Digital Transformation to Improve Operations

Customer experience expectations are ever-changing, creating a need to implement a digital transformation to improve operations. Digitizing customer-facing channels specifically can help you improve customer experience while also improve efficiencies on the operations side.

Of course, introducing any new tool will involve internal change management, and a short period of adjustment and adoption for your customers, so it’s important to choose tools that will ease the transition of both your organization and your customers into the future of banking technology. According to J.D. Power, only 49% of customers are making use of new, customer-facing tech implementations that have been integrated into some of the largest banks. Customers desire an enhanced, digitally-driven customer experience, however, they have to gradually shift into it, or else satisfaction rates can drop and and adoption can fail.

Interested in implementing a Digital Transformation? Learn more in Coconut Software’s Ultimate Guide to Digitally Transforming the Appointment Experience.

Call Volume is Increasing. What’s Your Plan?

Forrester’s 2018 Customer Service Trends Report predicted that over the next 12 months, call volume is expected to increase, causing contact centers to grow by 5 to 10%. Working with clients in the financial services sector, we’ve observed that the appointment booking process in their contact centers is often plagued by a number of inefficiencies, that result in:

- Extensive hold time in call queue

- Longer-than-normal call handle times

- High call drop rate

If you’re seeing these symptoms, maybe this is the case for you too. Some operations executives and contact center managers are scrambling to increase representative headcount to accommodate the slow process and to improve their call handling times. But this only solves one of the problems: managing high call volume. It doesn’t improve efficiency, and over the long-term, it isn’t an economically sustainable strategy.

How does a digital transformation to improve operations fix this problem? Implementing an integrated scheduling solution that streamlines the inefficient booking process currently in place in many financial services contact centers would help to accommodate the predicted increase call volume, subsequently eliminating the need and expense of hiring more contact center representatives.

Enterprise scheduling is an excellent first step in the digital transformation occurring in the financial services industry. Increasing the efficiency of the appointment booking process through a channel that customers are familiar with makes an integrated appointment scheduling solution a low-disruption push into a more digitally enabled customer journey.

Improving Digital Channels

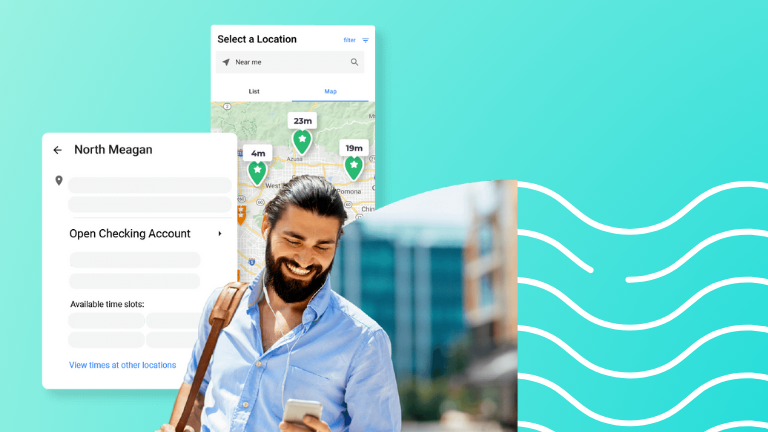

Starting to enhance the back-end efficiency of channels with which your customers are already familiar–like the contact center experience– is a strategic way to keep up with the digital transition in financial services. Going a step further, adding self-service channels give customers increased access to your organization at any time and from anywhere, and integrated appointment scheduling is a great way to start.

Enterprise appointment scheduling can be integrated into your organization’s online platforms, allowing you to offer your customers the ability to book appointments 24/7 and from anywhere. Without online channels, the only option for customers to schedule an appointment with your financial services organization is during regular business hours. Fewer and fewer customers will be willing to make time in their busy schedules to go through the time-consuming process of offline appointment booking. But by providing your customers with 24/7 access to book appointments through digital channels, you’ll have the opportunity to drive more and more business to your branches.

In fact, after implementing online scheduling and monitoring activity for a few months, many of our clients noticed that 41% of their appointments were booked after business hours through their online channel. This indicates that there was significant customer demand for appointment booking after regular hours of operations that was not previously accommodated, through the contact center appointment-booking channel.

Improve Workforce Management

There are a number of symptoms you may be feeling with respect to workforce management of your contact center team and your financial advisors. It’s as simple as this: When your staff are regularly preoccupied with inefficient tasks, this can result in operational costs to your business. What you may not realize, is that some of these can be alleviated with enterprise scheduling software.

In the contact center, your representatives who may be tied up with an inefficient appointment-booking process (resulting in longer call handle times) are not able to spend as much time doing other revenue-generating tasks, such as outbound calling or customer support. Appointment scheduling can also be a time-consuming task for your in-branch employees, requiring them to coordinate with customers and put them on hold, while finding a time for them to meet with a qualified and available advisor. This keeps advisors from spending more of their time actually meeting with customers and running appointments.

Implementing a scheduling solution in your organization’s contact center takes representatives through a streamlined, step-by-step appointment booking process, instead of the one currently in place, requiring call reps to toggle through multiple applications to book a single appointment. The solution also provides an online, 24/7 channel to schedule appointments, which will help divert traffic from the contact center and also allow your in branch staff to no-longer be tasked with manually scheduling appointments. Enterprise scheduling enables your organization to function much more efficiently, and saves your branch staff as well as your contact center representatives time, allowing them to accomplish other revenue generating tasks.

Implementing digital transformation to improve operations ultimately enhances customer-facing channels, which is a major factor in improving the customer experience. Implementing a tool such as integrated appointment scheduling allows your organization the opportunity to transition into the future of banking technology while also enhancing customer-facing channels. Tools that can enhance existing customer channels as well as help optimize staff time are hard to come by, and appointment scheduling is that diamond in the ruff. Allow your organization to reap the benefits of enhancing customer-facing channels by implementing an enterprise-grade scheduling solution.

What Next?

Looking to boost revenue and deliver a premium experience to your clients?