3 Banking Technology Trends Every Bank and Credit Union Needs To Know In 2024

Today’s banks and credit unions are facing immense pressure to do more with less. This is driven by several factors, including an industry-wide talent shortage, budget cuts, and an increasingly competitive industry landscape. As a result, FIs are increasingly relying on technology to help them operate more efficiently than ever. Global banking IT spending will reach $715 billion by 2025, according to Statista, and banking software spending will make up the bulk of this growth—with a 13.5% increase this year. The market for AI in banking alone is expected to reach $64.03 billion by 2030.

With so many banking technology options available, how can you determine which trends are worth the hype? In this article, we’ll help you cut through the noise. We’ll highlight three trends that will help your FI drive growth, loyalty, and a better experience for both customers and staff.

1. Hybrid Banking—The Key To Winning The Customer Experience Race

The last several years have seen an accelerated focus on digital experiences. More than 65% of FIs have partnered with at least one fintech company over the past three years, and 35% invested in a fintech startup. As of 2021, 30% of banks and 44% of credit unions planned to launch a banking chatbot. And that’s just the beginning. FIs are also revamping their digital banking strategy adding robo-advisors, implementing video banking, and so much more.

These digital tools have many advantages, helping to meet customers where they are and delivering more convenience at a lower cost to the FI. But there’s a danger to this digital-only approach: if you’re not careful, it can come at the expense of customer experience. Most fintech partnerships have fallen short of their FI’s goals, with just 28% saying they’ve seen a 5% or better increase in loan volume. Likewise, many banks say chatbots lack a crucial “human element,” and 42% of all businesses say their main priority is to connect on a deeper digital level with consumers. Worst of all, only 21% of customers say their FI has helped them improve their overall financial health.

The Benefits of Hybrid Banking

Clearly, FIs are struggling to give customers the financial advice they need in a way that’s both efficient and effective. But a hybrid banking strategy can help bridge this concerning gap, giving customers the human support they need when making critical financial decisions.

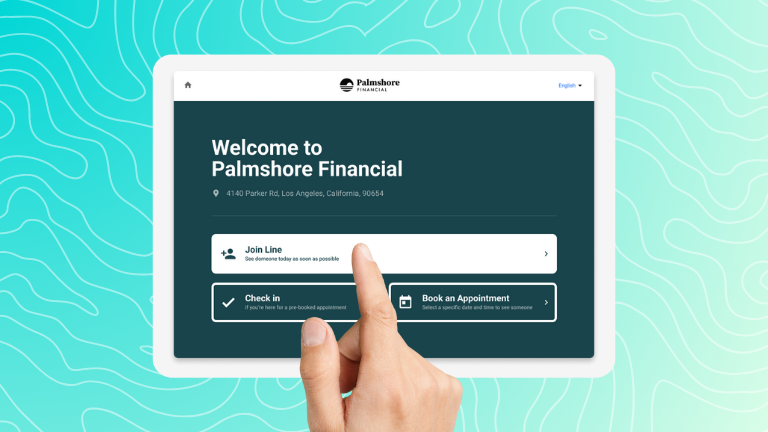

When FIs make it easier to connect with real humans (in additional to digital touchpoints), they’re more likely to attract new customers, sell more products, and improve the overall experience. Today’s consumers live fast-paced, busy lives. They don’t want to spend hours in line and they don’t want to spend hours Googling for answers to their financial questions.

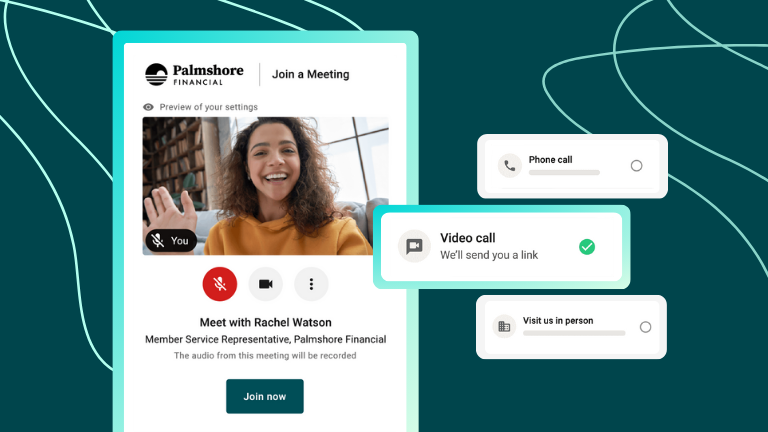

Instead, they want quick, simple, and direct solutions. Banks and credit unions can meet this demand by making it easy for customers and members to book with financial advisors in just a few clicks. Self-service appointment scheduling tools are easy to use, so clients are more likely to use them. Advisors can even send personalized links to proactively reach out and offer appointments at scale. When advisors have more face time with their clients, they can offer the type of personalized support that makes clients want to stay loyal to your institution.

2. Increasing Staff Efficiency To Overcome Staffing Shortages

In the past few years, banks and credit unions have faced a drastic increase in staff turnover and employee dissatisfaction. On average, banks had a turnover rate of 25% in 2022, and one credit union study revealed a 131% increase in dissatisfaction rates related to staff training. So it’s no surprise to learn that 80% of banks and credit unions name staffing efficiency as one of their biggest concerns.

How Staff Inefficiency Hurts FIs

Staffing shortages are a key driver of FI inefficiency and staff burnout, which poses a very real threat to customer service and overall growth. Here are just a few of the scenarios that can play out when FIs aren’t focused on staff efficiency:

- Long in-branch wait times. When branches are short-staffed, customers and members often face long wait times for even the most basic services, such as withdrawals or deposits. If they have to wait too long, clients leave before getting the help they need. This can lead to frustration, resentment, and decreased loyalty.

- Long lead times for pre-scheduled appointments. If customers and members have to wait several weeks to see an advisor in person, they may lose patience with the institution and look elsewhere for services. This creates missed opportunities to sell products and bring in revenue.

- No qualified staff to help with products and services. Nearly 60% of banking customers expect their financial institution to help them improve their financial health. These customers often want to speak with qualified staff for advice about specific products and services. When these staff members aren’t available, they may look to a competitor for faster services.

These circumstances all lead to missed revenue opportunities and missed changes to build important relationships with customers and members.

Tools to Increase Staff Efficiency

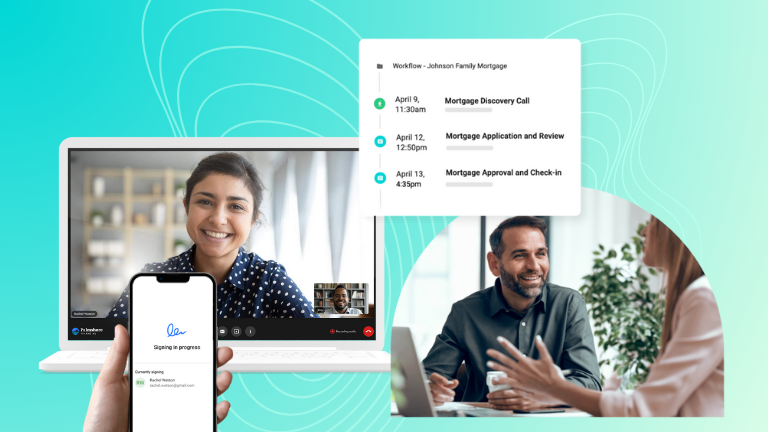

To combat this risk, FIs must make sure their staff is equipped with an end-to-end platform that empowers them to do their job well. An appointment scheduling platform can help staff prepare for appointments ahead of time, share documents, collect signatures, and note follow-up tasks from one user-friendly interface. Ultimately, they offer the tools needed to deliver the same quality customer experience, whether in person or online.

Video banking solutions also allow advisory or frontline staff to meet with clients from anywhere. Not only does this make them happier, but it cuts down on travel time and lets them serve multiple locations at once, meaning they can have more time for appointments. Solutions built specifically for banking will have the security standards, signing integrations, and co-browsing capabilities advisors need to complete paperwork virtually. Video banking also remains very popular with customers. About 46% of customers still wanted to use video banking after the pandemic, and 36% said it was their preferred medium for the future.

3. Investing in Data-Driven Decision-Making To Boost Performance

Businesses that analyze big data typically experience an 8% revenue increase and a 10% reduction in costs. Banks and credit unions have a similar chance to leverage data to become more efficient and profitable, but most FIs have yet to scratch the surface of its potential.

More than half of FIs say they want to improve customer satisfaction scores and staff efficiency, yet less than a third of them are actually tracking staff efficiency metrics. These banks are left without a solid baseline understanding of where staff members are spending their time, so they don’t have the full opportunity to unlock new efficiencies.

How to Unlock New Efficiencies

So how can banks and credit unions start leveraging the potential of data? One of the best places to start is by hopping on one of the latest banking technology trends: using an appointment scheduling and queue management tool to monitor in-branch traffic.

By tracking walk-ins and in-person interactions, FIs get a clearer picture of in-person engagements (instead of relying on paper trackers or guesses from branch staff). They can then be tied to engagements across in-person and digital channels—giving a holistic view of the entire customer journey. This data can then guide strategy, branch openings and closures, staffing plans, and more, allowing FIs to better serve customers.

In-branch traffic gives FIs a bird’s eye view of how each branch is performing, without having to actually step into the branch. It tells the FI key information like:

- Who is visiting

- When they’re visiting

- What kind of services customers need help with

- How long it takes for customers to be served

As a bonus, most queuing systems also offer customers the option to join the queue, see wait times, schedule an appointment for later, or sign up for alerts when it’s time for their appointment—all of which help reduce wait times and drive more efficiency.

FIs can then dive deeper into where staff members are spending their time, finding out who is busy, who has time to pitch in during peak times, and what kind of services are taking up the bulk of their time. From here, the organization can better understand how to get the most out of each staff member. They can see who is over-utilized, who has free time, and who needs to be reallocated to in-demand services.

Leverage the Top Banking Technology Trends with Coconut Software

There are lots of banking industry technology trends to keep up with. But banks can drive growth and improve customer satisfaction by staying focused on the bank technology trends that matter most: a user-friendly hybrid banking model, the right staff efficiency tools, and data-driven decision-making.

If your FI wants to make it easier for customers and staff to navigate digital and in-person channels, Coconut Software can help. Our tools for appointment scheduling, queue management, and video banking are tailor-made for banks and credit unions, so customers can effortlessly connect with your institution in the way they prefer.