How to Increase Revenue with Appointment Scheduling Software

Credit unions and banks rely on generating revenue through their appointments, making it crucial to maximize ROI on interactions. Learning to increase revenue with appointment scheduling software is a key way to maximizes these interactions to get the most value out of this customer touchpoint.

Interested in learning more about appointment management software? Download Coconut Software’s Appointment Management Data Sheet today.

An appointment is an appointment, right? Actually, there is a big difference between a walk-in and a scheduled appointment in terms of revenue generation. First of all, walk-in appointments are unpredictable, with unexpected influxes leaving your customers waiting, and your staff overwhelmed. Additionally, they leave little time for your customer-facing staff to adequately prepare in order to make the most out of the interaction.

For appointments your organization schedules ahead of time, you might be missing out on valuable information during the scheduling process that you could use to optimize your customer interactions.

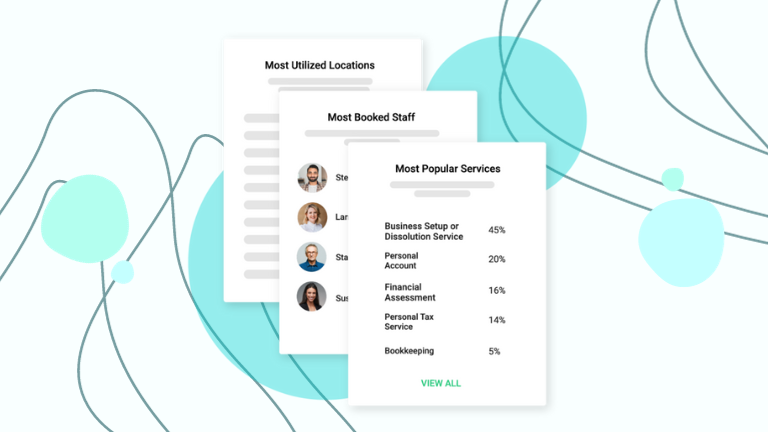

With integrated appointment scheduling, you will be able to get the most out of the appointment scheduling process. This will enable you to increase revenue generation and reduce operational costs within your organization by enhancing your contact center processes, gaining additional insight into customer needs as well as optimizing staff time. Below, we discuss three ways to use appointment management solutions to increase revenue:

1. Decrease Operational Costs

Integrated appointment scheduling is a great implementation to consider when your organization is looking to reduce operational costs and increase revenue generation while enhancing one of the most critical touchpoints of the customer experience. Enterprise appointment scheduling will help you reduce headcount in your organization, optimize staff time and gain additional insight into customer needs, in order to stay ahead of the competition.

2. Optimize Staff Time

The Problem

Scheduling appointments is a time-consuming process for your customers, as well as your staff. Typically, customers are left waiting over the phone or in person for one of your staff to sort through multiple applications, requiring them to go back and forth with the customer while coordinating staff-client availability. Needless to say, this is an aggravating process for both parties.

This process consumes a lot of staff time that could be used to accomplish other revenue generating tasks. Alternatively, walk-in appointments are also a nightmare when it comes to optimizing staff time, as your employees fluctuate between being overwhelmed and having too much idle time. When your business provides walk-in appointment services, you need staff who are readily available to last-minute customers. This means staff are either taken away from an alternate task when a customer walks in, or they are sitting idle, waiting for the possibility of a walk-in appointment. Both scenarios are a poor use of employee time and cost your business money.

The Solution

By transitioning your organization to function primarily off of scheduled appointments, you will be able to optimize your staff time in order to increase revenue generation. With reduced walk-in appointments, your staff can use their time preparing for upcoming appointments instead of idly waiting for walk-ins.

Along with eliminating the tedious task of coordinating staff-client availability, it frees up your customer-facing staff to accomplish revenue generating tasks. With more time to prepare for scheduled meetings, it’s easier for your staff to up-sell clients based on their history with your organization.

3. Gain Insight Into Customer Experience to Increase Revenue

The Problem

When customers schedule an appointment through a contact center, they provide basic information, including their name, status with your company and the appointment services they require. From there, the contact center rep will schedule an appointment that works for the customer and an available rep at the desired location.

Your customer-facing advisor has almost no information about the customer. They can’t prepare for the interaction, missing out on opportunities to up-sell and generate revenue for your organization.

Collecting limited information at the time of appointment scheduling is problematic for two reasons.

- For returning customers, it shows that your organization does not know much, if anything, about their history with your organization, making them feel undervalued.

- It leaves your organization missing out on key revenue generating information.

The Solution

When additional customer information is captured at the appointment scheduling, you gain additional insight into the customer’s history with your organization so your reps can provide a more personalized appointment experience.

If you want to gain insight into their banking history, you can ask:

- How long have you been banking with us?

- When was the last time you scheduled an appointment with us?

- Do you do most of your banking online?

These pre-appointment questions provide advisors with additional insight into customer banking behavior, allowing them to make more informed decisions about what other services they can offer during their upcoming customer interaction. Additionally, when a customer comes in for their appointment and is recognized by their financial institution, it makes them feel valued and reduces the chance of them seeking out a competitor who offers a better experience.

Increase Revenue With Appointment Scheduling Software – What’s Next?

Gain deeper insight into the benefits of appointment management software. Download Coconut Software’s Appointment Management Data Sheet today.

Looking to boost revenue and deliver a premium experience to your clients? Schedule a consultation with Coconut Software to learn more about how our appointment scheduling solutions can get you there.