How To Reduce Queues in Banks: 12 Key Techniques, Tips, and Tools

When it comes to running a bank or credit union, there are certain things you can’t control — like the flow of member and customer traffic. And even though you can predict certain member and customer behaviors based on the season, increased support requests and staffing challenges can further exacerbate the issue.

Long wait times don’t just frustrate clients — they stress out your staff, lead to burnout, and reduce member and customer satisfaction, too. So it’s no surprise that just about every financial institution is wondering how to reduce queues in banks.

If you’re looking for ways to reduce queue waiting times, then this is the guide for you. Here are 12 tips that improve waiting time management and foster happy members, customers and staff at your bank or credit union.

Tip 1. Shift Your One-Lane Mindset

So how can banks reduce customer waiting time? First, they need to think like their customers and members. Ultimately, today’s consumers want more control over their banking experience. They want to choose when, where, and how they interact with your institution — and long queues take that freedom away from them.

Instead, it’s time to shift from a one-lane mindset and think outside the box. Thanks to modern technology, lines and queues no longer need to be linear, first come first served experiences. They can be virtual and in-person, customized to the needs of the individual, and pre-booked online.

Once you get your administrative staff on board with this idea, anything is possible. This mindset shift will benefit more than your members and customers. It will also help staff be more efficient, productive, and effective. They’ll have more control over their schedules, save time between appointments, and have the data to ensure happy members and customers.

Tip 2. Set Waiting Time Management Goals

Any time you’re trying to change, it’s helpful to set goals to measure your progress and keep you on track. The path to reducing queue wait times is no different. If you want to improve wait time management, it’s imperative that you set goals to get you there.

Start by looking at where you are today. What are your pain points? What have members and customers said about their queue experience? How does your current queue management strategy affect staff members?

To get a strong pulse on your current strategy, consider going to a branch undercover, going through the process of requesting an appointment online, and tracking current wait times.

Next, consider where you want your experience to be. Set some modest goals for improvements, along with a check-in date and tracking method. Ideally, aim for a wait time of five minutes or less — the average for the highest performers in the industry.

Tip 3. Reduce Long Queues with Fast Lanes

How can banks reduce long queues? One of the most effective strategies is to offer fast lanes — specialized lines that give members and customers more choices. Fast lanes present members and customers with two options: 1.) get in line for transactional-type services (like cash deposits, withdrawals, or exchanges) or 2.) get in line for an appointment.

With this queue management method, service times vary depending on the needs of the member or customer. Staffing is tailored to the wait times in each line, and members/customers are served based on priorities, rather than on a basic, first come first served basis.

Tip 4. Offer Auto Sign-In for Pre-booked Appointments

Imagine a world where members and customers who have an appointment don’t have to wait in line to let someone know they’re in the branch. After all, they made an appointment to avoid the long lines, right?

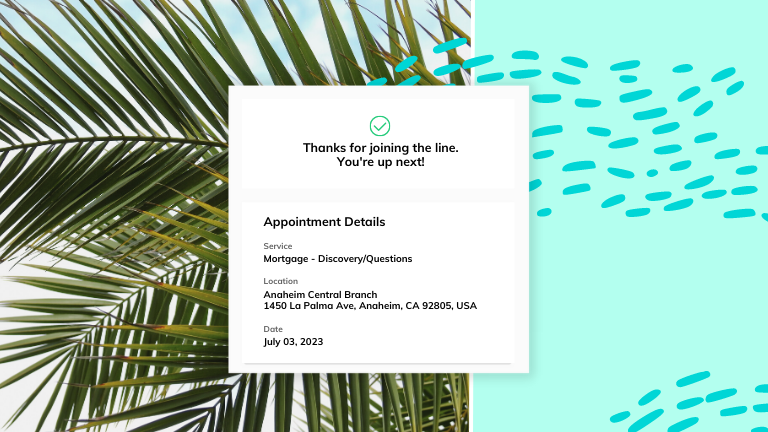

When you offer automatic sign-in for pre-booked appointments, this vision becomes a reality, allowing members and customers to check in easily from a tablet or kiosk. But here’s the catch — you’ll need to invest in the right tool to make it happen. And while some financial institutions use a simple tracing sign-in tool, there’s a better solution.

A queue management system with an integrated appointment booking system ties all systems together for a streamlined, seamless experience. Specialists get notifications on their calendars when members or customers check in, so queue management goes much more smoothly. In fact, financial institutions that use queue management tools enjoy a 75% reduction in appointment length and an average CSAT score of 97%.

Tip 5. Give Customers Alternative Self-Serve Options

Banks and credit unions that offer high-quality support are more likely to retain members and customers. And when you offer the best support, 63% of customers say they’re unlikely to switch away from you, and 78% say they’ll return for similar services — which is what makes self-service options so important.

Self-service queue management technology is proven to decrease no-shows, reduce appointment length, and improve customer satisfaction scores. It gives members and customers the freedom and flexibility they crave, and it helps staff members operate more efficiently, too.

Self-service options include a view of current wait times, the ability to join the queue or book an appointment for later, information on how to complete a service online (rather than wait in line), and the ability to get a notification when it’s their turn in line. Ultimately, self-service is all about flexibility, reducing queue wait times, and keeping staff and members/customers happy.

Tip 6. Show Members and Customers Wait Times (In-Person or Online)

Your members and customers want more visibility from their financial institutions. They don’t want to be surprised by long wait times when they show up in-branch. And if the wait takes them off-guard, they might leave without any plan to return.

By showing members and customers current live wait times, you empower them to choose if they want to visit the branch now, wait for a shorter line, or simply book an appointment for later. This strategy reduces stress by diverting members and customers who are in a rush and could become upset by longer wait times.

Queuing and appointment tools give clients this type of transparency automatically, so they have the freedom to plan their day. Members and customers are also more likely to show up for their appointments, or rebook when wait times are long. 20% of customers who abandoned a busy lobby rebook when they’re sent missed notifications.

Tip 7. Combine In-Person and Online Queues to One Central Queue

Queue management tools allow financial institutions to combine in-person and online queues in one central queue, allowing you to serve members and customers anywhere, anytime. With this tool, members and customers can hop between virtual or in-person services, depending on their needs and preferences. Likewise, staff can serve members and customers from where they are, rather than spending time commuting from one branch to another.

This system provides faster, better, and easier service. Financial institutions are no longer forced to split members and customers up between virtual and in-person queues, so they have fewer staffing challenges and more flexibility to serve members and customers from wherever they are.

Tip 8. Offer Real-Time “You’re Next” Notifications

Real-time “you’re next” notifications give members and customers the ultimate freedom: they can join the line, wait for service, or even leave the line until it’s their turn — without losing their spot.

Not only does this reduce the line, but it gives members and customers a better experience, too. Rather than standing in a long queue, they can run errands, grab a bite to eat, or enjoy some peace and quiet outside while they wait to meet with your staff.

Tip 9. Leverage a Robust Location Search

When banks and credit unions provide robust location search tools, members and customers can quickly find the branch near them at the click of a button. Maybe they’re at work and need to stop in to deposit a check. Or maybe they’re on a road trip and need to access an ATM. In any case, they can easily discover the closest branch that suits their needs.

The best location search tools also include service details, such as accessibility features, wait times, services offered, and hours of operation — so members and customers don’t end up waiting at a branch that doesn’t have the capacity to serve them. In these situations, members and customers take up space in line and leave disappointed.

Tip 10. Promote Pre-booking with a Digital Appointment Tool

One of the best ways to reduce wait times is with pre-booked appointments. With this strategy, you’re no longer playing a guessing game. You’ll have a better gauge of how many members and customers you’ll be serving that day, how many staff members you need on hand, which specialists need to be at which branch, etc.

Pre-booking also gives you visibility into how busy your staff members are and helps you determine hiring needs. And if your staff is consistently all booked up? It may be time to bring on more employees.

It’s important to note that pre-booking requires a transparent calendar system, so members/customers and staff can both see schedules and book specialists when they’re available. This self-service approach frees up staff members’ time and gives members and customers more autonomy in their banking experience.

Tip 11. Offer Video/Virtual Banking

If you’re not offering video or virtual banking options, you’re missing out on a large client base. After all, 28% of all banking customers prefer digital tools, and 33% want to use both in-branch and online services.

The demand for video appointments rose even more during the pandemic, with 46% of customers saying they’d continue talking to advisors over video when branches reopened, and 36% saying video is their preferred medium of communication.

Video provides members and customers with the same easy and relationship-building benefits of in-person meetings but without the hassle of travel, lines, and long waits. Advisors save time by not having the drive to the branch, and calendar tools make it easy for you to designate a staff member’s virtual availability.

Tip 12. Solve Queuing Problems with Data and Reporting

When you have a problem to solve, the answer often lies in the data. Queue management challenges are no exception — data and reporting give you the insights and visibility to solve queuing problems via an evidence-based approach.

Queue management tools come with an analytics dashboard that you can review on a monthly basis. You can discover the most popular sources, branch traffic patterns, busy times, staff capacity, and more. As you dive deeper into the data, you’ll have a better understanding of what you can do to improve the queue experience for your members and customers.

Reduce Queue Wait Times with Queue Management Tools

Long queue wait times lead to unhappy members and customers, overburdened staff, and poor service. Thankfully, queue management tools can help you reduce waits, increase visibility, and give consumers the freedom they’re looking for.

By blending online and offline queues, digital tools offer flexibility for you and your members and customers, so you can come out ahead of the competition. Likewise, self-service options can help you eliminate administrative tasks, increase efficiency, reduce no-shows, and so much more.

Just remember — not all queue management systems are created equal. Look for an integrated, streamlined solution that offers visibility across staff calendars, hybrid queues, “you’re next” notifications, and more.

Discover the power of a robust queue software system today. Book a demo with Coconut Software.