10 Bank Performance Metrics Every Financial Institution Needs To Track

Figuring out which bank performance metrics to pay attention to in a sea of data can be overwhelming, especially in the midst of staffing shortages and increasing client churn. In fact, financial health scores dropped 9 percentage points last year in the United States, with many FI’s failing to provide the help these clients needed.

Banks and credit unions owe it to their customers and members to find solutions, and the right bank performance metrics can point you in the right direction.

In this guide, we’ll cover the 10 most important bank performance metrics, and how this data can result in happier customers, more efficient staff, and overall growth.

10 Most Meaningful Metrics A Bank and Credit Can Track

Tracking bank branch performance metrics is usually in service of these three goals: increasing customer and member satisfaction, improving staff efficiency, and growing as a business overall. Each category contains important indicators every bank and credit union can benefit from following.

Tracking Satisfaction Metrics

First and foremost, FIs should be tracking metrics pertaining to the satisfaction of their customers and members.

- Member/Customer Effort Scores (CES)

The Customer Effort Score (CES) measures how much effort it took for a client to get an issue resolved, a request fulfilled, a product purchased/returned or a question answered.

A CES is often sent out as a single-question survey after someone visits a branch. The question is often worded with a scale. For example: “On a scale of 1 to 5 (1 being the hardest and 5 being the easiest), how easy was it for you to get answers to your questions today?” This has been an increasingly popular metric for banks and CUs to track to make sure it’s easy for members to get things done across any channel.

- Net Promoter Scores (NPS)

The Net Promoter Score (NPS) is similar to a CES in that it involves a one-question survey, but rather than inquiring about effort, it asks about a customer’s likelihood to recommend your business.

A typical NPS question looks like this: “On a scale of 1–10 (1 being not likely at all and 10 being extremely likely) how likely are you to recommend [insert FI name] to your friends and family?

Those who answer between 1 and 6 are often referred to as “detractors” which bring your NPS down, 7–8 are viewed as neutral, and 9–10 are “promoters” which increase score totals.

The NPS is especially helpful to credit unions because they often work with a much smaller membership base.

- Digital Adoption Rate

Digital adoption rate refers to the percentage of clients who are consistently using an FI’s online tools like a website or mobile app. This metric can help banks and credit unions identify demographics that need more encouragement toward online banking.

Today, mobile banking is a huge part of the customer and member journey as 78% of Americans prefer mobile or online banking. Self-service solutions give clients the flexibility they crave, and when digital adoption is high, banks and credit unions see more customer satisfaction and higher product holding.

- Customer/Member Retention

Customer/member retention refers to the percentage of clients who continue to bank with an institution year over year, rather than withdrawing their business.

The average retention rate for banks is 75%, but it’s important to be intimately familiar with your FI’s unique retention numbers. Retention rates should be analyzed at least annually, but this could also be a bank performance metric in quarterly reports as well. Any time these rates drop, it’s a clear sign that your FI should be reevaluating customer satisfaction measures.

Staff Efficiency Metrics

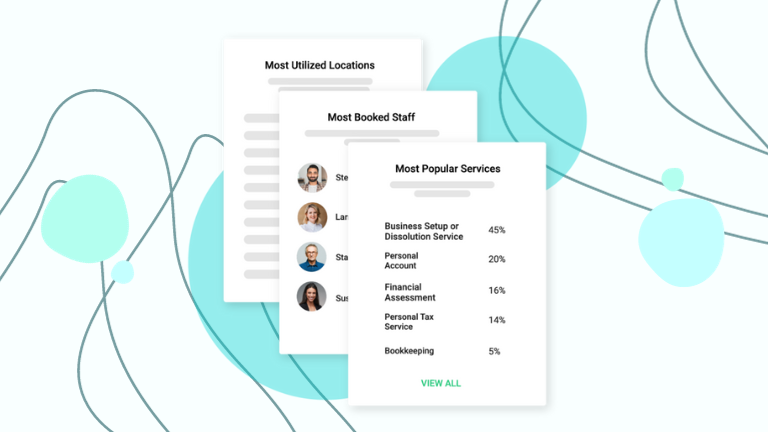

Along with customer satisfaction, staff efficiency is a key data point for FI’s. Staff efficiency metrics inform institutions about the length of appointments, average customer wait times, and the number of employees compared to the traffic of a branch.

Keeping track of branch traffic, staff productivity, and capacity will help your FI stay prepared, informed, and efficient.

- Branch Traffic

Branch traffic is a metric that tells FI’s how busy each location is on any given day. This is one of the most important bank performance metrics because understanding when customers visit your branch and why they’re visiting will help your FI prepare for busy days ahead of time.

Queue management software can help your FI keep track of walk-in traffic and wait times so that your staff feels better equipped to handle busy days. Digital queues also decrease the number of cancellations and walk-outs, because there’s an option to schedule a return visit for a later window.

- Staff Utilization

Staff utilization metrics involve appointment lengths, closure rates, and average handling times. Having a holistic view of the way your staff spends their time is a crucial banking performance metric because managers can fill time that is unaccounted for, and provide help to busy locations.

Appointment Scheduling software can also help staff better utilize their time with interactive calendars and pre-appointment checklists. Appointment scheduling software also allows customers and members to make appointments in advance, giving managers, advisors, and staff a much clearer picture of the day-to-day.

- Staff Capacity

Staff capacity is a fairly straightforward metric—it tracks how many employees are working at a location each day, compared to the traffic at that location.

Understanding staffing capacity needs for each individual branch will help managers place floating staff appropriately, and determine when advisors should be on call.

Staffing shortages continue to be an issue for banks and credit unions, which is why it’s so important to find out where current team members are needed, and if you need to focus on talent acquisition.

Tracking Growth

As your FI gains a better understanding of customer satisfaction metrics and staff efficiency, it’s also important to keep track of growth. Bank performance metrics like wallet share, new accounts opened, and loan closures all provide a clear picture of an FI’s success.

- Share of Wallet

Share of wallet refers to the number of accounts one person or household holds at your bank or credit union.

Around 56% of Americans have more than one bank—a customer might choose to open a high-yield savings account with an online FI, a checking account at their local credit union, and take out an auto loan from a Big Four bank. Earning a larger share of wallet means being the bank or credit union of choice for more than one type of customer transaction.

Your FI should be tracking wallet share and always aiming to gain more business from existing customers. This bank performance metric is crucial for marketing strategies, retention, and product sales.

- New Account Openings

New account openings is a metric that tracks how many new accounts (checking, savings, etc.) have been opened during a specific time period.

New account openings are another important bank performance metric to monitor because this data translates into future sales. New accounts are often opened by first-time clients like high school or college students, but they can also be existing customers opening a second or third account, or new customers choosing to change institutions.

Your FI should know how many new accounts are opened each year, and the demographics of these clients. This metric provides a good indication of growth and informs managers of new customers with the potential for cross-selling and upselling.

10. Mortgage Pull-Through Rates

Mortgage pull-through rates or loan application conversion rates track the percentage of loans or mortgages applied for vs. the number that were actually funded by your bank or credit union.

This bank performance metric helps FIs identify customers and members who are most likely to close on a new product or service and target them for future upsell and cross-sell opportunities.

This metric also allows FIs to single out advisors who are more likely to work with high-value clients. Top-selling advisors can provide training to other advisors, and work closely with management to take on larger wealth management clients.

Virtual tools like Video Banking can help increase the number of loan pull-throughs and other product conversions by making it easier for advisors and customers to meet. Your chances of closing a deal increase drastically when staff members put in quality face time—even remotely.

Examples of How To Use Bank Performance Metrics For Data-Driven Decision-Making

Without bank performance metrics, banks and credit unions are left making decisions for their FI in the dark. Data points that reflect customer satisfaction, staff efficiency, and revenue growth all lead to the informed decision-making that’s necessary for growth.

These are just a few outcomes from tracking bank performance metrics:

Focusing on Branch Locations With Lower Scores

Once a bank or credit union gains insight into how different branches are performing, they can determine which locations need more support. One branch might regularly get a high NPS score, while another is lagging. Administrators can meet with managers from both locations to create new training based on the successful branch’s performance data.

You could also single out high-performing advisors and meet with them to get a better understanding of their sales process. These advisors could train advisors at another branch that needs support with mortgage pull-through rates.

Forecasting and Realistic Goal-Setting

If your FI is performing well across the board, performance metrics can help you come up with new goals for the coming year. Compare your scores to years prior as well as national averages, and determine what amount of growth seems achievable based on your performance.

Retooling Marketing Efforts

Sometimes bank performance metrics shine a light on programs that aren’t working out or that need adjustment. Administrators should work with their FI’s marketing teams to shift focus based on these metrics. For example, a loyalty program may have low penetration rates and might need more promotion or different offerings altogether.

Stay On Top of Bank Performance Metrics That Matter With Coconut Software

Bank performance metrics help FIs analyze their goals, increase customer satisfaction, and ultimately reach new heights in terms of revenue growth. As banks and credit unions focus on gathering important insights, they will be able to implement new policies and procedures to support their FI.

With Coconut Software, your bank or credit union can track key bank performance metrics that other solutions don’t offer. With real, tangible data from Coconut, administrators can make informed decisions and improve their FI’s efficiency in no time.