Banking Queue Management System Guide: FAQs and Evaluation

Pop quiz—Do you know what your branch traffic volume looks like on a day-to-day basis? Do you know when and why customers and members are visiting your financial institution? Are you frequently under or over-staffed?

Queue management software can help you confidently answer these questions, and dramatically improve your financial institution.

You may be thinking, wait, what is a queue management system? How do they work? Does my financial institution really need one?

Today, banking queue management systems have evolved well beyond the rudimentary take-a-number model. Sophisticated tools are now available offering self-serve options, virtual and in-person queuing, wait time predictions (live!), and tracking analytics—all within one comprehensive system.

The best queue management systems improve the customer experience, streamline branch efficiency, and provide key insights to managers and operators.

Keep reading to find out everything you need to know about the latest queuing systems, so you can pick the right one for your institution.

What Is a Queue Management System?

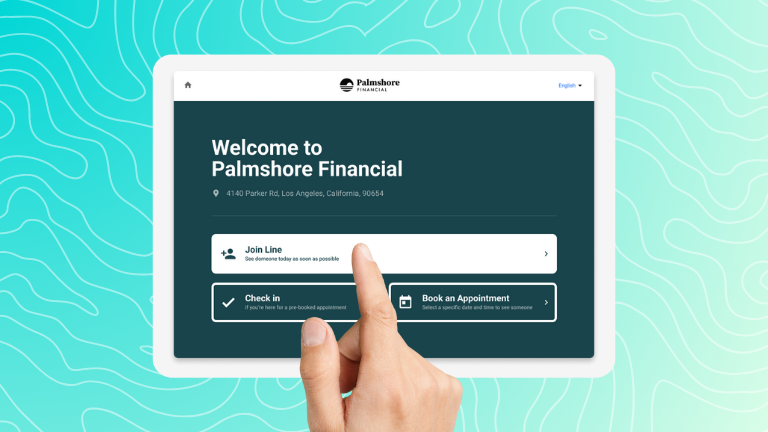

A queue management system is a tool put into place to help keep queues organized and accounted for. The queue system at your bank or credit union could be anything from a physical sign-in sheet to an iPad check-in.

Why Use a Queue Management System?

Banking queue management systems vary widely in capability and function, but the basic goal of any system is to help customers feel confident in their place in line, and keep employees in the loop.

Queue management systems in banking can also help with the following:

- Reducing In-Person Chaos

No one likes the uncertainty that comes with walking into an establishment with no clear direction of flow. A queue management system should help both clients and employees feel at ease, and sure of their next move.

- Speeding Up Lines

A queue with no system in place can result in long, painful wait times because customers and members with a simple cash request end up stuck behind someone trying to set up a new account or apply for a line of credit.

- Not Missing Anyone

With a queue management system in place, ideally, every client is accounted for and helped. No one should be walking into your bank or credit union for a service and then turning around due to poor queue management.

- Keeping Things Fair

We all know that blood-boiling sensation of seeing someone who arrived after you being helped before you. With a well-managed queue, wait time expectations are established, and clients are more likely to feel like they are being addressed in a fair manner.

However, not all customer flow management and queuing systems are created equal. Some systems aim to meet these goals, but meet hiccups when it comes to mobile app integration. Others use an in-branch system that totally excludes online customers and members. And when locations are short-staffed, or have a limited number of specialists per location, even the best queue management system won’t provide great results.

That’s why it’s crucial to choose a system that works for your institution on all levels. Let’s talk more about how to achieve that.

How Does a Queue Management System Work?

A basic queue management system involves a customer entering a queue, waiting for a service, and gaining visibility into their spot in line and their wait time.

Today, digital banking queue management systems combine physical and virtual queues to create a better experience for both clients and staff. This means that a customer or member can enter a branch, check in on a tablet or screen in the lobby, and be joining the same queue as another client sitting at home on their smartphone.

Take a look at some other features advanced customer flow management software offers:

- Gather Information 📝

With advanced systems, clients can input relevant information when they check in. Are they here to see an advisor? Do they have an appointment? What kind of services do they need? Do they have appropriate documentation? By sifting through a couple of details, customers and members will be sorted into the queue appropriately.

- See Wait Times ⏰

All queue management software should include a real-time display of current wait times. Ideally, the live wait time should be available both in person and online. This way, customers and members can gauge how busy their local branch is before joining the queue. When a client is done waiting in line and their turn is up, staff can update the queue (and wait time) with the touch of a button.

- Automatic Next-in-Line Notifications 📱

As soon as the queue moves, bank queue management software should automatically send an SMS message or email to the next person on deck. It’s a plus if the tool you use also sends an automatic notification when a client abandons the queue, because 20% of customers end up rebooking when they’re sent missed notifications. (Let’s recover those potential revenue opportunities 👀).

- Alert Staff of Arrival 📢

Queue management systems in banking provide helpful notifications to staff, advisors, managers, and operators as well. Alerting employees when someone checks in (whether physically or virtually) is just one of many benefits on the backend.

These are just some of the key features you can expect from customer flow management solutions.

What Are The Types Of Queuing Systems?

There are a few common types of queueing systems that banks and credit unions use today. Let’s break them down into four main categories, and look at the differences between each type of tool.

- Simple Sign-In / Check-In

The most basic type of queue management system in banking involves a tool that allows customers and members to either sign in (for a walk-in appointment) or check in (for a previously scheduled appointment). This simple system helps managers keep track of branch traffic, but it doesn’t necessarily add much to the client experience.

- Self-Serve in Lobby

A self-service queue management system is located in the lobby of a bank or credit union, and typically displayed on a large touch screen kiosk, or a series of tablets. This type of queue system allows customers and members to join the line, book an appointment for later (if they can’t stick around), see current wait times, and find other helpful information. Self-service kiosks also allow clients to check in, leave the branch to grab a coffee (or a pedicure depending on the wait), and get a text when it’s their turn to come back.

- Virtual Queue Management

A virtual queue management system is a tool that allows customers and members to wait their turn from anywhere, and be seen virtually by a staff member or advisor. 50% of customers and members polled said they prefer digital banking via mobile app, so virtual queue management is definitely becoming a popular feature for banks and credit unions today.

- Hybrid

Hybrid customer flow management and queuing systems combine virtual queue management with in-person queueing. This is really the best of both worlds—a queuing software that can handle both in-person traffic and virtual ensures no one is left behind, and that the right person is delegated to your client’s needs.

If you’re deciding on which type of queue management system to implement at your financial institution, find one that offers a centralized queue in one streamlined tool that helps clients feel accounted for, and provides insights on the backend.

What Are The Advantages and Disadvantages of Queuing Systems?

Any time you consider implementing a new tool in your institution, it can feel a bit daunting. With a queue management system, there are definitely some pros and cons to consider before diving in head-first.

Pros

First, take a look at the advantages of banking queue management systems. When queueing software is up and running successfully, you’re almost guaranteed to see improvements in customer satisfaction, staff efficiency, and meaningful data analytics.

- Better Customer Experience

The most obvious advantage of customer flow management software is the way it positively impacts your clients. When a tool is easy to use and available across multiple channels, your customers and members will be more satisfied with their banking experience. In fact, most institutions see an average 21-point increase in NPS scores after implementing queueing software.

- Improved Staff Efficiency

Queuing software syncs with your team’s calendars and integrates with your website, mobile app, and lobby self-serve screens—everything is connected to one central view. This allows your employees to see exactly how many people to expect on a given day, what kind of services clients need, and work more efficiently.

- Gained Insights

Queue management systems in banking also provide your team with a simple (yet robust) interface on the backend, so you can see what’s happening behind the scenes. Managers will be able to discover key insights like the number of walk-ins per day, cancellations, advisor appointment length, conversion rates, and more, to help them make informed business decisions.

Cons

On the other side of the coin, tackling a brand new software implementation comes with its own set of challenges. Make sure you consider these possibilities when making decisions about investing in the future of your financial institution.

- Learning Curve For Some Clients

While a lot of customers and members crave self-serve and virtual options at their financial institutions, some not-so-tech-savvy clients may be hesitant to use new customer flow management solutions. For example, if an older client walks into a branch and is greeted by a large screen rather than a staff member, their gut reaction may be to walk back out.

▶️ When you begin using a queue management system, post signage in and around your physical branches with information about the new tools. And always have someone available in person to answer questions.

- Adjustment For Staff

As for staff, getting trained on yet another new tool can be overwhelming—especially if your institution is currently using several other management systems. You may hear some grumbling and be met with some pushback at first.

▶️ The good news is that a comprehensive queuing management system should be able to replace several individual tools at once (like appointment scheduling, video calling, and data analytics), and blend in seamlessly with others.

- Security Concerns

If you’ve chosen a tool that doesn’t meet high-security standards for financial institutions, you may be concerned about the security of your information and data. If a leak were to occur, it could mean serious repercussions for your financial institution.

▶️ Be sure to choose a queue management system that complies with strict security measures, so you can rest easy knowing your client’s information is secure, as well as your team members’.

These are just a few of the advantages and disadvantages that come with adopting a new software solution. For more information on the pros and cons of banking software, take a look at our buying guide.

What Is The Best Queue Management System?

The best queue management system is one that integrates with your financial institution seamlessly, provides analytics, and offers both in-person and virtual capabilities.

- Built For Financial Institutions

The first question you should be asking yourself when choosing a new queuing system is: who was this software designed for? If the answer isn’t “banks and credit unions,” you should keep looking. Banking software comes with a unique set of needs like document signing, identity confirmation, co-browsing, and high security. The best tool will be catered specifically to your needs as a financial institution.

- Provides Data Insights

Again—analytics are such a key part of any banking software. The best banking queue management systems give your team a holistic view of your branch, and helps you make decisions about staffing, marketing, customer support, and more.

- Offers In-Person and Virtual Management

The best queue management tool doesn’t stop in the lobby. It encompasses virtual customers and members, and remote employees as well. Find queueing software that allows for self-service kiosk tools, remote sign-in, live wait times, and automatic text notifications.

The best queue management system will also ideally be combined with other tools as well. Today, systems like appointment scheduling and bank video calling are packaged together with queue management, rather than as separate products.

FAQs

How Do You Implement a Queue Management Solution?

So far, implementing queue management software might sound like some abstract, nebulous idea left up to the technical team at your institution. However, there are some concrete steps to take once you’ve landed on a customer flow management system.

- Kickoff With Software Company

After purchasing a queuing system, you’ll have a kickoff meeting to discuss your goals, scope, and what to expect in the next week or so. Your software partner should be knowledgeable in the financial sphere, and able to guide you through implementation confidently.

- Design Your Tool

Your queuing software should be a white-label tool that you can customize to fit your branding. Choose logo images to include, as well as color schemes, fonts, and other design elements.

- Transfer Data

Once your queuing tool looks like it fits in with your institution, you can transfer all pertinent data like branch locations, employee information, and service categories. After setting up all of your preferences, you’ll be able to test the product in-house.

- Train and Practice

Rather than holding one big, long, drawn-out meeting, tailor your training to the different roles in your organization. Give the bulk of the information to administrators, so they can act as owners of the product, then train team leads on what they need to know, and what information to pass down the line to managers, staff, and receptionists.

As long as your efforts are organized, everyone should be up-to-speed in no time. And your software partner will be there every step of the way to answer questions and help with the transition.

- Launch Your Queuing System

Once your team feels comfortable using this new tool, you’ll be ready to launch. Depending on what feels right, you may want to stagger this launch to one channel or location at a time, or go all-in at once.

With the launch, be sure to include marketing—both internally and externally. In the first push, provide materials within the institution so that everyone is reminded of their role. In the second push, create physical signage for your windows, lobby, and marquee, and send out digital flyers through your website, mobile app, and client email list.

After a successful launch, the rest of your journey will involve data collection, goal setting, continued coaching, and eventually a business review. We recommend taking a look at your progress after the first 30, 60, and 90 days of implementation.

How Can You Convince Others to Buy Queue Management Software in Banking?

If you need some help securing buy-in for customer flow management and queuing systems, we’ve got a few tips on building a business case for your institution.

- What is Your Organization Missing?

First, lay it out plainly: what is your bank or credit union lacking when it comes to customer flow management solutions? There is obviously a need for better queue management, or you wouldn’t be researching the best tools out there.

Now is your time to shine and illuminate all of the pain points in your institution’s current system. Here are a few examples of questions to ask:

- Do customers and members often walk out of your branch unattended or frustrated due to long wait times?

- Do you know what your average wait times are?

- Is there a fair system in place to help clients be seen in the order they arrived?

- Do customers and members have the option to join a queue online/remotely?

- Can clients join a queue, leave, and receive a notification when their turn is coming up or do they feel trapped in line?

- How many missed appointments does your branch see on average, and is part of that number due to ineffective queue management?

- How Can Your Financial Institution Benefit?

Once you’ve established what’s missing, address how your bank or credit union would benefit from these pain points being resolved. This step is crucial because it can encompass multiple areas of the organization (and multiple stakeholders).

- More customers and members would be able to receive services if they felt confident they would be seen in a fair and timely manner

- With clear data on wait times and the number of people who abandon the queue, you’ll be able to adjust business strategy accordingly.

- A system that makes queuing more equitable will result in more clients seen, and fewer missed revenue opportunities.

- The option to join a virtual queue will open doors to a whole new demographic of customers and members who prefer online banking.

- What Kind of Software Will Usher in These Changes?

The problem is clear; the benefits are clear—now it’s time to present the solution: a banking queue management system. Present the software you’ve chosen, and play a demo if available. It’s important that you explain how this tool works, but also how it answers the problems and benefits mentioned above.

- Queuing software creates a streamlined environment in-branch and online, allowing customers and members to feel confident about their place in line.

- This technology provides clients with the option to join, leave for a while, then come back when it’s their turn, or book an appointment for later—making people less likely to abandon a queue.

- All-in-one tools (like Coconut Software) not only provide self-serve and virtual queue management, but they also come with other features like appointment scheduling, data analytics, and video conferencing.

- A hybrid customer flow management system combines physical and virtual queues into one central location so more clients can be seen, and advisors can prepare accordingly.

Of course, this is just one plan for securing buy-in. You should customize a presentation to your stakeholders based on your institution’s needs, goals, and unique market position. And be sure to cater to your specific audience . Once you’ve made an irresistible case for a queue management system, it’ll be hard for anyone to say no.

Make a Better Queuing Experience a Priority at Your Bank Or Credit Union

These days, if customers or members walk out, they may not come back in. It’s time to meet them where they are with more options, more attention, and the right solutions. If you’re ready to improve your queuing experience, it’s time to invest in customer flow management software.

Customers and members want to feel seen, heard, and accounted for. Improving their queue experience will lead to better satisfaction, loyalty, and word-of-mouth recommendations to friends and family. Choose better service for your customers and members, and better branch and retail efficiency for your team with a queue management system.

Coconut Software has helped over 150 financial institutions implement queue management systems, and we’re eager to do the same for you. Our self-serve, interactive model provides your staff with insight into abandoned queues, more control over their schedules, and the ability to work remotely (when possible). And Coconut’s team is top in its class for customer service—we’ll be there with you every step of the way during kickoff, training, launch, and beyond.

Request a demo today to see how Coconut Software can check the boxes for your financial institution’s queue management.