Explore Coconut’s Self-Service Banking Solutions

Appointment Booking

Let customers and members choose when and where they meet with staff in a few clicks.

See MoreQueue Management

Help clients get where they want to go faster—in-branch or online—with smart, interactive queuing.

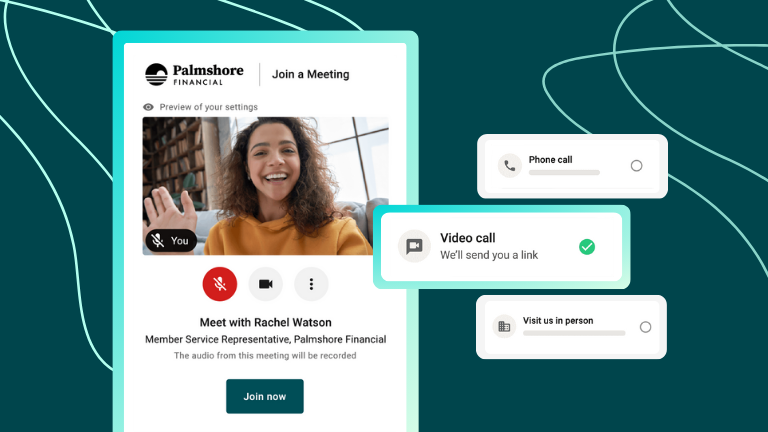

See MoreVideo Banking

Host secure financial conversations and complete transactions virtually with video.

See MoreReporting + Insights

Get a better view of traffic trends, staff productivity, and the customer and member journey.

See MoreThe Benefits of Appointment Scheduling

Keep Up With Customer and Member Expectations

Meet demands for convenient, frictionless experiences (both online and off) that your clients are craving. Then, watch your NPS, CSAT, and loyalty soar.

Time-Saving Automation and Tracking

Save time on low-value, administrative tasks so staff can focus on having the best meetings possible. Plus, get insights to help you run your branches better.

Better Connections = More Opportunities to Grow

When it’s easier to meet with your clients—and understand their journey—there are more opportunities for your team to thoughtfully drive sales.

Results Coconut Clients Enjoy

Increase in Booked Appointments

Higher Conversion Rates Than Before

Decrease in Appointment Length

Point Higher Customer and Member NPS