The Branch is Convenient, But Customers Want More

Despite the ongoing shift toward digital services and distancing banking, the branch is far from dead. That said, customers are increasingly expecting a seamless experience when switching between the convenient digital tools they use every day and the branch environment they trust for their most important financial matters.

This need is clearly highlighted in a 2020 consumer study from WBR Insights, where despite 85% of customers rating their most recent branch visit as either convenient (34%) or very convenient (51%), most had strong opinions around digital options – the importance of omni-channel appointment scheduling and the availability of virtual/remote meetings – and how it all correlates to a better in-branch experience.

Self-Serve Online

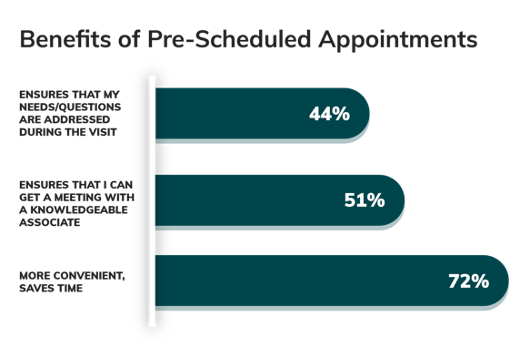

72% of customers state that the ability to pre-schedule appointments online would help increase convenience. Other anticipated benefits include ensuring they meet with a knowledgeable associate and that their needs are properly addressed.

Yet just 23% say that capability exists in their own bank or credit union today.

Using an online self-service solution allows customers to not only select the appropriate associate, whether by name or skill set, but also provide key information ahead of time. Your associate can then review before the meeting and effectively address all customer requirements. This not only provided the added benefit of increasing the number of high-value appointments, but also optimizing employee schedules to improve their overall efficiency and productivity.

“Whether the business is ready or not, your customers are ready to start booking appointments online. Don’t wait to implement appointment scheduling — do it immediately!”

Shara Abrams

Senior VP of Operations, Jackson Hewitt

Self-Serve In-Branch

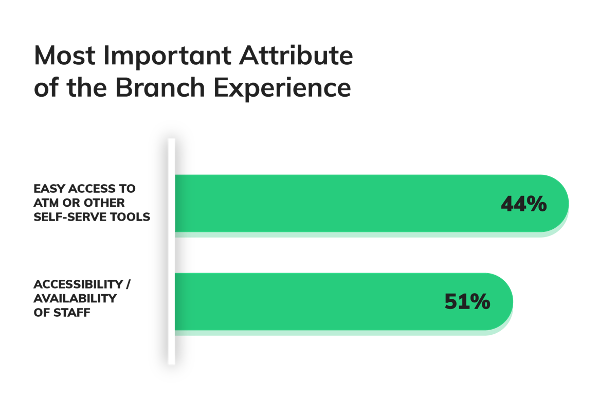

Customers want the flexibility to manage their own banking experience. So it’s unsurprising that 71% say access to self-service tools in the branch are important in their physical banking experience. This includes ATMs, but also other self-service options like lobby kiosks using tablets to provide information — both of which work well for transactions and information, but tend to underperform in sales. Rather than attempting to replace sales staff with self-service kiosks, higher success can come from utilizing them as a method for walk-in and pre-scheduled customers to skip the queue and get face time with staff faster. Considering that the second highest rated attribute of the branch is accessibility of staff (61%), this strategy is directly in line with customer priorities.

Most importantly, this strategy can help to shift the focus of branch employees from answering routine questions and booking appointments to making sales, as they are given more time to engage in higher quality conversations with customers about their financial goals.

Wait Time Transparency

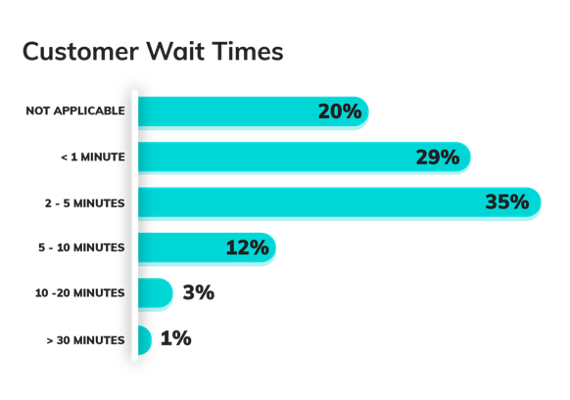

Despite 64% of consumers saying that they waited less than five minutes to speak to an associate during their most recent branch visit, wait times remain an issue. In fact, when asked about the biggest difficulty around their branch visit, “lines,” “long lines,” “wait times,” and “waiting” were some of the most popular responses. With this in mind, it’s apparent that the problem most customers have with waiting is not necessarily the actual wait time. Rather, it’s the poor waiting experience.

One of the simplest methods for improving that experience is to eliminate the uncertainty. Clearly displayed wait times — either online, on a mobile device or in-branch — do this instantly, yet only 23% of customers reported this capability from their branch.

Key Takeaway: Easier access to staff, increased value from appointments, and clearly displayed wait times drive customer satisfaction and engagement — there are reasons why customers want to bank in-branch versus digitally. By leveraging technology to help make the in-branch experience more effortless for your clients, you’ll solidify the satisfaction of visit and reiterate the value your branch brings.

Reference:WBR Insights, The 2020 Future Branches Consumer Study