What is Hybrid Banking And How Can You Master It? Everything You Need to Know in 2024

Today’s FIs have raced to create digital-only experiences that move customers and members away from physical channels. And while digital banking has many advantages, many FIs are in danger of over-rotating on digital channels—a mistake that always comes at the expense of customer experience.

Case in point: consumer trust in FIs fell two percentage points in 2022—the first drop in trust since 2018. Likewise, consumer experience scores for multichannel banks dropped for the second year in a row, with more than one-third of customers saying their experience has been poor or very poor.

In short, banking has become less personal. The vast majority of customers and members (82%) say that having a local branch is extremely or very important—yet many still want the convenience of digital banking for certain situations.

Thankfully, hybrid banking offers a welcome solution. If you can master it, you’ll be well on your way to fostering consumer trust, loyalty, and overall growth in 2024.

Hybrid Banking, Defined

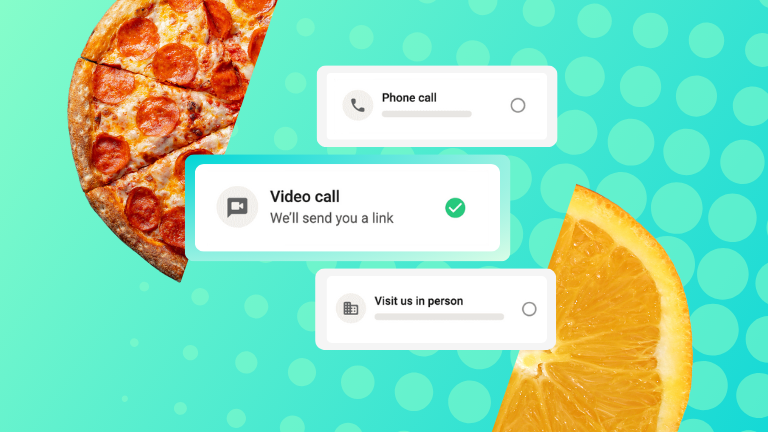

So what is hybrid banking? It’s a modern approach to banking that meets today’s consumer demands, seamlessly blending digital channels with in-branch experiences. It grants customers the power to choose when, where, and how they access banking services, whether it’s via video banking, mobile apps, self-service options, or face-to-face appointments.

The hybrid banking approach recognizes that many of today’s consumers prefer a blend of traditional in-branch services and self-serve digital tools. While most would prefer to log into online banking to say, move funds from one account to the other, they’d much rather sit down with someone face-to-face for tasks that involve complex decision-making, like applying for a mortgage. Hybrid banking also accounts for individual preferences and accessibility needs—giving customers the flexibility to bank on their own terms.

In this post, we’ll explore the advantages of a hybrid banking strategy in 2024. Then we’ll share keys to building a successful hybrid banking strategy and examples of FIs that are putting the hybrid banking model into action.

4 Reasons Hybrid Banking is the #1 Key to FI Growth in 2024

Hybrid banking is vital for growth because it allows financial institutions to adapt to evolving customer preferences. By offering both traditional and digital banking services, banks can attract a broader customer base, increase customer retention, and tap into new revenue streams, positioning themselves for sustainable growth in the future.

Let’s take a look at some of the ways hybrid banking helps FIs grow.

- Attract New Customers

By combining the convenience of digital banking with the option of in-person services, hybrid banking appeals to a broader audience. It accommodates all types of customer preferences, including the 28% of customers who prefer visiting a physical branch, and the 52% who prefer mobile banking. The model fosters financial inclusivity and creates a more seamless, personalized banking experience, which makes the FI more attractive and accessible to all potential clients.

- Improve the Customer Experience

Hybrid banking enhances the customer experience by offering greater flexibility and seamless service across multiple channels. Customers can effortlessly move between a bank’s mobile app, website, in-person queue, self-service features, and video banking services. Likewise, staff can use digital insights and reports to tailor their interactions to customer and member needs. Appointment booking and queue management tools can help FIs reduce appointment length by 75% and increase CSAT scores to an average of 97%.

- Sell More Products

When customers have easy access to financial advice, they’re empowered to confidently make financial decisions—leading to more products sold. Whereas customers who are disempowered and confused by the financial products you offer are far less likely to successfully make a purchase. What’s more, with hybrid banking, FIs can leverage customer data from digital interactions to offer personalized recommendations and sell more products. This data-driven approach enables banks to tailor product offerings to individual needs and preferences and improve cross-selling and upselling opportunities. Banks that adopt this approach see an average of 41% more appointment bookings and a three times higher conversion rate.

- Improve Customer Lifetime Value

On average, FIs that embrace the hybrid banking approach have a 21-point higher customer and member NPS. These satisfied customers are more likely to stay loyal and use a wider range of financial products and services. As customers and members reap the benefits of a more convenient, personalized banking experience, their lifestyle value increases and their relationship with their FI grows stronger.

4 Tips To Build a Successful Hybrid Banking Strategy

Hybrid banking has clear benefits, but it’s not always easy for banks to implement. To successfully execute a hybrid strategy, banks must first understand how customers and members are currently using digital and physical channels. They should identify pain points, and then use that knowledge to create more flexible ways to connect in both digital and physical environments.

Since 50% of customers prefer visiting a branch for sensitive or complex situations, in-branch services should stay focused on advice. FIs can leverage appointments to improve the branch experience and leverage post-appointment data to understand how customers want to engage.

Let’s take a look at the top strategies FIs can use to successfully incorporate hybrid banking.

- Understand Your Customers

FIs should have a laser focus on understanding their customers’ and members’ needs. They should keep a pulse on when, where, and how customers want to engage. When do they visit the branch? What activities do they prefer to complete online? When do they reach out to the contact center?

Banks and credit unions should also review traffic patterns and adoption of self-serve tools across services and products. They should get anecdotal feedback from in-branch staff, contact center agents, and customer satisfaction surveys to better understand friction points in the customer journey. This information can be used to improve the customer experience, fine-tune processes, enhance staff training, and invest in new technology that’s best suited to resolve customer needs.

- Help Customers Connect Quickly

The modern banking customer craves fast, convenient access to services. Yet when customers have more ways to connect, it can feel overwhelming to know where to get started. Case in point: 64% of bank customers say their bank’s mobile app doesn’t solve customer service questions quickly enough, or in some cases, at all.

FIs can overcome this challenge by helping customers find the fastest way to get their needs addressed. Teams and self-service tools should know how to ask the right questions, ensuring the customer reaches the right person to resolve their issue quickly. When FIs understand which channels lead to the best experience in the least amount of time, they can focus on promoting those service delivery models.

FIs should also take opportunities to educate customers on other, simpler ways to get needs addressed quickly. For example, if a customer comes into a branch to deposit a check, tellers can share ways to accomplish the same tasks from the mobile app.

- Deliver a Seamless Cross-Channel Experience

Three-quarters of banks and credit unions have launched digital initiatives, yet only 30% say their transformation has been successful. Banks can overcome these challenges by taking a more holistic approach that merges both digital and traditional services into a seamless hybrid experience.

To do so, FIs should have a central location to store customer activity and details. This platform should capture the context of every interaction. Every time the FI engages with the bank, the platform should gather context clues about customers’ needs and wants. This will ensure staff members are better prepared for conversations and customers aren’t stuck repeating their stories.

Banks and credit unions should map out thoughtful customer journeys for key products and services across all channels. They should ensure that the experience is consistent across all platforms, whether the customer engages via video, chatbot, email, phone, or in-person.

- Make It Easy to Connect with a Real Human

Though digital self-service tools are an important part of day-to-day banking, they often leave customers at a loss when they have more complex questions. In short, today’s consumers still crave human connection from their banks. For this reason, it’s important to make sure every digital channel has direct access to a real human.

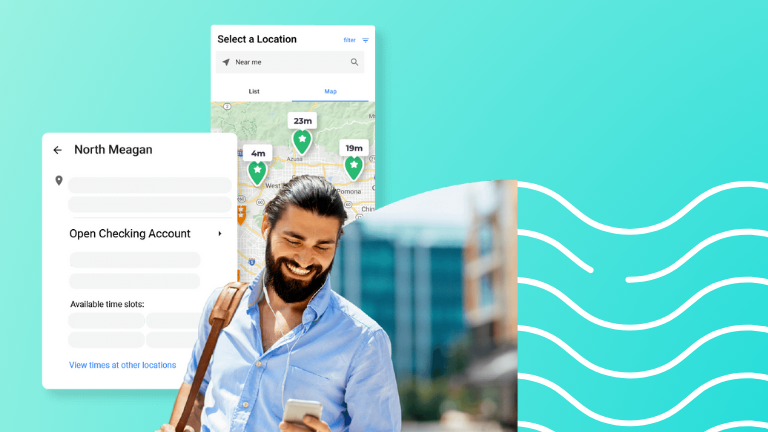

FIs can add this human element with online scheduling that routes customers to staff members best suited to help. This gives customers a quick view of staff availability and multiple ways to meet in person or online. Both staff and customers can be better prepared for the appointment since the tools send reminders, alerts, and information about what to bring.

Banks and credit unions can also provide access to staff during an online account opening or loan application with chat, on-demand video, or appointment scheduling.

Adding this human touchpoint along the customer journey is critical to decreasing application abandonment rates, increasing product sales, and improving the overall customer experience. In fact, FIs that digitally enable the human experience have the potential to double advisor productivity and boost assets under management by 1.5 times.

Arvest Bank: An Example of Hybrid Banking in Action

Hybrid banking is more than just a buzzword—it’s a strategy that’s helping real banks and credit unions achieve a tangible return on investment. Take Arvest Bank, for example.

Before 2020, Arvest Bank helped customers on a first-come, first-served basis. They didn’t take appointments and customers often had to wait in long queues, only to discover that the associate who could help them wasn’t available.

To solve this issue, Arvest launched an online appointment scheduling solution that provided customers with convenient, self-service options for scheduling meetings. The solution also provided visibility into services completed, staff productivity, and appointments booked at each branch.

As a result, Arvest shortened appointment times from one hour to 15-20 minutes. They achieved a 69% completion rate for appointments and optimized branch operations and staffing levels, which in turn, increased customer satisfaction.

For more proof that hybrid banking works, check out these hybrid banking examples.

Embrace a Hybrid Banking Strategy with Coconut Software

Though 89% of customers use online banking features, the vast majority still want quick and easy access to staff members and in-branch services. Hybrid banking offers customers the best of both worlds, making it easy for customers to navigate digital and in-person channels.

Coconut Software’s self-service banking solutions allow FIs to keep up with customer and member expectations, save time, and make better connections that lead to growth. Watch a demo today and discover how to successfully implement hybrid banking with our appointment scheduling, queue management, reporting, and video banking tools.