When Channel Switching Interrupts the Customer Journey

When dealing with their finances, clients want to interact with their institution where, when, and how they want. It is well known that channel switching interrupts the customer journey, and nothing is more frustrating than attempting to complete an action through one channel, and then being forced to start over on another. When aiming to reduce churn and abandonment, a frustrated client is something that all institutions should be looking to avoid. Luckily, as has been mentioned in a Kofax sponsored study published by the Digital Banking Report, increased digitalization can help to solve this issue. Here we will outline some of the risks associated with forcing clients to switch channels, and what Coconut Software can do to reduce them.

The Risks of Channel Switching

High Abandonment

SaleCycle recently completed a market report which showed that abandonment rates for both online and offline finance applications were an average of 79.3%, second highest only to travel bookings. Due to the high stakes and complicated process of applying for these types of services, it’s not surprising that they experience a higher drop off rate than other industries. However this is exactly why it’s more important than ever for them to be as smooth as possible.

Are there tools in place to direct clients to real time assistance channels like live chat when they run into problems? Have you provided them with a clear expectation of the time and information required to complete their interaction through their chosen channel? And perhaps most importantly, is the process streamlined to ensure that clients don’t need to start over when they are moved to another channel? These are all questions that institutions should be asking themselves if they are looking to reduce abandonment rates, as failing to address them is likely leading to your clients feeling as though their time is not being valued highly enough and causing them not to complete their interaction.

Increased Churn

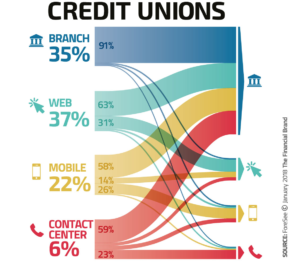

With so many choices for consumers, brand loyalty is rapidly decreasing as clients jump ship in search of the most streamlined application process and friendliest user experiences. If forcing them to switch channels to complete an interaction with your organization is causing them to abandon the process, it’s entirely likely that they will seek out a competitor rather than continue. Currently, 58 to 63% of interactions with credit unions that start outside of the branch end up with the client making a visit to the branch to complete. When this process isn’t optimized, that’s a lot of opportunity for them to find a different provider who can offer a more efficient customer journey.

By examining your client trends and collecting valuable data on the way they prefer to do their banking, you can ensure that their customer journey is streamlined from start to finish. A good experience on any channel should be convincing and take users smoothly through their interaction so that there are few opportunities for the client to stop halfway through in search of a smoother process.

Poor Customer Experience

Existing clients want to be remembered and have their loyalty to your brand acknowledged, but if they are forced to switch channels and begin the process over again at every touchpoint it can quickly foster a negative impression and send them in search of a better experience. In fact, a Gartner study shows that 96% of consumers with a high-effort service interaction become more disloyal compared to just 9% who have a low-effort experience.

By focusing on creating a personalized customer journey for your clients, you can help to avoid these issues. Developing ways for your clients to complete their interaction through a single channel with minimal effort on their part, and ensuring that any information provided is carried over when they do need to switch channels is key to providing the personalized customer experience they expect from their financial institution.

How to Reduce Risk With an Appointment Management Solution

Provide Alternatives to Keep Their Business

When clients are unable to complete an interaction through their chosen channel, whether because they don’t have the time to complete it at the moment, the process is complex or because an in-branch visit is required, ensure that you have the tools in place to keep them engaged enough to schedule a face-to-face meeting at their convenience. With Coconut Software, you are able to provide them with clear options to do this, saving them the frustration of wondering how to continue or directing them away from their chosen channel to find a solution. Whether their initial contact is through your digital channels, contact center or in the branch itself, Coconut Software offers solutions to help streamline your clients’ interactions and ensure they have the options they need to get the service they’re after.

Keep Clients Engaged on Their Chosen Channel

Give clients the option to complete the customer journey on whatever channel they choose. If they are looking at available services online, directing them to a contact center is only going to interrupt their customer journey and can easily lead to abandonment. By ensuring that your online scheduling solution is positioned front and center when clients are viewing your provided services, you can keep them engaged and lead them toward booking an appointment all without ever having to leave the page. Even after the appointment is booked, you have more opportunity to keep them engaged through instant messages and email alerts to remind them what they need to bring to the appointment. You can also provide simple ways to check-in when they have arrived or offer an easy method for rescheduling their meeting. All this ensures that they are both involved throughout the entire process, and prepared when they arrive.

Streamline the Customer Experience Across all Channels

Implementing an appointment management solution will keep the customer experience consistent regardless of the channel they prefer, as well as streamline your operational processes. Through Coconut Software’s integrated appointment management solutions, all information collected through any channel is available to your staff. From online to in-branch, your representatives will be able to quickly access client information that has been provided, allowing them to provide the smooth, personalized experience that consumers have come to expect. This saves your clients from having to go through the process again at every touchpoint and displays to them that no matter how they choose to engage with your organization, their business is appreciated.

What’s next?

Ready to discover what areas of your operational processes can be enhanced with an appointment management solution? Schedule a Customer Effort Assessment

Interested in learning how appointment scheduling can help your entire organization engage more efficiently and effectively with clients? Download our Customer Experience Whitepaper

Ready to get started? Schedule a Consultation Today