What Does The Branch of the Future Look Like? 8 Trends To Embrace Today

What does the “branch of the future” look like? This discussion has been a hot topic lately among financial institutions, as professionals speculate on how advances in technology might impact banks and credit unions in 2024 and beyond.

As FIs begin to embrace unconventional ideas like mobile banking in trucks and vans, the possibilities for the branch of the future seem endless. Let’s take a look at some changes the financial sector may see in the next 10 years, and what banks and credit unions should be aiming for in order to create the branch of the future.

The Branch as an Extension of Digital Touchpoints

In our digital era, many folks are asking, “Will physical branches completely phase out? Do we really need financial institutions on every street corner in this digital age?”

While mobile and remote banking is growing in popularity, around 29% of people still prefer to do their banking in person. While online options are nice for simple transactions, by and large, people want to speak with an advisor for complex matters like applying for a loan or discussing wealth management.

Rather than ceasing to exist, brick-and-mortar banks and credit unions should evolve with customer and member needs. What does this look like in the branch of the future?

Aaron Young, SVP of Branch Operations at the Credit Union of Southern California, has some ideas. “The branch should be an extension of the digital experience, not the other way around,” he says. “If a customer or member wants to do the majority of their banking online, but they need help at a physical location occasionally, they should be met with digital efficiencies in-branch as well.”

Here are eight distinguishing features that will characterize the branch of the future.

- 1. Interactive Teller Machines (ITM)

One tool that will be a hallmark of the branch of the future is the Interactive Teller Machine (ITM). Like an Automated Teller Machine (ATM), ITMs allow customers and members to make deposits and withdrawals, but they also feature a video screen for virtual calls with staff members.

Recently, a bank in North and South Carolina deployed 200 ITMs in an effort to make banking more accessible to its customers. These self-service machines work with tellers to provide face-to-face interactions for help with account questions, paying bills, and even e-signatures.

As bank staffing shortages persist, ITMs are a great alternative to physical branches in areas that may not have as much demand.

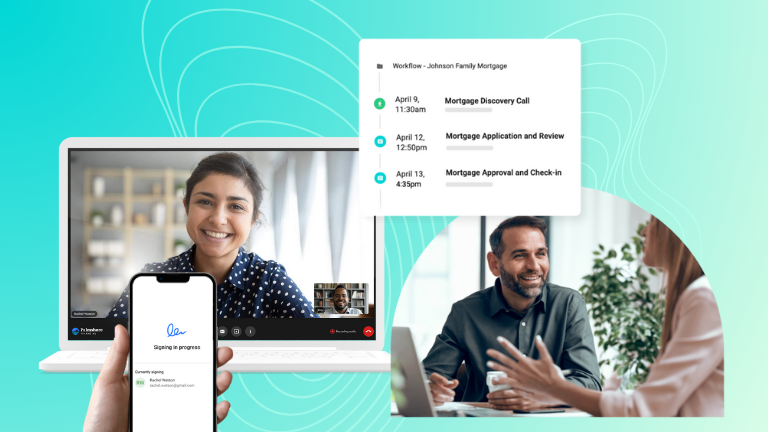

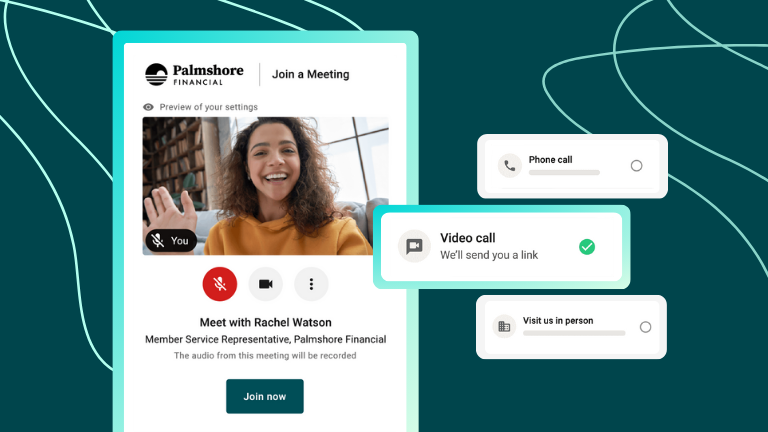

- 2. Video Banking

During the lockdowns of 2020, video banking became a crucial tool for financial institutions. Today, customers and members still enjoy this feature as an option, as 46% say they will continue to use video banking.

In the branch of the future, video banking should be a given. Offering this flexibility increases customer satisfaction, provides remote work options for staff, and improves appointment efficiency.

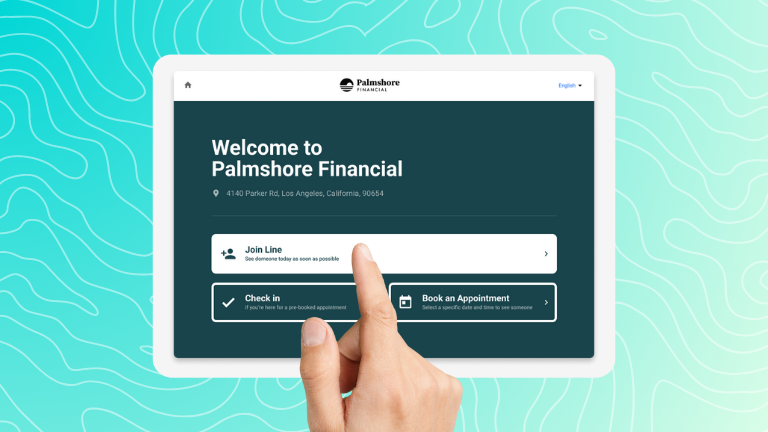

- 3. Appointment Scheduling and Virtual Queueing

Other self-service tools like appointment scheduling and queue management software will be a must-have in the branch of the future. Customers and members should be able to book appointments online, join a queue virtually, see live wait times, and select an appointment time directly from Google search results.

Self-service appointment booking options save employees time, result in fewer no-shows and cancellations, and increase close rates. Implementing this technology is a win-win-win that benefits customers, frontline representatives, and the FI at large.

- 4. Efficient, Advice-Driven Branches

Along with an increase in self-service options, banks and credit unions may begin to see a big shift in the types of services they offer in the branch of the future. Rather than being available for every small transaction or question, staff members may spend time at physical branches only to walk customers through larger concerns like mortgages and auto loans.

Aaron notes that this shift has already caught on in some parts of the world. “I was in Europe a year ago and I went into every financial institution I could to see their setup,” he said. “There aren’t really any teller lines. In-person branches are advice-driven, and people get their cash from an ATM.” In this scenario, the branch of the future may begin to look more like a concierge service for scheduled meetings, and only the occasional walk-in. Aaron is confident that this shift will soon be the norm in North America as well.

- 5. Micro-Branches

While brick-and-mortar branches probably won’t be phasing out any time soon, there may be an increase in smaller branches, sometimes known as “micro-branches.” According to Aaron, “You hear about a lot of branches closing, but what you don’t hear about is all those that are opening. We’re focused on optimization. Populations are shifting, and we have to ask: where can we capitalize on the most opportunities?”

Aaron also notes that there are smaller pockets of opportunity in communities that can benefit from micro branches. “I think there will be distinct ways the branch of the future is organized based upon population size. We will see greater numbers in smaller branches.”

- 6. Smart Bank Automation

The branch of the future will also embrace the concept of the “Smart Branch.” Imagine a bank or credit union with automated features built-in—like a smart home. Smart features like lighting, alarm systems, security cameras, thermostats, and AI voice assistants can all be incorporated into physical branches.

Taking it one step further, a smart branch could integrate personalized features—like a smart shopping experience. Amazon uses radio-frequency identification (RFID) technology to automatically charge customers as they “just walk out” of storefronts. The branch of the future could use similar technology to streamline transactions and personally welcome customers and members.

Artificial intelligence (AI) will also likely play a large role in Smart Banks. Generative AI tools like Large Language Models (LLMs) and voice assistants can help customers and members find resources, fill out applications, and even make financial plans.

- 7. Financial Advisors As Reliable, Personalized Contacts

The branch of the future will also feature a more personalized banker experience. Aaron Young believes that customers and members may soon be able to pre-select the staff they would like to work with based on common interests, background, and personality.

“In this scenario, it’s do-it-yourself, or we can do it together,” says Aaron. “Future customers and members can work with the representative of their choice on any channel, whether that’s chatting online, emailing, video banking, or in-person.” At every point in the customer journey, there should be an option to speak with someone or further the conversation.

This idea of developing a more personalized relationship with advisors could be crucial for FIs moving forward. In one recent study, 71% of participants stated that they believe it’s important to build a relationship with bank personnel. The branch of the future will make that relationship more attainable.

Imagine people casually discussing their financial advisor in the same way they might talk about their realtor or personal trainer. Advisors can (and should) become relationship-driven in order to gain new clients, retain them, and improve the overall customer experience.

The average customer and member should be able to feel like their business at their bank or credit union is valued. Increased personalization will lead to increased customer loyalty, referrals, and cross-selling and upsell opportunities.

- 8. Increased Account Management Capabilities

As FIs focus on providing a more personalized experience, this could include more capabilities for managing accounts. For example, the branch of the future may be able to further automate payment methods, bill payments, and direct deposits. Rather than customers and members dealing with the setup and authorization of these processes, a financial advisor could be the one managing payments.

Anything that makes life easier for the customer should be incorporated into the branch of the future—as long as it’s also sustainable for staff and advisors. In the future, FIs could also implement more communication with customers and members in regard to account management. Clients could opt-in to text, app, or email alerts for important account notifications like overdraft fees, scheduled credit card payments, account balances, spending summaries, and more.

Future-Proof Your FI By Embracing The Branch of the Future

In the age of digital banking, consumers now have more choices than ever. To stay competitive, the time to invest in technology and tools for the branch of the future is now. In order to stay relevant, banks and credit unions must invest on the most important differentiator—the customer experience. By implementing self-service capabilities like video banking and queue management, you’ll give your customers and members plenty of reasons to stay loyal to your FI.