4 New Banking Initiatives for 2020

New initiatives in banking that encompass digital transformation have allowed the customer experience and operational processes to be greatly enhanced in many financial institutions, leading to their increasing success over the first half of 2020. What can we expect from the financial services industry for the remainder of this turbulent year? Deloitte has released a 2020 Banking and Capital Markets Outlook report, highlighting some of the initiatives that FinServ organizations will be focusing on in the coming year to perpetuate their industry’s successes.

We have highlighted the top four credit union and banking initiatives that we think are going to be crucial to understand and implement for the remainder of 2020.

Initiative #1 – Back-End Innovation

2020 has shifted the focus around bringing back-end processes up to speed. 87% of financial organizations don’t believe their current core systems can keep pace with customer-facing initiatives. And with 60% of customer dissatisfaction originating from the back-office of financial organizations, it’s clear that inefficient back-end processes can have a negative impact on customer experience and need to be addressed in 2020.

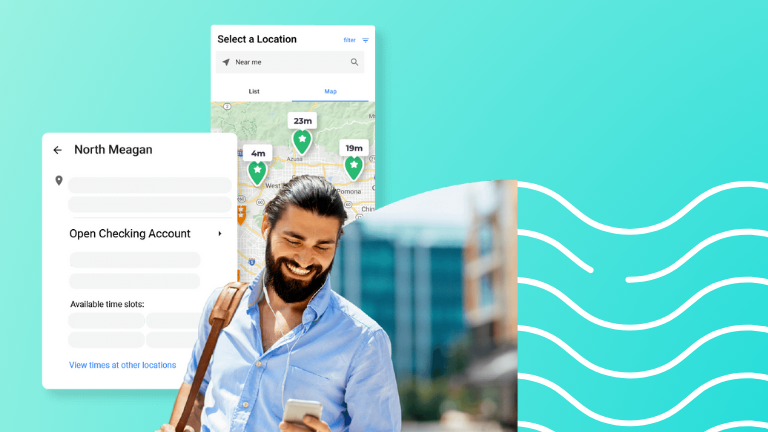

Appointment scheduling is a tool that enhances customer-facing channels, while streamlining back-end processes within your organization. It can be implemented organization-wide, into your contact center’s appointment booking process, in-branch as well as online, providing a new appointment booking channel to your customers.

Initiative #2 – Better Data Management

The second banking initiative encompasses better data management between customer-facing and back-end channels. If your organization utilizes platforms that do not provide integration options, you are placing your organization at an increased risk of slowing down operational processes and creating a disjointed customer experience. When you are an appointment driven organization, it is crucial that the data captured through your customer-facing channels is transmitted to your back-end processes.

Implementing an enterprise appointment scheduling solution will allow your organization the ability to integrate both front and back-end processes into one platform, resulting in all customer and appointment related information being stored in one place. This will enhance operational processes and streamline the management of data between your two channels.

Initiative #3 – Empower Customers Self-Service

We live in an ever-evolving digital world that has streamlined many of the tasks in our day to day lives, such as checking out at the grocery store, buying clothes, and ordering food. With all of these advancements, shouldn’t financial organizations be providing self-service channels to their customers as well?

The increase in customer experience expectations does not mean that customers expect to have your organization wait on them hand and foot. Independence and autonomy are very important and according to a survey conducted by GetApp, 70% of customers prefer to use self-service channels to manage their lives, and 31% said that they would leave a current provider if another offered online accessibility.

With appointment scheduling, you can provide your customers with the luxury of scheduling appointments with your organization through self-serve, online channels, allowing them to connect with your organization whenever and wherever they want.

Initiative #4 – Revitalizing the Lobby Experience

To match the continuously changing landscape of 2020, it is important to adhere to the customer’s continuously changing needs when they decide to make their selective trips into the branch. Customers now more than ever require a clear line of sight into the lobby experience, whether it’s accurate wait times on when they can meet with an advisor, or seeing how many people are actually inside of the branch.

With Lobby Management, your customers get to centre the banking experience around their own needs, providing accurate branch information while prioritizing the customers physical safety inside of the branch.

New Initiatives in Banking – What’s Next?

According to Deloitte’s 2020 Banking and Capital Markets Outlook report, “Banking consumers have a stronger emotional connection to technology brands like Apple, Amazon, and Google than to their banks.” And in response, many banks are deploying digital strategies to stay ahead of the game.

Does your organization have a game plan for the rest of 2020 to keep up with the digital transformation occurring in the financial services industry? Take advantage of the latest trends, and what Coconut can do to help in our Digital Transformation Guide.

Ready to get started? Schedule a consultation today.