The Top Benefits of Appointment Scheduling Software

In today’s digital world, people can book appointments for just about anything from any device: a dentist appointment, spa session, dinner reservation, or movie showing, to name just a few.

Yet most people can’t do the same at their bank or credit union. Instead, they call, email, or walk in. They wait in lines, sit on hold, and hope for an email reply. And they often don’t have an easy way to communicate when they need to cancel or reschedule, so they simply skip the appointment altogether. (Unsurprisingly, no-show rates are at an all-time high.)

This state of affairs isn’t just stressful for the individual—it puts a burden on tellers who have to coordinate back and forth, and on operations managers who don’t always have visibility into their upcoming appointments. Plus, branch or retail operations managers base staffing levels on guesses instead of actual capacity.

This is where appointment scheduling software comes in. This effortless, rewarding, and fast solution gives customers and members the streamlined experience they expect when they engage with your location.

In this blog, we cover the top benefits of appointment scheduling software—including how it can help transform the customer experience, increase customer loyalty, improve operational efficiency, and more.

Why Is Appointment Scheduling Software So Important?

Appointment scheduling software isn’t just nice to have—it’s essential for financial institutions and credit unions looking to gain and retain clientele for two main reasons: increasingly digitally-savvy competitors and shifting consumer demands.

- Digital Competitors: As an increasing number of fintech and digital banks steal wallet share, it’s important for banks and credit unions to do everything they can to stay competitive. And to do so, convenience is the name of the game.

- Consumer Demands: In the post-COVID world, demands for fast, convenient service have reached new heights: 50% of customer activity switched from in-person to digital in 2020, and 32% of customers now want to avoid branches altogether. Nearly half of all consumers say they’d use video appointments, and half prefer opening a new bank account online.

Customers and members want to engage on their own terms. They want more digital options, more personal choice, and greater ease of use—and they’ll ditch the institutions that don’t offer the flexibility they crave. Self-serve appointment scheduling solutions are one huge (and often overlooked) area that can deliver just that.

But transparent appointment systems don’t just benefit the individual—they’re an incredible tool for tellers and advisors, too. As the ongoing economic crisis and labor shortage leaves staff members tired and overburdened, appointment scheduling software saves them time and allows them to serve more customers efficiently and effectively.

Ultimately, appointment scheduling software is important for banks and credit unions that want to retain existing clients, attract new digitally-savvy individuals, increase staff efficiency, and grow. It can be an impactful part of the customer or member experience and an important productivity tool for staff members.

What Are the Advantages of an Appointment System?

1. Better Customer/Member Experience (and Retention)

Without appointment software, clients often endure long lines, limited flexibility, and unknown wait times. When they need to reschedule or change appointment locations, they either waste time contacting the local branch or call center or skip the appointment altogether.

This poor experience can lead to lapsed memberships, decreased appointments, and missed revenue or growth opportunities. Yet appointment systems can eliminate all of these worries for customers, members, and staff by improving efficiency, increasing flexibility, and boosting customer satisfaction and lifetime value.

2. Improved Operational Efficiency

Rather than wasting time coordinating meetings, waiting on no-show customers, or bugging members with unnecessary follow-up, your staff can focus more on matching people with the right products and services to meet their needs.

Then, by increasing efficiency and optimizing workflows, bank appointment scheduling software cuts down on administrative burdens and costs for both tellers and advisory staff. They also have been shown to cut down on wait times and appointment length. It’s a win-win in terms of time and cost savings.

3. Increased Revenue

Long lines, incorrect transfers, and extended call center hold times can all result in lost revenue for financial institutions. In fact, up to 68% of people abandoned the digital onboarding process for a banking product in 2022, all due to poor user experience.

Luckily, an efficient appointment system can help recapture revenue opportunities by fostering stronger connections with clients. Here are just a few ways credit unions and banks can measure ROI from their appointment software:

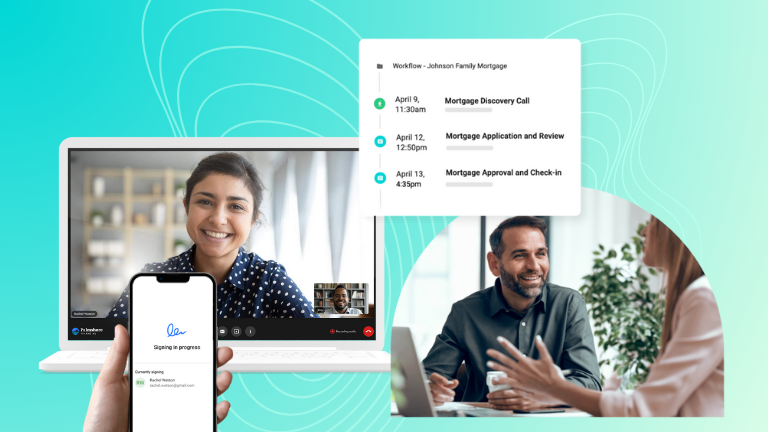

- Increased bookings for products and services (mortgages, loans, financial investments)

- Better close rates

- Reduced no-shows and cancellations

- Increased successful handoffs and missed transfers

4. Better Decision-Making With New Data Insights

If you’ve ever wished you had a complete picture of the customer journey, we have good news: a bank-by-appointment platform gives banks and credit unions greater visibility and control with better data tracking and reporting.

Banking analytics also makes it easier than ever to understand exactly how staff performance impacts revenue and products sold. So say goodbye to the old guessing game—instead, you can let key data insights give you the power to take action and improve your institution for the better. For instance, you can get an understanding of which products, branches, or services are the most popular or busy so you can adjust your staffing or offerings accordingly.

The Top 8 Benefits of Appointment Systems for Customers and Members

It’s hard to summarize all of the benefits of appointment system software in one list, but we’re up for the challenge. Here are a few of the ways a bank appointment scheduling platform will change your members’ and customers’ lives for the better.

1. Convenient Self-Service

Today’s consumers want fast, easy service on their terms. Rather than sitting on hold or standing in line, they want proactive solutions they can access anywhere, anytime. Appointment scheduling software gives them the self-service option they crave, allowing them to book, change, or cancel appointments quickly from any device. No phone tag, no email chains, and no support queue required.

2. Instant Routing

With appointment scheduling, customers are instantly routed to the staff member who can best serve their needs. They’ll simply scroll through a convenient list of options, then pick their desired appointment time, location, service, and/or channel. They can also search for special needs or accommodations (like language preference, wheelchair access, etc.) and see what’s available. Instant routing gives customers the frictionless experience they demand.

3. Easy Rescheduling

Life happens. And when someone feels under the weather or has a family emergency, the last thing they want to do is wait on hold with their financial institution to reschedule an appointment. Fortunately, bank appointment scheduling software eliminates the hassle, allowing them to reschedule or cancel an appointment with just a few clicks.

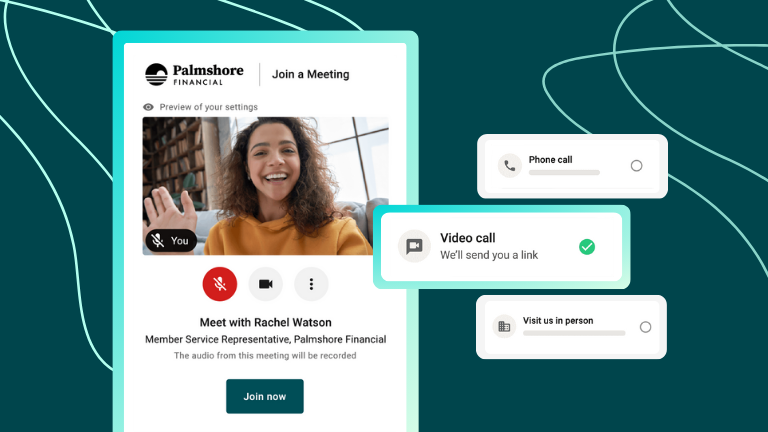

4. Virtual Appointment Options

Your customers can meet with their doctor and their boss online—why shouldn’t they be able to meet with their banker online, too? Video banking is convenient and time-saving and gives customers the same top-notch service of an in-person appointment—without the commute. This secure, easy option will draw in customers with busy work schedules, childcare responsibilities, or other limitations that make it difficult to get into a local branch.

5. Helpful Pre-Appointment Reminders

When life gets busy, a friendly appointment reminder can make the difference between a customer making it into their appointment—or ending up as a no-show. Customers get automated pre-appointment reminders at just the right time to ensure they never forget what’s on their calendar. They’ll also get notifications about which documents or information they’ll need for the appointment.

6. Automatic Check-In

Queue management solutions (which are often connected to appointment scheduling systems) can take the headache out of long lines in-branch. Customers can quickly check in on a lobby screen or kiosk when they arrive, then get a notification when your staff is ready to serve them. Automated check-ins lead to shorter wait times, and shorter wait times lead to more happy customers.

7. Shorter, More Efficient Appointments

It’s plain and simple: appointment setting software makes for better, faster appointments. Thanks to tracking tools and customer history data, tellers are more prepared for appointments—and better suited to serve customers quickly and efficiently. Plus, customers come prepared with the documents they need to complete a service, thanks to pre-appointment notes and reminders.

8. Better Post-Appointment Follow-Ups

Appointment scheduling software ensures nothing falls through the cracks after a customer meeting. Tellers can track post-appointment notes within the software, integrate with a CRM, and easily schedule follow-up calls or appointments.

7 Benefits of Appointment Systems for Bank and Credit Union Staff and Operations

It’s easy to see how customers and members benefit from appointment systems—and luckily, banks and credit unions enjoy just as many benefits of appointment scheduling software when it comes to staff efficiency and branch operations.

Let’s explore all the reasons why frontline staff, advisors, branch and retail operations managers, and customer or member experience professionals benefit from appointment scheduling software.

1. Improved Customer Satisfaction

Customers love the convenient benefits of appointment systems, and it shows. Institutions that implement the technology enjoy higher customer satisfaction rates, close rates, retention rates, and more. As appointment scheduling improves the customer experience, it also brings in more revenue. After all, happy customers are more likely to stick around (and buy more products).

2. Customer and Member Growth

Appointment setting software is intuitive and easy for customers to use, meaning they’ll consistently book more new meetings than they likely do now. Self-serve links for services or individual advisors make it easier to promote “book an appointment” as a next step in marketing or email campaigns—leading to more new bookings (and, eventually, higher revenue.) Staff members can use data insights from the software to build deeper relationships and provide a better experience, too, leading to better close rates.

3. Fewer Missed Connections

Phone tag, long email chains, and missed appointments aren’t just frustrating for staff members—they also hurt your institution’s bottom line. Luckily, appointment setting software helps recover revenue by eliminating many of those missed connections. Customers can proactively manage the scheduling process and will reschedule or cancel if needed—rather than leaving your frontline staff hanging.

4. Increased Operational Efficiency

Financial institutions are guaranteed to save time and resources with appointment systems. And when you’re saving time, you’re saving money, too. Rather than manually managing appointments across multiple time zones and locations, staff members enjoy automatic calendar syncing. Tellers spend less time on administrative busywork, and have more time to prepare for appointments. They have better time management and are empowered to do their job well—which leads to happier, more productive employees.

5. Meet Digital Innovation demands

Many financial institutions have the mandate to drive digital transformation across the organization. Adopting self-serve scheduling and video banking tools offer quick, tangible ways to improve your customers’ and members’ digital engagement (compared to other investments in back-office tools or AI). As an increasing number of industries adopt appointment setting technology, more consumers expect—and demand—the same from their banking institutions as well.

6. Better Insights Across Customer and Member Journeys

Offline interactions between staff members and customers are impossible to track—yet walk-ins, voicemails, and in-person conversations are an important part of the client journey. Thankfully, appointment scheduling software offers data insights to help institutions make smarter decisions that improve the customer experience. Institutions can better understand the most popular products or services, customer preferences, close rates, and more to drive the outcomes they want and improve the client experience.

7. Staffing Optimization

Do you know when your tellers are overbooked or underbooked? Have you optimized staffing for slow days or busy periods? Without an appointment system, addressing these issues can be a major challenge. But the right software makes the process a breeze, allowing you to instantly see which staff members are busy, overbooked, selling the most products, etc. This data can help you make informed decisions about staffing levels, training needs, branch strategy, and more.

Learn More About Appointment Scheduling Growth

If you’re ready to increase retention, drive revenue, and acquire new clients, appointment scheduling software can be a huge growth lever. Online appointment solutions make scheduling easy, so your team can focus on what they do best: consulting, uncovering opportunities, and helping your customers or members.

Schedule a Coconut Software demo and see how your bank or credit union can stand out with an intuitive appointment scheduling software built just for financial institutions.