6 Interesting Appointment Scheduling Statistics for Financial Institutions

Last year, we powered over 120 million minutes worth of financial engagements. That number means a lot to me.

In our small way, our platform helped people get the right financial advice when they needed it most. We helped them arrange mortgages, secure college loans, and plan for retirement.

But our analysis didn’t just reveal what we and our customers have done. It also showed where the financial industry’s headed. Explore the future of financial appointments with our 6 data-backed insights.

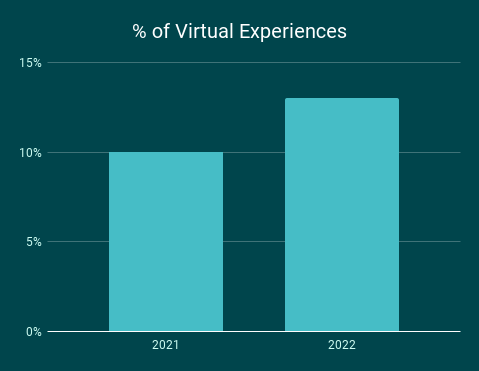

Stat #1: Digital Banking Engagements Rise 3%

The pandemic upended our work, family, and social lives. When the world opened back up, some trends like eCommerce slowed down. Others, like virtual banking appointments, keep accelerating.

Last year, digital (whether phone or video) accounted for 10% of all bank and credit union engagements powered by Coconut. This year, it’s 13%.

I’m not surprised by the jump — at all.

Booking a video call is easy. Wrangling your kids into their car seats, fighting through traffic, and finding parking at your bank or credit union is not. People don’t row back on convenience.

The move from in-person to virtual will speed up as digital experiences get better and better. Just look at Google’s 3D chat booth, Project Starline.

Starline replaces 2D screens with a three-dimensional representation of the person. It doesn’t feel like a Zoom call. It doesn’t feel like you’re talking at a glass screen. It’s like there’s a real person seated opposite you. Starline isn’t the norm yet… but it’s a glimpse of what the future looks like. (Coconut is on a mission to pull it forward with our video banking solution.)

Key Takeaway: Embrace Digitization Now—Or Get Left Behind

The finance industry is like an oil tanker: enormous, inflexible, and unmoveable. The industry takes a while to turn, but when it starts moving, there’s no stopping it. As banks and credit unions continue to invest in digitization, the rate of change is going to accelerate.

Customers and members will learn to expect digital options as standard. If you’re not offering “standard” features and functionality, they’ll look elsewhere.

Stat #2: Staff-Based Bookings Fall By 12%

Speaking with a bank and credit union staff member remains the most common way people book appointments. But that’s changing—fast.

Financial institutions are pouring investment into digital scheduling channels and self-serve options.

And that’s great news. First, when staff save time on administrative work—like booking an appointment—they can stay focused on giving customers and members the best financial advice possible. And second, people are natural problem-solvers, when they have a query or hit a challenge, more than 80% of people say they try to solve it themselves.

I’ve already seen really innovative ideas, like banks including QR codes in their mailers. Customers scan the code, which takes them to an appointment booking platform. Instead of calling the branch, they book an appointment right there and then on their phone.

Takeaway: Experiment With Low-Lift Self-Service

Something I hear a lot from new customers is that they’re worried about implementation. They think it’ll be a large burden on their already busy IT team. But most appointment integrations aren’t a heavy lift. In fact, you can get started today with zero input from IT.

Trial low-lift options like including booking links in your email signatures. Or print out a QR code and stick it on your branch wall. These tactics take 10 minutes and have a huge impact on customer experience.

Stat #3: Shortcut Usage Triples—And Conversions Jump 50%

Speaking of giving people options, booking shortcuts proved particularly popular last year. Compared to 2021, usage tripled — jumping from 1% to 3%.

If you haven’t heard of shortcuts, let me explain what they are.

A generic meeting booking link takes a customer to a blank booking form. They select the branch, service, meeting method, date, staff member, and so on.

A shortcut is a customized link that prefills some or all options.

Say you’re a mortgage advisor and want to include an appointment CTA in your email signature. You’d set the shortcut to include a staff member (you) and a service (mortgage advice). When a customer clicks your signature link, they’d get a pre-filled booking form instead of having to muddle through all the options on their own.

Shortcuts make customer journeys simpler, easier, and more personalized. That’s why shortcut users are 50% more likely to convert (AKA: result in a completed booking) than non-shortcut users.

Takeaway: Embed Personalized Appointment CTAs

I hate it when I get 90% of the way through a customer journey, hit the contact button, and it takes me to a generic appointment booking form. It feels like starting again from scratch.

Ideally, your CTAs should match what your customer or member is trying to do. For example:

- Residential mortgage product page ➡️ Appointment with a mortgage broker

- Danny’s email signature ➡️ Appointment with Danny

- Chatbot conversation about retirement ➡️ Appointment with a retirement specialist

Stat #4: No-Show Rates Fall To 8%—An All-Time Low

Everyone hates no-show appointments.

They waste employee time. Customers and members have to go through the entire appointment booking process again. And they burn valuable appointment slots that could have been used by other people.

Seeing the no-show rate fall from 9% to 8% felt like a huge win. That’s an extra 20,000 people remembering an appointment who would otherwise have forgotten about it.

The big driver here is automated reminders.

The reality is people are busy, and they forget things. I know I do. Regular reminders take the pressure off human memory.

Takeaway: Automate Your Reminders

Sending reminders is repetitive, tedious, and time-consuming — the perfect opportunity for automation. Use an appointment booking platform to send nudges via SMS and email. As a best practice, we recommend sending one reminder (at least) one day before and another reminder one hour before.

Stat #5: Engagements Peak On Fridays

At Coconut Software, we work a four-day week. I pack all my life admin—dentist visits, doctor visits, bank appointments—into my Fridays. While I knew that my engagements peaked on Friday, I was surprised to see that everyone else’s did, too.

Fridays were the most popular day for financial appointments. Interestingly, people preferred later slots, too. Throughout the week, branch activity peaks at 6PM. Peaks and valleys make staffing difficult, especially when you treat each branch as an independent organization. The good news is there’s a new way to tackle staffing and maximize utilization.

Takeaway: Share Human Resources Across Branches With Virtual Banking

In the past, branches acted as resource siloes. Sure, you could lend staff members between branches, but you had to plan far in advance. But digital engagements and better utilization visibility are changing the game.

When a customer or member is phoning for advice or calling an employee via Zoom, it doesn’t matter where the employee is based. Today, banks and credit unions can share employee time between branches.

Our hybrid working hours feature lets banks and credit unions run this without a ton of admin. Employees set their hybrid availability, and it’s automatically shared across your entire company. If someone tries to book a video call, it’ll look at all your employees’ availability, not just one local branch.

Stat #6: People Book Appointments Up To 50% Earlier Than Last Year

The last time I went to the dentist, they asked if I wanted to book a follow-up appointment for six months from now. I was thinking, “Heck no! I don’t know what I’m doing tomorrow, let alone months from now.” I want to book appointments for this week. I think that’s a common mindset, especially after looking at our data.

On average, Canadians book appointments 7.5 days (50% sooner than the previous year) in advance. Americans are even faster, booking just 4 days in advance (20% sooner).

However, that 7.5- or 4-day delay isn’t necessarily a choice. Customers and members often pick the first available slot. It’s a function of the bank’s or credit union’s availability rather than their preference.

Takeaway: Open Up Availability, but Keep Some Scheduling Limits

Across the industry, financial institutions are opening up more short-term availability. While offering earlier appointments is a boost for customer experience, I’ll highlight two caveats.

First, be careful about offering same-day appointments. Keep these for emergencies and walk-ins. Not only that, but same-day appointments nix your prep time. Can a retirement advisor really give great advice if they’ve only had five minutes to look at someone’s circumstances? Probably not.

Second, limit how far in advance customers and members can book. The further out someone schedules an appointment, the more likely it is that they’ll forget or double-book themself. As a best practice, I’d recommend you let people schedule one month in advance and no more.

Small Changes, Big Impact

Looking at our stats, I’m excited about the breadth and depth of change happening in our industry. Banks are digitizing. Credit unions are transforming their services. While there are big changes on the horizon, I’m also impressed at how impactful small improvements can be.

Something as simple as pinning an appointment booking QR code to a wall makes a huge difference. Instead of standing in line, people can book a call on their phone and get back to their days. What other five-minute task can save hundreds of customers an hour of their time?

While Coconut Software might be a technology company (it’s in the name afterall), our focus is on empowering staff to help out their clients. That’s the north star and this data shows we’re making progress towards this goal.

To see how else you could be tracking and improving customer experience at your bank or credit union, check out our Banking Analytics guide.