Coconut Software Announces Integration with Q2’s Digital Banking Platform

SASKATOON, SK (October 16, 2023)—Coconut Software, the leading appointment scheduling platform for banks and credit unions, today announced its integration with Q2’s Digital Banking Platform, via the Q2 Partner Accelerator Program. Q2 Holdings, Inc. (NYSE: QTWO) is a leading provider of digital transformation solutions for banking and lending. This integration allows financial institutions to offer Coconut’s appointment scheduling capabilities directly within Q2’s Digital Banking Platform. Since one-to-one appointments greatly reduce friction for customers looking to make financial decisions, the potential for FIs to leverage the integration for growth is significant.

The Q2 Partner Accelerator is a program through the Q2 Innovation Studio that allows in-demand financial services companies who are leveraging the Q2 SDK to pre-integrate their technology into the Q2 Digital Banking Platform. This enables financial institutions to work with these partners, purchase their solutions and rapidly deploy their standardized integrations to their customers.

“We’re excited to welcome Coconut Software to the Q2 Partner Accelerator Program,” said Johnny Ola, managing director of Q2 Innovation Studio. “Financial institutions now have the ability to offer Coconut’s appointment scheduling capabilities directly to their customers.”

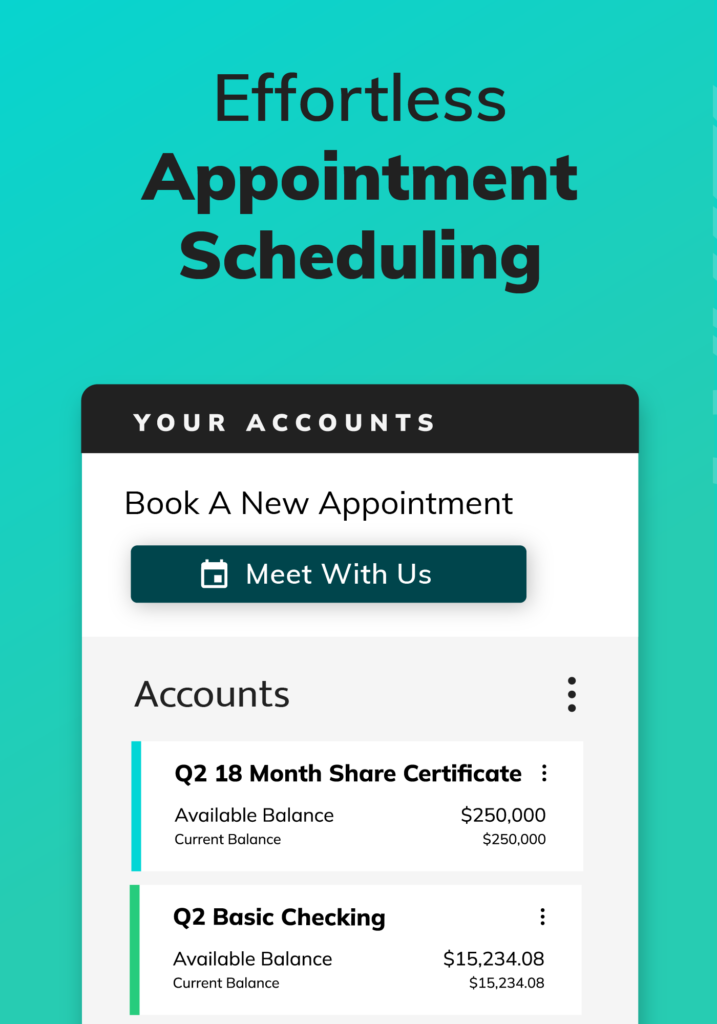

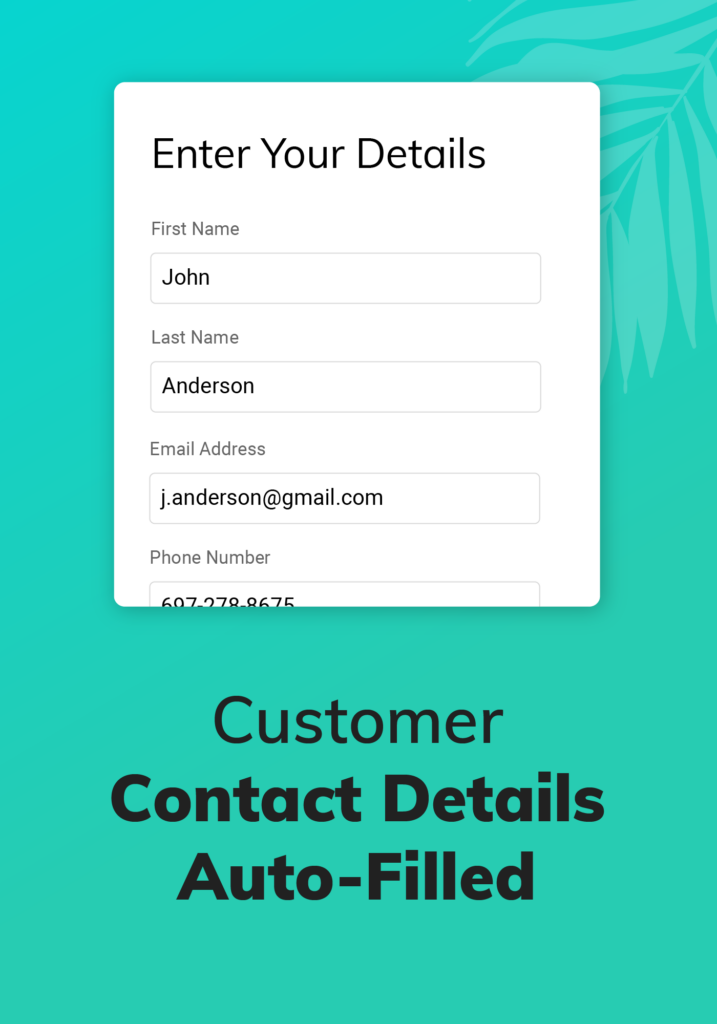

The integration of Coconut Software with Q2’s Digital Banking Platform addresses rising consumer expectations by removing friction for banking customers. Specifically, it allows them to request an appointment with a qualified representative in-app whenever they need it—instead of waiting in line, hoping the right advisor is available. Not only do customers save time and energy by pre-booking appointments, but they can also choose between various booking options like in-person meetings, phone, or video calls.

“Our integration with Q2’s Digital Banking Platform marks a major milestone for Coconut Software,” said Kari Bergh, Vice President of Partnerships at Coconut Software. “Through strategic partnerships and innovative technology, we’re excited to empower our customers with in-app scheduling capabilities, driving meetings that will grow revenue and deepen relationships.”

To learn more about the Q2 Innovation Studio Partner Accelerator Program, please click here.

3 Benefits of Integrating Digital Banking With Appointment Scheduling for FIs

With upwards of 70% of current members relying exclusively on their online and mobile channels to communicate with their financial institution, integrating digital banking with appointment scheduling brings a host of benefits to financial institutions.

- Unlock more lending opportunities

Connecting customers with banking experts directly within your online banking experience gives them immediate answers about new products or services. By making it easier for customers to make informed decisions quickly, your FI can increase lending opportunities.

- Deliver a seamless customer experience

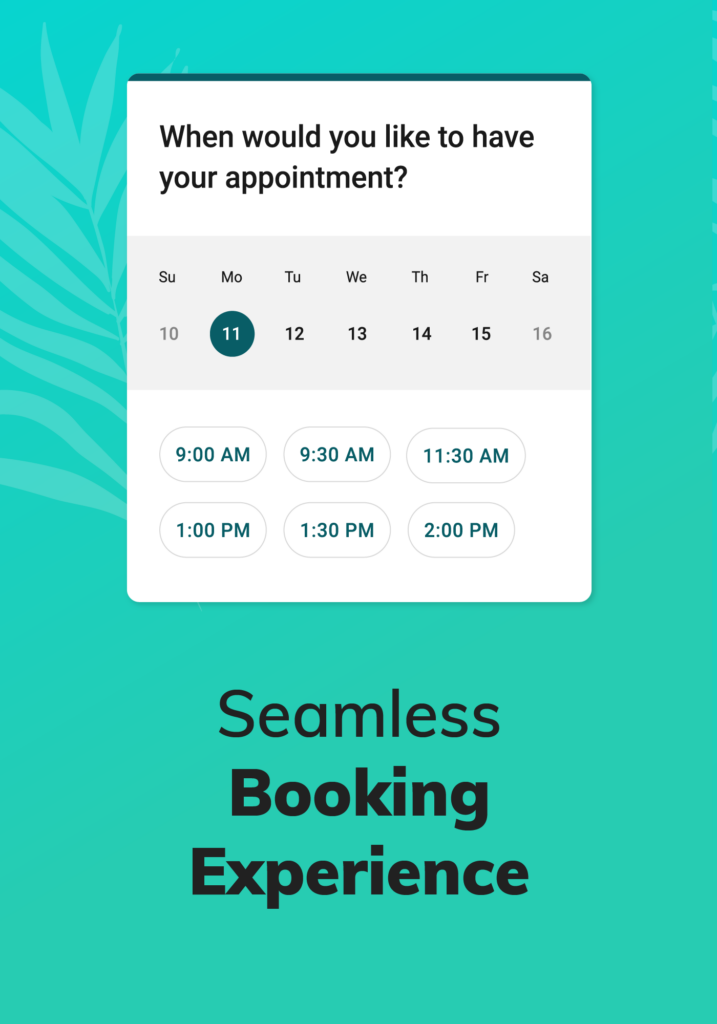

Allowing customers to seamlessly book appointments within their online and mobile banking platform is a much easier and more pleasant experience than having to navigate somewhere else.

- Reduce overhead costs

By empowering customers to easily schedule appointments at their convenience, you’re reducing the reliance on resource-intensive channels like call centers and in-branch operations, ultimately lowering your costs.

Addressing Customer Needs with Convenience

In addition to the benefits for financial institutions, the Q2 integration offers many benefits to your customers and members:

- Smoother Customer Experience

By embedding appointment booking links into your digital banking platform, customers can seamlessly request advice when they need it. This ease of access to experts keeps pace with modern member expectations and helps you stay competitive in today’s fast-paced market.

- Saves Customers Time

The integration eliminates long wait times for customers, making their banking experience more efficient and convenient.

- Flexibility

With an appointment booking solution integrated into Q2, customers can choose from various booking options, including in-person meetings or tailored video calls to meet their specific needs.

- Efficiency

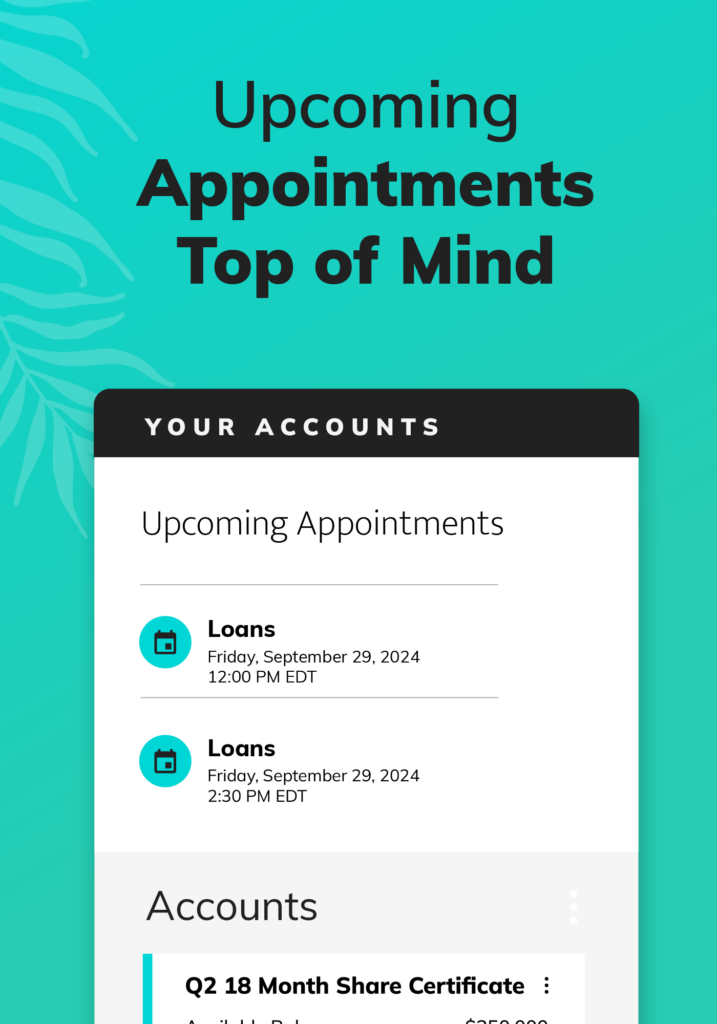

The integration makes it easy for customers and members to reschedule appointments. They’ll also receive timely reminders via email and SMS, ensuring that clients don’t miss their meetings.