A Strategy To Combat COVID-19 in Five Weeks Or Less

I loved reading through this insightful article “A Strategy to Combat Covid-19 in 5 Weeks or Less” by Rebecca Wessler, who by the way is a very prolific author.

I wanted focus on the importance of people coming first – that the technology we utilize is how we cater to them: the means to the end but not the purpose!

“Tara McQuillen, Chief Experience Officer of Discovery FCU Discovery Federal Credit Union ($161.1M, Wyomissing, PA) was already exploring online appointment scheduling and lobby management capabilities in the hopes such a system would provide a deeper understanding of why members visit a branch as well shed light on wait times, appointment length, and more.“

The particularly important part of this opening statement is that Discovery FCU wanted to better understand their members’ needs, first and foremost. As much as we talk about digital transformation, it needs to be all about the member (and staff) experience. I’ve seen change management projects started that were focused on the technology itself, versus what the technology allows the people to actually do. Those projects tend to be ineffective as they don’t keep the focus on how technology is a tool for humans to accomplish tasks.

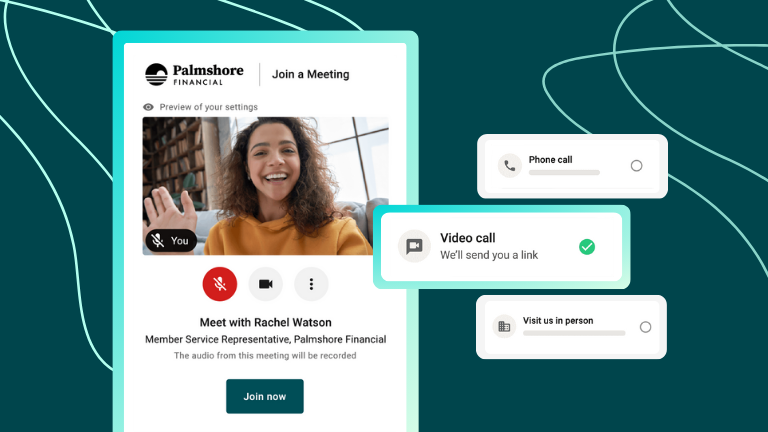

Simplicity is a sought after experience which does not come easy. I often talk about the Apple Remote. It’s simplicity hides a massive amount of work and consideration to make such an elegant solution. Just because something is simple, doesn’t mean it was easy to create! I believe that if Discovery FCU can roll out Coconut Software in five weeks, we have a sophisticated, simple system that isn’t complicated.

As I read through the interview I was intrigued to see the extent to which we’ve had an impact with Discovery FCU, outside of improving the customer experience.

Most of our financial institutions clients work with us to improve their member engagement experience, however I was happy to see the discussion around the impact that real-time engagement tools have on the internal workforce.

Below are some key benefits from the article that Tara mentioned that I wanted to highlight:

- Enhanced Safety and Communication Tools During Covid-19

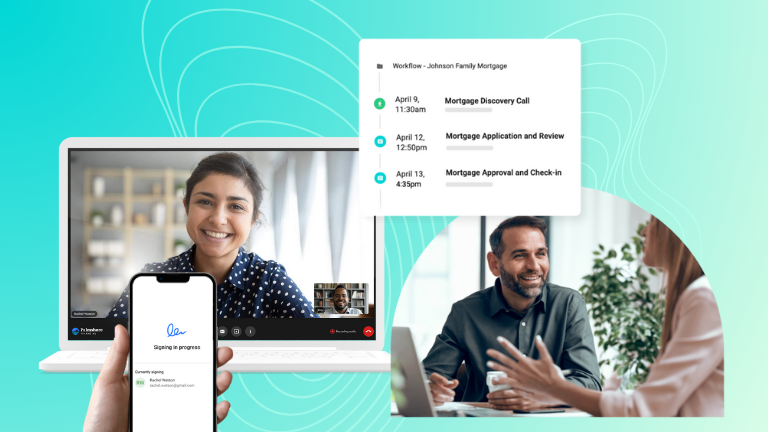

“We have the ability to limit the number of people in our lobby and manage the number of people in our offices and lobby at any given time. Also, we can allow members to wait for their appointment in their car. When a member service representative or loan officer is available to meet with them, we send a text message or e-mail to the member.”

- Customers are getting served faster

“Empowering employees to make appointments for members — whether they are talking to them at the teller line or on the phone — is definitely a positive benefit. It allows the employee to help the member then and there without transferring them to someone else or making them wait until they can get an answer.”

- Insights and Reporting

“We have a detailed view of why members are visiting the credit union in person. We also receive data analytics on wait times, appointment times, and more per appointment, per employee, and per branch to determine efficiencies and process improvements.”

As the Founder of Coconut, my heart has always been about the customer and people before the technology and as I read through the interview, it was clear to me that even though my intent was to create a self serve way to connect customers through online appointment scheduling and lobby management for financial institutions. We are doing something else that is very magical.

Thank you Rebecca for a great interview with Tara and really highlighting the meaningful purpose of Coconut, which is to always ground ourselves in People, Passion, and Performance. For a more in depth look into how our innovative efforts have impacted Discovery FCU, be sure to click here for the full article in detail.