarks all financial institutions need to know about and see how your financial institution stacks up