How Online Booking Platforms Tie into Current Banking Industry Trends

Many banks are switching to online booking platforms. Check out this guide to learn how it can shape the current trends you have in place.

If you schedule a haircut, most barbershops or salons will offer the ability to book an appointment online. It’s convenient, fast, and it gives the customer instant engagement.

Your problem isn’t yet solved (you still need that haircut!), but you have a date and time for the solution. Yet, many banks still lag behind in digital onboarding techniques. Deloitte refers to these banks as ‘sub-performers‘ in their Digital Banking Benchmark.

Online booking platforms cater to hotels, doctors, personal trainers, holidays, and transport. More appointments mean more business, right?

While a booked appointment doesn’t guarantee business, it does raise its likelihood. Appointments make the customer feel accountable. But they also help them feel listened to.

A scheduled appointment is far more meaningful than being fifth on a call queue. It’s also just smarter business.

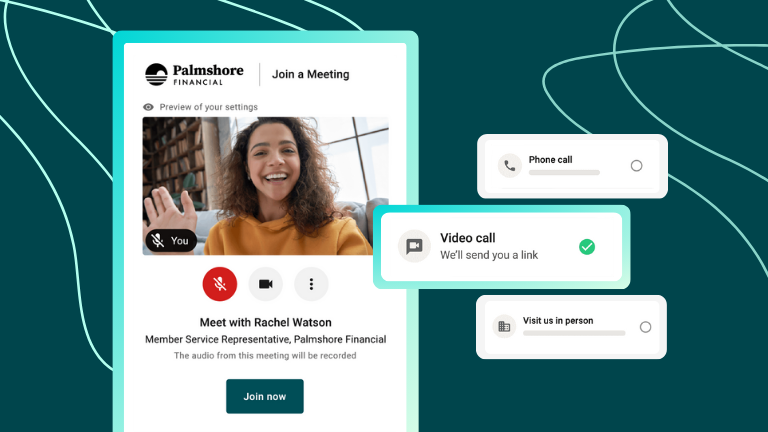

While digital banking is on the rise, in-person consultations are far from disappearing, even during a global pandemic. This article details how online booking systems are crucial to staying competitive as a bank in 2021 and beyond.

The Role of Online Booking Platforms in Banking

Online booking platforms are an essential element of digital banking services. Even if your bank does not sell products online, booking advisory or transactional services digitally is far more efficient.

Consumers have begun to expect the presence of an online booking option. With the technology readily available, it seems irrational not to have one. But how do booking platforms help banks perform better?

The Advantages of an Online Booking System

Every financial institution manages a multitude of customers. But, it can be hard to handle and anticipate when those customers enter the branch – or which branch they enter.

Banks and credit unions end up having to employ staff based on the estimation of peak hours based on historical trends. This can result in an unpredictable stream of customers, with each customer having different needs and requiring different skill sets to assist them.

Online booking platforms take the guessing out of the game. Banks and credit unions can predict not only when customers will arrive, but who arrives, for what service, and for how long they stay. In doing so, they can also gather information about what customers need and better plan for the future.

It can be challenging to predict what customers want without violating data privacy laws. But in booking systems, customers volunteer their own information, and booking systems should be built with the utmost attention to security and compliance policies. So what other advantages do online booking systems boast for banks?

Increasing Business

Digital prompts for prospects and customers to make an appointment increase the likelihood of purchasing a service, such as an account opening, loan application, or financial plan engagement. If a customer browses for a loan, you can place a link on that page. The link directs the customer to make an appointment to speak with a local loan officer.

People come to expect all services to have online booking capabilities. As we pointed out earlier, most modern services or products feature a digital booking system. It’s more efficient, practical, and needs less attention to operate.

At the end of the day, financial institutions are still businesses with the goal to maximize profits, minimize losses, and keep their customers and members happy. Therefore, it is in their best interest to sell the right products to the right customers at the right time and in a way that is most convenient to the customer. Having an online booking system increase the conversion rate from online searches to clients.

Ultimately, customers spend more money after meeting in-person appointments versus completing all business online.

Capturing Market Gaps

All businesses capture X% of Y. In this equation, Y is the potential value they provide, and X is the percentage of that value they capture in the form of revenue.

McKinsey’s recent banking intelligence report exposed that consumers’ willingness to purchase banking products online far exceeds actual digital sales.

What this means is that there is a large percentage of undiscovered clients. And, therefore, wasted revenue. For a bank or credit union to efficiently capture its market, it has to go where the customers already are, not expect customers to come to them.

To that end, banks and credit unions can also use social media to schedule their appointments. The most loyal customers already follow their financial institution on social media to keep up with updates.

Customers can use online booking systems to schedule appointments on the go. They can do it while commuting, at work, at 2 am, or even while waiting in a queue at another business. Online booking systems are quite simply more effective.

Online booking is the first step towards a strong omnichannel banking experience. In-person branches are not disappearing, but they are evolving in nature.

Banker Efficiency

Better scheduling, traffic management, and a better customer experience are possible with booking platforms. Online booking platforms allow the customer or prospect to schedule appointments that are most convenient for them, naturally taking into consideration the staff member’s real-time availability in question.

Financial institutions can now manage and smooth the traffic spikes of customers through their branches. Long queues tend to send the signal that the bank is inefficient, not that it is popular. Reducing peak traffic makes the flow of customers more evenly spread and vastly improves the customer experience.

Not only does the customer benefit, but the bank or credit union too. This way, they make the best use of their space, time, and workforce.

Even customers that do not book an appointment, the walk-ins, will find themselves having a more pleasant experience. There is nothing worse than a customer who feels ignored. That’s a fast way to lose clientele, permanently.

Preparation is key: the customer experience benefits from a prepared and planned financial institution.

A Personalised Experience

Customers want to interact with an employee they feel they can trust and that knows their goals and preferences. Remembering personal details is a psychologically proven way to establish trust in a relationship.

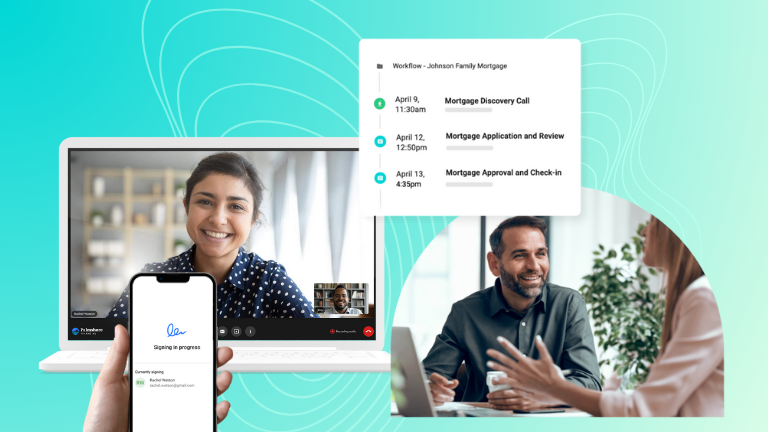

Prebooked appointments make it possible for your staff members to prepare ahead of time, using details from the booking. Teams can gather data about their customers they would otherwise not have: you likely already access the purchase history of a client, but with an engagement platform, you’ll also be able to see when and how they first engaged with you and review notes from previous discussions.

Prebooked appointments are faster than walk-ins, more personal, and more effective. Even if the customer misses the appointment (even after receiving email reminders and SMS notifications), the customer still provided valuable information like:

- Their name

- Phone number

- Email address

- Current banking concerns or desires

Strength to Strength

You can also integrate your employee training scheme with your appointment routine. Each employee can be paired with customers looking for advice in that employee’s area of strength.

Every customer feels as though they have an expert. No employee needs to stop the consultation to seek advice or ‘double-check’ something.

The result is professional and trusted advice across the board.

Banks and credit unions can then strategize better, pairing the right employees with the right customers. This is especially effective in establishing and strengthen long-term customer relationships, particularly important for key advisory services like wealth management and insurance. Customers are far more likely to make a purchase with a familiar face.

A Bespoke Experience, At Scale

Each customer should never have to repeat themselves. If a customer tells one employee about their banking concerns, everyone that talks to that customer should know.

Customers expect this from other essential industries. For example, what use would it be for a patient in a hospital to describe their illness to every doctor they encounter. Would that patient be willing to undergo surgery?

Banking is the same. Money management is an earnest endeavor for most customers. If they feel that you don’t understand what they need, they won’t trust you.

Even worse, if a customer feels you don’t care what they need. Or that their priorities fall below yours as a business. The customer’s priorities should be business priorities.

Online booking platforms help keep those two factors aligned.

Customers won’t be stuck waiting or feel as though other clients are more important. Every customer is expected, appreciated, and served immediately.

When customers do enter your branch, their experience is personal. You can provide a level of service that isn’t achievable online.

Reduce Phone Queues

By moving booking online, customers can do it at their own convenience. They can book appointments at any time, instantly in their channel of comfort.

There’s nothing more frustrating for a customer than getting stuck in bureaucracy. Customers can find themselves unable to walk into a bank without an appointment and unable to book one because the call lines are busy.

Online booking also frees up call center workers for more effective work. Banks and credit unions can prioritize customers calling with emergencies, those without an internet connection, or folks that prefer to bank in-person.

The more processes you can automate, the more time each call center employee can give to your clients. Improved customer support satisfaction signifies a better reputation and an increase in that key metric – net promoter score.

Consistency

The digital revolution is encouraging consumers to judge businesses by their online reputation as much as in person. In fact, given that most consumers with internet access research potential financial institutions online before doing business with them.

There aren’t many potential customers left that will walk into five banks in a day before making a choice. It’s not that your in-person experience is irrelevant; it’s that consumers are looking for specific traits first. And those traits are easy and quick to discover online.

The point here is that your bank should be consistently represented across all channels. It’s no use having an exquisite in-branch experience with a website designed in 1995. Consumers will assume that you are old-fashioned and not up to date with current practices or investment strategies.

Digitalization must, however, be conducted while respecting the importance of long term relationships. Online banking shouldn’t further prioritize short term product sales over consumer relationships.

Pandemic Consideration

Besides the obvious benefits of having a digital banking service during a pandemic, online booking systems are useful in other ways.

Having a method to schedule customers at planned intervals helps you observe social distancing rules. Scheduling also helps customers feel safer to enter your bank or credit union in person.

Even if you cannot conduct in-person meetings, scheduling systems can help plan phone or video conferences. Customers will always appreciate the personal touch, especially during such a stressful time.

The global pandemic will accelerate the digital banking trend. Your institution mustn’t be left behind in the race.

Three Digital Banking Priorities

Banks will have to meet the following essential consumer expectations:

- Understanding what consumers need before they request it while protecting them from adverse financial decisions.

- Communicate with consumers on channels they prefer.

- Learn about consumers and democratize that information, so the consumer does not feel like they are talking to different organizations when addressing other employees.

Online booking platforms help banks satisfy points 2 and 3. And further digital innovation will help banks meet the expectations of point 1.

Digital Banking is Here

Conducting your banking online is quickly becoming the standard. This doesn’t mean that banks should rid all branches and employees – a human face is an integral part of the process.

IBM claims A.I. should stand for ‘augmented intelligence,’ rather than ‘artificial intelligence. In the same way, digital banking services like online booking platforms are there to assist bankers, not replace them.

Banking is changing, but only in line with new technologies and societies. If you read through this article and want to know more about how online booking platforms can help you, send us a message. We’d be thrilled to help.