About Kawartha Credit Union

Headquartered in Peterborough, Ontario, Kawartha Credit Union’s purpose is to improve the financial success and well-being of their members and the communities they serve. Kawartha provides values-based expert advice, a full range of competitive and easy-to-understand financial solutions, and convenient, innovative service channels (including a 22-branch network, and online, mobile and telephone banking), and access to thousands of surcharge free ATMs across Canada and the U.S. Their 56,000 members consistently rate them extremely high for overall service, knowledgeable staff and for the caring and respectful way they help their members achieve financial success. Kawartha is open to anyone looking for a financial services provider they can trust.

Hear More

Kawartha Credit Union shares how they’re using the data captured in Coconut.

The Goal:

Leave Missed Appointments In The Past

In 2018, Kawartha Credit Union found that members were booking appointments, but weren’t showing up. Some members were booking appointments at the wrong location and realizing their mistake too late.

Kawartha Credit Union operates with two branch models: the advisory-based branch model relies on strong lobby management and benefits from advance booking. Kawartha was seeking a more reliable booking solution—one that was easy, intuitive and wouldn’t lead to so many mix-ups.

Martin Harris, Kawartha’s Senior Manager of Retail Delivery and his team also wanted to learn more about what their members needed, but they didn’t have access to the right data. They wanted a solution that would help them keep a pulse on how many members were coming in, what types of appointments they were coming in for, and how long their appointments lasted. Without this data, it was hard to plan schedules in a way that optimized staff time and ensured that member needs were being met.

Ultimately, they wanted a solution that provided positive, easy user experiences for both members and staff, was easy for Kawartha’s staff to use. Martin also needed analytics that were robust and could support decision-making.

The Solution:

An Easy-to-Use Platform For Members and Staff

Kawartha Credit Union chose Coconut Software’s appointment scheduling and queue management platform for a few important reasons:

- The relationship felt like a true partnership. From the beginning, the Coconut team was committed to helping Kawartha Credit Union solve problems and grow the business. “Beyond just the software, the Coconut team consistently provided guidance on how to look at our analytics and also gave us their own insights, which has helped us make big improvements,” says Martin.

- Through-the-roof ease of use. Members immediately found Coconut’s interface was easier to use than the previous system. “Right away we saw an increase in the completion of successful appointments and a reduction in cancellations and no-shows,” says Martin.

- Precise insights that enable operational decisions. Martin and his team immediately had full visibility into daily transactions: who was coming in, how long they were staying, and which services they were using. “We also had insight into our most-used locations, our most engaged staff, and our most popular services, which has changed our operations. Now we can ensure that we have enough coverage based on those metrics,” he says.

“We also had insight into our most-used locations, our most engaged staff, and our most popular services, which has changed our operations. Now we can ensure that we have enough coverage based on those metrics”

Martin Harris

Senior Manager of Retail Delivery

Kawartha Credit Union

The Results:

Better Coverage, Satisfied Members, and Useful Insights

- No-shows reduced. By implementing Coconut, Martin and his team saw an immediate fix for the cancellation and abandonment problem. Today, members rarely abandon their appointments, and staff are much more engaged.

- Better hours that serve member needs. Martin and his team realized they could use Coconut to improve branch hours. “I looked at Coconut to see how busy the branches were at different periods and investigated member behaviors during these times,” says Martin. “Subsequently, we increased our hours, using data from Coconut to inform the decision.” These hours support high-traffic times, resulting in better member experiences.

- A view into member behaviors and preferences. Martin has used Coconut’s reporting to make operational changes at various branches. For example, he noticed that members of a branch in Peterborough were booking a high number of investment appointments. “We heard from the branch that they needed additional advisory staff to support these appointments,” says Martin. He used Coconut data to build a business case for more staff at that location. “We could see that it was one of the busiest branches for wealth engagements, and we could also see that many members weren’t able to get an appointment as soon as they wanted.” With the supporting historical data at his fingertips, Martin was able to hire a new advisor rather than spending months trying to build a case.

- Services that reflect member behaviors. Insights from Coconut have also led Martin to make improvements he didn’t even know Kawartha needed. He transitioned one retail location to a cashless branch after months of data showing that members were primarily using it for advisory engagements. “Because that branch had a much lower volume on the transactional side, we could shift our focus to advisory services and direct members online and to our ATMs to complete transactions,” he says. “We wouldn’t have seen without Coconut.”

“Because that branch had a much lower volume on the transactional side, we could shift our focus to advisory services and direct members online and to our ATMs to complete transactions”

Martin Harris

Senior Manager of Retail Delivery

Kawartha Credit Union

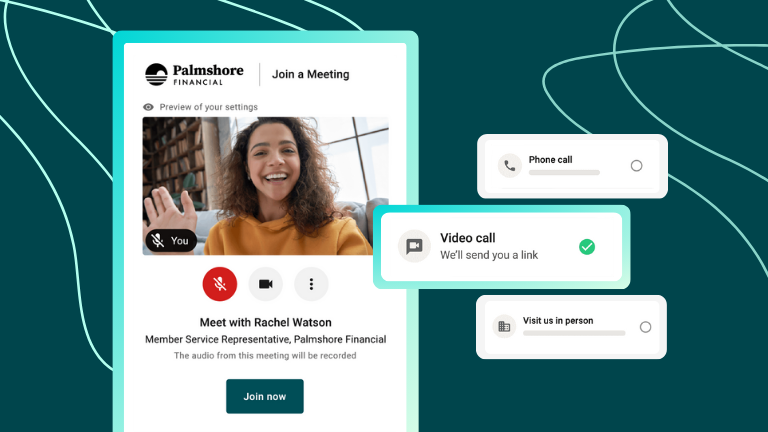

Martin and his team have already achieved a lot with Coconut, and he’s excited to keep innovating in the future. “We can understand how our members and their needs are evolving,” he says, “whether that’s through online, video banking, over the phone, or in person.” In fact, Martin is looking forward to leaning into Coconut’s Video Banking tool in the year ahead. “It’s a big opportunity for our financial planning offering,” he says. “We haven’t maximized yet, but I know we will.”