How Electronic Appointment Booking Systems Can Revolutionize the Financial Services Industry

The financial services industry has been completely transformed by advances in technology. Over the past 10 to 15 years, internet banking has become the norm, currency itself has turned digital, and there’s now an app for just about everything financial.

Not only has technology completely revolutionized the financial services industry, it will continue to do so. With technologies constantly advancing, financial institutions across the board have no choice but to follow suit.

The impact of electronic appointment booking systems has been particularly powerful. The implementation of what might seem like a relatively small change could in fact have a significant effect on the financial services industry, especially in a time of social distancing.

The new normal we’re living in has necessitated new technologies we never even knew we needed, and is demanding – and inspiring – a whole new way of doing business.

In this post, we’re going to be taking a look at exactly how technology has shaped financial services up until now, some current fintech trends, and what they mean for the future of financial services.

Technology and Banking: A History

The 2018 valuation for the global fintech market was just under $128 billion. It is projected to grow to almost $310 billion by 2022.

Fintech encapsulates one of the most influential changes the financial services industry has undergone practically since Medici was the biggest name in banking.

Fintech actually refers to any new technology or solution in the realm of banking or finance. Buzzy as it may sound, it’s here to stay.

Humble Beginnings

Although now so commonplace that it may seem to lack the “tech” component of fintech, the creation of the credit card was essentially the beginning of technology’s slow infiltration into financial services.

Credit cards were first introduced in the 1950s in a bid to lessen the necessity of carrying cash.

From this point on, it seems as though each new decade brought with it some sort of technological sea change in the financial services industry.

From Then Until the Modern Day

The 1960s saw the introduction of ATMs, which lightened the workload for tellers. They also brought banking to more locations and allowed customers 24-hour access to their funds. 1,000 ATMs had been installed around the world by the end of 1971.

The 1970s also saw the establishment of the very first digital stock exchange. NASDAQ soon became the standard for the majority of major trades and changed the entire face of the trading world.

In 1980, the first iteration of what we know today as online banking is born. Financial institutions also began to adopt the usage of mainframe computers at this time. For the majority of large banking organizations, they’re still the technology of choice today although many are beginning to investigate the use cases of cloud-hosted digital banking platforms.

In the 1990s and 2000s, the development of the internet predictably coincided with a rise in the popularity of internet banking. More and more lending institutions began to digitize their services. Technology had become fully and firmly entrenched in the financial services industry.

More Recent Developments

The rapid rise of technology in banking between 1950 and 2000 is nothing compared to the rate of advancement the industry has seen since then.

Many significant disruptions have shaken the financial services world, even in the past few years.

Cryptocurrency and contactless payments. The rise of smartphones giving way to the rise of banking apps. New payment technologies. The creation of completely digital banks.

Financial Services: Current Technological Trends

Financial institutions can be laggards when it comes to adopting the latest technologies, and with valid reasons, typically around security, compliance and risk.

Despite this, new technologies are constantly being developed. And new applications for these technologies are being discovered all the time. Innovations in this field are never-ending and are not only changing when and where we bank, but how.

Robotic Process Automation

Robotic Process Automation (or RPA) is already being utilized in some fields, such as healthcare. Now banks are beginning to see the benefits, too. RPA essentially means training robots or “virtual assistants” to carry out administrative tasks. These can range from processing credit card fraud claims to customer onboarding.

RPA is of particular interest to those in the financial services industry. This is due in part to the time and money it can potentially save, and the errors it can help to drastically reduce.

It can also help to provide an overall better customer experience through a reduction of human errors and a streamlining of efficiencies. Which of course is an invaluable benefit for lending institutions everywhere. These types of solutions are best paired with lower value transactions that don’t require the “human touch” of financial institution employees.

Blockchain

Blockchain is a distributed ledger technology and allows users to store and exchange data on thousands of different servers across the globe. It is associated primarily with bitcoin and cryptocurrency however many pundits predict that it will soon completely change the face of fintech as we know it today.

The reason for all the blockchain buzz is that it is a relatively cheap, easily verifiable, and very safe way of storing information. It can be used to make payments more secure, save time, money, and much more.

Many believe blockchain technology could pose a potential solution to some of the big problems plaguing the financial services industry today.

AI and Machine Learning

AI and machine learning have been around for some time and have reached the critical mass required to start making their mark in the financial services sector.

AI is being applied in a number of interesting ways particularly in customer service as evidenced by the rise of chatbots. Banks and credit unions are now using chatbots to answer customer queries, open new accounts, and even in some cases give basic financial advice.

Electronic Appointment Booking Systems: The Future of Banking

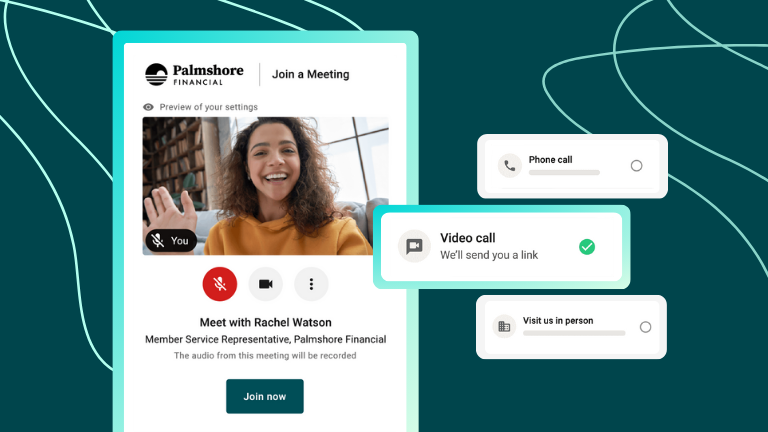

A recent study found that more than six out of ten Americans prefer an automated self-service for simple customer service tasks.

More and more, consumers and clients are not only learning to accept but coming to expect automated solutions.

By 2024, it is estimated that the global appointment scheduling software market will be worth as much as $360 million. Why?

Better Customer Experience

As we have seen, customers seem to be calling for more automation themselves. Aside from wish fulfillment, automated booking systems can also be beneficial to the customer in many different ways.

We live in an ever more digitized age. Clients and customers expect to be able to interact with businesses on a 24/7 basis. Online booking systems allow customers to make bookings when it is convenient for them.

They also reduce wait times for customers and can help to forge better business relationships. Great customer service is the key to keeping customers happy and increasing share of wallet.

Automated booking systems don’t just make appointments. They can also carry other parts of the process. Sending out confirmations and reminders, for example. It’s little touches such as these that customers appreciate and remember.

Another big benefit: implementing an online booking system frees up the staff that would normally be tasked with scheduling bookings to devote more time and attention to other more complex, higher value customer issues.

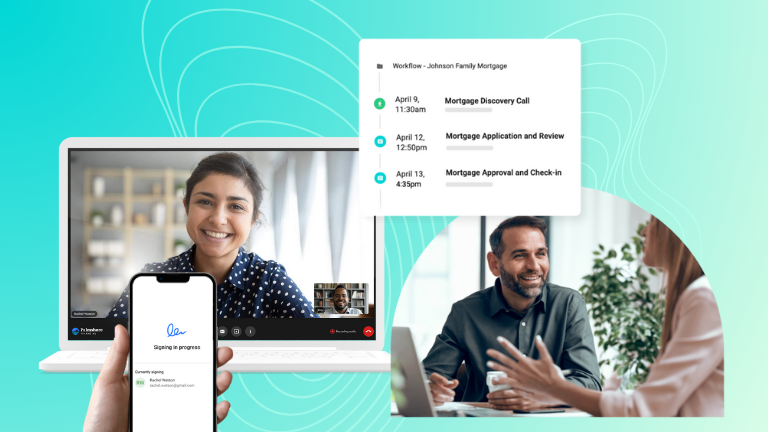

A Completely Streamlined Booking System

Automating your booking system is not only good for customers but also beneficial for staff members and productivity, too. Online booking eliminates the possibility of human error and the dreaded double booking situation.

It also, as we’ve mentioned above, frees up staff to work on other more pressing projects. It can make the booking process more speedy for customers, as well, through programmable shortcuts to quickly schedule an appointment for a specific service, staff member, language spoken or location.

All these saved people-hours and speedily processed bookings also mean that you’ll be able to process more customers, take more appointments, and help more members of your community.

In one case study, a financial organization increased its total bookings by 41% just by upgrading from its previous, outdated booking system. Another organization increased NPS from a very respectable 65 to an astounding 86, thanks to appointment scheduling.

Valuable Customer Insights

Many institutions are also benefiting from the real-time data and analytics these systems provide to pinpoint exactly when their most valuable engagement with customers occur.

Taking a deep dive into your appointment data can provide valuable insights: overviewing of all your scheduling statistics can allow you to identify patterns, manage your KPIs, see where teams need performance coaching, and where branches could possibly improve.

A recent study found that businesses that are using customer insights to their advantage are, on average, outperforming their competition by 85% in sales growth.

If you want to optimize your institution for maximum efficiency and improve customer experience, you need to know how your customers behave. These days, information is power, and the insights an online booking system can provide should not be overlooked.

Standing on the Shoulders of Giants

As any business in the financial industry will be aware, new software and systems can be a nightmare to adopt. The desire to forge a new path and be on the cutting edge of technological advances is tempered by the need to deliver the consistent levels of service and care customers have come to expect.

Not to mention the fact that businesses – especially large or established ones – will naturally have their own software and systems already in place. New technologies and traditional systems can be uneasy bedfellows.

Thankfully, with electronic booking systems, this doesn’t have to be an issue. The vast majority of appointment booking systems are equipped with APIs designed to make their adoption a breeze. With calendar syncing capabilities and the ability to integrate with a wide variety of popular applications, electronic booking systems are surprisingly simple to embrace, for financial institutions of any size.

The best ones will even facilitate customization, allowing organizations to completely tailor the system to suit their needs. With some electronic booking systems, businesses can integrate their chosen language, branding, and desired customer booking experience.

Managing Visitor Traffic

COVID-19 has completely turned every facet of our lives upside down. It has necessitated structural changes, new protocols, and the utmost caution. Perhaps more than any technology, it has disrupted and changed the way we do business.

And yet, to millions of Americans, financial assistance remains an essential service. Countless people across the US need to continue to be able to come to their local bank or credit union. This has created a unique quandary for lending institutions around the world.

Financial institutions are finding the solution in online booking systems. One case study followed the struggle of an Oregon-based credit union to bridge the gap between serving its customers and keeping them safe.

Through the automated scheduling and lobby management solutions it implemented, WECU managed to successfully continue to help customers while making sure that social distancing guidelines were being adhered to on their premises.

The Future of Fintech

At the end of the day, even with all the technological advances, new software, and constant innovation in finance, one thing will always stay the same: banks and credit unions need people to survive. A financial institution’s greatest asset is its customers, which is why it is always so important to put customers first.

Electronic appointment booking systems are one key way to do just that.

Coconut Software can help engage with more prospects and clients, streamline your appointment booking process, and provide an elevated customer experience. Get in touch to schedule a consultation with one of our financial services experts today.