How Investing in Analytics Provides Big Returns for Financial Institutions

The statistics around data in today’s environment are mind boggling. Did you realize that the global volume of data produced doubles every two years? Or that currently, five quintillion bytes of data are produced every two days? An amount equivalent to all the information produced by every conversation that has ever taken place on earth? And yet, despite the fact that banks have always held vast amounts of data, their ability to interpret and extract value from it continues to be something that many struggle with. In order to begin interpreting that data and turning it into something that can provide insights into potential opportunities, it’s vital to have a system in place for structuring and organization it. Below, we will explore some of the benefits that come from investing in such a system, and outline the ways by which it can provide a significant return on investment.

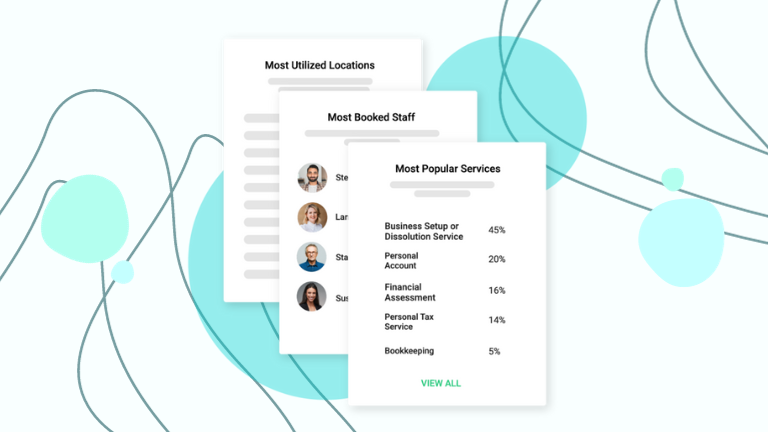

Looking for more information on the capabilities and benefits that Coconut Insights can provide your organization and provide a high return on your investment? Download our Coconut Insights Info Sheet.

Accelerating Growth

Deeper and more detailed profiles of customers, together with transactional and trading analytics, can improve the acquisition and retention of customers, as well as cross- and upselling. With access to a comprehensive, easily navigated database of financial behaviour, it becomes significantly easier to model prospective and existing customers’ potential value and prioritize resources. This can have broad sweeping benefits to achieving high returns through increased effectiveness of marketing campaigns, raised adoption rates of new services, promoting positive word-of-mouth, precise targeting of existing customers for new product promotion and more.

Enhancing Productivity

Through analytical tools, it’s possible to make every banking process faster and more effective. Among other things, banks can use advanced analytics to provide faster and more accurate responses to changing customer behavior, branch traffic or product demand, and give teams analytics-enhanced decision support. What’s more, by ensuring that this data is readily available, banks can also be much better equipped to align sales and service capacity to market opportunity. Through accurate forecasting of customer demand, you can not only determine the ideal branch staffing mix—you can also ensure that you have experts such as mortgage, investment or business bankers placed in the right branch at the right time. By ensuring that business moves smoothly and reducing wasted resources in your organization, cost savings and increased efficiency can quickly add up to provide a high ROI.

Improving Risk Control

Banking is built on risk, but with millions of data points paired with an insight collecting analytics system, financial institutions can gain a more comprehensive method for the assessment of the risks involved in making loans and investing cash. In the next decade, heightened risk management capabilities are going to become even more valuable. As predicted by McKinskey, already strict regulations will continue to broaden and deepen as public sentiment becomes less tolerant of preventable errors and inappropriate business practices. At the same time, customer expectations will rise and change as new technology and business models emerge and evolve. By implementing a system that allows for the analysis and organization of the massive amount of data that banks and credit unions process daily, it will be possible to gain insights into millions of transactions, as well as branch-specific information. In this way, organizations will be equipped to meet these shifting customer demands while lowering the cost of risk management.

Meeting Shifting Customer Expectations

With insightful data analysis, it becomes significantly easier to deliver the digital banking experience that customers are looking for in today’s environment, offering a much better customer experience at a fraction of the current cost. The majority of today’s customers interact with their banks via multiple channels; from browser, to mobile app, to contact center and branch, not to mention outside channels like social media and search engines. Their paths through these channels are extraordinarily complex, often involving a minimum of two different channels, plus plenty of information gathering along the way. In order to keep these customers from losing interest or getting frustrated on their journey, it’s vital to deliver a truly seamless multichannel experience. The only way this can realistically be achieved is through the gathering of real-time data and using analytics to understand the customer. In this way it is possible to reduce drop off rates by building a proper and consistent customer journey.

Uncovering New Sources of Growth

If you want to look long term in achieving a high ROI on your data analytics tools, it’s possible that banks may be able to reap income from their data alone — for example, by sharing customer-analytics capabilities with new ecosystem partners, such as telecom companies or retailers. By exploring data-sharing agreements with fintech and nonfinancial services firms, banks and credit unions will be better able to stay ahead of the curve as more open banking options pour into the market. While data sharing in financial services is subject to regulation and risk management, if done well, it can deliver increased security and a better understanding of customers, not to mention increased business through strategic partnerships. In this way, it may actually be possible for banks and credit unions to out fintech the fintechs and drive growth far into the future.

What Next?

Looking for more information on the capabilities and benefits that Coconut Insights can provide your organization and provide a high return on your investment? Download our Coconut Insights Info Sheet.

Trying to work out the best way to make use of data as you take on your digital transformation? Download our Ultimate Guide to Digitally Transforming the Appointment Experience to learn more about areas to concentrate on when seeking to increase revenue and drive growth in your organization, and how to utilize digital tools to transform the experience for everyone involved.

Ready to get started on collecting, organizing and diving into the insights you need to make informed business decisions and set your organization up for success? Schedule a consultation with Coconut Software to learn more about how our tailored solutions can help.